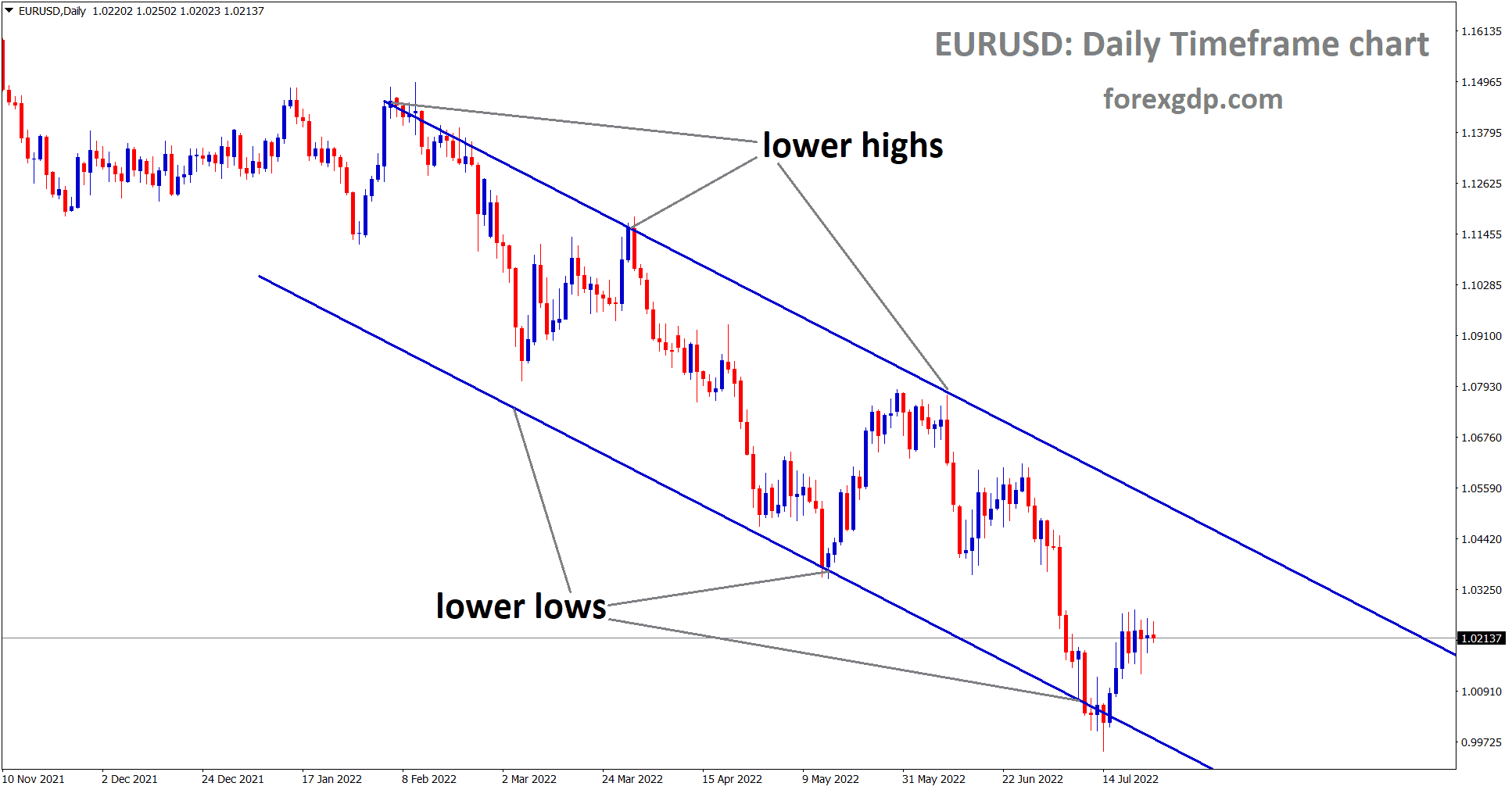

EURUSD moving in descending channel and the market has rebounded from the lower low area of the channel.

Where Is EURUSD Today

The EURUSD charts are quite unstable today as a result of the news that Russia has significantly increased the pressure on Ukraine’s pipelines in hopes that they will burst. We also witness the release of Feds and ECB speeches.

EURUSD in Box pattern and the market has reached the resistance area of the pattern.

As a result of these releases, the EURUSD pair faced a high instability in its value and is now teasing around the 1.02 region. We may continue to see this pair be volatile throughout the day.

