Gold

Gold XAUUSD is making a correction from the top resistance zone.

Gold prices show a resilient move to 1915$ today as US Dollar continues to decline. This week NFP report expectations are a 650k outcome; once Positive Data outcome may push the Dollar up and reverses Dollar gets down.

And Biden plan of $6 trillion spendings of the Budget will impact the Gold prices, Pandemic solving money equal to gold prices higher.

China one side buying Gold of 150 tons from the UK, this simple formula, UK and US selling Golds to print US Dollar, UK Pound and China simply buying gold without buying US Dollar or UK Pound from them.

Due to this scenario, US Dollar impacted at least a 4-year term of Biden till 90% of the economy to come back to a normal level.

USD

USDCHF breaking low levels continuously, recently broken the low level of the minor uptrend line.

US Dollar declines as Consecutive news of Joe Biden Infrastructure plan of $2.2 trillion and Budget news of $6 trillion for the 2022 year.

More US Dollar spending will lead to Weaker Dollar in Face value, as the US selling Gold to print US Dollar more and China using a better opportunity to buy Gold as Safe Currency than US Dollar.

GBPUSD, EURUSD, AUDUSD, NZDUSD all major currencies 20-30% higher than the last year 2020 Dip.

And US Dollar will see another four years for the declining market as the Pandemic hits more on Businesses and Employment rate.

US recovery is not a single day recovery as we see in the news; it is a step by step compounding manner to rebuild the economic infrastructure to the Previous level is a big job for the US.

Whatever Stimulus plan is decided to put on Economy, Businesses will see at least 2–3-year revenue to generate to compensate all losses from pandemic and Job’s recovery is on the way, Normal it will take 2-time services of Biden years that is 2021-2028.

