Gold: US shows more robust PCE numbers last day

XAUUSD Gold price is moving in an Ascending channel and market consolidated at the higher low area of the channel.

XAGUSD Silver price is moving in an Ascending channel and the market reached the higher low area of the channel.

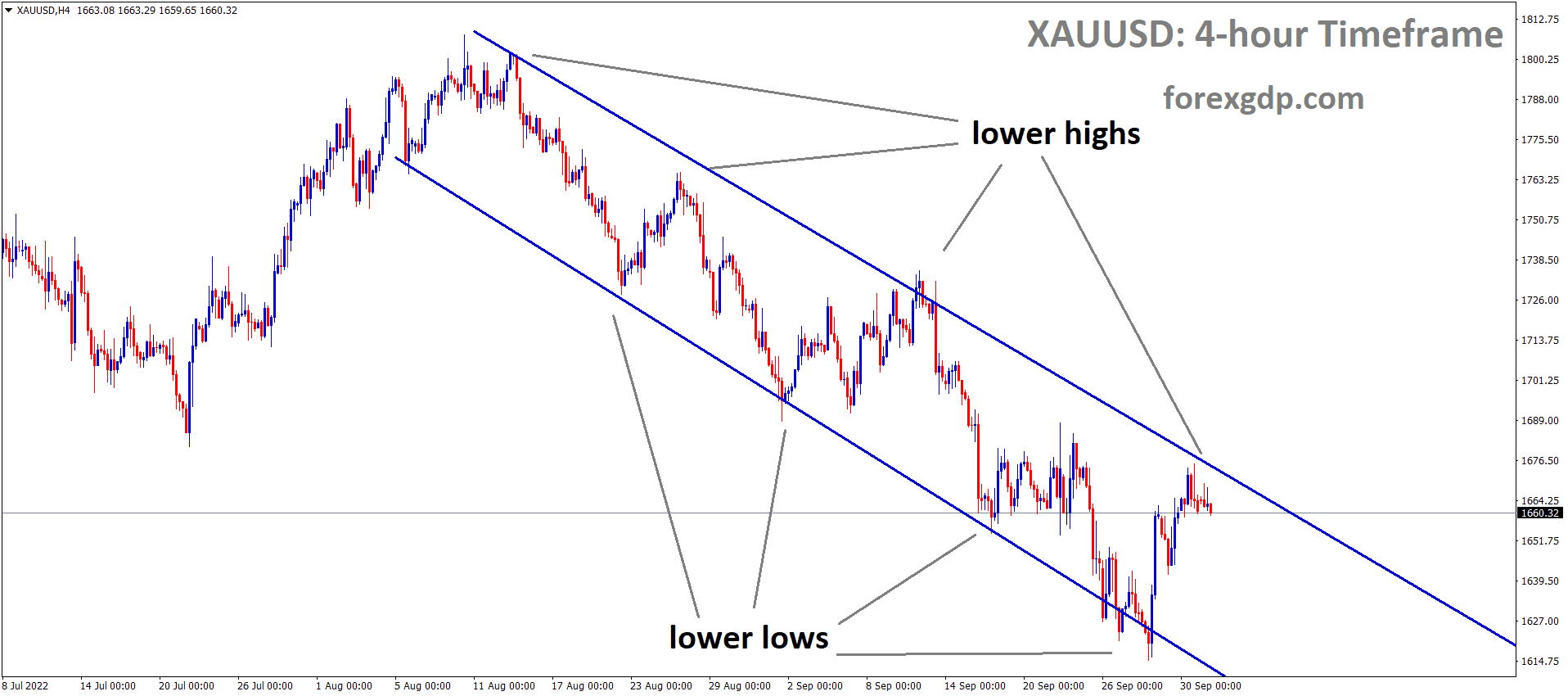

Gold prices are remains down as US Domestic data shows a mixed bag of printed numbers.

Gold prices are remains down as US Domestic data shows a mixed bag of printed numbers.

US Core PCE index numbers came at 4.1%, in line with expectations and above 3.7% last month.

Now FED meeting has considered this Personal consumption expenditure data as necessary in the table because the rise in inflation causes more emptying your pocket money.

So, FED must do tapering higher than previously described and do rate hikes earlier in 2022 expected.

Euro suffered more covid-19 cases, and Germany, Austria joined hands for Lockdown implementations to arrest Covid-19 Spread.

Gold prices came down due to demand being slower in Global nations.

US Dollar: US Domestic data shows a mixed bag of numbers

GBPUSD is moving in the Descending channel and the market reached the lower low area of the channel.

US GDP Q3 shows 2.1% came down from expectations of 2.2%; Core Durable orders came at lower as -0.50% versus 0.20% expected.

And Main Personal consumer expenditure index came at higher as 4.1% above from previous reading of 3.7%.

But Michigan Consumer sentiment came at 67.4 versus 66.9 as higher reading.

