Gold: US ISM manufacturing PMI came at a lower

Gold prices are still higher against US Dollar as Yesterday US ISM Manufacturing PMI came at lower-than-expected reading and also, Omicron fears slumped; Investors turned to invest in Gold rather than US Dollar.

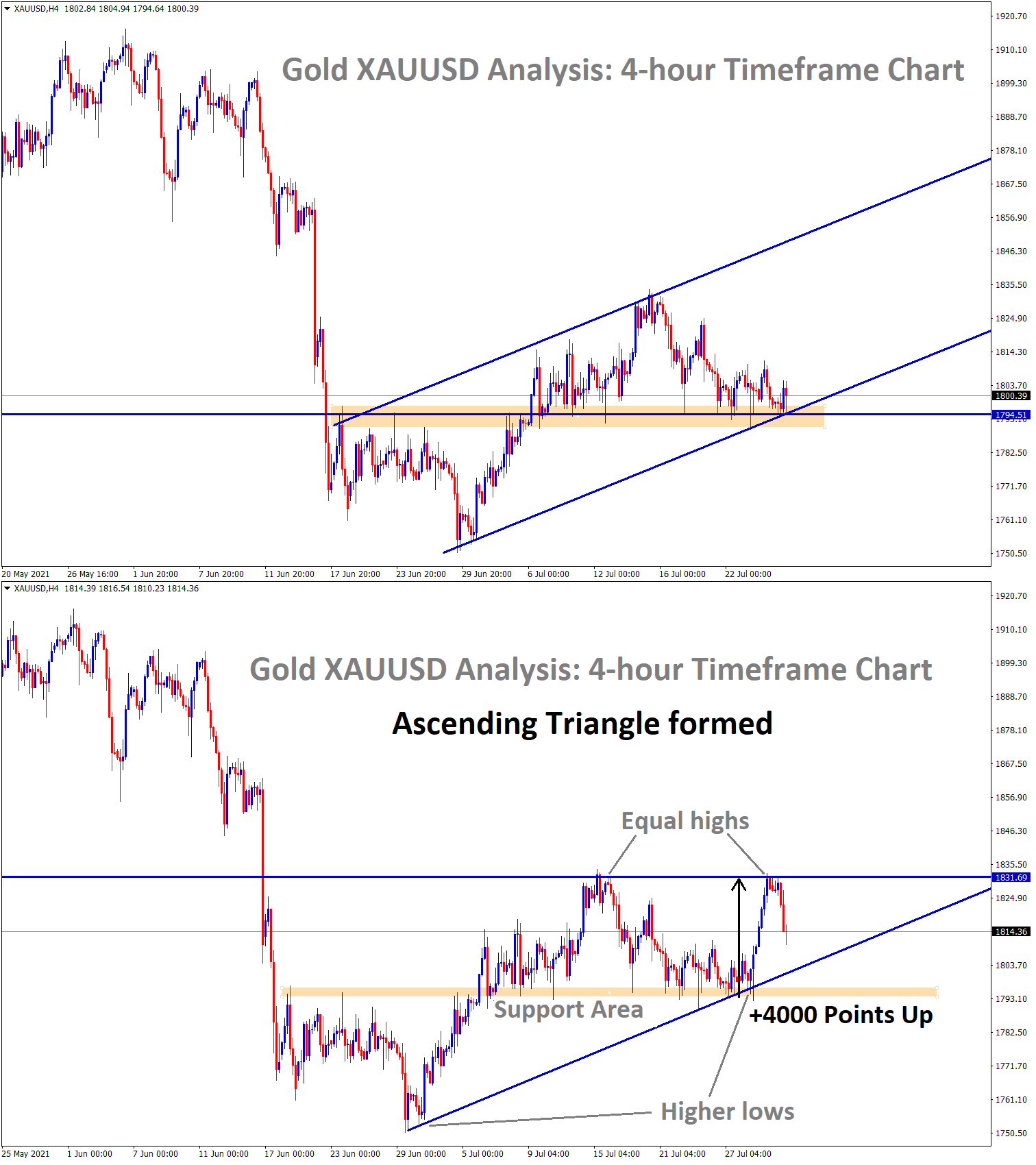

XAUUSD Gold prices are moving in an Ascending channel and the Market has rebounded from the higher low area of the channel.

XAGUSD Silver prices are moving in an ascending triangle pattern and the market has rebounded from the higher low area of the Ascending triangle pattern

And the December FED meeting now taken into consideration, FED Powell said Rate hikes would begin once tapering is completed in March 2022.

And also, Omicron variant fears slumped; Investors turned to invest in Gold rather than US Dollar.

