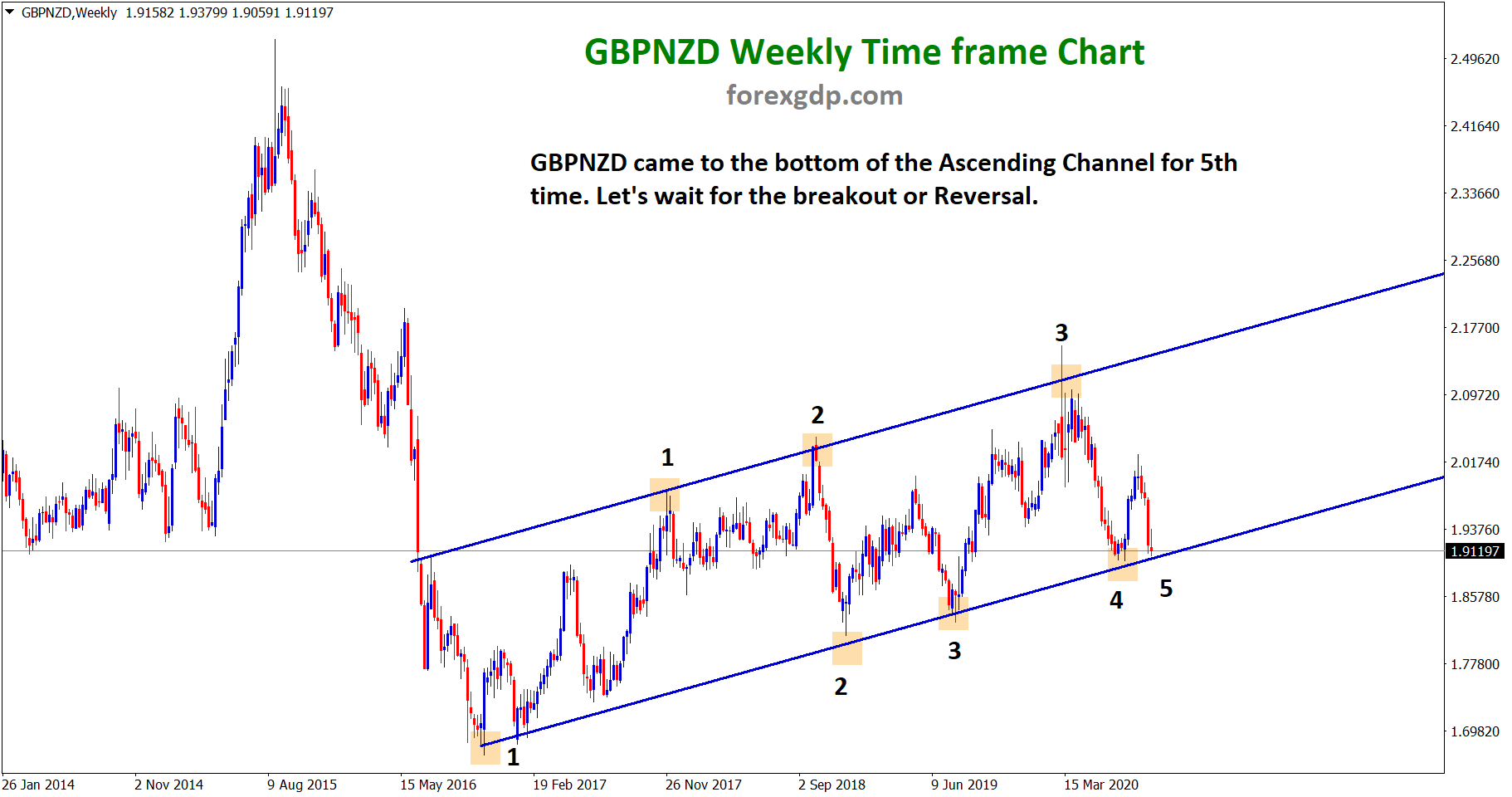

UK Pound: UK GDP rate increased above expectations

UK GDP rate rose to 1.1% on 3month Avg reading from 0.80% forecast, and All sectors grew up by proper rates.

- Construction up by 1.1%

- Services up by 0.80%

- Production up by 0.70%.

GBPNZD is moving in the Rising wedge pattern and the market has reached the higher low area of the pattern.

And the economy now recovers back to above the 2020 crisis level, and So the Bank of England bet for 50Bps rate hikes, but a 25bps rate is expected next week.

And GBPUSD Dropped to 1.3080 area from 1.3180 area after Ukraine negotiations failed to Russia.

But the UK made more sanctions on Russia, and So Oil prices are soaring higher, making the UK Pound weak.

