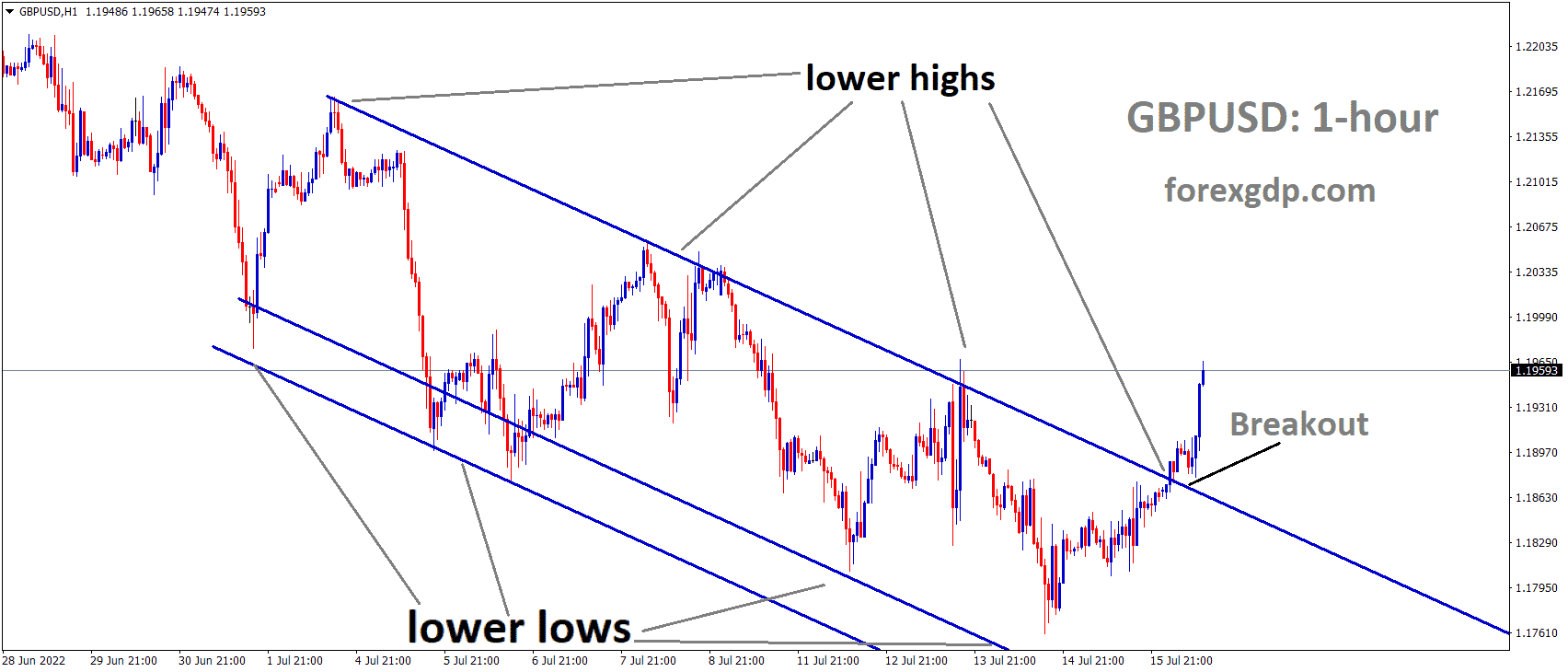

GBPUSD has broken the Descending channel in Upside.

Where Is GBPUSD Today

The GBPUSD charts are quite unstable today as a result of the release of the UK currently facing the hottest day of the year and a couple of speeches released by the BOE.

GBPUSD has broken the Descending channel in Upside.

As a result of these releases, the GBPUSD pair faced a high instability in its value and is now teasing around the 1.19 region. We may continue to see this pair be volatile throughout the day.

