Gold: US Core PCE index drags the gold prices to Down

Gold Prices after fell in Last week about 70$ and Today Gets rebounded from Support Areas and Russia Ukraine heightened Geopolitical tension and Global cues, and Demand for Gold slightly increased due to War fears.

XAUUSD Gold Price is moving in an ascending channel and the market has rebounded from the Higher low area of the channel.

US Core PCE index for December Printed at 4.9%, which is higher than a Decade, US FED Must take this reading of the PCE index to more considerations because Consumer Spending data is Based on How much income received.

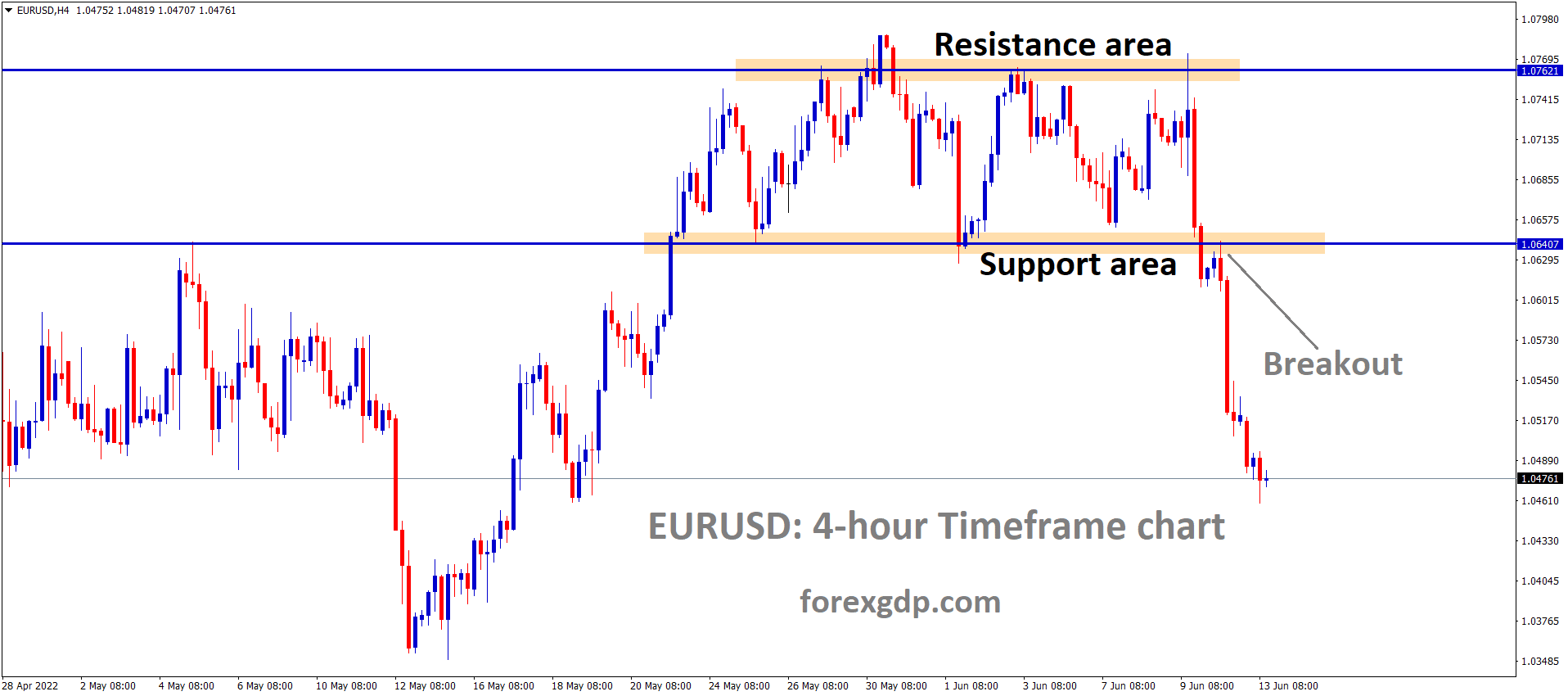

US Dollar: US NFP and Unemployment change forecast

USDJPY is moving in an ascending channel and the market has reached the Resistance area of the channel.

The US Dollar index reached the Resistance area of 97.00 Mark last week, and this week, the same Bull Run continuation will be seen ahead of Non-farm Payroll’s and Unemployment change data.

And FED Powell quoted that in March rate hike is possible, and Analysts expected a 50Bps instead of a 25Bps rate hike.