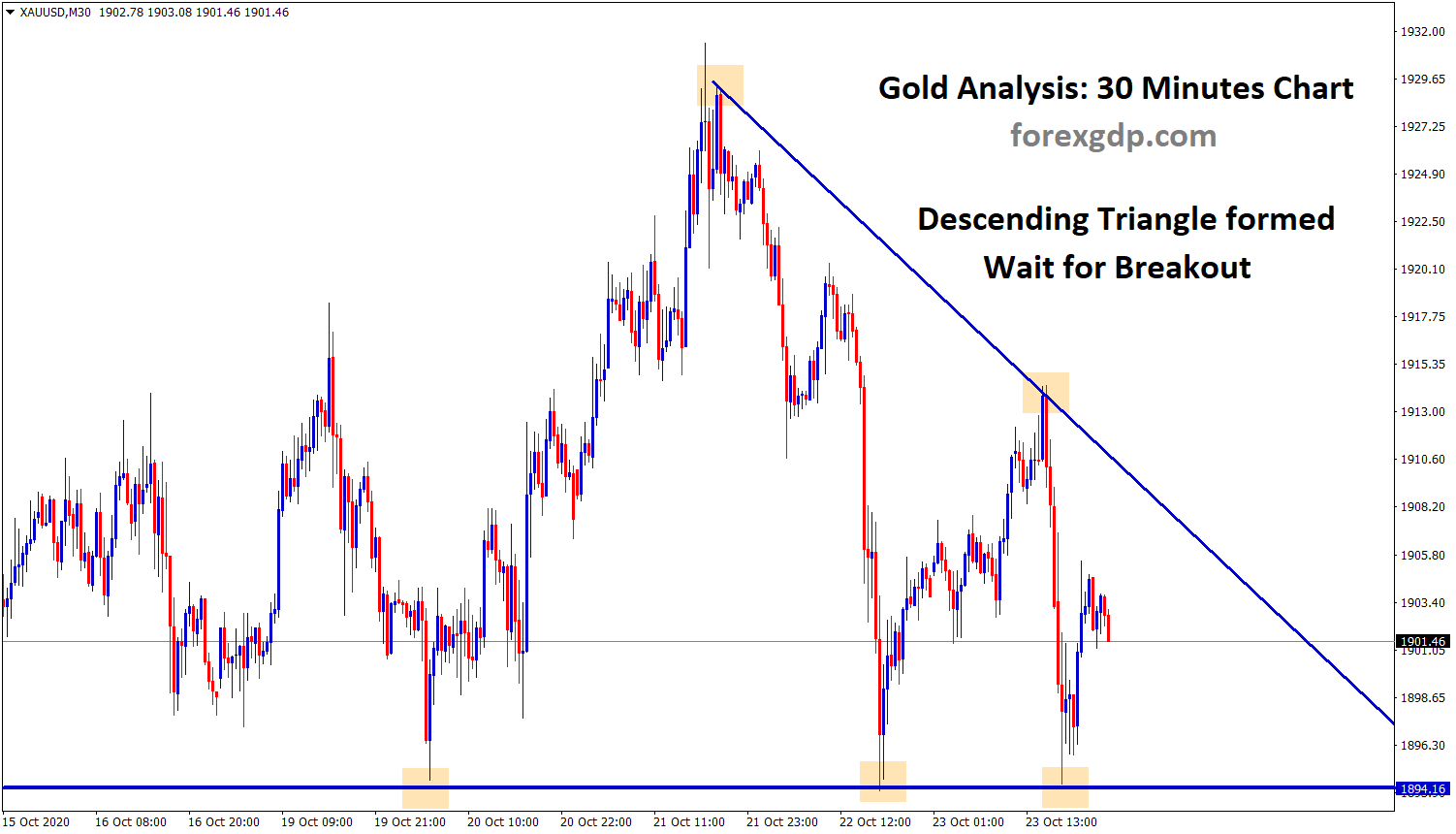

Gold: Ukraine and Russia disagreed with Negotiations

XAUUSD Gold price is moving in an Ascending channel and the market has reached the Higher low area of the pattern.

The gold market fell by 2.9% on Wednesday due to Ukraine President Zelensky agreeing to Negotiate with Russia, But Yesterday’s meeting is no hope for a ceasefire in the war.

And Russia firmly told Ukraine must meet our Rules and Regulations, then only We stop the war.

US Senate passed $13.6 billion for Humanitarian and Security aid in Ukraine.

The yellow metal felt last day because US CPI data came at 7.9%, which is 40 years high nearer reading.

US Dollar: US President Joe Biden planning to end the normal relationships with Russia

GBPUSD is moving in the Descending channel and the market has reached the lower low area of the channel.

US President Joe Biden have a speech today regarding Russian Trade relationships, and the US like to end the normal relationships with Russia.

