Gold: Global factors affected gold prices

Gold prices went higher and near the resistance area of 1815$ on Friday because US Senator Joe Manchin votted against Joe Biden Plan of BBB tool to raise debt ceiling.

XAUUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

And this brings back the stimulus hopes of passing to House in 2021.

US House Speaker Nancy Pelosi hopes that Voters will pass the BBB Bill in 2022.

And Gold prices are pretty lower after Omicron spread occurs globally, China finds real estate liquidity crunch, US and Iran tussle with denuclearization.

Following factors affected much for gold buying, Central banks one by one tightening stimulus and doing rate hikes in recent months making investors shift their funds to Higher Interest rate bonds.

US Dollar: US House Speaker Nancy Pelosi speech & Refusal of debt ceiling raising

USDCHF is moving in the Symmetrical triangle pattern and the market consolidated at the Box Pattern and rebounded from the Bottom of the triangle pattern.

US Speaker Nancy Pelosi said that US senator Joe Manchin disagreed and voted against Joe Biden’s Build back better (BBB) Plan.

This is a Fatal blow for Joe Biden plan of Safety net and tackling climate change and makes the US Dollar increase as uncertainty prevails in the US Government debt ceiling.

Remembering the earlier statement of Joe Manchin that this is the final support for Joe Biden to increase the Debt ceiling limit, next time, it won’t happen like this.

Newyork Fed President Williams speech

Newyork Fed President Williams said FED tapering will fasten in 2022, and rate hikes in 2022 are possible.

Fast tapering will help inflation slow its pace in the economy, and Rate hikes will see in March after completing the tapering process.

The FED target of a 2% Unemployment rate will soon be achieved, but a 3.5% rate of Unemployment will be achieved in 2022.

And the Full Goal of Unemployment and inflation target will be achieved in 2024-2025.

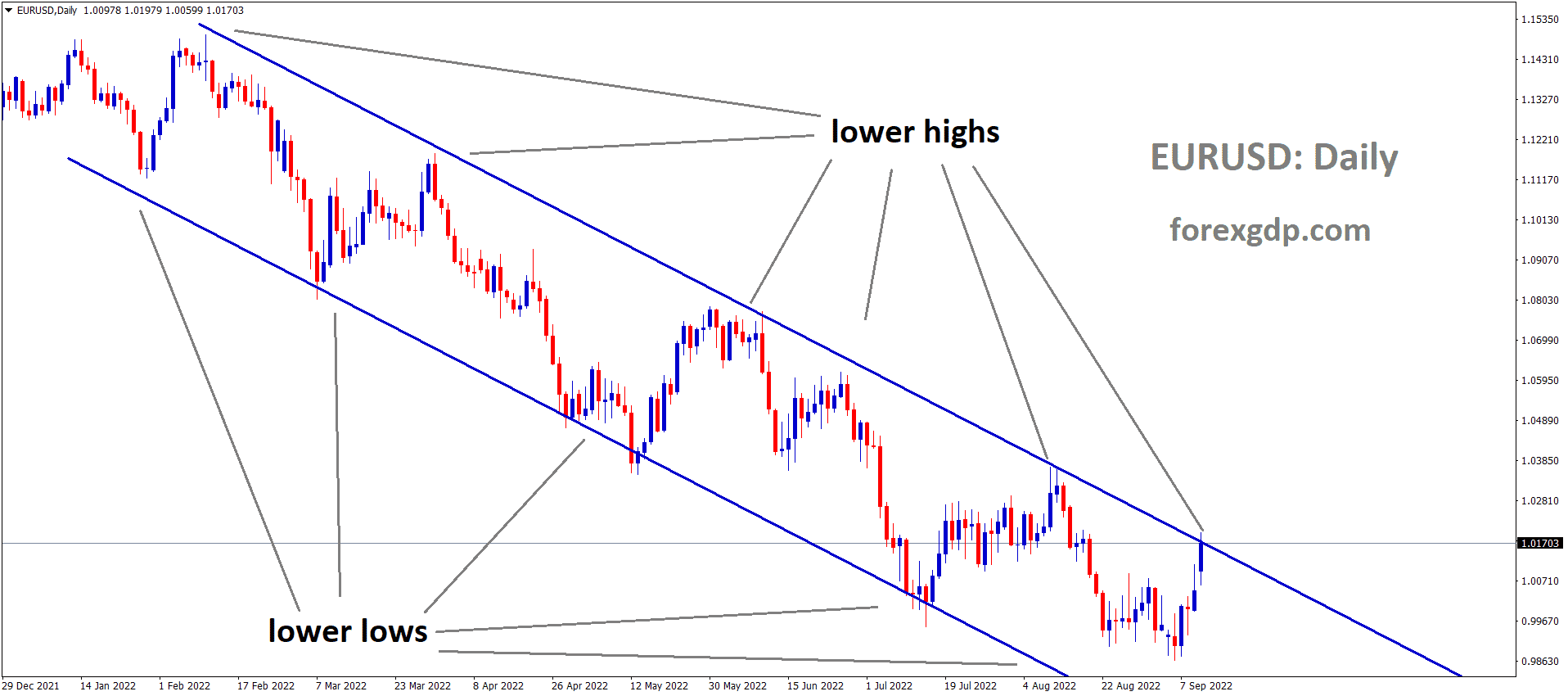

EURO: the Netherlands announced lockdown for four weeks

EURUSD is moving in the Box Pattern and the market has rebounded from the Horizontal support area of the pattern.

