Gold: Gold Prices increased with inflation expectations higher this week

US CPI data is going to publish today, and the expected number is 7.0% versus 6.8%; this was a massive number since the 1982 year.

XAUUSD Gold Price is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Gold prices are rising very aggressively against US Dollar due to FED Powell said reducing the Balance sheet not in a fast manner and plan to reduce according to the situation.

So, 7% inflation for the US Economy is more uneasy for investors’ minds, and FED May act for a rate hike this month before March.

Fears of Omicron Variant is down across investors, and Investing in Gold is higher only for inflation rate ticked higher month on month.

US Dollar: FED Powell testimony makes confidence for Investors

USDCHF is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

USD sinks last night after FED Powell Testifies rocks the market for counter pairs.

FED Powell reiterated the exact words as explained in last month FED meeting.

That Fed will soon do rate hikes in March this year and never short the balance sheet immediately after rate hikes.

This news keeps calm for investors fear of mind on the last day.

Reducing the size of the Balance sheet won’t happen in quick mode; we have seen the US Economy recovery and make appropriate adjustments according to the situation that occurred.

Today US CPI data will publish, the main stem of US Domestic data this week; based on numbers, only FED will act soon to control inflation numbers.

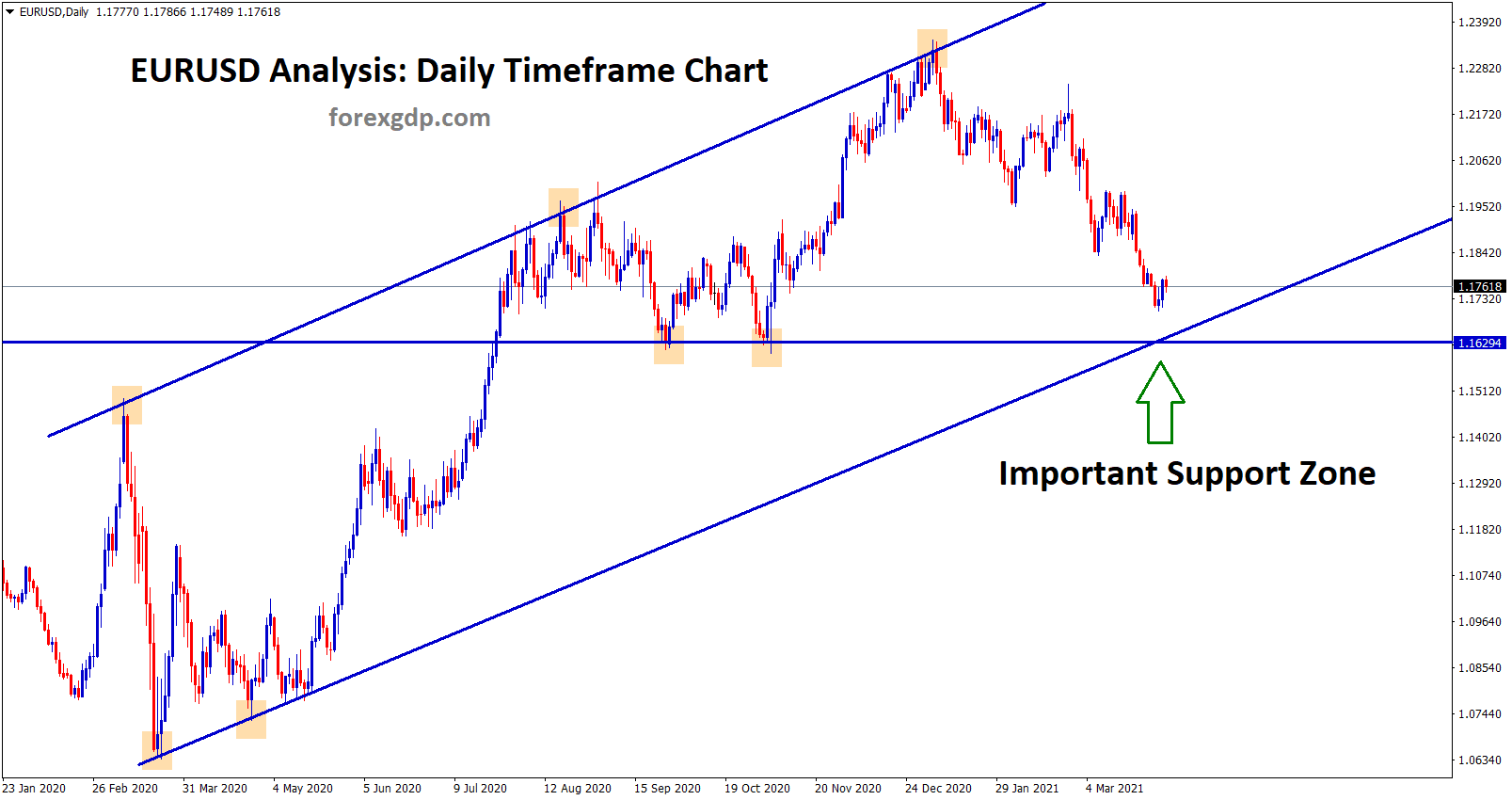

EURO: ECB Lagarde Speech

EURUSD is moving in an ascending triangle pattern and the market has fallen from the horizontal resistance area.

