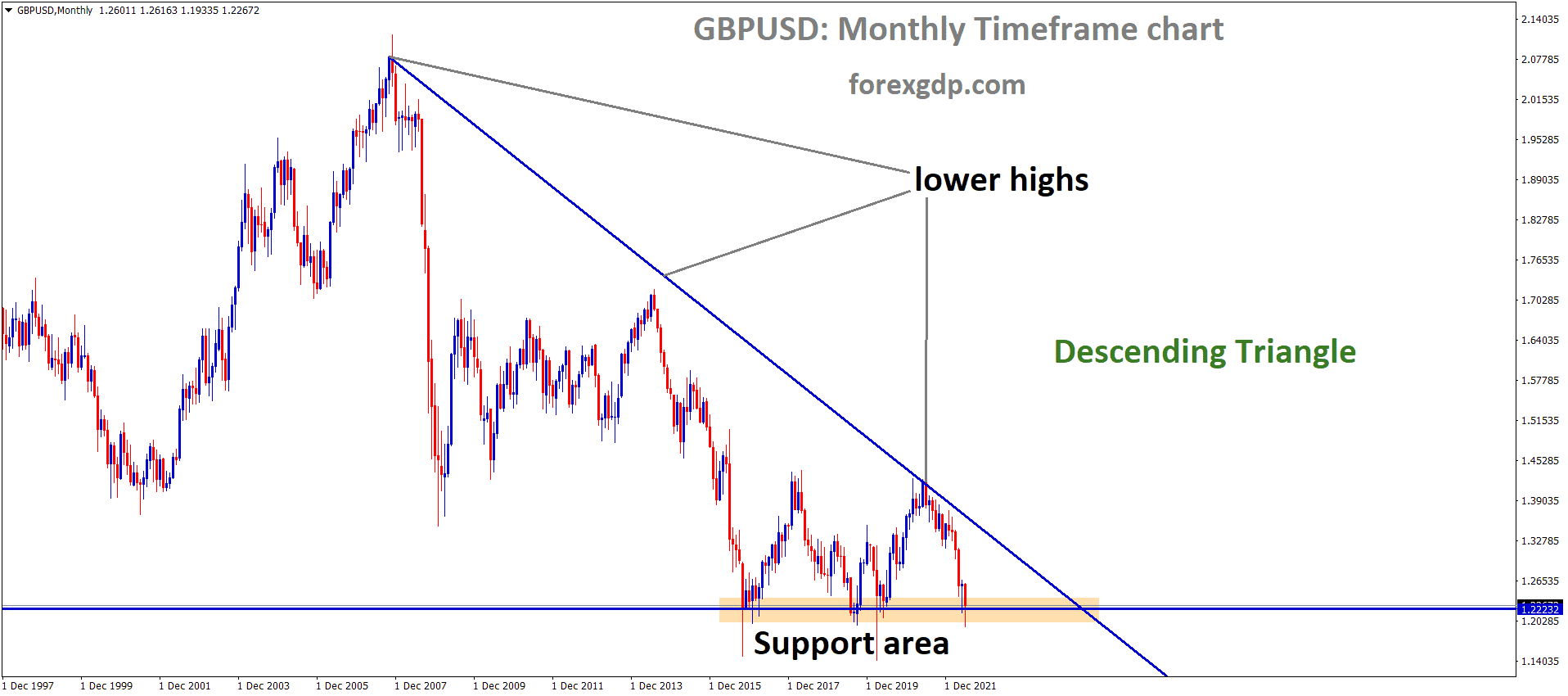

GBPUSD is moving in the Descending triangle pattern and the Market has reached the Horizontal support area of the Pattern.

Where Is GBPUSD Today

The GBPUSD currency pair is falling today as a result of the release of the UK Retail Sales data and PMI data. As a result of these recent releases, the GBPUSD pair faced a decline in its market value and is now teasing at around the 1.226 region.

GBPUSD is moving in the Descending triangle pattern and the Market has Fallen from the Lower high area of the Pattern.

The GBPUSD chart is showing some bearish market conditions. We may continue to see this pair decrease in value throughout the day. The UK is not being able to bring its inflation under control very properly.

