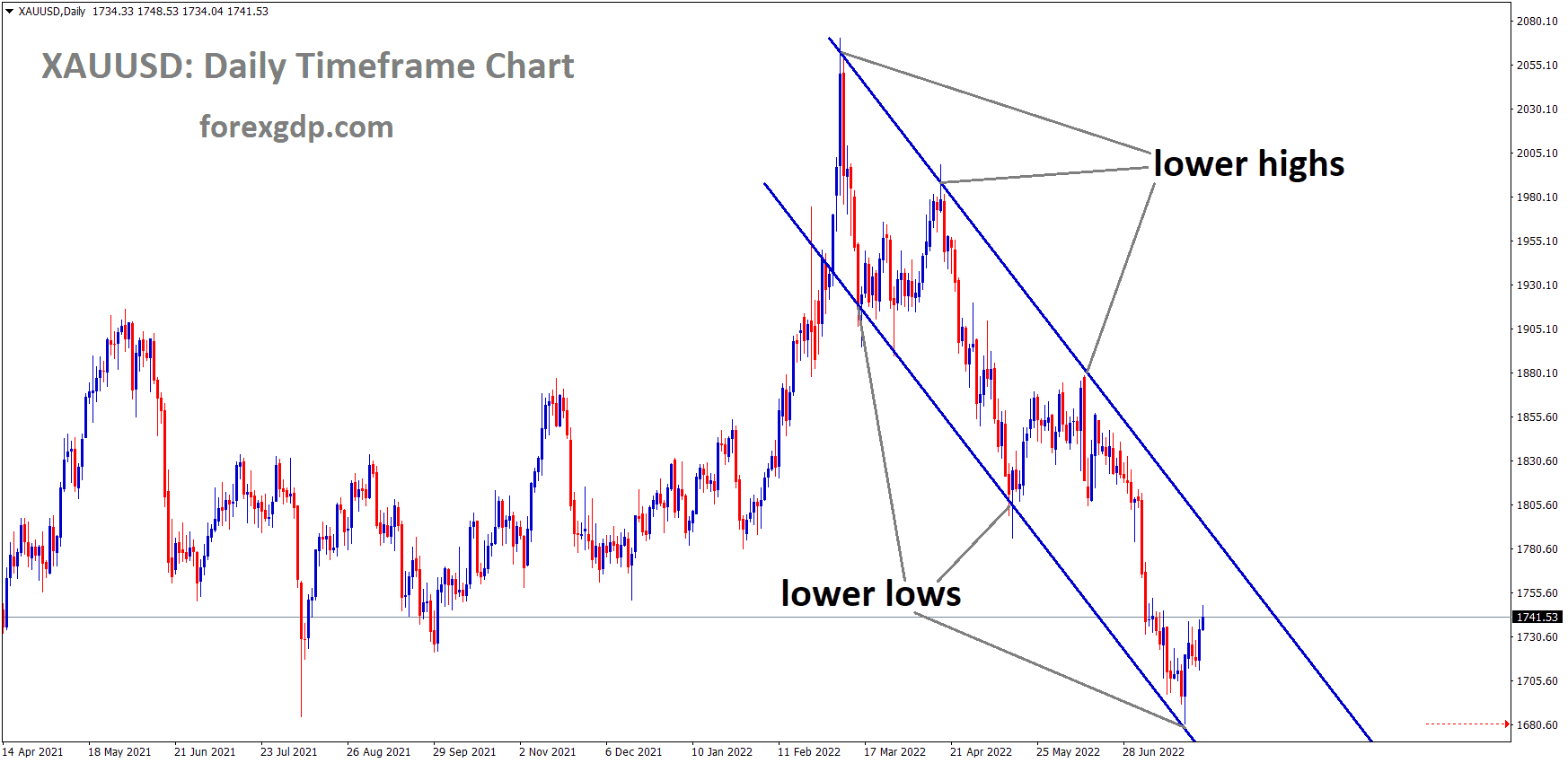

Gold

Gold moving in an Ascending Triangle.

Gold Prices climbed higher as US Manufacturing and Services PMI data shows a stronger number than expected.

US inflation fears Drives US Dollar higher.

And FED may take taper tantrum decision as Inflation higher day by day.

China imports 111.8 tons of Gold in April than in March 35 tons, which was increased by three-time bigger imports than the previous month.

And they have increased the quotas for importing Gold as Covid-19 raising in Asian Countries.

SPDR Gold trust shows buyers of gold outstanding more than Net sellers of Gold in last 3 months.

Due to these scenarios, Buy on Dips is preferable in the gold market as Demand created much higher in China.

