Gold

Gold price has broken the bottom of the Ascending Channel.

Gold prices pushed lowering behind this reason ahead of the FOMC meeting.

FED may reverse the Repo conditions as Demand for reverse repo facility surged to $547.8 million.

And this Reverse repo conditions pushed the Central bank to sell the securities and get back funds to Bank. This process is done for more swelling of Funds in Institutions having and wanted to sell the securities and Buyback the Funds from People.

And this scenario may push FED for tapering stimulus bets and pushed rate hike in 2023. The same thing happened in 2013, and the Rate hike was done in 2015.

Time cycles rotation repeat the events cyclically as same intervals.

Gold prices pushed lowering behind this reason ahead of the FOMC meeting.

USD

USDCAD breakout the top of the Ascending Triangle pattern.

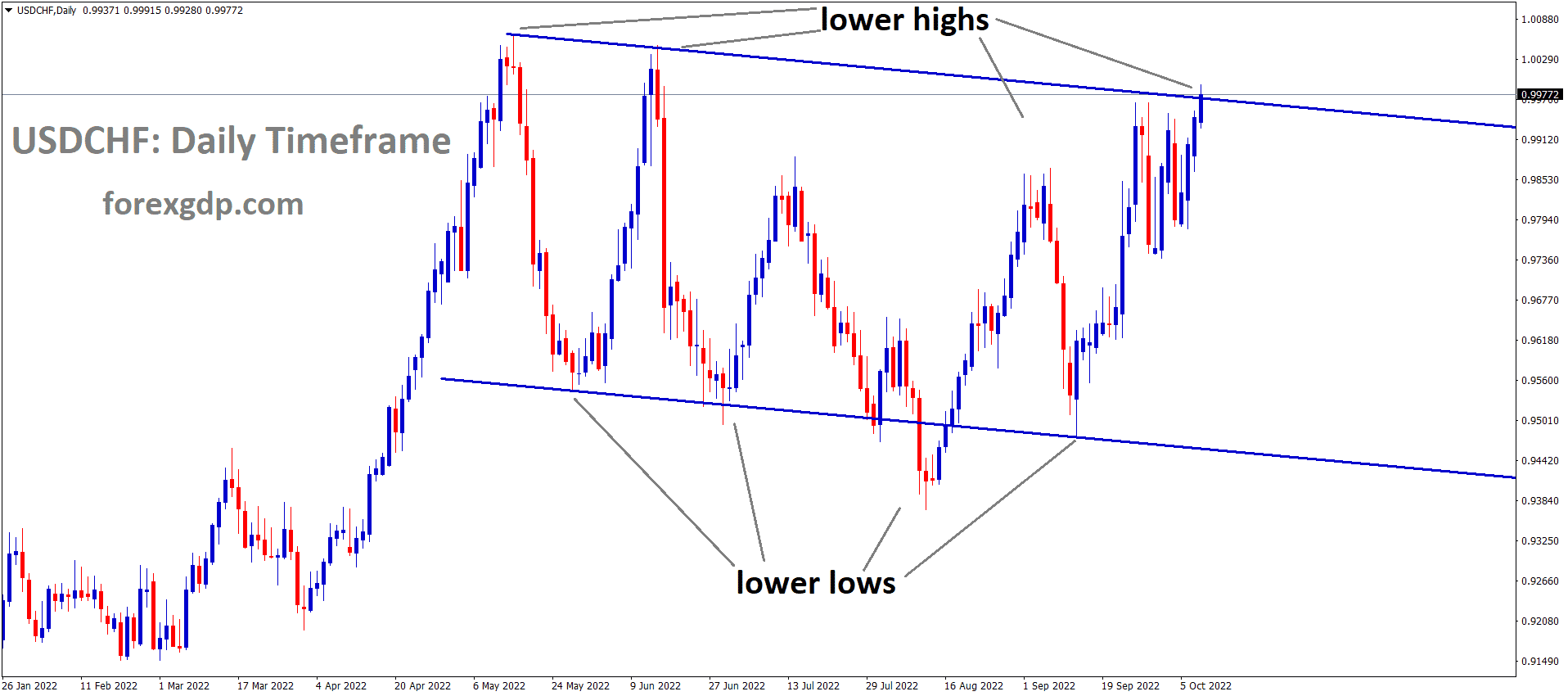

USDCHF is moving in a Descending Triangle pattern

US Dollar set to higher after Michigan Consumer sentiment reading printed in Higher number than expected.

And FED Monetary policy meeting that happened this week focused on Tapering talks of Swelling Funds in institutions.