The UK PMI Data

The UK released their PMI data early on Thursday which showed some confusing results. On one hand, the Manufacturing PMI data had dropped to 53.4 from an expected 53.7. This comes after it had seen values of 54.6 in the previous session. On the other hand, the Services PMI data showed a growth to 53.4 from an expected 53.0. The previous session also recorded values of 53.4 so in other words, the Services PMI remains virtually unchanged. Overall, Composite PMI also reaches a growth as it reveals numbers reaching 53.1 after an expected 52.6. This comes after it recorded values of 51.8 in the previous session. Looking at this data, we may understand that although the economy isn’t doing that great at the moment, it is certainly doing much better than we expected. This means that perhaps the Bank of England is being successful in their monetary policies to help reduce the inflation in the country.

Chris Williamson from S&P Global reveals, “The economy is starting to look like it is running on empty. Business confidence has now slumped to a level which has in the past typically signaled an imminent recession. The economy was likely to show a fall in output in the second quarter that could deepen in the third quarter. Growth was being propped up by previously placed orders. Manufacturers had reported especially weak demand for exports, and service firms were seeing their post-lockdown bounce reverse as the cost of living rose. The PMI’s business expectations index fell by 4.6 points in June, representing the biggest monthly fall since the start of the pandemic, with manufacturers and service providers both reporting their lowest business optimism levels since May 2020.”

The UK Retail Sales

Early on Thursday it was also revealed that the UK released their Retail Sales data which is basically a measure of how well the economy is doing. It measures this by seeing if the citizens of the UK are spending their money on retail items or if they’re saving up because bills and rent have become unaffordable to many.

GBPUSD is moving in the Descending channel and the Market has rebounded from the Lower Low area of the Channel.

The UK retail sales are down by roughly 4% since last October, which reflects both the cost of living squeeze and a more general rotation from goods to services spending post-Covid. This means that the citizens are not spending much on non-essential items and are instead saving up to pay for essential goods and services.

James Smith from ING reveals, “UK retail sales fell by half a percent in May, reversing a percentage increase of a similar magnitude in April. In what has always tended to be a fairly volatile data series, these are not monumental changes. Still, spending excluding fuel is down by roughly 4% since last October. It’s tempting to put this entirely down to the squeeze on household incomes, and that’s probably at least partially true. The ONS reckons the 1.6% monthly decline in food spending is down to higher prices. But the picture is muddied by a more general rotation away from goods back towards services post-Covid. One consequence is that retailers are likely to find they have excess inventory. Household goods stores have seen sales fall by 15-20% since the same time last year.”

FEDS Bowman Speech

The Feds governor, Michelle Bowman, held a speech at the Executive Officers Conference, Massachusetts Bankers Association. She discussed the outlook for inflation and the monetary policy for the upcoming session. She reveals, “Inflation is the highest we have seen in the United States in 40 years and so far it shows little sign of moderating. At the same time, the economy is growing at a moderate pace, and the labor market is extremely tight, as indicated by a variety of measures including reports of many employers unable to find workers despite significantly raising wages. That tightness is contributing to inflation, because labor is the largest input cost for producing goods and providing services. Inflation is a significant challenge for everyone, but it hits lower- and moderate-income people the hardest, since they spend a larger share of their incomes on necessities and often have less savings to fall back on. Inflation is also a burden for businesses that must somehow balance unpredictable costs while setting prices that aren’t so high that they discourage customers from purchasing. Inflation that continues at these levels is a threat to sustained employment growth and to the overall health of the economy.”

She further adds, “One important factor that we often point to in driving today’s spending decisions and inflation outlook are expectations of future inflation. Near-term expectations tend to rise as current inflation increases, but when inflation expectations over the longer-term—the next 5 to 10 years—begin to rise, it may indicate that consumers and businesses have less confidence in the Fed’s ability to address higher inflation and return it to the Federal Open Market Committee’s (FOMC) goal of 2 percent. If expectations move significantly above our 2 percent goal, it would make it more difficult to change people’s perceptions about the duration of high inflation and potentially more difficult to get inflation under control. As we see surveys like the Michigan survey report higher longer-term inflation expectations, we need to pay close attention and continue to use our tools to address inflation before these indicators rise further or expectations of higher inflation become entrenched. While I expect that the labor market will remain strong as the FOMC continues to tighten monetary policy, these actions do not come without risk. But in my view, our number one responsibility is to reduce inflation.”