ECB Lagarde Speech

There was recently a press conference held by European Central Bank president Christine Lagarde and vice president Luis Guindos. This conference was in relation to the recent monetary policy changes and their thoughts on the economy in the region. It reveals, “The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalization path than signaled at its previous meeting. This decision is based on our updated assessment of inflation risks and the reinforced support provided by the TPI for the effective transmission of monetary policy. It will support the return of inflation to our medium-term target by strengthening the anchoring of inflation expectations and by ensuring that demand conditions adjust to deliver our inflation target in the medium term. At our upcoming meetings, further normalization of interest rates will be appropriate. The frontloading today of the exit from negative interest rates allows us to make a transition to a meeting-by-meeting approach to our interest rate decisions. Our future policy rate path will continue to be data-dependent and will help us deliver on our two percent inflation target over the medium term. In the context of our policy normalization, we will evaluate options for remunerating excess liquidity holdings.”

They further state, “Economic activity is slowing. Russia’s unjustified aggression toward Ukraine is an ongoing drag on growth. The impact of high inflation on purchasing power, continuous supply constraints, and higher uncertainty are having a dampening effect on the economy. Firms continue to face higher costs and disruptions in their supply chains, although there are tentative signs that some of the supply bottlenecks are easing. Taken together, these factors are significantly clouding the outlook for the second half of 2022 and beyond. At the same time, economic activity continues to benefit from the reopening of the economy, a strong labor market, and fiscal policy support. In particular, the full reopening of the economy is supporting spending in the services sector. As people start to travel again, tourism is expected to help the economy in the third quarter of this year. Consumption is being supported by the savings that households built up during the pandemic and by a strong labor market. Fiscal policy is helping to cushion the impact of the war in Ukraine for those bearing the brunt of higher energy prices. Temporary and targeted measures should be tailored so as to limit the risk of fueling inflationary pressures. Fiscal policies in all countries should aim at preserving debt sustainability, as well as raising the growth potential in a sustainable manner to enhance the recovery.”

EURUSD moving in descending channel and the market has rebounded from the lower low area of the channel.

Ukraine Gas Pipeline

In a confusing turn of events, we are hearing two different parties reveal two different scenarios and it is currently unclear who is right and who is wrong. Russia supplies gas to the EU through Ukraine’s pipelines. Earlier today, Ukraine revealed that Russia had significantly increased the pressure of gas in these pipelines to the point that we now fear that the pipelines will burst. The EU believes this was done purposely to permanently stop the supply of gas to the EU as they have themselves sanctioned Russia a lot too. On the other hand, earlier today we are also hearing that Russia is stating that they have significantly reduced the supply of gas to the EU. It is unclear at the moment which story is true and which is false.

Economists at Reuters reveal, “Russian gas giant Gazprom has sharply increased pressure in the pipeline that delivers Russian gas to Europe without prior notice, the Ukrainian state pipeline operator company said on Tuesday. Such pressure spikes could lead to emergencies including pipeline ruptures, and pipeline operators are obliged to inform each other about them in advance, the Ukrainian company said. Gazprom said flows would fall to 33 million cubic meters per day from 0400 GMT on Wednesday – a halving of the current, already reduced level – because it needed to halt the operation of a Siemens gas turbine at a compressor station on instructions from an industry watchdog.”

Feds Statement

The Federal Reserve Bank recently released a statement in which they talk about the LIBOR rate and they invite comments on this rate as well. This statement reveals, “The Federal Reserve Board on Tuesday invited to comment on a proposal that provides default rules for certain contracts that use the LIBOR reference rate, which will be discontinued next year. The proposal implements the Adjustable Interest Rate (LIBOR) Act, which Congress enacted earlier this year. LIBOR, formerly known as the London Interbank Offered Rate, was the dominant reference rate used in financial contracts in recent decades, but the rate in its current form will be discontinued after June 30, 2023.”

It further reveals, “In response to the planned end of LIBOR, Congress enacted the LIBOR Act to provide a uniform, nationwide solution for replacing references to LIBOR in existing contracts without adequate fallback provisions, which are provisions in the contract related to the identification of an alternative reference rate. Consistent with the law, the proposal would replace references to LIBOR in certain contracts with the applicable Board-selected replacement rate after June 30, 2023. The contracts include those governed by domestic law that does not mature before LIBOR ends and that lack adequate fallback provisions. The proposal identifies separate Board-selected replacement rates for derivatives transactions, contracts where a government-sponsored enterprise is a party, and all other affected contracts. As required by the law, each proposed replacement rate is based on the Secured Overnight Financing Rate.”