Gold: Nonfarm payrolls Forecast

Gold has reached the horizontal resistance area while moving in an Ascending channel.

Gold prices are moving in the ranging market as non-farm payrolls data are ahead today.

Non-farm payrolls expected reading is 750K and well above expectations support for US Dollar, reverses if came in negative numbers.

FED Powell clearly stated that the inflation target reached our Goal, and the Labor target did not reach our Goal.

Prices of inflation numbers are rising month on month as Labor cost wages are rising higher to correspondence, So Fed May take action soon to chill inflation rates in the economy.

US Dollar: Unemployment rate forecast

NZDUSD has reached the lower high level of a descending channel.

GBPUSD is moving in an Ascending Channel in the 1-hour timeframe chart.

US Dollar shows ranging market as 92-93 level this week, and non-farm payrolls data is a main key event marked today.

Based on expectations, US Dollar decided the right direction. Japanese Yen and Euro, GBP all pairs are stronger against USD.

As FED delaying tapering assets in the near end and want to do in long term period to reduce asset purchases makes worry for investors mind.

The unemployment rate is scheduled today, whether positive or negative numbers based on numbers FED Powell decided in this September month policy meeting for tapering or rate hikes.

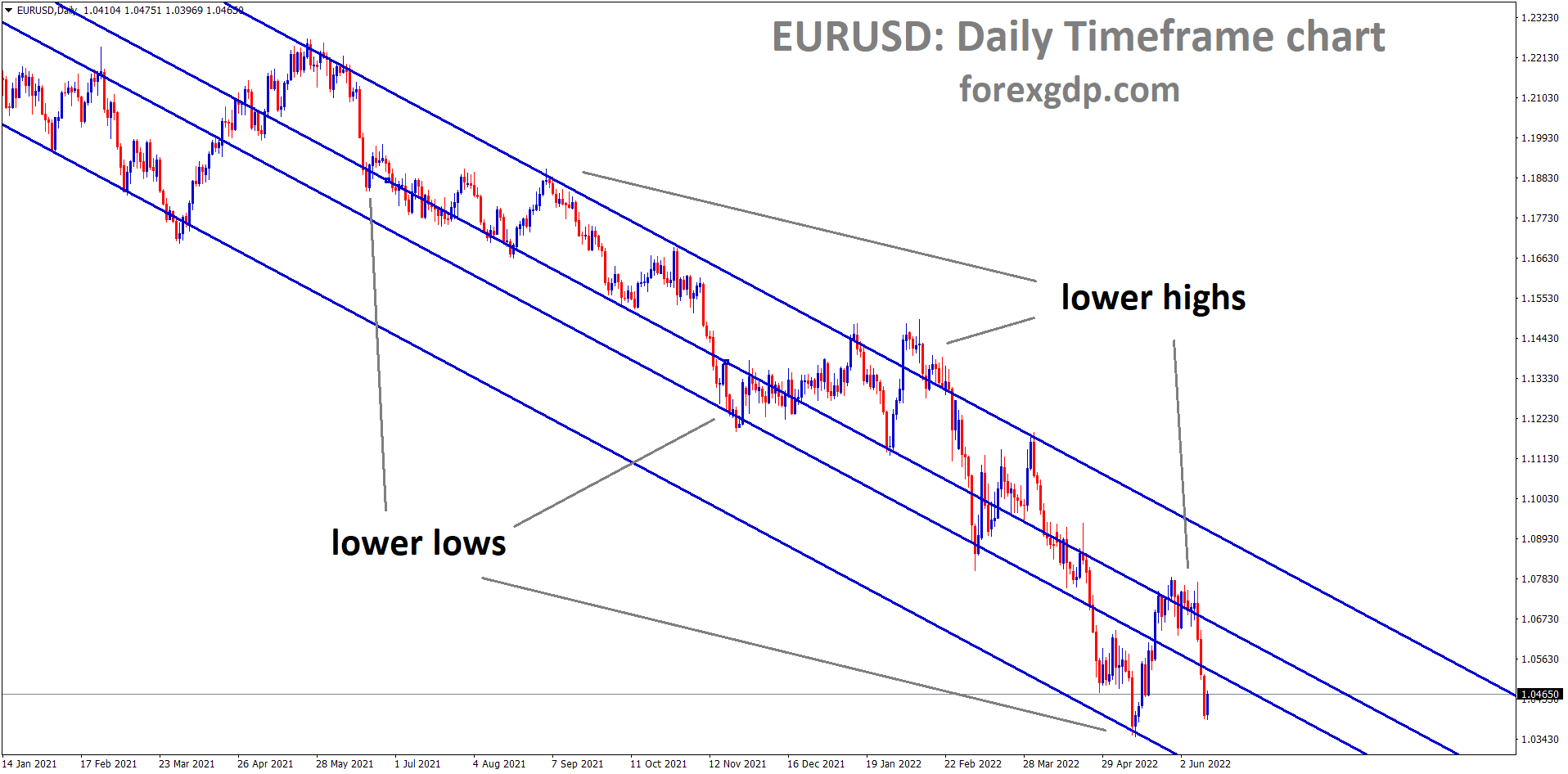

EURO: Retail sales data

EURUSD has reached the horizontal resistance area after breaking the descending channel.

EURJPY have chances to retest the broken descending channel.

EURUSD makes higher after ECB Board members discuss Tapering talks to implement in Upcoming ECB meeting in September.

And Retail sales for Eurozone came at 2.3% in July and expanded by 3.1% in the last 12 months. August Services PMI in Germany and Euroland came at 60.8 and 59 respectively.

So, Eurozone now came up with mixed bag data, and EURUSD makes higher this week.

Now US NFP data to publish this evening will decide the market direction of the Euro against the US Dollar.

Tapering assets purchases by ECB

Eurozone shows some positive feedbacks from ECB board members to do tapering soon by early 2022.

Currently, 80 billion Euros purchasing and reduced back to 50 billion Euros in March 2022 is expected by Economists.

And UK PM Johnson planned for tax hikes to recover the economy from the pandemic, so 25 million people pay extra tax in the UK.

Delta variant is increasing one side; Age-16 -17 people were now injecting with vaccinations.

And NFP data is scheduled this evening, which will give the Directions for EUR and GBP this week.

UK Pound: UK and EU concern onNorthern Ireland Protocol

GBPJPY hits the lower high level in a downtrend line.

GBPCHF is moving in an Ascending channel breaking the recent resistance area.

UK Pound moved higher as US Dollar weakness is shown in the market.

