Gold: Many FED Presidents in the US Believe that Four rate hikes in 2022

XAUUSD Gold price is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

XAGUSD Silver Price is moving in the Descending triangle pattern and the market has rebounded from the higher low area of the Bullish Trendline.

Gold is gained from the Support ahead of ADP Non-Farm employment numbers scheduled today.

And FED Presidents in the US believe that more numbers will print, which will help in 4 more rate hikes in 2022 and a faraway forecast of 50bps in March month and more likely 25bps rate hikes are Visible in March Month.

And US Economy is performing well, and the US inflation data stood at 4.9%, which is well above the target of 2% and farther from the target.

So, inflation numbers triggered gold prices to higher and the Rising US Economy and US Domestic data pressed the gold prices to the downside against Rising moments.

US Dollar: US ADP report forecasted

USDJPY is moving in an Ascending channel and the market has fallen from the Resistance area of the pattern.

US Dollar index set to lower as correction phase after 2% up in last month.

And Today, US ADP employment change forecasted in positive numbers, US FED projections of rate hikes and tapering is faster in progress.

The US and Russia clash on Ukraine issues are critical, and anytime War occur in Ukraine, Borders causes US Dollar to make more robust as Buyer’s demand.

Euro: Nord 2 Pipeline from Russia to Europe under approval from the US.

EURNZD is moving in the Descending channel and the market has reached the lower high area of the Channel.

Eurozone is a suffering nation if Russia and Ukraine are involved in War activities.

And Nord Stream 2 Pipeline from Russia to Europe has done and Still waiting for approval of the Two nations.

Natural Gas and Crude Oil Prices send to wave-like Prices if Russia not Supported to Eurozone in Energy sector.

And Now, Washington likes to approve Russia to Europe zone Nord 2 Pipeline because Germany is the steam engine of Europe.

And Nord 1 Pipeline is sent from Russia to Europe accounts for 85% of natural gas and Oil in 2021.

The Pipeline that goes from Russia to Europe have intermediaries like Ukraine and Poland. No taxes detected in these Two nations from Russia sent to Europe so far.

In case War happens, then taxes issues from Ukraine appear in Eurozone. Euro Currency will mostly suffer if War happens between Russia and Ukraine.

