Gold: Russia added more troops across the Ukraine Borders

Gold prices are soared to higher as 1880$ due to higher tensions surrounding Russia and Ukraine Borders and EU leaders gathering to discuss on this war matters.

XAUUSD Gold price has reached the Resistance and Top area of the Symmetrical triangle pattern.

And the US has clearly said Russia backed little troops from Bases, and more troops are injected across the Borders in the latest view.

So anytime war will be escalated from Russia and Waiting time is now.

And Gold is the clear hedge for inflation reading if it hits high when the War period starts.

So, Investors plays safe type now according to fear situations.

US Dollar: FOMC meeting minutes outline

USDCHF has broken the Symmetrical triangle pattern.

FED’s FOMC meeting minutes happened today, and a faster pace of Tightening accommodative policy stance will handle.

And 25Bps points rate hikes are expected 70% Polls and 30% polls suggested for 50Bps rate hikes in March.

Ongoing tensions between Russia and Ukraine make economic recovery doubtful and expenses more happening if War type escalated.

So, a rate hike from the FED side is mandatory and controlling the inflation rate is much more possible this year.

As US inflation rate hits 7.5%, which is 40 years high, and January NFP data shows Robust growth makes FED confident for Rate hikes in March.

US Treasury secretary Janet Yellen speech

US Treasury secretary Janet Yellen said the US economy faced a tough inflation rate in 40 years and peaked higher.

And FED has taken Proper actions to control the inflation readings, and rate hikes and the pace of tightening Asset purchases will escalate the inflation control points.

In the West, Russia shows more intention on Warlike appearance on Ukraine, and if war started, US Will made more sanctions on Russia in all business areas.

Already inflation hits higher if war happens, then an additional boost to the inflation rate ticked up higher.

EURO: EU Leaders summit happened today

EURNZD is moving in an Ascending channel and the market has reached the higher low area of the Channel.

Russia Backed Separatists claimed that the Ukrainian army had Blasted the Grenade at the Borders and they have backed some troops from the Base; the news was chilled the War fears.

But Secretary-General of NATO Jens Stoltenberg said there was no evidence of Returning troops from Ukraine Borders and Forwarding more into Ukraine Borders is viewing.

And Kremlin has denied the words from NATO, and US Secretary of State Antony Blinken said that Russia is still in a War mood.

Today, an emergency meeting of EU leaders has scheduled afternoon to discuss the Russian Actions on Ukraine.

And US FOMC meeting minutes gives another positive momentum for US Dollar.

As FED seeks a faster pace of releasing accommodative policy this month and brings the rate hikes in March.