52% Jump in the UK makes more tight lockdown restrictions planning for Christmas Festive season, and the Virus Led death for New Zealand Resident who took Pfizer vaccine.

ECB Governing Council members Olli Rehn and Madis muller support rate hikes, and the Bank of France has Francois Villeroy said inflation will be higher in 2022.

And Dr Anthony S. Fauci said Omicron spread around the world very rapidly and the US may be suffering another large case due to new strain is possible.

Considering these situations, the Netherlands announced a four-week lockdown to control spread around Christmas and New year gatherings in cities.

UK POUND: UK Found 82K cases of New variant

GBPUSD is moving in the Descending channel and the market consolidated at the lower low area of the channel, reaching the Bottom area of the Box pattern.

GBPJPY is moving in the Descending channel and the market has reached the Horizontal support area from the broken minor Ascending channel.

Brexit minister Lord Frost has resigned due to No progress activities on Northern Irelan Protocol.

And Now Trade minister Lizz Truss takes into Brexit negotiator for England this week makes more pressure on Northern Ireland protocol.

UK Founds 82k Cases of New strain and 45 deaths occurred, in that 28 cases Positive of Omicron.

And PM Johnson said we have to implement a light touch plan to impose lockdown restrictions on Christmas gatherings and New Year celebrations.

And UK Chancellor Rishi Sunak said to resist the new variant Omicron before Christmas and Newyear eve.

Canadian Dollar: Canada faces 4k cases daily and US debt ceiling raising at refusal

CADCHF is moving in the Box Pattern and the market reached the Horizontal support area of the pattern.

Canadian Dollar moves to lower lows after US Oil declines lower on Friday.

And also, Canada faced 4000 cases daily from the new Omicron virus, and lockdown planning is in progress by the Canadian Government.

Due to more lockdown constraints in all parts of the Globe, Oil prices decline as lower consumption.

And Joe Biden plan of BBB tool to increase debt ceiling limit now at the refusal by US Senator Joe Manchin.

And this refusal came makes disappointments for US Democratic party to pass a Trillion-dollar stimulus to cover safety health measures and climate change.

Japanese Yen: Yen got stronger after Omicron spread fast

EURJPY is moving in the Box Pattern and the market has rebounded from the Horizontal support area of the pattern.

Japanese Yen remains stronger after the Omicron variant spread faster in the UK, Europe and China.

And Safe Haven currency like JPY, Swiss Franc, US Dollar went higher during riskier times.

Now Japanese Government passed hefty stimulus measures to increase Manufacturing and Business activities from slowing down.

USDJPY makes consolidated at 112.50 to 115 area from the past two months.

And Japanese Yen like to appreciate against counter pairs except for CHF and USD.

This week, the Japanese inflation rate like to focus; if it came lower than expected, the bank of Japan would escalate further activities to increase inflation measures.

Australian Dollar: New South Wales reported higher cases

AUDNZD is moving in an Ascending channel and the market has reached the higher high area of the channel and consolidation at the top of the channel.

Australia reported 2566 cases in New South Wales, the most populous city, and Daily cases 3900 crossed now.

But Lockdown restrictions may not be needed to clamp down the Christmas Eve and Newyear festivals.

Australian Health Minister Greg Hunt said Australia might not impose tight lockdown restrictions like the Netherlands imposed lockdowns in Christmas and Newyear celebrations to avoid the spread of highly contagious disease.

But We have prepared All safety measures to curb the Omicron variant, and we won’t need any lockdown measures to curb the spread of the Virus.

New Zealand Dollar: New Zealand Domestic data weak numbers printed

GBPNZD is moving in an Ascending channel and the market has reached the previous resistance area of the channel.

New Zealand Westpac’s consumer confidence shows fell in output numbers as 99.1 from 102.7 and 101.5, which was forecasted.

And the Balance of trade for November saw a Deficit of N$864 million, which is better than the October month deficit of N$-1.2 billion.

The Exports are N$5.86 billion and Imports are N$6.73 billion causes more impact in November.

And China’s loan prime lending rates are scheduled this week; the 1 and 5 years Loan Prime rate is 3.85% and 4.65%, respectively. Any Loan rate cut will impact major markets this week.

Swiss Franc: SNB like to curb the Overvalue Swiss Franc

AUDCHF is moving in the Descending channel and the market has fallen from the top of the channel and has broken the minor ascending channel..

Major central banks like US and UK started to tapering and increase rate hikes path in 2022.

Swiss Franc hits 6.5 years high makes SNB control the overvalues of the Swiss Franc by intervening in foreign and FX markets.

And the plan of selling Swiss Franc in more to curb the Swiss Franc prices to lower and stable like other developed currencies.

Swiss Economy also feels the heat of inflation, and negative rates show lower in the Swiss economy

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/