UK Pound: Bank of America expected 25bps rate hikes from Bank of England

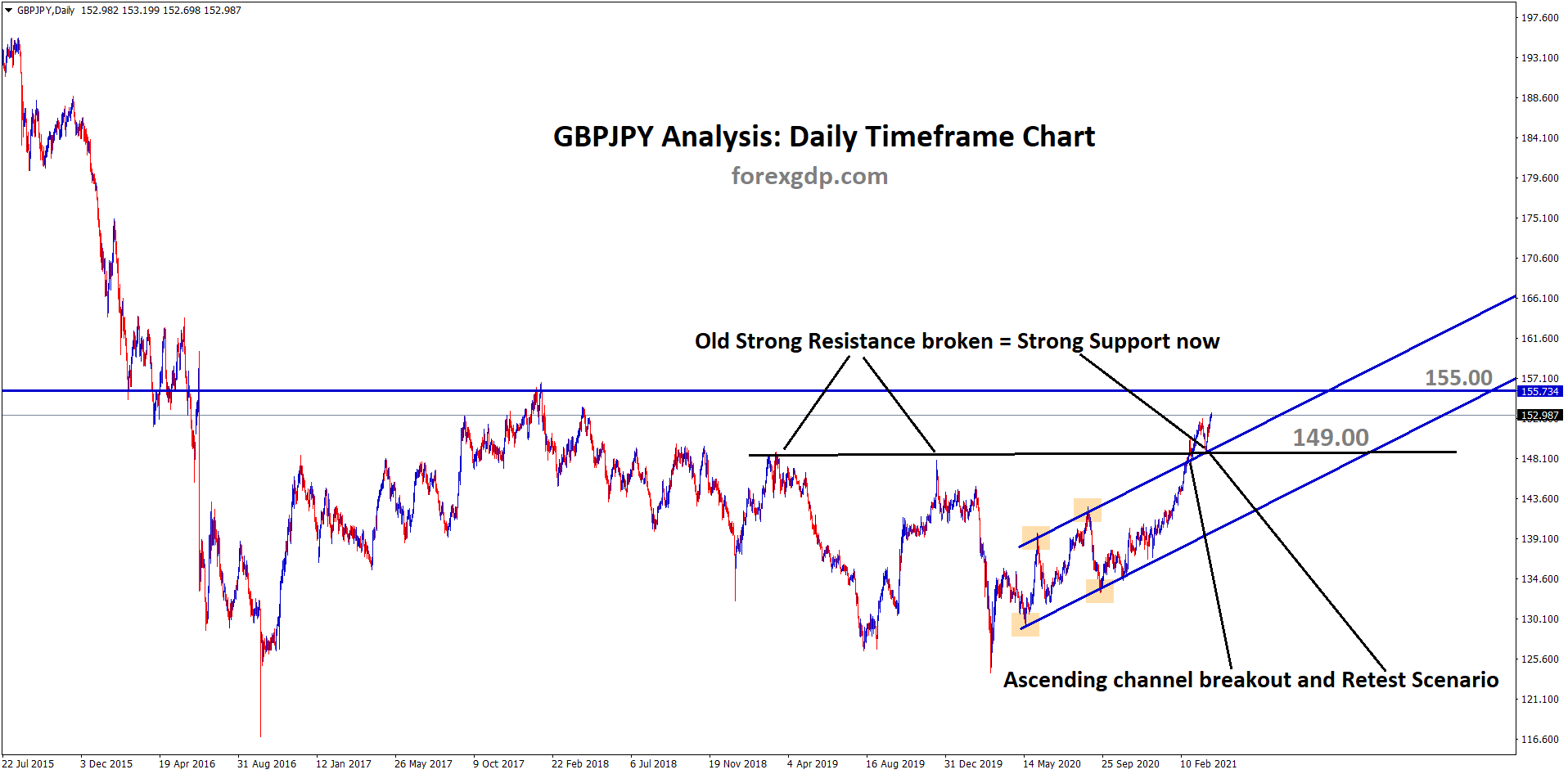

GBPJPY is moving in an ascending channel and the market rebounded from the higher low area of the channel.

Bank of America analysts expected Bank of England to hike the 25Bps rate in February month and then 25bps in May and August is expected.

The Bank of England will raise rates 25Bps, and then it will stop the Gilt reinvestments program.

And this will be tapering passive quantitative easing in Monetary policy assets.

Rate hikes and Local domestic data impact UK Pound rise to support the UK Pound extends rising.

UK Retailer increases cost to Consumers

UK retailer’s consortium said Retail prices of Food, Fuel and transportation costs are higher.

And Consumer end feels hard to pay such prices to Retailers.

And Retailers facing higher costs to wholesalers due to Manufacturing and Agriculture side inflation hitting in higher numbers due to supply and demand mismatch after Covid-19.

And BRC said prices rose 1.5% from a year earlier Food prices inflation reached 2.7%, and Non-Food stores prices rose to 0.9% from 0.20%.