US Dollar: the US has reached 1 million Covid-19 cases

The US has reached 1 million cases so far, but the severity came to lower when compared to Delta variant.

USDJPY is moving in an Ascending channel and the market has reached the higher low area of the channel.

US Dollar index shows higher from Support area as US Domestic data scheduled this week.

And Forecast of FOMC meeting minutes, ADP Non-Farm employment, Non-Farm Payrolls will impact US Dollar this week.

FED Powell tapering actions makes a stronger view on US Dollar; Omicron variant fears subsided makes a positive for US Dollar.

Economy recovery seen in the market as US 10yr,5Yr and 2Yr Bond yields are rose to higher.

EURO: German retail sales raised & Omicron fears subsided

EURJPY is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

German retail sales for December month crossed expectations of -0.50% with +0.6%; US Figures are weaker in ISM Manufacturing PMI came at 58.7 versus 60.0Forecast and 61.1 previous reading.

Lower US Jolts Job Openings came in as 10.562M versus 11.091M.

And World Health Organization WHO Manager Abdi Mahamud Sounds support for US Dollar and lesser damage from omicron variant.

It causes upper parts of the Body and, unlike the other ones attack the Lungs causing Pneumonia.

WHO Manager words cleared the confidence created across investors’ fears over the Omicron variant.

UK Pound: UK Pound remains more robust forecast by Credit Suisse

GBPUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

According to Credit Suisse Forecast, EURGBP will further Fall to 0.8250 area if it breaks the support of 0.8300 area.

And GBP will turn to bearish after last year Bullish momentum progress.

The second one is UK 10-year inflation breakeven again near 4%, sends a message to the Bank of England to control more inflation prices.

Bank of England rate hikes in December helps GBP against Counter pairs.

The third one is UK Brexit minister Lord Frost replaced by Truss is calmness showing to EU and Decision made by PM Johnson.

In May 2022, the Parliament election is beginning for the end of Johnson, raising pressure him to drive incorrect nation way rather than EU tussles and France seawater tussles.

UK PM Johnson speech

UK PM Johnson said Omicron cases created lower hospitalizations and lower Deaths ratio.

So, no more lockdowns to implement in the UK to avoid the Spread; the Omicron variant is a simple ride out by tightening restrictions and appropriate vaccinations and proper mask Wearings.

GBP is now not affected by lockdown fears in the UK due to UK PM Johnson giving confidence in the Omicron variant.

Canadian Dollar: OPEC+ agreed 4lakh barrels/day &Omicron fears cooled

EURCAD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Oil inventories in the US Fall to 3.6 million Barrels this week, and Oil prices are lifted daily due to the US having a low stockpile of Oil Barrels.

And OPEC +Nations agreed to produce 4lakhs barrels per day for February, and it is breathing for Demand in Oil Market.

The holiday season for last one-week public transports and public usage of outdoor more use of Petrol and Gas stations makes shortages for US Oil inventories.

And Canadian Dollar benefitted from Oil prices surging, and US Oil inventories remained lower in stockpiles.

Bank of Canada next month meeting maybe do tapering or rate hike according to performance of Unemployment rate this week.

Japanese Yen: JGB Bonds yields higher

GBPJPY is moving in an Ascending channel and the market has reached the horizontal resistance area of the channel.

Japanese Government Bonds yields notably higher with G-10 nations bonds yields more heightened in the market.

In December 2021 US 10-year yields above 1.68% from 1.50% is noted and the economy is recovering from the pandemic’s Bullish path and not down with Omicron variant issues, As Omicron is not a deadly virus-like Delta or Covid-19 first variant.

So, Investors are shifting their funds to riskier assets like Australian and New Zealand Dollars.

Japanese PM Kishida focused more on pandemic affected Business areas to recover and Vaccinations to be adequately done to guard against the Omicron variant.

USDJPY lifted to 4 years’ high of 116.20 area yesterday after Omicron variant fears to calm down in markets.