BOE Pill Speech

Jon Cunliffe who is the Deputy Governor of the Bank of England recently held a speech in Eden Hall where he talks about what he thinks are the lessons from the recent instability and losses in crypto markets. He reveals, “In recent years, we have seen the small but growing development of exchanges and other mechanisms in the crypto world, like DeFi platforms, which have given investors – retail and wholesale – the ability to take very highly leveraged positions. As crypto asset prices began to fall, this has led to large margin calls and automatic liquidation mechanisms – a feature of some protocols designed to protect against risk – that further amplified price falls. We have seen a range of crypto funds taken down by these effects; one of the biggest has been here in Singapore with Three Arrows Capital filing for bankruptcy last week. Or to put it the other way around, the lesson we should not take from this episode is that ‘crypto’ is somehow ‘over’ and we do not need to be concerned about it anymore.”

He further states, “I should stress that when I refer to crypto here, I am talking about crypto technology in finance writ large, such as encrypted tokenization and distributed ledgers (like blockchain), rather than just the dominant initial use case, which has been the creation of speculative assets such as Bitcoin. I do not know what the future holds for such assets, other than that they will continue to be volatile and that those that invest in them need to understand that the prices can collapse. However, while the initial use case for crypto may or may not have a limited future, the technologies that have been developing in the crypto ecosystem and their possible use cases are, I think, likely to be developed further in both the crypto world and in the much larger traditional financial system. Indeed, I suspect that the boundaries between these worlds will increasingly become blurred. So, the interesting question for regulators is not what will happen next to the value of crypto assets, but what we need to do to ensure that these developments, this prospective innovation about which I shall say a little more later, can happen without giving rise to increasing and potentially systemic risks.”

The UK Hottest Day

Today the UK is bracing itself to face the hottest day of the year with temperatures reaching 40 degrees Celsius. The Met Office has also sent out its first red hot heat warning which is to be taken seriously by the citizens of the UK. Not only is this the hottest day of the year, but it is also becoming the hottest day ever recorded in the UK. This is nothing that should be celebrated. In fact, we need to take this very seriously. Climate change is getting worse every day. We are facing the hottest day of the year and possibly eternity.

