Gold: Goldman Sachs downgraded US GDP to 2.0%

Global concern over the rapid spread of omicron variant.

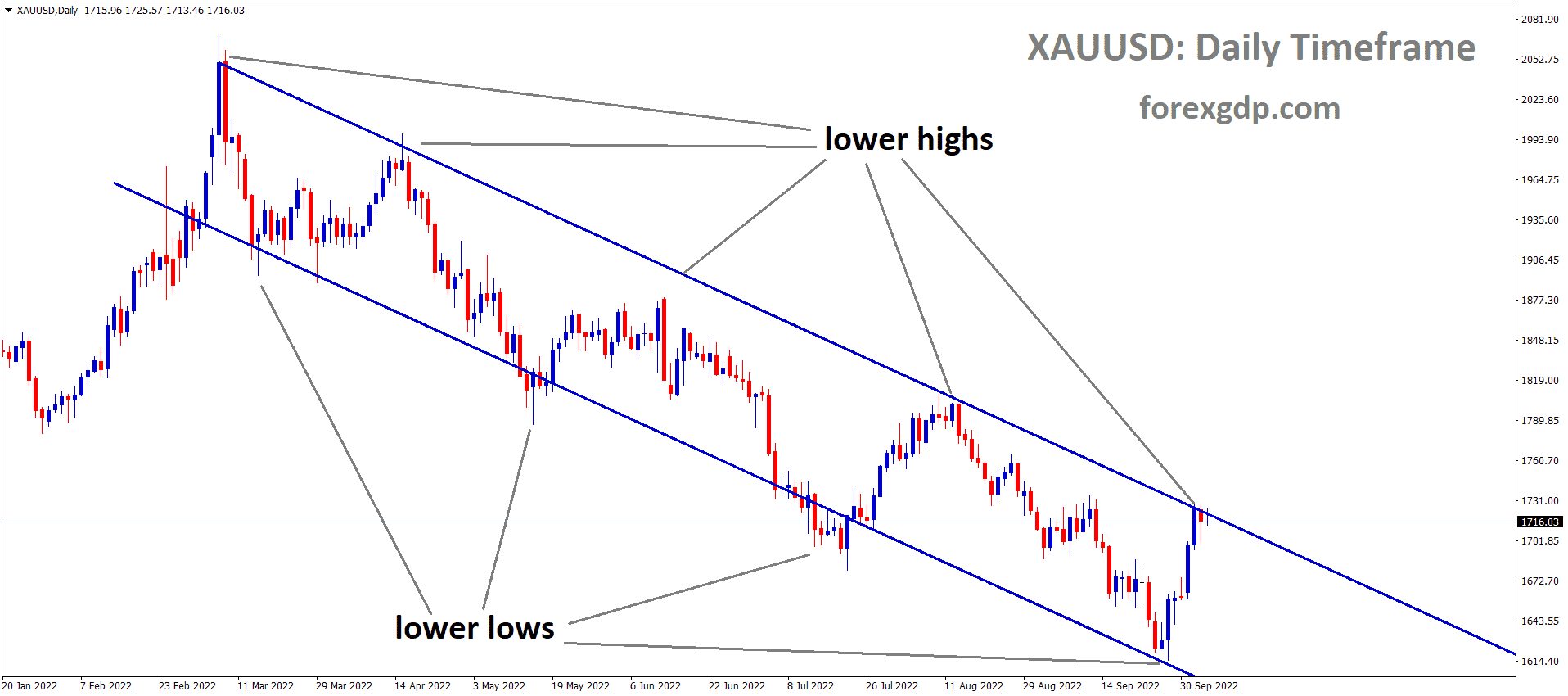

XAUUSD Gold price has rebounded from the Horizontal support area after hitting the higher low area of the bullish trendline.

XAGUSD Silver price is moving in an ascending channel and the market reached the horizontal resistance area.

Goldman Sachs forecasted Q122 US GDP is 2.0% from 3.0%. Which was Downgraded due to Joe Biden plan of spending is ended.

US Joe Biden plan of (BBB) was ended by US Senator Joe Manchin last day. This becomes a big blow for US Dollar, and the US 2-year yield falls overnight.

This week’s Core PCE index for November is Going to publish, and the expected rate was 4.6% from the 4.1% previous reading.

So, Gold prices remain bullish momentum as the inflation rate will go better.

