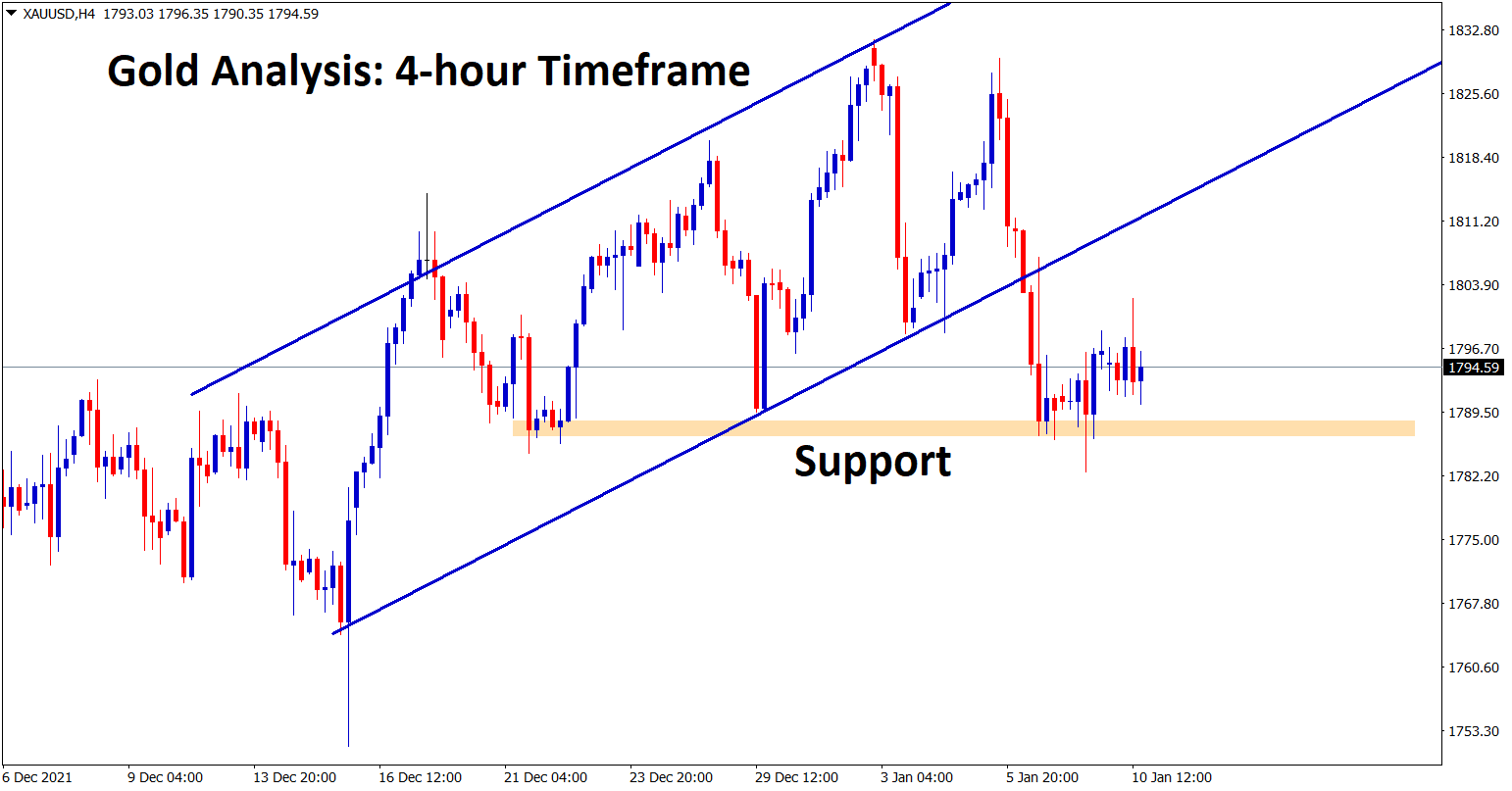

XAU/USD HAS PICKED ITSELF BACK UP ATFER DATA REVEALS THAT JOBS WERE LESS THAN EXPECTED. Gold price is consolidating at the support area after breaking the Ascending channel in the 4-hour time chart.

WHERE IS GOLD TODAY

For almost a month now, Gold has been consistently dropping in value following the rise in the U.S. dollar index. The interest rate predictions along with other recent events played major roles in causing the dollar index to spike and therefore the gold rates to drop as a result. However, on Friday we witnessed gold stand back up for the first time in a couple of weeks. This comes as a result of the publication of the US jobs data which showed that the number of jobs created for the month of December was less than predicted.

Analysts predicted that the jobs created would be a lot more than expected but the opposite occurred. As a result, a lot of traders lost bets and positions due to false analysis. As a result of finding out that the jobs created were less than expected, the U.S. dollar index dropped which in turn caused XAU/USD to finally get some room to stand back up and face the market. Analysts are eagerly waiting to hear more news about the interest rate predictions as the gold rebound could give clues to a possible rise in prices earlier than expected.

PAYROLL REPORT ANALYSIS

These past few weeks, analysts have been predicting that the Non-Farm Payrolls created in the U.S. will come close to the 400,000 mark. This would’ve caused the U.S. dollar index to spike. Currencies such as XAU/USD, EUR/USD and GBP/USD would’ve had to face sudden drops in their market value. However, much to everyone’s dismay, the opposite actually occurred. The U.S. Labor Department had published their Non-Farm Payrolls Report last month. According to this report, the Non-Farm Payrolls came close to reaching the 200,000 mark. This was only 50% of what was expected. As a result, many positions and bets were lost.

Other important details in the report include the unemployment rate which is now 3.9%. This comes as a surprise as well considering that the rate was expected to be at 4.1%. It is also important to note that earnings rose by 0.6% as well which shows that the labor market is not ready to shift drastically anytime soon. The sector which faced the most increase in jobs is the leisure and hospitality sector. They experienced an additional 53,000 new positions. This was followed by 43,000 new jobs in the business sector, 26,000 new jobs in the manufacturing sector, and 22,000 new jobs in construction. It is also important to note that government jobs faced a drop by over 12,000 jobs. Overall, there was a good consistent increase in most of the important sectors which is what matters at the end of the day.

TREASURY YIELDS ANALYSIS

As of last Friday, the U.S. Treasure yields have been consistently on the rise. As of a few days ago, they reached as high as 1.8%. This comes after the publication of the Non-Farm Payrolls report for the month of December. Similarly, the yield on the 10-year Treasury note closed at 1.76% and the 30-year Treasury note closed at 2.12%. They are still on the rise and don’t seem to have any intention on slowing down.