And Delta cases spiked in the UK; again, any lockdown measure is possible if a pandemic is not controlled.

UK and EU are not solved in Northern Ireland Protocol, and discussions are progressing.

UK PM Johnson announced tax hikes, and Now People has recovered from the pandemic.

Many Furlough schemes are started to close as the economy reaching Goal.

Canadian Dollar: OPEC+ extended Supply

EURCAD is moving in an ascending channel pattern.

CADCHF is moving in an Ascending channel range in the hourly chart.

Canadian Dollar is stronger more as Oil prices make higher again as Demand created more in Global level.

OPEC+ agreed to extend the Supply of 400k Barrels per day, which will support the Canadian Dollar to boost the economy.

And USDCAD makes fresh lows today ahead of NFP data releasing today evening.

Canadian Dollar stronger performance is due to the Bank of Canada is ready to taper assets soon in the upcoming meeting.

Japanese Yen: PM Suga resigned

USDJPY is still moving in an Ascending Triangel pattern.

Japanese PM Yoshihide Suga resigned from Japan Prime minister Posting as Handling of Covid-19 is worst performance as declared by the Ruling party itself.

And Now, Fumio Kishida, the Foreign minister likely to place in PM Post as analysts expected, but other members like Taro Kono is likely to be the next PM seat in Japan.

Due to lack of stimulus spending and Governing economy is worst handling by Suga period makes him to out of office by the self-ruling party.

Now, this is a good time for Stocks, Forex and Commodities in Japan, and New PM may act according to a fast approach to bring back a strong economy in Japan.

Australian Dollar: Australian AI index data

EURAUD reached the support area and trying to bounce back.

GBPAUD bounced back after retesting the old resistance level.

GBPAUD bounced back after retesting the old resistance level.

Australian AI Group index crossed the wires and came at 38.4, down from 48.7 in July month. The final PMI of August month shows the second straight month of contraction.

The readings are below expectations after Tight lockdowns are injected in New South Wales and Victoria state.

As the Pandemic once again got higher and panic surrounded, whether grownup economy from pandemic will again go dip for the second time, this situation is called Double Dip recession.

But another side Australian Dollar prepared for Bullish momentum as Breaking through previous resistance line.

Today US NFP data is scheduled to update, and good numbers will drag Aussie down; bad numbers will help Aussie to Upside.

New Zealand Dollar: RBNZ Governor ORR announced rate hikes soon

EURNZD has reached the support area again in the daily timeframe.

New Zealand Governor Adrian ORR announced more rate hikes would be done in earlier 2022, which spiked the New Zealand Dollar in higher reading.