US Dollar: Turkey President speech

USDJPY is moving in an Ascending triangle pattern and the market has rebounded from the higher low area.

Turkish President Recep Erdogan said there is no pulling back of Lira and converted to foreign currencies due to Turkey’s image of financial instability.

And he said that they are going to cut 1% of Corporation taxes, which will benefit to Support employment in Turkey.

And Lowering interest rates will pull back the inflation to lower.

Currently, CPI rose to 20.0% in Turkey, and the interest rate got down by 14.0% from 15.0%.

And the President’s confidence speech makes investors sell USD against Lira today and plunge from 18.0-11.0 in 2 days.

EURO: ECB showed no intertest to hike rates and concern over Omicron variant

EURCAD is moving the Descending channel and the market reached the horizontal resistance area and lower high area of the channel.

Euro currency made sideways market against US Dollar due to Omicron variant spread faster in Euro region.

And ECB has no plan for increasing rates in 2022 end, but PEPP purchases will be reduced and completed in March 2022.

The Netherlands announced a lockdown to curb Omicron variant spread during Christmas and Newyear Festivities.

And Germany faced a lot of cases and hospitalizations; another round of lockdown may be imposed after Newyear festivities.

US Senator Joe Manchin stopped US Joe Biden plan of $1.75 trillion with the refusal vote.

UK POUND: the UK faced more daily cases of New Omicron variant

GBPJPY is moving in the Descending channel and the market rebounded from the Horizontal support area of the channel.

The UK faced 91723 cases daily, and UK PM Boris Johnson said tightening measures have to be taken to control the Omicron variant.

The Imperial College of London said Omicron is more severe than Delta and spreading capacity than the previous one.

The UK Chancellor Rishi Sunak commented resistance for Omicron plan must see before Christmas is support for the economy.

And Foreign minister Liz Truss said more points to resolve the Brexit issues on Northern Ireland protocol after David Frost quit.

US President Joe Biden is going to address the nation, and the US Reported that Jen Psaki said it would not be lockdown measures, and only about Omicron variant spread and caution for people usage

Canadian Dollar: Canadian retail sales forecast

Crude oil is moving in the Descending channel and the reached the lower high area of the channel.

Canadian Dollar posted lower lows as US Dollar gets stronger in direction due to Oil prices dropping is the main reason.

And Oil Demand is slower due to the Omicron variant spreading faster in All parts of the Globe.

The US Found first death due to Omicron variant, World health organization (WHO) and US Disease preventions control board warning signal for Omicron variant.

Canada reported daily 4000 cases of New Variant, and lockdown restrictions are not imposed yet.

Canadian Retail sales expect to be +1.0% versus -0.6% previous reading.

Japanese Yen: Japanese Government upgraded December month Assessment

EURJPY is moving in the Descending channel and Box Pattern, the market has rebounded from the Horizontal support area.

Japanese Government raised and upgraded its view of assessment first time in 17 months in December.

And this comes after Overall private consumption, and car sales rebound occurred.

Japan raised views on Business conditions and Employment data but downgraded perspectives on Capex and Housing constructions.

And Japanese economy has experienced a more severe pandemic in the last 17 months due to Covid-19.

Now the economy is recovering at a moderate pace but still fears surrounding from Omicron variant going to spread fast as expected.

Australian Dollar: RBA meeting minutes

AUDNZD is moving in an ascending channel and the market fell from the higher high area of the channel.

RBA meeting minutes followed today; RBA has to maintain a higher monetary support condition during the pandemic.

And inflation won’t go higher and will be controlled under the target.

Three possible options for the Bond purchase program in 2022 if it happened.

Is inflation going to increase, or is the economy going back after gradual recovery, or does the Omicron variant spread affect and more lockdowns in Australia?

Risks to the Economy is more if new variant spread across Australia in coming quarters.