USD

USDJPY has broken the bottom level of the Ascending Triangle and made a retest at the broken level.

US Dollar edges higher as Stronger US manufacturing data and services data published on Friday.

And Inflation fears around the market and FED may act as support to control inflation within a target of 2%.

FED Powell said still not the time comes to taper the quantitative easing tool and may wait for some more months to discuss tapering assets.

Core PCE inflation data is publishing this week previous reading 1.8% forecasted 2%, if came above 2% target, then FED must take this reading for adjusting assets by tapering or easing is possible.

Overall, US Dollar shows Stronger performance based on Domestic data and FED Decision on interest rates, Hawkish tone support for US Dollar to up, and Negative rates keep US Dollar Down.

US-China Trade Deal:

China promises of a Phase one trade deal with the US was slower than the Agreement deal.

As of now, China purchases 10.4 billion worth of Manufacturing, Agricultural and Energy in April, and since January 2020, China has just completed $147 billion worth only purchased.

As per the deal two-year target was $378 billion, China now finished 38.4% only out of 100% in 2 years.

This creates some Geopolitical pressure between the US and China in trade wars. But Biden Administration may take it differently from Tariffs hikes because Vaccination is the major role for the US to complete it then the Tariff war.

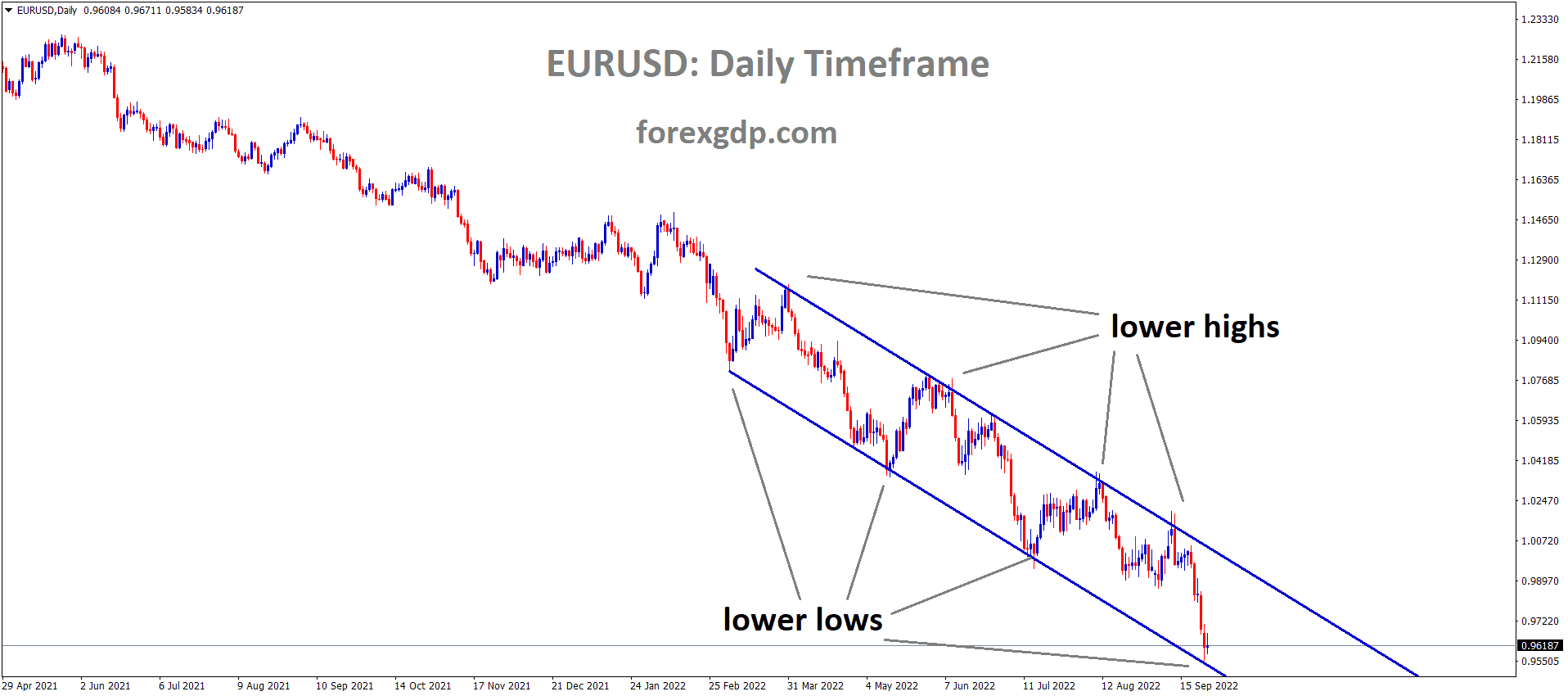

EUR

EURUSD failed to break the support and trying to move up breaking the highs.