And Assistant Governor Hawes said there are more chances for tapering and rate hikes in the reserve bank of New Zealand monetary policy tool. Still, the Delta variant must control properly to implement rate hikes.

And Covid-19 pandemic this time may increase resistance for RBNZ to hike rates, but sooner than expected on October 6 meeting, RBNZ makes tapering in assets.

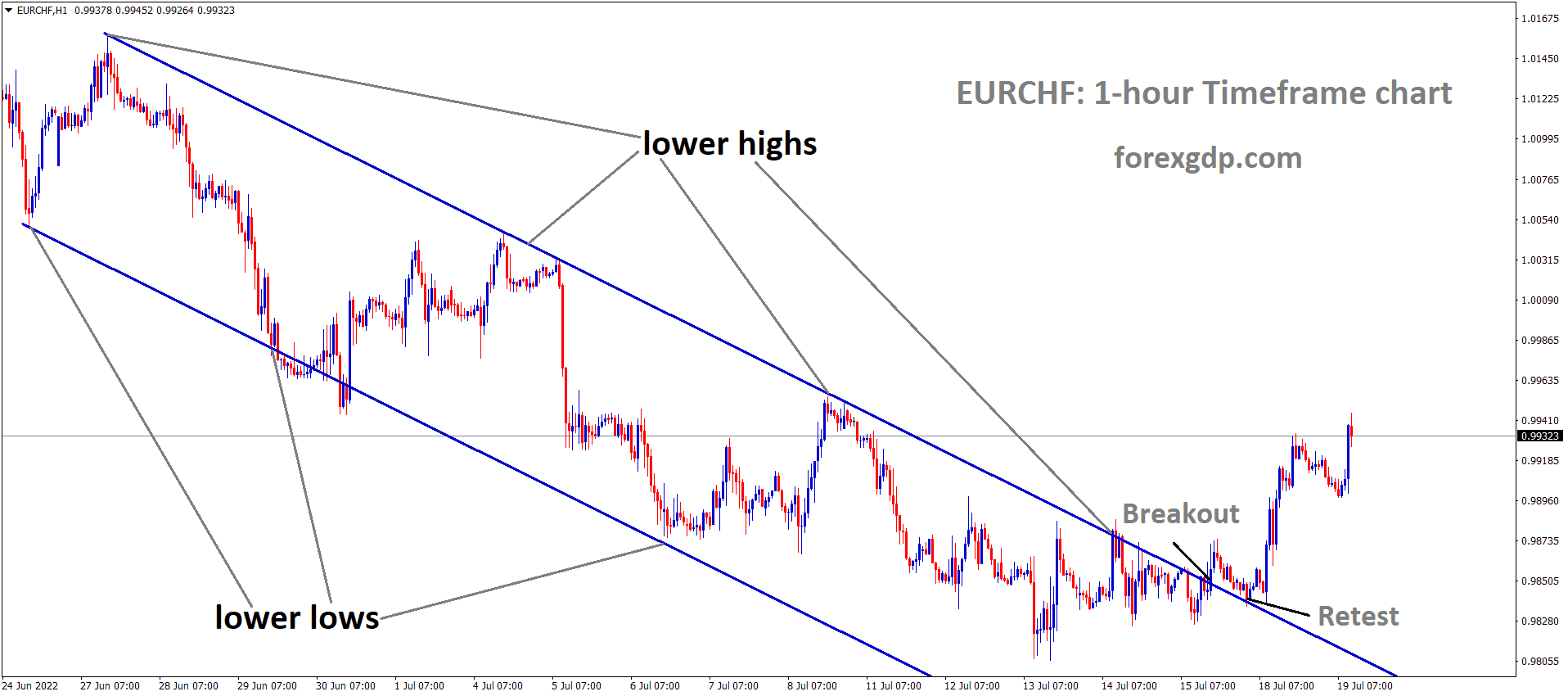

Swiss Franc: Swiss retail sales data

USDCHF is consolidating after breaking the top of the descending channel – wait for the breakout from the consolidation move.

US Initial jobless claims data fell to 340k versus 345K expected, many companies show 15723 jobs cuts in August, But Jobless claims data failed to impress US Dollar.

In Switzerland, Retail sales fell 2.6% on a yearly basis, and this reading is an annual decline in the first five months, and the Economy is expanded by 1.8% but below 2% expectations.

The inflation rate jumped to 0.9% in August from 0.7% previous level and above market expectations of 0.8%.

And Swiss data shows a mixed bag of retail sales down and inflation rate up as a Favour for investors tapering mode.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/