Gold: Fed Meeting Forecast

Gold is still moving between the range zones where resistance turned into support, and the higher low of uptrend line is reached in another view.

Gold Prices remains lower as Ahead of FOMC meeting and US Dollar pretty solid higher as FED Powell makes any hint on tapering assets speech Today.

And Demand for Gold is Quite lower as China kept interest rates lower in Private Banks.

Now gold is ready to sell for the Slowing Chinese economy, and US Dollar remains a Dominant, strong player in the Market.

Delta Variant makes worry for Domestic currencies to fall as Exports remain lower and domestic needs are lower in China.

US DOLLAR: FOMC meeting

USDCAD is falling to the higher low level of Uptrend line.

DXY index moved higher as Friday data of Flash PMI reading printed.

And manufacturing momentum picked up and Weakness sustains in Services sector. The next 2 days FOMC meeting happening and will reflect in the US Dollar index.

Risk Aversion keeps an eye on Investors, and QE tapering, Rate hikes in major risk for Inflation numbers keep higher.

And Biden’s plan of multi-billion Dollar supports the Infrastructure and Families.

US and China made trade conflict in All areas, impacting both US and Chinese Economies.

US Janet Yellen on the Debt limit

US Treasury secretary Janet Yellen Urges Congress to set the Debt limit soon by August 1.

As US Will meet the statutory limit on debt on August 1, the treasury will suspend the sales of state and local government securities at noon on July 30.

If congress does not act by August 2, then-Treasury will take extraordinary measures to prevent the US from Default.

Euro: German IFO Business Survey

EURUSD is moving in a descending Triangle, wait for the breakout from this triangle.

According to German Business IFO Survey, Institute’s economist Klaus Wohlrabe said. Supply problems are the main concern for the German economy, both in Industrial and Retail.

64% of Industrial Firms reported a shortage in materials, and Prices have risen higher.

60% off Wholesale merchants and 42.5% of Retailers complaining about their shortages.

Industries are more affected by pandemics and cannot produce as much as before. The tourism and Consumer sector were also affected more by the third wave and now again pressure for the Fourth wave.

Q2 GDP will rise to 1.3%, and Q3 GDP Will rise to 3.6% in 2021, as economists forecasted.

Companies demanding More staffs especially in Industry sides.

UK POUND: Post Brexit deal rejected by EU

GBPUSD has bounced back from the major higher timeframe support 1.36 now it’s trying to break the top of the minor downtrend line.

GBPJPY is at the lower high area of the descending channel, wait for the confirmation of breakout or reversal.

UK Pound remains higher as the FED meeting is scheduled this week Wednesday.

And EU Rejected Post Brexit deal rewriting issue is raised by the UK on Northern Ireland Protocol.

Already Northern Ireland Union leader warned UK PM to avoid interruptions in Brexit deal overwriting issue. If not signed by the UK, Northern Ireland makes a unilateral agreement to pass Goods from Britain with no checks.

Covid-19 Delta variant keeps more Selling Pressure on UK and Freedom lockdown release may again come to arrest in next few weeks if cases rise above 1000 per day.

UK Domestic data makes weaker than expected as Lockdown releases from last week. Once picked up the economy, then Domestic data will do well in the economy.