New Zealand Dollar: Border reopening postponed to February

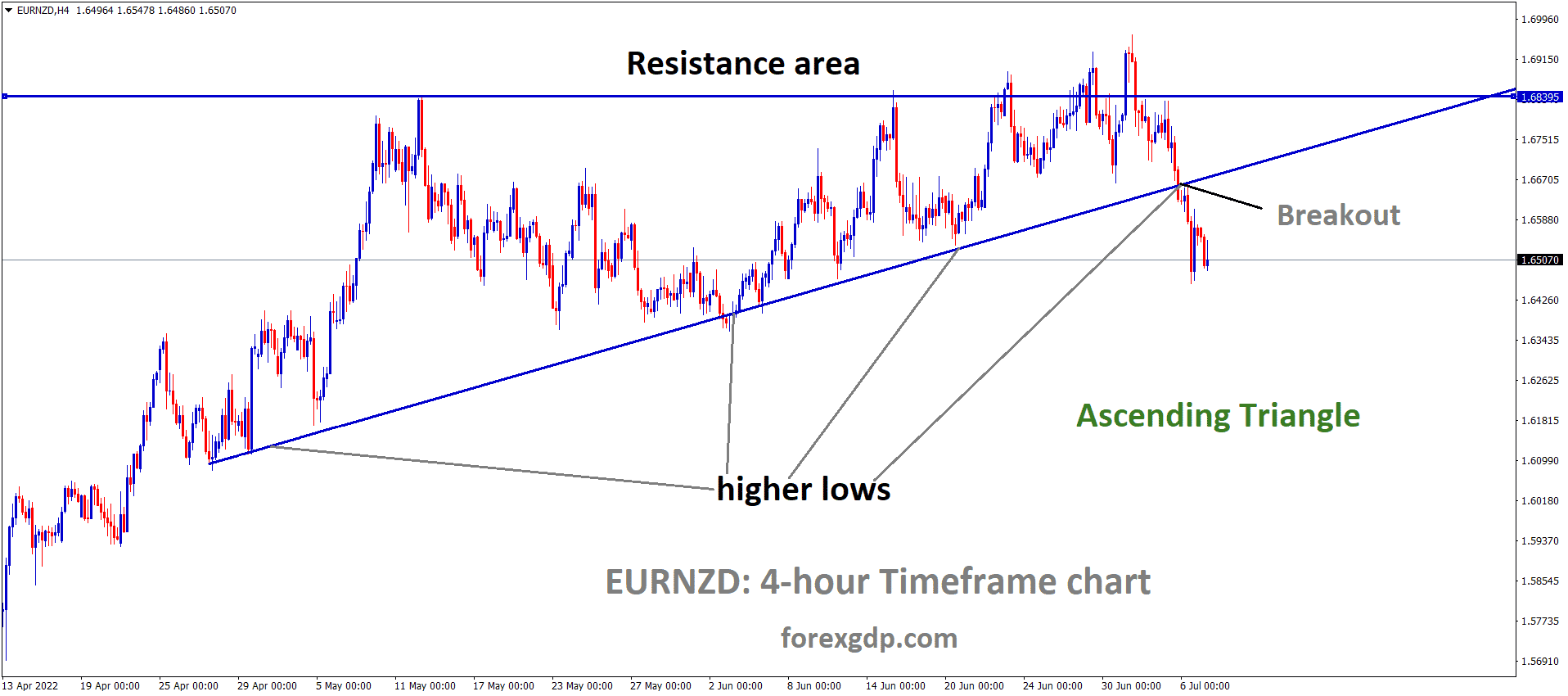

EURNZD is moving in the Descending channel and the market has reached the lower higher area of the channel.

New Zealand Dollar shows more weakness, and New Zealand Government announced the postponement of January to February for Border reopening. This decision was taken as the speeding spread of the Omicron variant.

Auckland University Covid Modeler Dr Dion O’Neale said the Traffic light system would not affect Omicron cases this time.

We cannot see the levels of Orange, red this time, and the phase of Omicron is different from the previous Covid-19.

So be cautious on Doses of two-stage completion, and the public place’s mask has to be mandatory to prevent Omicron partially.

Swiss Franc: Swiss Zone announced tight lockdowns

CHFJPY is moving in an ascending channel and the market has rebounded from the higher low area of the channel.

In Switzerland, Omicron cases did severe spread, so that a Covid certificate will be mandatory for those Vaccinated Fully. To enjoy public vacations and to enter bars, Sports centres and Gyms, a Person should be vaccinated with two doses.

And SNB already said the Swiss Franc is overvalued, and FX intervention must play will compensate the values of Franc.

US Joe Biden is scheduled to address the nation about Omicron virus caution, and masks must be mandatory if they go for public locations.

And Unvaccinated people must be vaccinated with two doses to avoid Deaths and infections from the Omicron variant.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/