In a clear way, Biden has increased the tariffs on Russian imports to the US; the main reason is the Ukraine invasion by Russia.

Both Parties in the US have supported Joe Biden’s move to end the normal relationships with Russia.

Now Biden has to take the call from G7 nations to support the approach against Russia.

US Senate has approved $1.3 trillion funding for US Government

US Senate voted to approve the bill for funding the Government until September month $1.3 trillion.

The bill included approving $13.6 billion for Both humanitarian and Military support for Ukraine as long as Battle to Russia.

And US lawmakers scrapped $15.6 billion Covid-19 relief from the plan.

Senate Majority leader Chuck Schumer said we had provided food, shelter, medicines for millions of Refugees in Ukraine who had shifted to Neighbor countries.

We have also provided weapons like Javelins and Stingers.

EURO: ECB makes rate hikes if Tapering of Bond purchases completed

EURCHF is moving in the Descending channel and the market has fallen from the lower high area of the channel.

Euro strengthens against USD last day after ECB monetary policy hints for Rate hikes if tapering of bond purchases completed.

Bond purchases of tapering are completed in the 3rd quarter, and ECB has to 30bps rate hikes from 50bps expectations.

Russia and Ukraine War makes stagflation growing in Europe regions, So ECB proceeded for maintaining the Status Quo this time.

ECB monitoring energy prices soaring in European nations and have to control by proper demand and Supply of Oil resources.

The rate hike is the next tool if not controlled the inflation at initial steps.

Canadian Dollar: Unemployment rate forecast released today

CADJPY is moving in the Symmetrical triangle pattern and the market has reached the top area of the pattern.

The Canadian unemployment rate is expected to drop at 6.2% against the previous number of 6.5%.

And Employment change may come at 160K versus -200.1k previous reading.

USDCAD fell about 2% this week after the Oil price spiked to $129 price, Yesterday US CPI Data came at 7.9%, which is 40 years high in the US.

And the US Sees inflation as significant hurt for the economy, and the FED maybe do a 50bps rate hike this month.

And US President Joe Biden has put sanctions on Russian Oil imports so that the US may feel more Oil consumption in coming quarters, and more production has to increase in Oil refineries.

Japanese Yen: US CPI data came at 40 years high

CHFJPY is moving in the Symmetrical triangle pattern and the market has reached the top area of the pattern.

Japanese Yen hit five years low against US Dollar after US CPI hits nearly 40 years high as 7.9%.

And Now, Currency is depreciating against inflation reading, so the monetary policy committee’s goal is to stabilize currency price.

And by considering this situation, FED has to rate hikes consecutive this year, then inflation will slow down, and Currency appreciation will get higher; otherwise, no worth of Currency notes if inflation gets higher than ever.

If FED raised interest rates, conversely, the Bank of Japan had to raise rates, but BoJ now has no space for rate hikes because of Goals of inflation; Jobs reports are not achieved their goals.

Australian Dollar: RBA Governor gives hopes for a Rate hike this year

AUDCHF is moving in the Rising wedge pattern and the market has reached the higher low area of the pattern.

Australian Dollar boosted by RBA Governor Phillip Lowe said rate hikes this year; inflation is sustainably moving to a 2-3% target.

Russia and Ukraine war makes Soaring commodity prices like Iron ore and Aluminum.

And Exports revenues came higher than expected, but inflation on the Domestic side increased.

So, Currency is more important to strengthen this time; based on the Proper situation, the rate hike will be announced to curb inflation readings.

New Zealand Dollar: New Zealand Domestic data came in mixed Bag

NZDJPY is moving in an Ascending channel and the market has reached the higher low area of the pattern.

New Zealand Business PMI for February came below 54.5 forecasts to 53.6, and the Food price index drooped to -0.10% versus 1.3% expected.

And Electronic card retail sales slumped to -7.8%MoM from 0.0% and 2.9% previous reading.

RBNZ plans for consecutive rate hikes in the coming months after Ukraine, and Russia talks about failure last day.

And This makes the hopes for New Zealand Dollar Rising against the USD today.

Swiss Franc: US Dollar strengthens against Swiss Franc as War continues in Ukraine

USDCHF is moving in the Symmetrical triangle pattern and the market has reached the top area of the pattern.

Swiss Franc appreciated against counter pairs except for USD; due to higher inflation in the US, the FED rate hike is more basis points than expected.

This, in turn, USDCHF climbed to 0.9300 area, which was a weekly jump this month.

Russia and Ukraine negotiations in Failure mode, UN security council, called Moscow for usages of chemical and biological weapons in Ukraine War.

So Russia and Ukraine War goes in Serious way no ceasefire has yet now between the two countries.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://www.forexgdp.net/buy/