US Dollar sustaining Strong Bullish momentum as Geopolitical tensions surrounded and Omicron Variant spread higher.

Russia refused US Words of Troops return from Ukraine

Russia has Sent 1 lakh Troops to Ukraine Borders and created fears among the NATO countries.

The US Has already warned Russia to step down the Soldiers who are standing in the Borders of Ukraine.

But Russia strictly refused with US words of step-down soldiers from Ukraine Borders.

And Now in US Senate, Sanction Bills is prepared against Russia if it invades Ukraine and does Not Obey US Words.

So, Sanctions on Russia made By the US is more critical for Global countries, and Europe is the only country most affected by Gas and Oil supplies from Russia.

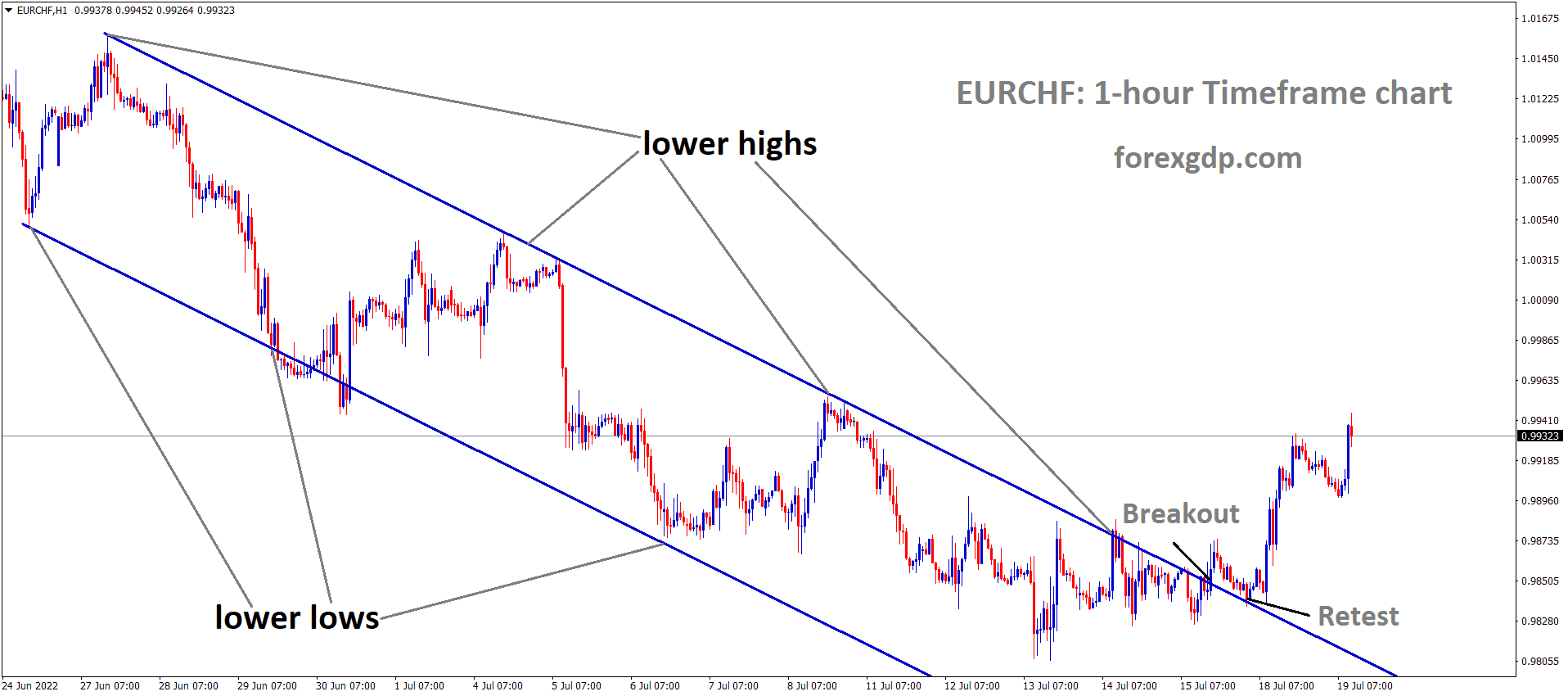

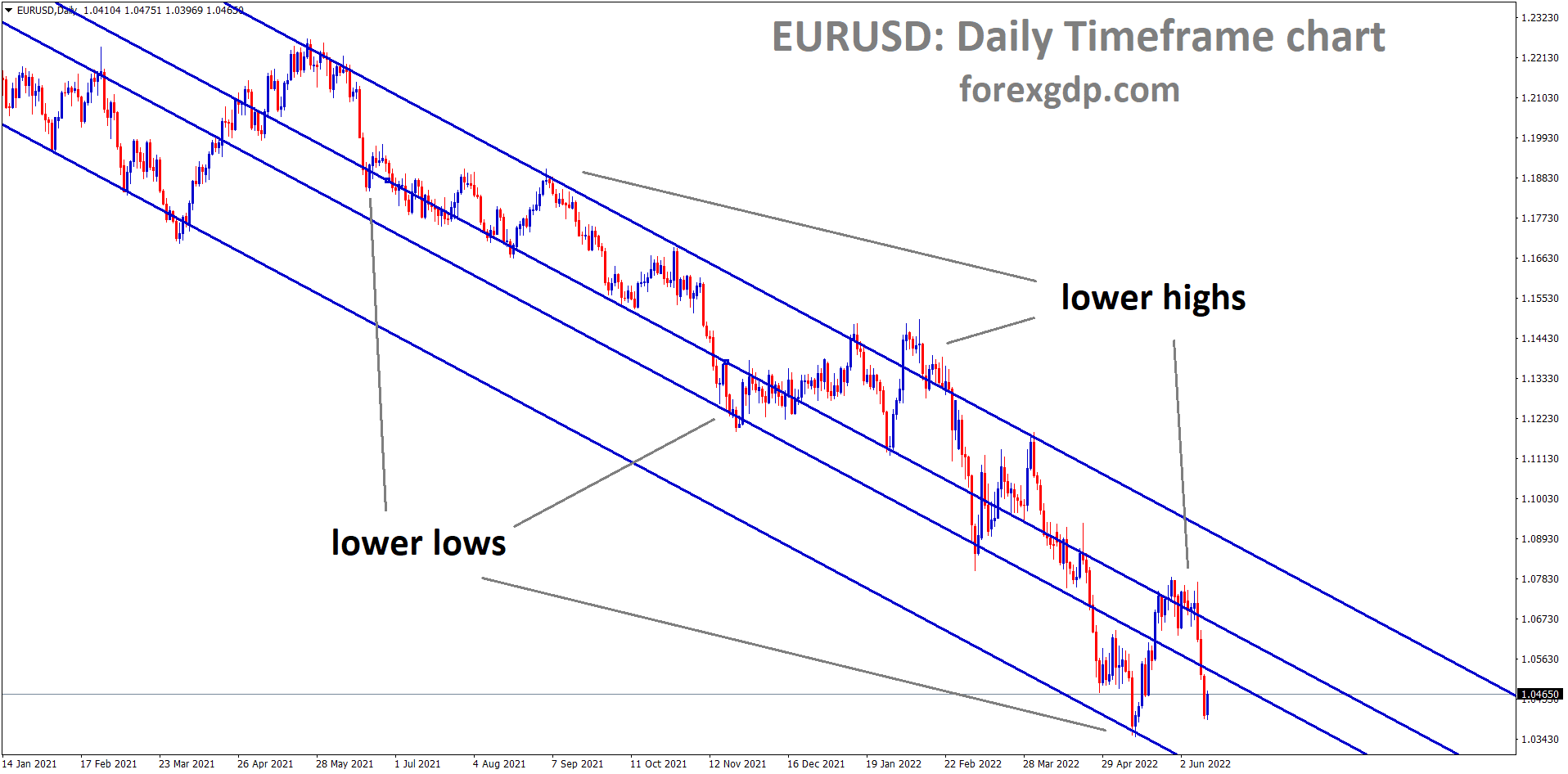

EURO: ECB Interest rate forecast

EURGBP is moving in the Consolidation Pattern and the market has reached the Support area of the Box Pattern.

This week is a very busy week for Euro Pairs due to the ECB Monetary policy decision scheduled for Thursday, and German inflation data and Eurozone Q4 GDP data will publish.

Every news this week will trigger the EURUSD move in the market is possible after a long downtrend occurred in the EURUSD market.

Russia and Ukraine matters made Geopolitical tension cause more worries about Russia’s European consumption of gases.

UK Pound: Goldman Sachs Predicted BoE do four rate hikes in 2022

GBPJPY is moving in an ascending channel and the Market has fallen from the higher high area of the channel.

Goldman Sachs predicted that the Bank of England might be done Quickest tightening in the monetary policy decision this year since decade years Ago.