US Initial jobless claims made at 199k came down from 270K.

Due to this US Dollar makes higher after a mixed bag of Data printed yesterday.

EURO: Covid-19 Spread increased in many parts of the Eurozone

EURNZD is moving in the Box pattern and the market reached the horizontal resistance area.

Eurozone faced tight lockdowns in Netherlands, Austria, and Germany as Covid-19 Spread increased higher.

And Eurozone Governing council member and Bundes bank head Jens Wiedmann said. There is no tapering, and rate hikes are possible until problems are solved.

And the UK also faced 43K cases, and the Virus death toll rose to 149.

UK PM Johnson said to Northern Ireland PM Michael Martin there would be no ordering of Article 16 if talks were not going to collapse.

UK Pound: the UK does not compromise with EU on NI Protocol

GBPNZD is moving in the Descending channel and the market reached the lower high area of the channel.

UK Made stopped some portions of the Divorce deal with Northern Ireland in Post Brexit deal due to conversations progressing between the EU and UK.

The EU said the UK does not want to compromise with the EU; they are stubborn in their activities.

And France planning to block British Vessels crossing French Ports due to Britain making refusals for giving licenses to French Fishermen to cross British Waters.

And Today, Bank of England Governor Bailey’s speech will happen; any hawkish tone will bull the UK Pound once again.

Canadian Dollar: US Domestic data makes Canadian Dollar lower

Crude oil is moving in the Descending channel and the market fell from the Lower high area of the channel.

Canadian Dollar shows weakness in markets as US Oil shows weaker tone and corrections performed in markets.

And US Dollar index shows continuous bullish momentum and is ready to target 100 marks by December month.

Now Canadian Dollar faces no policy steps has been taken by the Bank of Canada as of now; any rate hike like New Zealand will trigger the Canadian Dollar back to the 95-100 mark by next year-end.

And UAE does not have a plan to increase the supply side on a clear path, the US and other nations planning for sharing Oil reserves won’t help much in the Energy crisis

US Imposed duties on Canadian Lumbers

Canadian Trade minister said they were mostly disappointed for US Actions on Duties proposed for Canadian Softwood lumber for most producers to 17.9%.

And Canadian Lumber business contributed $25 Billion to the Country’s GDP in 2020and 1.80K workers behind in lumber industries.

Canadian Dollar going weaker tone after the US Imposed duties in Lumber from Canada.

And the US has used more Canadian Lumber for high-quality construction sites. By considering this US has imposed more duties on Canadian Lumbers.

Japanese Yen: Japanese Government makes unchanged on Economy view

CADJPY is moving in the Descending channel and the market reached the lower high of the Channel.

Japanese Cabinet has kept its view on Economic Assessment as Unchanged in November.

The economy shows a downbeat in recovery due to supply chain bottlenecks and Covid-19 spread.

And Japan has raised its view on Consumption due to Services spending being increased.

Exports and Productions areas are down due to Chipset shortages and Supply chain bottlenecks.

Pandemic causes severe infections in the economy, and Foot traffic has been eased after lifting the Covid-19 restrictions.

Australian Dollar: Iron ore Prices lifted Up

AUDCAD is moving in the Descending triangle pattern and the market reached the Horizontal support area of the pattern.

Iron ore prices lifted to $15 in 4 days as $103/T due to China’s recovery from property defaults and Economy backlogs.

Australian GDP is now watching in following week data; easing lockdown restrictions make lower GDP data is expected.

And China Domestic data finds Downbeat in Productions and manufacturing areas due to Energy, Electricity and Delta Virus issues.

Australian Dollar depends on the Chinese economy because half of the products exports to China and Exports revenues are affected mainly by China incidents in the economy.

New Zealand Dollar: RBNZ Rate hike is in vain to create Bull momentum

AUDNZD has broken the Descending channel.

Reserve Bank of New Zealand made 25Bps rate hikes last day, but New Zealand Dollar fell as much as 0.50% from highs.

And the market was slightly disappointed after rate hikes because the market had already moved higher highs before the news came after News Selling pressure had come in markets.

And New Zealand PM Going to release lockdown in Auckland from December 15th, as Already told.

Now releasing lockdown, inflation went higher, unemployment came lower than other Developed countries, Retail sales up to mark, So All Domestic data favouring for Reserve Bank of New Zealand makes rate hiked this week.

But the market has already expected before, so now the market shows weak momentum.

Swiss Franc: Swiss GDP Forecast

CHFJPY has broken the Descending channel and the market reached the Horizontal Resistance area.

Swiss Zone GDP is set to release on Tomorrow, and the Expected reading is 3.2% from the 7.7% previous reading.

Swiss Zone made economic recovery slower, and inflation readings are higher for 30 years.

The US showed higher inflation data yesterday as 4.1% from 3.6%, and FED might do tapering of purchases in increasing order from next month.

But the Swiss national bank is waiting to do tapering and loosening monetary policy is more on the table.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/