EURJPY is moving in a Descending Triangle pattern.

EURO seems tough play for breaking resistance level of 1.22500 level, US Dollar shows stronger on Friday as Manufacturing and services data came in positive numbers.

And Euro has also received stronger Manufacturing data in April month as earlier reported last week.

Due to this, Now EURUSD is battled to breaks the resistance level of 1.22500.

US FED speakers one by one added for the team to push tapering bets in FED Policy tools as increasing numbers of inflation.

And Vaccinations are pretty good progress in Europe and no side effects from Moderna and Pfizer Vaccinations till now, AstraZeneca only created more side effects for Euro people to suffered.

This is Vaccination politics between Europe and UK, which will be the first to recover the economy from Covid-19. Still, Euro has to wake up from the initial stage, As AstraZeneca Vaccine stopped earlier before the disaster.

As of now

- 45% of people got Dosed in Europe

- 80% completed in the UK.

GBP

GBPUSD moving in a minor channel range.

EURGBP is moving in an Ascending channel in the 1-hour timeframe.

UK British Pound made lower after France warned the UK to control over Brexit headlines with Northern Ireland Protocol.

And New forms of Indian Variant Covid-19 also arrested by New Vaccination from Pfizer and AstraZeneca as DR.Jenny Harries head of national Health services and UK Health minister Matt Hancock said.

And This results to give an end to lockdown on June 21 in the UK as published.

CAD

EURCAD is moving in an Ascending channel in the 1-hour timeframe

Canadian Dollar set to a ranging market as Oil Prices moved in a Ranging market.

And US Data of Manufacturing and services PMI data shows Positive numbers on Friday picks up US Dollar prices to higher and USDCAD moved in the Ranging market from 1.20-1.21 level.

1.20 formed major support prices for USDCAD as 2016 level if breaks we see major fall from USDCAD to 1.19 level.

And Bank of Canada may adjust another tapering asset as the Domestic data of Canada performing well.

Tapering asset purchases and employment data will encourage the Canadian Dollar to higher.

JPY

CHFJPY formed an Ascending Triangle in 1-hour timeframe.

Japanese Yen shows more weakness as US Dollar steadied after strong US manufacturing and services numbers published.

Japanese Yen shows more weakness as US Dollar steadied after strong US manufacturing and services numbers published.

USDJPY shows strong support of 108.500 and Strong resistance of 109.800. Markets moved in a more ranging market.

And FED may consider tapering bets soon as inflation fears around the market.

The US easing lockdown measures in all over States and Vaccination has now completed with 80% and the second dose was started at a fast pace.

Extended lockdown:

Japan has set to extended the lockdown to May 31 as severe Spread across important 8 states.

And Economy is a lesser expectation of Growth of 1.7% this quarter according to Polls of analysts.

As per Reuters poll, the Japanese economy is slower growth than other Countries.

A major step is vaccinations and Vaccination could drive fast pace like US and UK; Japan will comeback from crisis level.

AUD

AUDJPY reached the higher low, wait for breakout or reversal.

Analysts of Australian and New Zealand Banking Group raising the forecast of Australian Private capital expenditure data reported later this week.

And the Private capital expenditure rose to 3% q/q in Q1 2021 and marching the increase of Q4 2020.

And the Firms will upgrade the CAPEX to $126 billion in 2020-21 from $121 billion and $114 billion in 2021-2022 from $105 billion. These upgrades will come after the Consumer and Business sectors shows rapid improvement.

But CAPEX plans not upgraded if Vaccination rollout slow in progress and Lockdown increases.

NZD

NZDUSD is moving in a Symmetrical Triangle pattern.

New Zealand Dollar shows much waited for Reserve Bank of New Zealand Monetary policy decision on Wednesday.

And the Cash rate remains the same at 0.25%, but Retail sales of Q1 up by 2.5% than the previous -2.7%. As a result of this, RBNZ may take a Hawkish tone on cash rate, or tapering assets is possible this week is expected.

If Tapering occurs by Monetary policy tools adjusted from RBNZ New Zealand Dollar robust to 1% move from 0.71700-0.72700 is expected.

And US Dollar solid move on Friday drags New Zealand Dollar down after Manufacturing and Services PMI data showed Positive numbers.

Any hike in the interest rate may sparks New Zealand Dollar to a higher move of 1-2% this week.