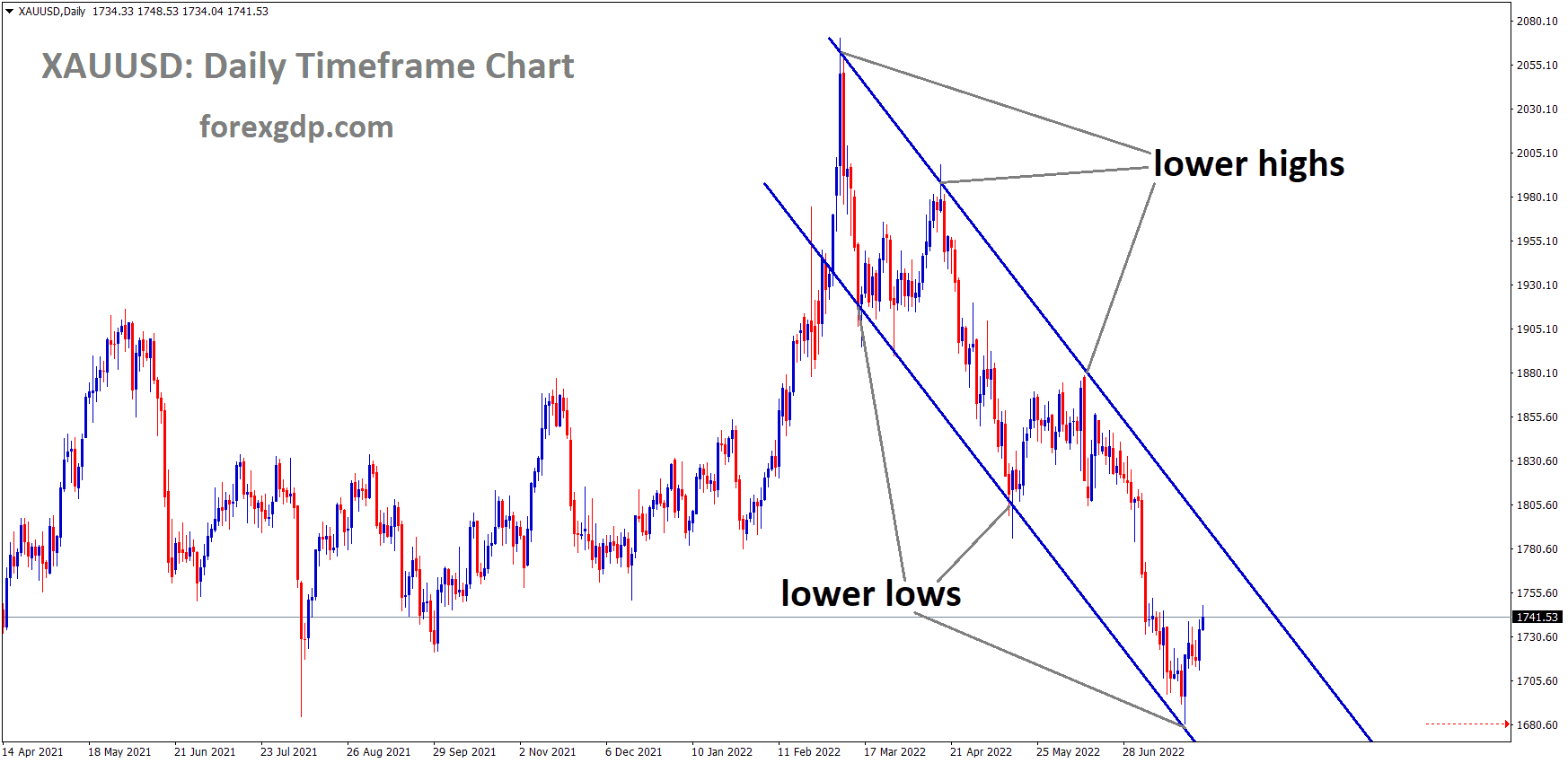

XAUUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The Dollar Markets

The dollar markets have taken a big hit recently as a result of the Feds releasing some major news within a day. They have released both their FOMC statement along with their monetary decision which is to combat the inflation crisis in the country.