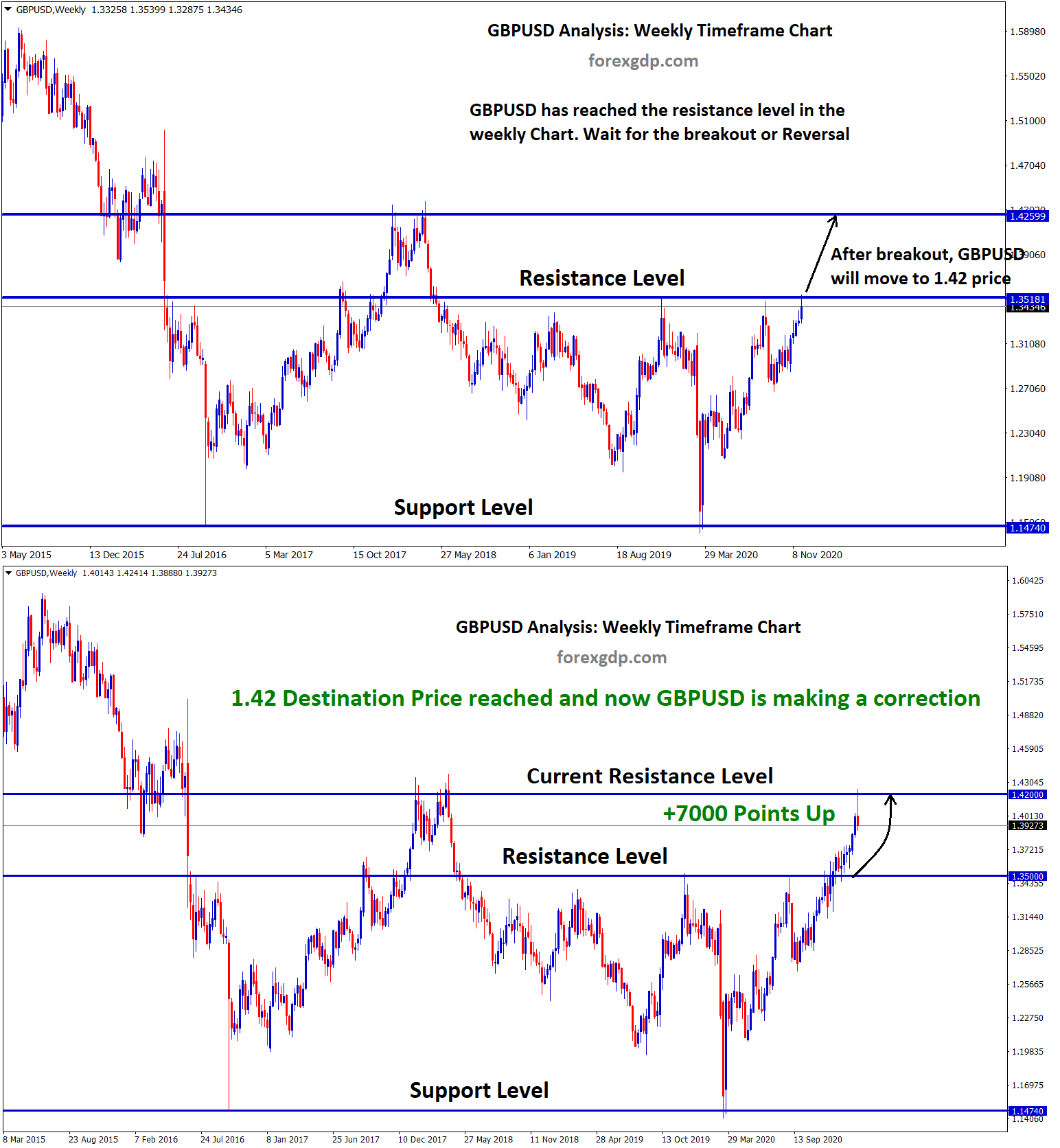

UK Pound: UK CPI hits higher than expected

GBPUSD is moving in the Symmetrical triangle pattern and the market has reached the Top area of the pattern.

UK CPI inflation printed at higher numbers and 5.5% printed versus 5.4% expected.

And Bank of England will have the right to do rate hikes of 25 Bps in March due to inflation numbers heating up in the Economy.

And ECB Board member also commented that rate hikes is possible if the inflation reading beats the target’s goal.

Today US Initial Jobless claims data scheduled and FOMC meeting minutes make positive for US Dollar.

And Anytime War escalation fears between Russia and Ukraine made fears on UK Pound.

Canadian Dollar: Bank of Canada Deputy Governor Speech

GBPCAD is moving in the Descending triangle pattern and the market has reached the lower high area of the pattern.

Bank of Canada Deputy Governor Timothy Lane said there would be policy tightening in March as all we expected.

Like FED rate hikes in March, the Bank of Canada cannot do the same; according to Canadian Economy situations, the interest rate will be decided.

And Timothy Lane further added there would be no rate hikes until asset purchases are completed.

So, inflation remains the central blockade for the Canadian Economy to recover and soon, we all hopes that the blockade does not last for an extended period.

Japanese Yen: Safe haven Assets are more robust due to Geopolitical tensions

NZDJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Japanese Yen makes higher due to War escalation fears surrounding Russia and Ukraine Borders.

Today EU leaders are gathering for discussion on War-related caution measures if happen.

So Safe Haven assets like the Japanese Yen, Swiss Franc and Gold are going higher as Fear peaked at investors’ minds.

And Ukraine bombed in LPR’s region in Ukraine, handled by Russian Backed Separatists.

Australian Dollar: Australian Job report shows Healthy numbers

AUDUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

Australian jobs data shows 12.9K numbers printed versus zero rates expected. The unemployment rate keeps steady at 4.2% low and aligns with expectations. The job participation rate increased to 66.2% from 66.1%.

And RBA Rate hikes are more expected, and 100 bps rate hikes are expected until the end of 2022.

RBA Governor Lowe said that stopping the asset purchases does not aim for Rate hikes.

And FED Doing rate hikes motivation to control the US inflation from 7.5%, but Australia facing 2.6% annually, so our Goal target is 2%, inflation is in our controlled one in Australia.