ECB’s President Christine Lagarde Speech last day and Favors for Investors, Hawkish steps will be taken only when things are going as per the plan of ECB.

Bunde’s Bank President Joachim Nagel said that temporary factors do not trigger euro area inflation.

ECB’s Chief Economist Phillip Lane said Euro Area inflation would fall this year, making restrictions for Euro to go upside.

World Bank Expected Global GDP Growth for 2022 is 4.1% from 4.3% due to Citied Covid-19 spread.

UK POUND: Article 16 plan pushing by Truss to UK PM

GBPCAD is moving in the Descending channel and the market has reached the lower low area of the channel.

According to UK Express news, British Commentator Henry Hill has mentioned that the Newly Appointed Brexit minister forces UK PM Johnson to trigger Article 16 against the EU Because Truss is a contender for conservative leadership.

GBPUSD Stood higher as Any time Article 16 will trigger in the market.

And US Domestic data is not favourable for US Dollar and supports Counter pairs.

Brexit issue has no still results obtained in Northern Ireland Protocol.

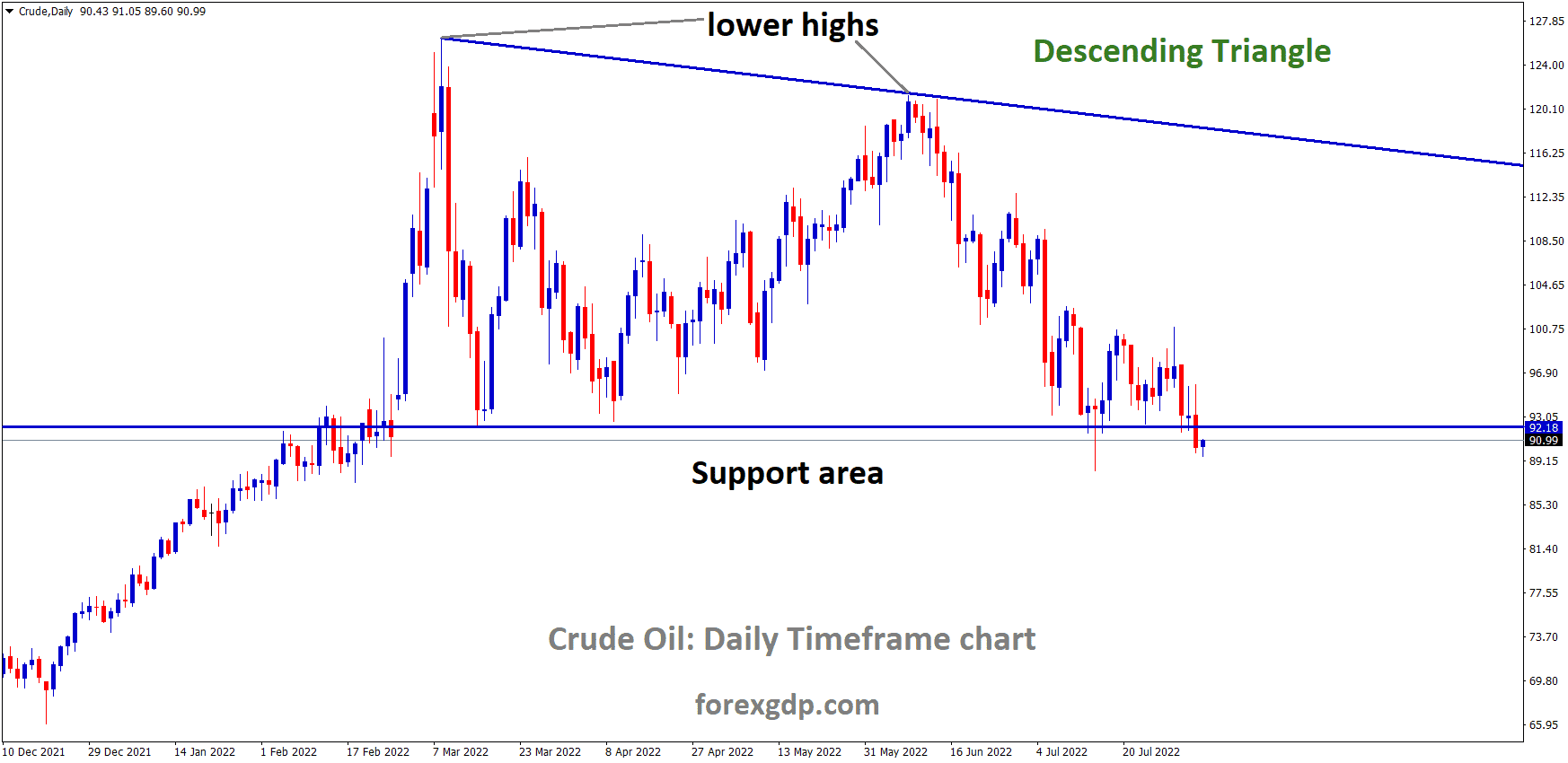

Canadian Dollar: Bank of Canada forecast of CAD in 2022

USDCAD is moving in the Descending channel and the market has reached the lower low area of the channel.

National Bank of Canada given the report, 26 types of Commodities produced under Bank of Canada shows Higher profits this year.

Canada’s Trade balance, Exports, wage growth, Job numbers and sales are higher.

This type of commodity profits is achieved mainly by Crude oil prices.

And Rising Commodity prices make substantial current account deficit, Job numbers, manufacturing growth and the Canadian Dollar.

Oil prices are reached 80$ Mark again today; Overall Supply has decreased across the nations.

Demand for Oil Still not yet over until 2025 Oil Demand will sustain once Covid-19 public has forgotten.

Japanese Yen: Bank of Japan Osaka Speech

USDJPY is moving in the Descending channel and the market has rebounded from the higher low area of the minor ascending channel.

Bank of Japan Branch Manager Osaka said Omicron variant spread increases will affect the Supply of Asia.

And Bank of Japan upgraded the Economy views on Nine regions in Japan.

Rising inflation in Japan is now slower than in other countries.

Raw material costs higher, and the Cost of Consumption is also higher, but this is not impacting Japan’s Economy due to Slower inflation.

Wage Growth Broadens and Companies Booking profits, But Companies are given Bonuses rather than salary hikes for workers.

Rising inflation makes squeezed the profits of Companies.

Australian Dollar: Australian Retail sales came up with higher

AUDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Australian Retail Sales data came at 7.3% versus 3.9% forecast and 4.9% previous one.