And Bank of England MPC’s made vote favour for rate hikes and four more rate hikes like FED, Bank of England Also do rate hikes.

UK and EU still talk over Brexit issues from Northern Ireland and the UK.

PM Johnson is Going to be investigated if Law passed against him.

Canadian Dollar: Canadian Domestic data forecast

USDCAD is moving in an ascending channel and the Market has fallen from the higher high area of the channel.

Canadian Dollar Performed well as Oil Prices soaring day by day forming new highs.

And Canadian Employment change and CPI data, Ivey PMI data are scheduled.

Based on Data this week, USDCAD maybe Perform higher.

Bank of Canada failed to impress the investors, and no essential tapering happened in the last meeting.

Russia and Ukraine Geopolitical tension more pressure on US Side so that Anytime War is surrounded.

This week Domestic data for Both CAD and USD plays the Major Drivers for the Directions of USDCAD.

Japanese Yen: Japan faced 82K cases per day

CHFJPY is moving in an Ascending channel and the market has reached the higher low area of the channel.

The Preliminary readings of Japan’s industrial Productions dropped to 2.7% YoY versus 9.7% expected, and Retail sales came at 1.4% YoY versus 2.7% forecast.

Corona Virus conditions are worst in Japan, and Daily, 82000 cases of Covid-19 facing in Japan; hospital Beds are equipped with Proper instruments ready to face Covid-19 cases handling.

Due to these USDJPY strong Up Trend in Market makes higher in each month and Closer to 115.00 Mark.

This Week US NFP and ADP employment change is the Key Driver for USDJPY.

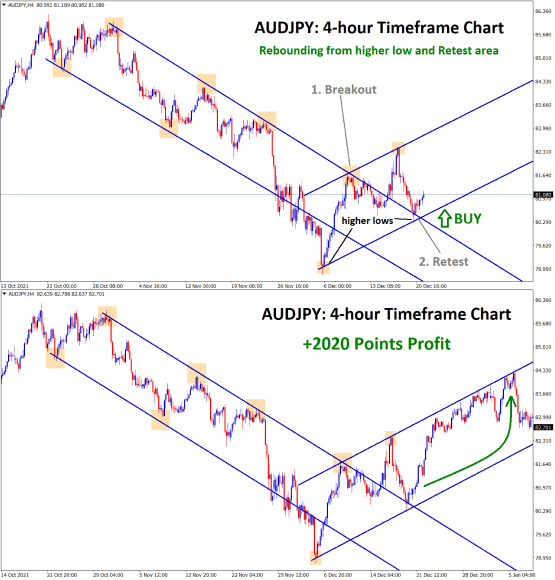

Australian Dollar: RBA interest rate decision Forecast

AUDCAD is moving in the Descending channel and the Market has reached the lower high area of the channel.

National Bureau of Statistics shows the Manufacturing PMI to printed at 50.1 versus 50.0 expected in China.

And China is facing more lockdowns & restrictions as Omicron Variant Spreads faster in Pace.

Tomorrow RBA Interest rate decision will be the Main impact for AUDUSD to break the Support area of 0.7000 level further. Again corrections to the Previous resistance area of 0.7200 is possible.

Australian Exports of Iron Ore are posted higher as Chinese Demand for Steel productions is higher.

New Zealand Dollar: New Zealand faced only one death on Omicron Variant

EURNZD is moving in the Descending channel and the market has reached the lower high area of the channel.

This week New Zealand Employment data is going to Publish, and Last week, Upbeat New Zealand CPI data won’t affect the New Zealand Bear trend.

This week’s hefty news across the US, EU, AUD, and UK are significant impacts creating one.

So New Zealand Dollar keeps driving according to Respective news flashed.

And PM Jacinda Ardern stated that If any Covid-19 cases are found, keep isolated from others.

109 Community cases so far in New Zealand, and only death occurred in New Zealand.

Swiss Franc: SNB follows accommodative policy conditions in Swiss Zone

USDCHF is moving in the Symmetrical triangle pattern and the market has reached the Top area of the Triangle Pattern.

Swiss Franc is doing better in Economy as Accommodative stance maintaining By Swiss National Bank.

And Easing Monetary conditions happened in the Swiss Zone and Swiss Franc small up against other currencies except for USD.

Fears around the Global markets and Global News seems Best safe asset class Swiss Franc Buyers higher when compared to Sellers.

And USDCHF clinched the 0.9300 Mark once again, and the market may be sustained above this mark will be considered a strong Bullish move in the market.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/

As a beginner

How do I translate this news to Technical Terms