Australian Dollar: PBOC injection of more funds helps Australian exports

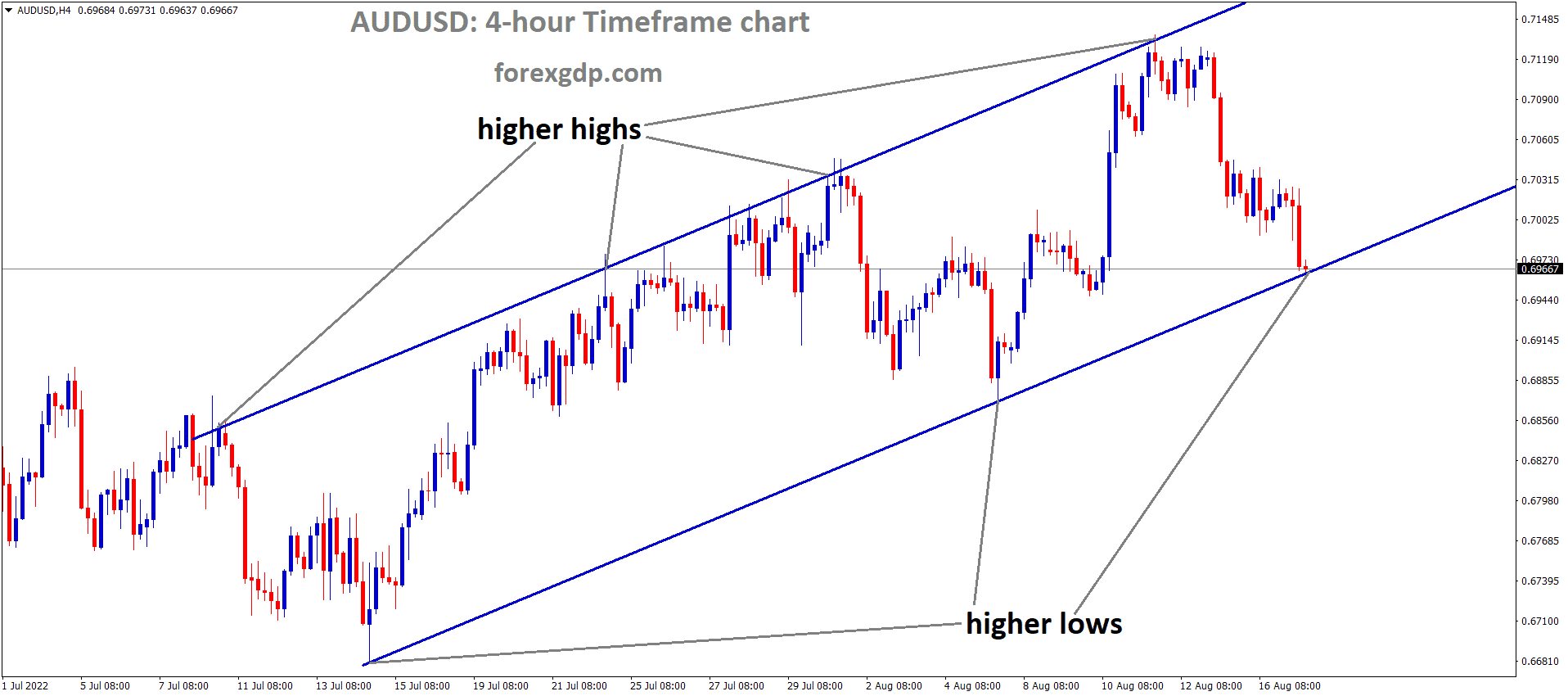

AUDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Australian Dollar shows come back from lows in last month December onwards, due to China metal imports are surging as Economy recovery is on track.

PBOC injected more funds for Businesses to recover, and the Omicron variant was kept under control by proper two doses of vaccinations.

US Domestic data scheduled this week as major events and FOMC meeting minutes form major impact on USD Counter pairs.

US ISM manufacturing PMI came at 58.6 versus 60.1expected.

US 10-year Bonds, US 5Yr and 2Yr bonds are rose to higher as Economy recovery seen in the US.

New Zealand Dollar: New Zealand revenues won’t be affected by China’s pandemic situation

GBPNZD is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

New Zealand Dollar shows consolidation and correction phase for last one year.

And China is the major importer of dairy products from New Zealand. So, in China, whatever real estate sector problem or Omicron problem, nothing happening to New Zealand Export revenues.

Agricultural exports are always in demand for China in whatever pandemic situations.

But Australian metal exports and Canadian Oil exports will slump during pandemic times.

Another revenue is the Tourism sector for New Zealand; temporary visits for New Zealand partially allowed in the last two months will get decent revenues for New Zealand Government from the Tourism board.

And RBNZ acted according to the situation by doing the rate hikes twice in 2021.

Swiss Franc: SNB lifted inflation forecast to 1.0% for 2022

CADCHF is moving in an Ascending channel and the market has rebounded from the Support area of the Box pattern.

Swiss Franc moved higher highs versus Euro due to more differences in inflation in Both regions.

And SNB lifted the inflation forecast for 2022 is 1.0% from 0.70%.

In December Swiss inflation data shows 1.5% YoY.

The Defensive sectors like healthcare, Utilities and staples are regaining from lows; it helps the Swiss Franc move in higher paths.

And SNB is waiting for foreign interventions to control the overvalues of CHF against Counter pairs.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/