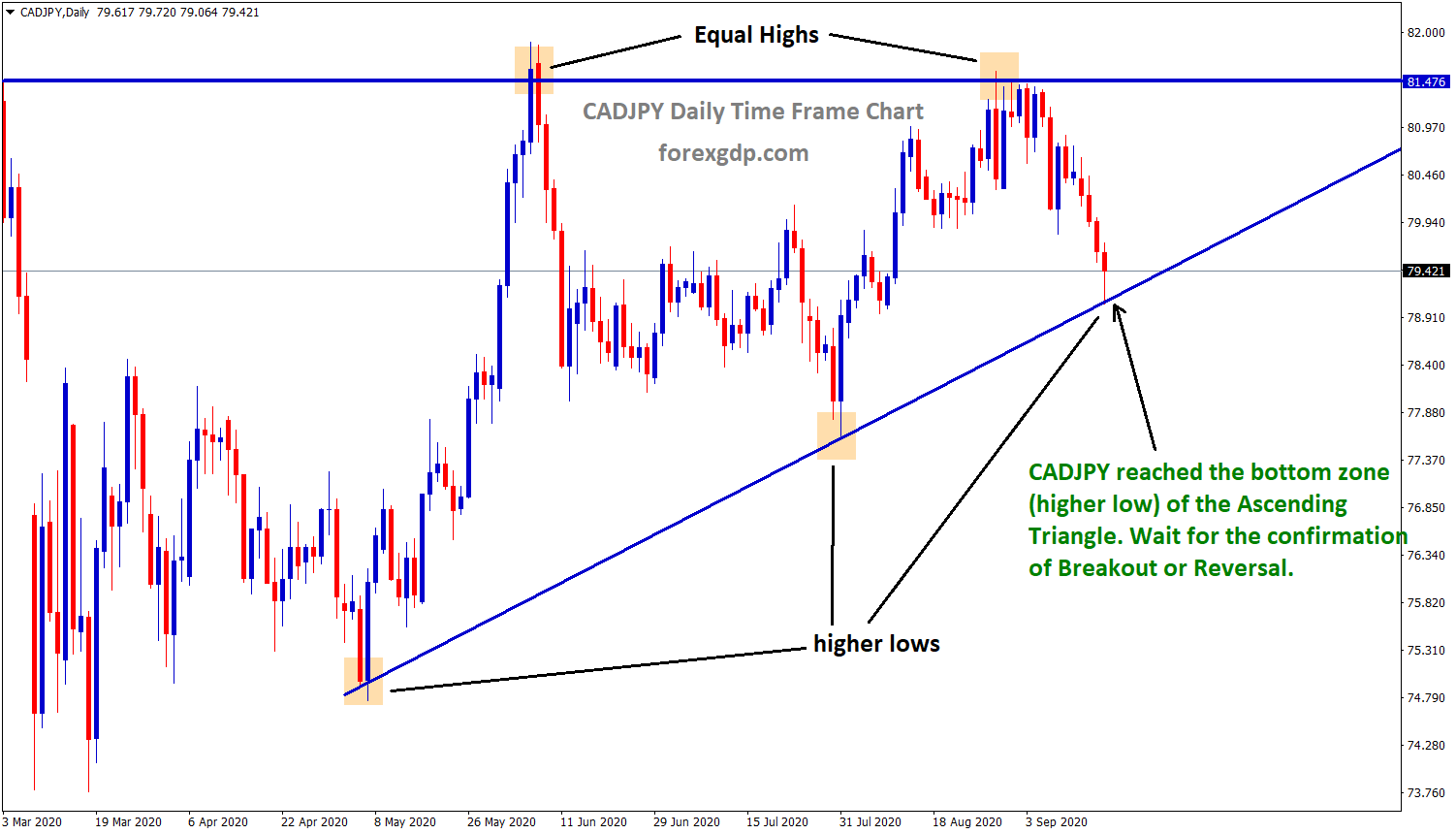

Canadian Dollar: FOMC meeting

AUDCAD is ranging now at the support area.

USDCAD makes lower in last week after 8% up in 2 months and corrects 4% in last 2 weeks.

Now Canadian Dollar makes under pressure as Oil Prices suddenly drops as OPEC+ Countries agreed to increase the supply of 4lakhs per day.

This, in turn, Canadian Dollar selling pressure as Demand slower as the Delta variant spread across the Global level.

This week FOMC meeting makes the effective direction of the US Dollar whether to stronger or Downside move based on a speech delivered by Powell.

Retail sales

Last week Friday, Reported Canada retail sales dropped by 2.1% in May month as the government ordered social distance measures, 5.6% of shops were closed from 5% in April.

Statistics Canada shows a 4.4% rise in June month Forecast and annualized losses in the second quarter to 3.0%.

Canadian economy recovers once all reopen the shops and services made higher by consuming more by retailers.

Australian Dollar: Lockdown in Major Cities

AUDUSD is bouncing back from the lower low of the descending channel and market starts to rise after a pull back.

Delta Variant is Spread across cities like New South Wales, Victoria and Sydney. So Major Lockdowns is proposed for 2 weeks to control spread.

And also, the Chinese economy is slowing shows as major Floods attacked Parts of the Chinese Region. It puts more pressure on Economy recovery areas, and Manufacturing sector growth remains slower.

These Negative feedbacks make Australian Dollar to thumbs-down to the lower area.

10-year Treasury Yield makes higher for 1.30% last week tumbled other currencies makes lower.

New Zealand Dollar: Domestic Data

NZDUSD is trying to break the top of the Descending channel range.

New Zealand Dollar moves in ranging momentum in the market as New Zealand trade surplus is decreased to NZ$261 million from NZ$469 million.

And The decrease came after income rise over exports. This will indicate the Overall Asia-Pacific Trading activity is doing well.

This week New Zealand Business and Consumer Confidence report is scheduled, and also FED reserve Interest rate is scheduled, and many investors expecting an accommodative stance on Policymaking. Tapering bets is more expected from FED Policy.

Swiss Franc: FED meeting

GBPCHF is at the lower high of the descending channel range, wait for breakout or reversal.

Swiss Franc is benefitted more from the Delta variant of the Covid-19 spread as it has been treated as haven currency.

USDCHF traded in 1% level in market 0.91-0.92 level as FED meeting scheduled this week.

And Domestic Inflation data which scheduled this week makes seem much worry for the US.

Swiss Franc moved in sideways market Against Japanese Yen as Vaccination Rollout is slower in Swiss Region.

Once fast vaccination Workout plan will help the nation Domestic currency to the higher upside.