And Rate hikes in 2023 end are expected, and the Rise of the inflation target to 5% every month fired US Dollar to jump Up last Friday.

This week US Dollar may sound longer as the FED meeting outcome will support the US economy.

And the Fed Balance Sheet of $8 trillion rises made Central Bank implement Reverse Repo operations soon this year.

EUR

EURUSD is moving in a descending channel and if it falls further, we can see the market on the next support zones.

EURUSD moved in the range-bound market as Friday US Data shows Strong numbers.

This week FOMC meeting will decide the Consolidation or trending market for the EURUSD pair for the last 5 months ranging market.

And Vaccinations are progressing well in the Eurozone, and Lockdown restrictions are easing in more regions.

US Dollar continuous stronger makes Euro suffer more.

UK-EU Brexit deal on Northern Ireland result will come in positive for Eurozone as expected.

Eurozone industrial production

In Germany, industrial production reading came at 0.8% in April month versus 0.4% expected. This seems there are more factory orders in Gate, and More orders lead to economic growth gets regained momentum.

Consumer spending leads to More factory orders, and the Manufacturing hub will be operated in a Full-fledged manner.

The higher readings in Eurozone industrial production shows, sooner to increase rate hikes by the central bank.

GBP

GBPUSD is moving up and down between the Resistance and Support lines.

GBPJPY is forming a flag pattern in the uptrend.

UK Pound likely to be consolidated under the range of 1.41-1.42 level due to Lockdown extended to 4 weeks after the June month.

As planned by UK PM Boris Johnson. Due to the increasing virus of Delta Indian Variant of Covid-19, still more people to injected by July end.

Consumer prices ticked higher to 1.8% in China and the US, And the UK also welcomes the same reading of 2.0% this week.

BoE’s Chief Economist, Haldane, already said there is a possibility of Monetary policy setting changes sooner than expected in the UK.

More economic data scheduled this week for UK and UK-EU Brexit issue on Northern Ireland is still focused.

CAD

CADCHF in the higher timeframe (weekly), it’s the lower high zone of the downtrend line.

Canadian Dollar moving in the correction phase as it reached 91 levels and formed a strong resistance level.

Canadian Economy working well, But Vaccination is in slow progress.

And we can expect the Bank of Canada may be tapering another asset by December end.

And Oil Prices Day by day surges feed more hurt for inflation rising fears in the Energy sector. Once the Iranian deal is completed, a heavy oil supply will compensate the Demand for Higher prices.

USDCAD consolidation range a 1.20-1.22500 is survived for Last 2 months if breaks 1.22500 level then jumps to 2% higher as 1.24500 level.

JPY

USDJPY is still ranging in an Uptrend channel

Ahead of the FOMC meeting, USDJPY gained small pips as US Dollar gained momentum after the Friday release of the Michigan Consumer Sentiment.

And Japan’s extended lockdown until June month-end makes the Japanese Yen weak over this month.

USDJPY may hit another 110 range this week as expected, but FED may like to tighten the policy makes jitters for US Dollar to surge up.

And Covid-19 Vaccination made slower in Japan makes worry for economic come back.

AUD

AUDUSD is moving up and down between the specific price boundary.

AUDCAD is consolidating after breaking the top of the downtrend line.

Australian Dollar keeps consolidation market between 0.77-078 for 2 months. Here Market will get an answer by this week’s FOMC meeting on Wednesday to decide the market’s direction.

And Reserve Bank of Australia takes a dovish stance, and China relationships with Australia becomes a worrying fact as the Origin of covid-19 investigation supported by Australia against China.

The Raw material prices of Iron ore and Copper made higher, and the higher producer price index makes China’s output factory gate prices higher. This, in turns, supports Australian exports to China.

China Issue

Conclusion of G7 meeting last week, Group of Seven leaders decided the result overview against Chinese activities.

And China must support Expert investigations on the Origin of Covid-19 as approved by WHO, Follow the human rights in Xinjiang Province and Hongkong of Autonomy rights as Sino British Rule.

East and South China malpractices by China will be taken as serious action if goes continuously.

NZD

NZDUSD hits the support zone, wait for breakout or reversal.

New Zealand 10-year rate fell to near 11%, and Rising milk prices failed to support New Zealand Dairy revenues.

And New Zealand Services index came at 56.1 versus 61.2 in April month. This is the third consecutive month higher than 50’s reading and Slower pace.

Lack of Tourism and Education have hurt the New Zealand Dollar revenues.

The First Quarter of GDP crossed the line numbers, and the Reserve Bank of New Zealand says the economy recovered better than forecasted.