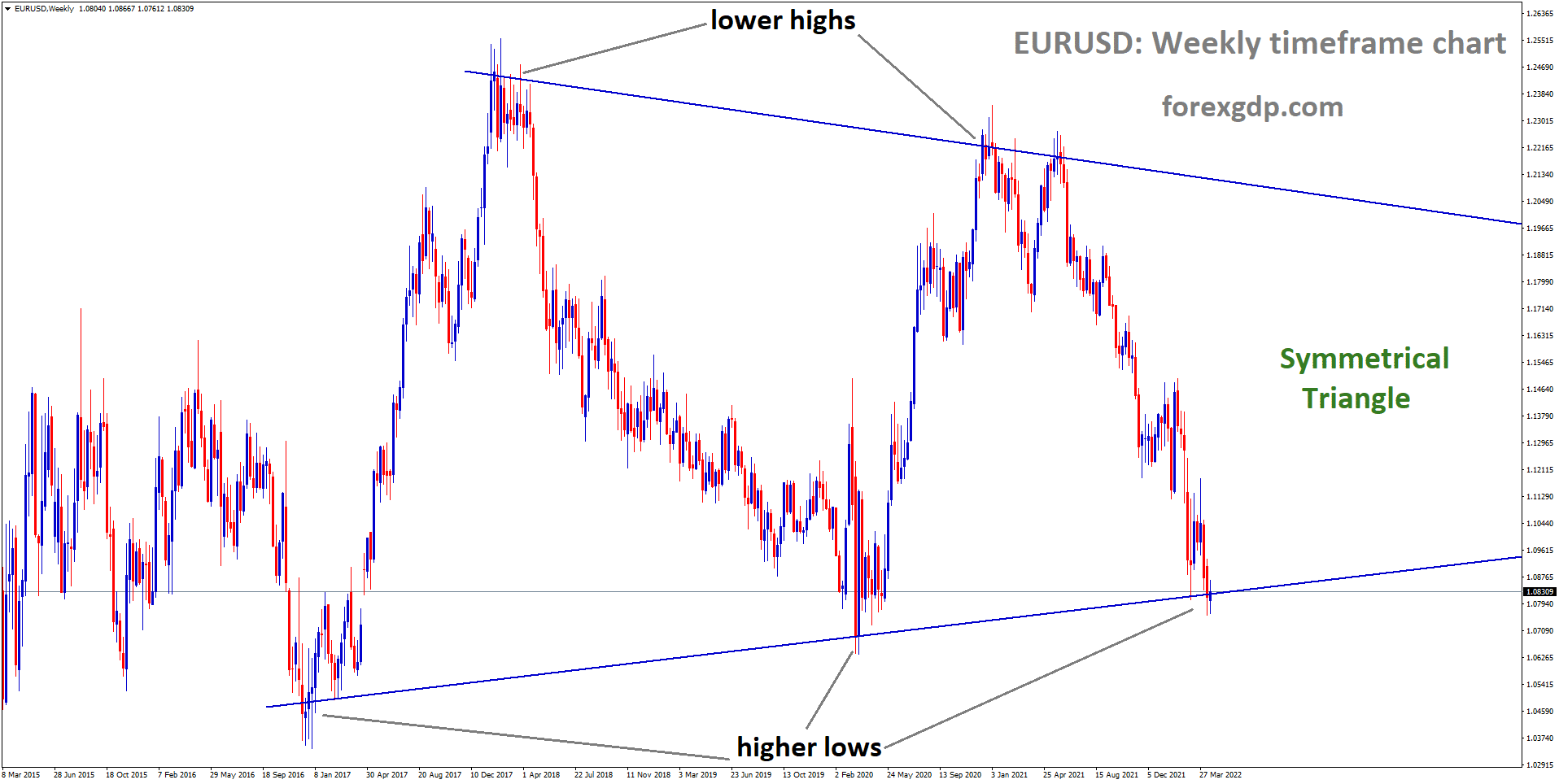

EUR

EURUSD moving in an uptrend continuously breaking higher highs.

EURCHF is moving in an Uptrend for the long term view, but in short term, it’s moving in a downtrend.

Unemployment rate falls in Germany pushed Euro Currency to higher.

And Lockdown easing pushed for a good start for Businesses to start up. More jobs provided for people, and the Employment agency reported 15000 jobs created; and Overall, jobs decreased to 2.5 million.

The unemployment rate fell to a healthier level, and consumer spending is expected to increase, and Economy recovery will soon be happening in Eurozone.

But uncertainty forming in the UK because of the New Indian Variant COvid-19 spread across the UK.

ECB meeting June’10

ECB may decide for Status Quo as CPI inflation numbers may come in Positive numbers.

And Vaccinations are smoother progress in Eurozone, and New Variant of Indian Covid-19 attacked in some UK places; it will hurt Economy again to dip fears surrounding Europe and UK.

The ECB meeting will be held on June 10 and expected no rate hikes or no rate dips until 2024; no tapering is seen in ECB, but more easing of stimulus we see in ECB if new Variant of COvid-19 spread to Eurozone.

EURUSD will break the resistance of 1.22400 this month is possible due to FED dovish stance as Joe Biden increases the Stimulus and budget in Trillion dollars.