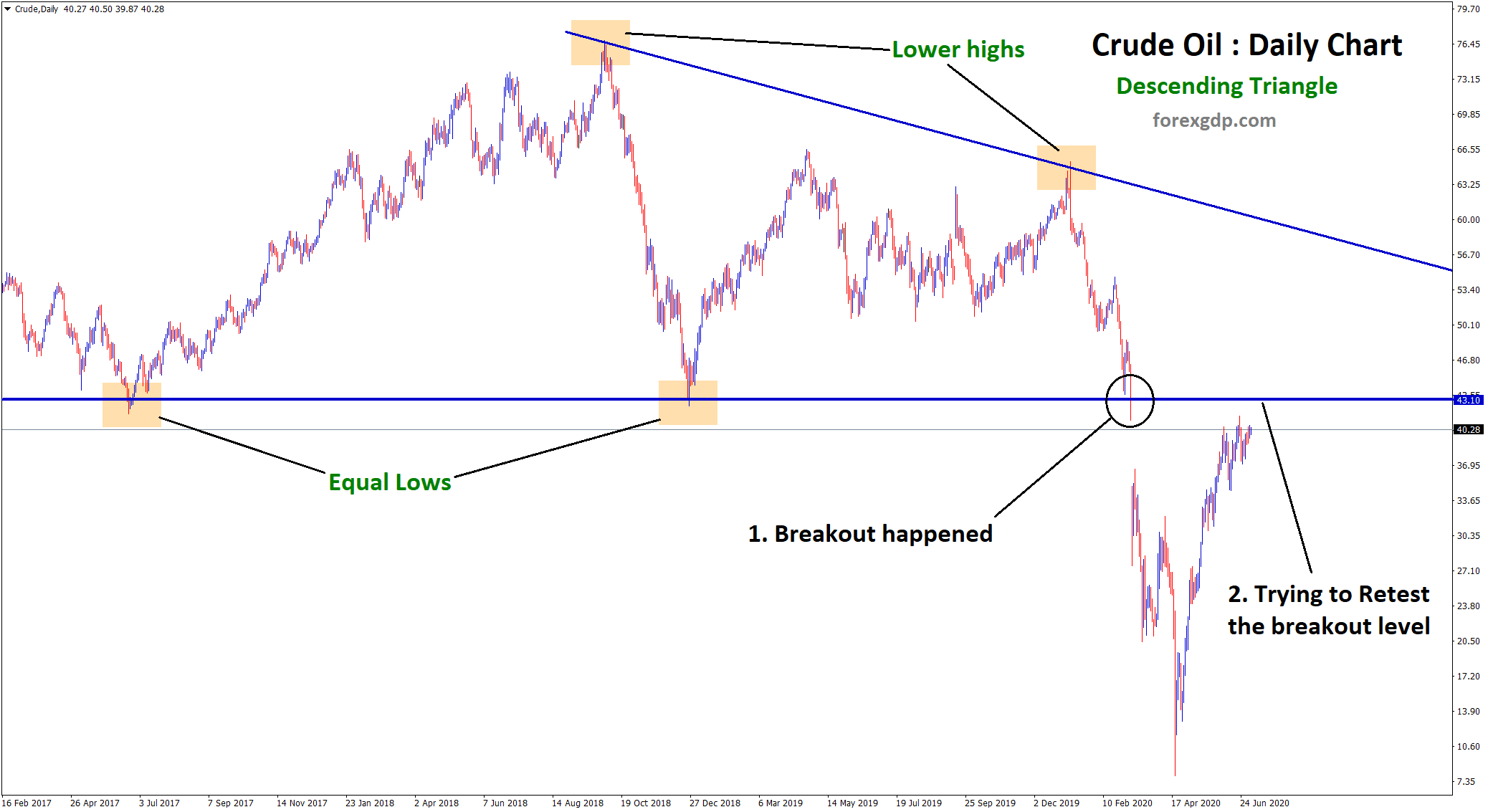

And also, Iron ore prices declined from a recent high as China started to ramp up steel production again.

Iran committed to 2 to 4 barrels per day if the US has agreed with Iran Deal This month.

New Zealand Dollar: War fears makes Worry for Riskier currencies

GBPNZD is moving in an Ascending channel and the market has reached the higher low area of the channel.

New Zealand Dollar seems to have a slight Upside in 2022, and marking towards 0.70 level is possible in 2022.

And Commodity prices are helping New Zealand Dollars by exports, and Rising European tensions with Russia makes Declines for New Zealand Dollar.

War type fears make more worry for Riskier currencies like New Zealand and the Australian Dollar.

And If any smooth agreement reached by no War makes Support for Riskier currencies.

In March, FED has to rate hikes by 25bps possible, and This month, RBNZ will hike 25 Bps.

Swiss Franc: Renewed Fears of Russia and Ukraine makes appreciation for Swiss Franc

EURCHF is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Renewed Fears of Russia and Ukraine War made higher for Safe Haven assets like Swiss Franc.

And USDCHF has dropped due to Russian Backed Separatists claiming that Ukraine Government Forces have bombed four times.

The US has forcefully said Russia has more intention on War escalation on Ukraine, So anytime more cautious on every step of Russia.

This week US initial Jobless claims data is scheduled, and Yesterday FED meeting minutes support US Dollar.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://www.forexgdp.net/buy/