USDCAD is moving in the Descending channel and the Market has rebounded from the Lower low area of the channel.

EURUSD is moving in the Descending channel and the Market has Fallen from the Lower high area of the channel.

USDJPY is moving in an Ascending channel and the Market has reached the higher low area of the channel.

As a result of these releases, USDCAD has been unstable and is now at 1.28, EURUSD has been dropping and is now at 1.17%, and USDJPY is teasing around the 135.3 region. Other dollar markets have been showing the same reaction as well.

Fed’s FOMC Statement and Monetary Decision

The Feds recently released their interest rates for the new terms and it is quite a shock to some but overall, it was expected by many. The Feds increased their interest rates by 75 basis points to take it from 1.75% to 2.50%. They even released an FOMC statement that reveals, “Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate.”

Analysts at Reuters also reveal, “The Federal Reserve on Wednesday raised interest rates by 75-basis points for the second straight meeting and reiterated that further hikes would be appropriate to curb “elevated” inflation, which is weighing on global economic activity. In the press conference that followed the monetary policy statement, Powell backed the idea of the central bank delivering an “unusually large” rate hike in September, though said that a slower pace of hikes could be required to allow the Fed time to assess the impact of tighter policy measures on the economy and inflation. Following the Fed’s latest hike, Powell suggested that the fed funds rate had reached the neutral rate – one that neither stimulates nor slows economic growth – but would likely need to move beyond this rate — to about 3.4% by the end of the year, paving the way for about 100 basis points between now and year-end — to curb inflation. In the weeks leading up to the decision, bets on a much larger rate hike had gripped investor attention following data showing inflation hit a fresh four-decade high last month. But Fed members quickly downplayed the need for a much larger hike, saying that a 0.75-point increase would be appropriate to keep the central bank on its path to move to a restrictive stance to bring down elevated inflation pressures.”

Feds Powell Speech

Following the huge interest rate hike decision made earlier today, Feds Chairman Jerome Powell made a speech discussing how this hike was correlated with the ongoing inflation crisis in the country. He reveals, “We do want to see demand running below potential for a sustained period to create slack. We’re trying to do just the right amount. We’re not trying to have a recession. Restoring price stability is just something we have got to do. There isn’t an option to fail. Economists at Reuters reveal, “The Federal Reserve said on Wednesday it would not flinch in its battle against the most intense breakout of inflation in the United States since the 1980s even if that means a “sustained period” of economic weakness and a slowing jobs market. As he explained the logic behind the stiffest interest rate increases in roughly four decades, Fed Chair Jerome Powell was peppered with questions about whether the U.S. economy was in or on the cusp of a recession – a notion he rejected because U.S. firms continue to hire in excess of 350,000 additional workers each month.”

They further reveal, “The 75-basis-point rate increase announced by the Fed on Wednesday, coupled with earlier actions in March, May, and June has now jacked the central bank’s overnight interest rate from near zero to a level between 2.25% and 2.50%. That is the fastest tightening of monetary policy since former Fed Chair Paul Volcker battled double-digit inflation in the 1980s. The cure then involved back-to-back recessions. Consumer prices haven’t yet breached the 10% annual mark this time – but at 9.1% they are close enough to raise the stakes for both the Fed and the Biden administration, which is particularly sensitive on the issue ahead of congressional elections in November. While Powell said he did not think a recession would be needed to fix the problem this time, he acknowledged that the economy was slowing and would likely need to slow more for the Fed to bring the pace of price increases back to earth.”

US Prisoner Swap

The United States is making a deal with Russia in order to regain two American citizens who are held captive in Russia as prisoners. The deal involves swapping a Russian arms dealer for two American prisoners. This decision is being made by the Biden administration. The arms dealer is also called the merchant of death as he was found selling weapons to Columbians in order to kill Americans. He was serving about 25 years in prison for this crime however, he may now be let free and replaced by two Americans stuck in Russia. This deal or exchange has mixed reactions from Americans. While most of them are happy about this exchange, they are not happy that the arms dealer gets to go off free after the horrible crimes he has been committing on US soil. Russia has yet to release a statement on whether or not they accept this deal. However, we will probably know about this within the week and you’ll be the first to know!