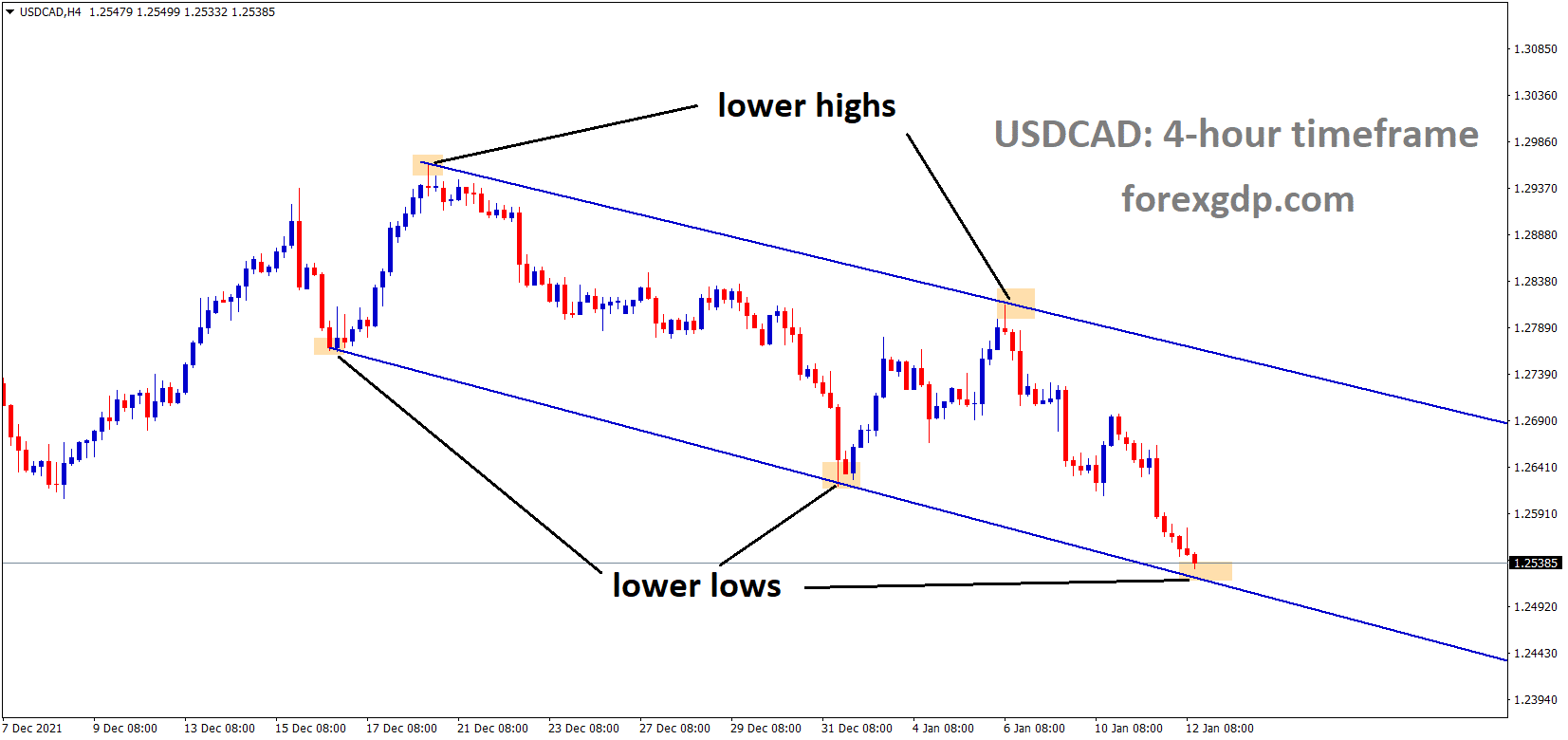

GBPUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Owen Amos from ABC News reveals, “After an emergency Cobra meeting for ministers on Saturday, Health Secretary Steve Barclay said ambulance capacity would increase, alongside more call handlers. The London Ambulance Service said it had seen 7,000 calls a day with rising temperatures and expected up to 8,000 on both Monday and Tuesday. A busy day in the capital would generally see around 5,500 calls, it explained. Sunday was the hottest day of the year so far with temperatures reaching 33C in Flintshire, 32C in Cheshire, 27.7C in Armagh in Northern Ireland, and 26.4C at Auchincruive in Ayrshire. Beaches across the country were packed, and people have been warned to take care if they cool off in the water.”

BOE Cunliffe Speech

Huw Pill who is the Chief Economist of the Bank of England recently held a speech at Kings College where he talks about how getting inflation back to our 2% target is important if we are to have a stable economy that supports people’s jobs and incomes. He states, “As we have seen, higher energy prices feed through to CPI inflation within a matter of months, via both direct and indirect channels. If a rise in international oil or gas prices is a genuine shock – in other words, it could not have been anticipated – then even an immediate monetary policy response would not be able to offset its initial impact on UK inflation. The offset would only feed through as the lags in policy transmission unwind. As a result, even very active employment of UK monetary policy cannot prevent the emergence of some short-term volatility in UK CPI inflation.”

He further reveals, “What’s more, given the uncertainties surrounding (a) the lags in monetary policy transmission and (b) the direction and magnitude of further external price shocks, the danger exists that attempts to ‘fine tune’ inflation developments using monetary policy become a source of volatility themselves. Policy actions may turn out to be ill-timed or mis-calibrated in the face of these uncertainties. There is thus inevitable short-term volatility in UK inflation, which monetary policymakers have to live with. And when the shocks driving that short-term volatility are large, then the amplitude of this short-term volatility in inflation can be large. This story remains an important part of what the UK has experienced of late. Recognizing the impossibility of fine-tuning inflation developments on a month-to-month basis, the MPC has long emphasized its focus on achieving the inflation target over the medium term. This medium-term orientation of monetary policy is crucial if the inflation target is to be met in a sustainable manner and monetary policy is not to become a source of inflation volatility itself.”