China CPI data is expected to drop from 2.3% to 1.8% today.

In China, Vegetables and Pork prices are falling; will impact the CPI data to lower.

But Chinese Yuan is getting stronger against US Dollar.

And China will report New Yuan Loan (Dec) expected to Drop at CNY1250 billion, slightly down from November’s CNY1270 Billion Figure.

Goldman Sachs cuts China’s Growth for 2022

Gold Man Sachs downgraded the China Growth to 4.3% from 4.8% where previous projected.

As Omicron variant increasing across China shows higher and Handling of Virus is more difficult for China this time, due to Real estate headache problem in another hand.

Already People Bank of China injected hefty funds as a liquid injection to markets; more easing monetary policy settings will create a Downward portion for China Economy growth.

Only the Curable stage will attain after the winter season; the second half of 2022 will see some relief from Covid-19.

Goldman Sachs maintained its view of 50-basis points cut in reserve requirement ratio in the First quarter.

New Zealand Dollar: US CPI data forecast

EURNZD is moving in the Descending channel and the market has reached the lower high area of the channel.

US CPI data for November is going to publish today; expected numbers are 7.0% versus 6.8% per annum previous reading.

If CPI data came at higher than US Dollar jumps from the current area due to FED will act soon to do rate hikes to control inflation numbers.

US Inflation is 7% only seen in Late 1982, and after 39 years only the same reading is expected now.

So, US Economy is facing more inflation prices in All sectors.

And New Zealand Dollar seems to have no Central bank data this month, so US Domestic news will play for Kiwi.

And the Covid-19 variant is increasing in New Zealand Borders regions, and Strict rules are implemented in those regions.

Two Doses plus Booster Dose is compulsory for All public to ensure before gathering in public.

Swiss Francs: SNB intervention in Foreign markets makes discomfort for Francs Gains in Forex market

AUDCHF is moving in the consolidation pattern and the market has reached the Horizontal resistance area.

Swiss Francs shows smaller correction against US Dollar, due to SNB making more profits in foreign investment portfolios.

Now Swiss Francs reducing their gains due to SNB started for Global financial markets investments.

And inflation is lower in the Swiss zone; the Negative rates push for Swiss Francs to higher in the market.

US Dollar makes Lower last day as FED Powell testimony happened.

Last week NFP data shows fewer numbers printed makes disappointment for US Dollar and Supported counter pairs.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/