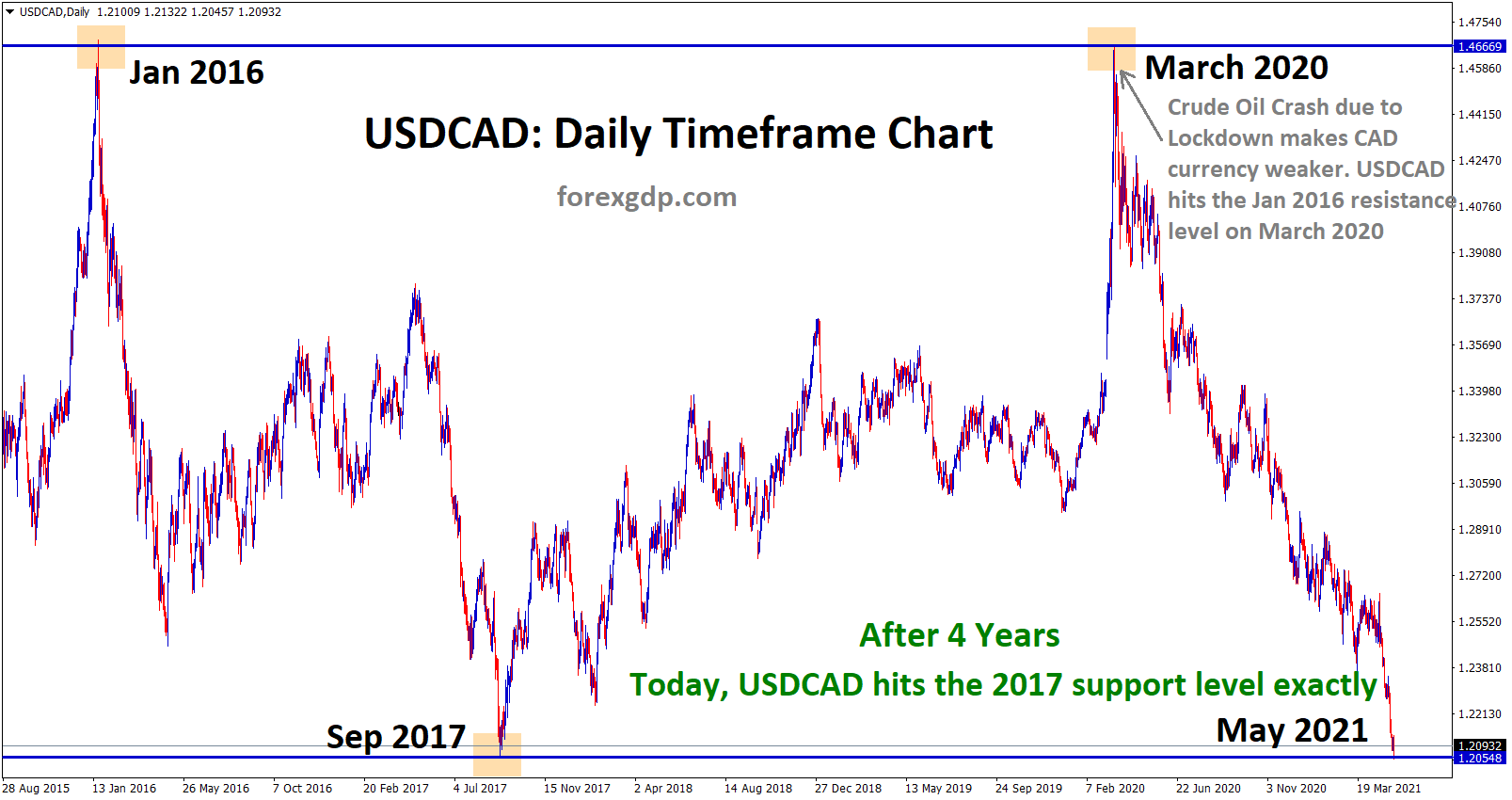

Canadian Dollar: Canadian GDP came at higher than expected

CADJPY is moving in the Descending triangle pattern and the market has reached the Support area of the pattern.

Canadian GDP Numbers came at 0.3% from 0.6% YoY, and Markit Manufacturing PMI came at 56.2 from 56.9.

And US ISM Manufacturing PMI came at 57.6 versus 57.5 expected and marking the 20th straight Expansion of the manufacturing activity.

Due to these, USDCAD shows a slight correction from the Uptick moves to 2% higher last week.

And Canadian Dollar is primarily supported by Oil prices rising as Disappointment from the Bank of Canada.

Japanese Yen: BoJ Governor Speech

CHFJPY is moving in an ascending channel and the market has rebounded from the higher low area of the channel.

Bank of Japan Governor Haruhiko Kuroda said Easing monetary policy measures expanded the Japanese economy moderately.

And this lower interest rate environment won’t affect Japanese Banks health systems.

The Japanese PM Kishida said Longer, lower interest rates and easing monetary policy aspects would benefit for Japanese economy only.

And Japanese Yen is in slight Bull mode after easing monetary policy measures taken by the Government.

Australian Dollar: RBA Governor Speech

GBPAUD is moving in an Ascending channel and the market has reached the Support area of the channel.

RBA Governor Philip Lowe said Stopping the Stimulus program was not aimed at Rate hikes expectations.

And the Inflation rates are temporary and not permanent; RBA won’t do rate hikes until the 2024 economy returns.

Australian Dollar is in Correction Phase from last week 2% dipped to support area.

And Omicron variant facing medium tone in Australia and some releasing restrictions measures will be taken to promote Business activities.

New Zealand Dollar: New Zealand Employment data in line with expectations

NZDJPY is moving in the Descending channel and the market has reached the lower high area of the channel.

New Zealand Employment numbers were released this morning and missed 0.4% Q/Q versus 0.10% printed in Q4 q/the jobless rate fell to 3.2% from 3.3%, beating expectations by 0.10%.

The missing expectations are primarily affected by Omicron Variant from October to December Month.

And New Zealand is unfazed by Employment data continuing in the Correction phase after a 2%-3% dip in Last week.

And New Zealand Faced Omicron variant cases are a little higher, but Restrictions are not announced so far in New Zealand.

Swiss Franc: Credit Suisse affected by Money Laundering cases

USDCHF is moving in the Symmetrical triangle pattern and the market has fallen from the Top area of the Pattern.

Switzerland Second largest Bank, Credit Suisse accused of Money laundering cases, and Law prosecutors said for compensation of 42.4 million Swiss Francs.

In December 2020, higher-level wrestlers did illegal transactions through this Bank by Cocaine trafficking activities.

Credit Suisse denies these actions, and the Bank employee was innocent; he was not supported for Money laundering in this case.

And Credit Suisse now have to pay for compensation, and Court will be active this week.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/