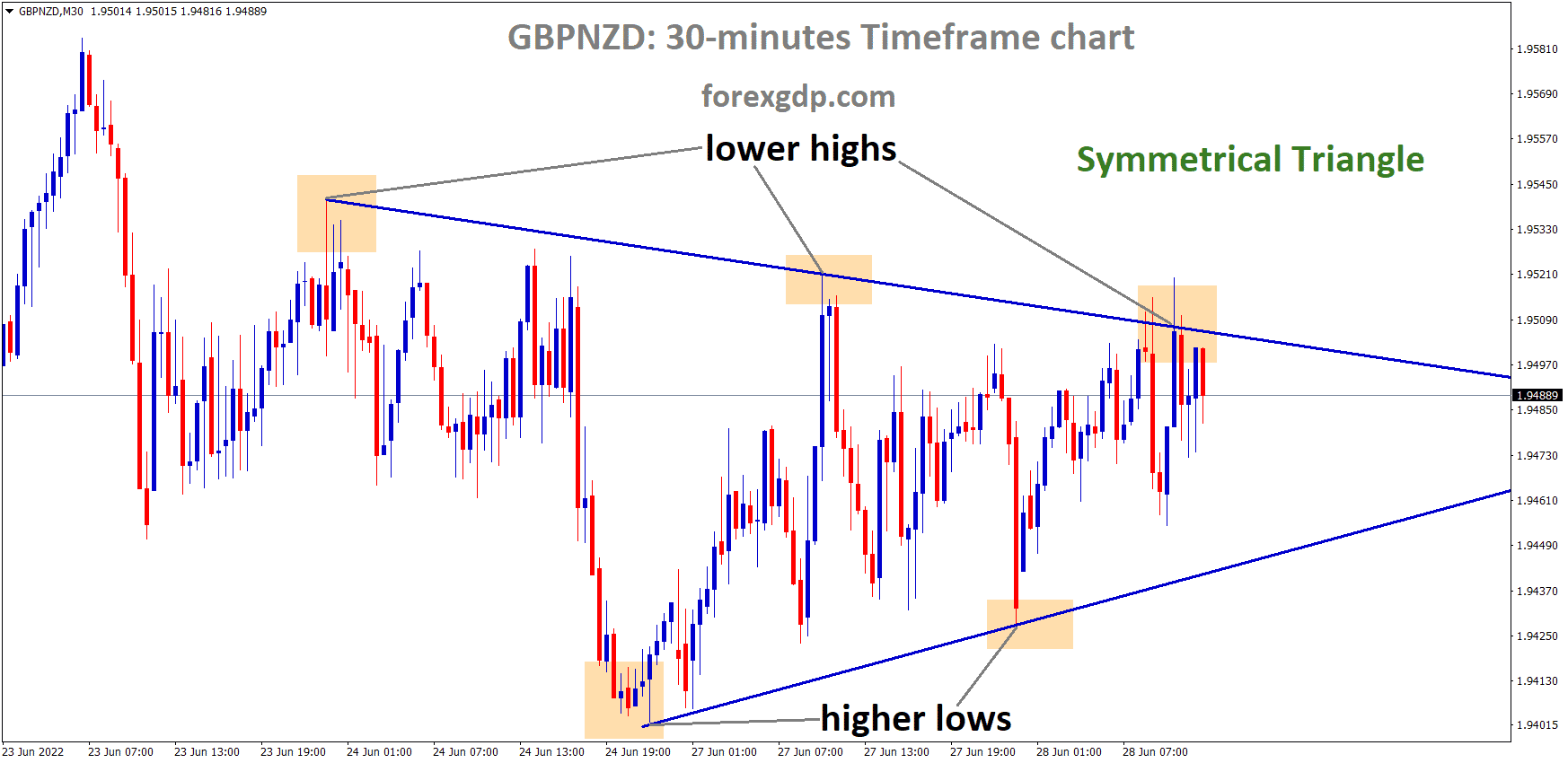

GBP

GBPUSD ranging at the important resistance, wait for breakout or reversal.

EURGBP formed a symmetrical triangle, wait for a breakout.

Bank of England Deputy Governor Dave Ramsden said that the UK Housing market booms to 10.9% compared to Last year it is a huge Boom in the last 7 years.

UK Inflation booming from the pandemic is backed up from Housing market prices and Consumer spending increasing.

And June 21 will be the end to lock down as many of habitants Vaccinated and Economic recover in Full Fledged move.

A New Covid-19 Variant may hamper the good news of recovery soon we may expect; we may see negative rates also possible if Spread made higher once again.

CAD

USDCAD hits the bottom of the descending triangle, wait for breakout or reverse.

OPEC+ meeting held this week due to this Oil market and US oil touched above the March month resistance 67.95$.

As demand from the US, Europe and the UK creating more from Oil Producing countries.

Canadian Dollar gets ultimate benefits after 2 million barrel per day cut for Increasing demand from Global level. CADJPY still moves in Profit Booking Consolidation level, and whenever gets booming to 92-93 level.

USDCAD this second quarter of 2021 will break the level of 1.20 and will target to 1.19-1.18 level in September month.

JPY

USDJPY moving in a rising wedge pattern in the h4 chart.

USDJPY said to range-bound market between 108-110 level since it is tough to break above 110 level as Strong resistance in 10 years.

And Japanese Yen plays down as Lockdown extended until June 3rd week.

Manufacturing activity and consumer spending data came in positive numbers, but Vaccine rollouts are up to mark.

The only error in Japan is Vaccination fast progress lagging, and once this problem is rectified, the Japanese Yen started to boomer high.

Lockdown leads to Lockdown businesses, and vaccination leads to open up businesses in Japan.

AUD

AUDUSD ranging between SR levels and it’s moving in a triangle pattern.

Reserve Bank of Australia Monetary policy Meeting happened today and left interest rates unchanged in the 7th Policy meeting since the pandemic.

And Victoria state announced Lockdown for 3 weeks again as the spread of New Covid-19 Variant causes major Burden for economy retrieving.

And RBA Clearly stated that there is no change in the rate of interest until 2024. But the inflation target of 2-3% will hit gradually to 2024, and there is a way to hike rates, and Tightening purchases is possible.

Third round quantitative easing will be A$75 billion to A$100 billion is possible expectations.

AUDUSD moved in the ranging market because the outcome of news is expected.

NZD

NZDCHF falling from the lower high level of a descending channel.

New Zealand Dollar performing well as economic data in the home country performing well as Business confidence rose to 1.80% in May from -2% in the Previous month and Building permits jumped to 4.8% in April.

And Chinese Caixin manufacturing PMI jumped to 52.0% in May month compared to 51.9% expected.

This will support Kiwi currency more, and Any disruptions from New Zealand in China matters will affect Business matters, as China previous said.

New Zealand is more traded materials than Australia in the last one-year report due to China and Australia’s relationships not in a smooth manner.

CHF

CHFJPY is moving in an uptrend forming higher high and higher low areas.

Swiss National Bank Vice Chairman Fritz Zurbrugg said Forex intervention is much important; our Swiss Franc currency is overvalued. Continuous FX intervention will keep the Swiss Franc higher Value.

And the Monetary policy seems appropriate and Negative rates are welcomed; due to this, the Swiss Franc remains the safest currency on Globe.

US Dollar weakness makes the Swiss franc more expensive, and CHFJPY declines 0.80% in the last 1 week as a Profit booking step.