Gold: US Domestic data and pandemic sent Gold prices down

Gold is making a correction from the higher low area of the minor ascending channel.

Gold prices are pushed for corrections from lower on Friday, and US Dollar makes higher due to robust US Domestic data in October.

The third wave hits. Global nations make gold demand lower on the Global side.

And China’s issues over Energy and Covid-19 crisis made slower demand for Gold.

Inflation readings are higher in G-10 nations and pushed gold prices higher last month.

And FED renominated Chairman Powell makes Drag down the gold prices.

Powell &Co makes a hawkish tone on economic recovery, so investors are confident in Powell for doing rate hikes

US Dollar: FED expected to rate hike sooner than later

GBPUSD is standing at the lower low area of the descending channel in the daily timeframe.

NZDUSD is standing at the horizontal support zone in the daily timeframe chart.

US Dollar index dropped 0.50% today after the Global pandemic hits continuously.

The 10-year yields dropped 5% make worry for investors. And FED may do a rate hike sooner than later due to the higher inflation rates in the US.

And the third wave made another plunge for the Global economy, and this situation came after nonvaccinated people who had no awareness about the vaccine.

US Dollar shows stronger bullish momentum in the past two months, now sees correction in the market.

EURO: Germany crossed 0.10 million death cases

EURUSD is trying to break the lower high of the minor descending channel.

Germany has 75k cases every day, and Austria announced a 2-week lockdown. Germany surpassed the 100k mark deaths yesterday as 351 death cases were reported last day.

And France Health minister told them they have no plan for reimplementing Covid-19 lockdowns in their country.

World health organization announced a meeting to discuss the new variant spread from South Africa.

Now ECB made no tapering and no reduction in PEPP purchases due to covid-19 cases higher in the economy.

Due to the above situation, this will not be the right time to do tapering and rate hikes for the Eurozone.

ECB Expected to end PEPP purchase program

ECB is expected to complete the Pandemic emergency program by the end of March 2022, as Analysts at Nordea said.

ECB would try to do compensate the $200 billion by $20 billion every month asset purchase program.

And also ECB will announce a new Asset purchase program rather than PEPP purchases.

The current situation in Eurozone is worried of Covid-19 spread and more lockdowns. Euro slightly Up from corrections today due to month end.

UK Pound: French Fishermans made blockades for UK Vessels

GBPAUD has broken the lower high (top) of the descending channel in the daily timeframe chart.

UK PM told Northern Ireland PM that UK and EU talks are concerned about implementing the NI Protocol.

If talks are solved, Article 16 will not be triggered for Northern Ireland.

And French Fisher mans started to block French ports and Vessels that crossed Europe and UK Paths.

This decision came after the UK had restricted licenses for French fishermen.

So now, Brexit violations made by the UK hurt European countries more than expected.

The UK is facing Brexit issues on one side and Domestic party issues on another side.

And Bank of England might do rate hikes next month is widely expected.

Canadian Dollar: Oil prices fell by 5% today

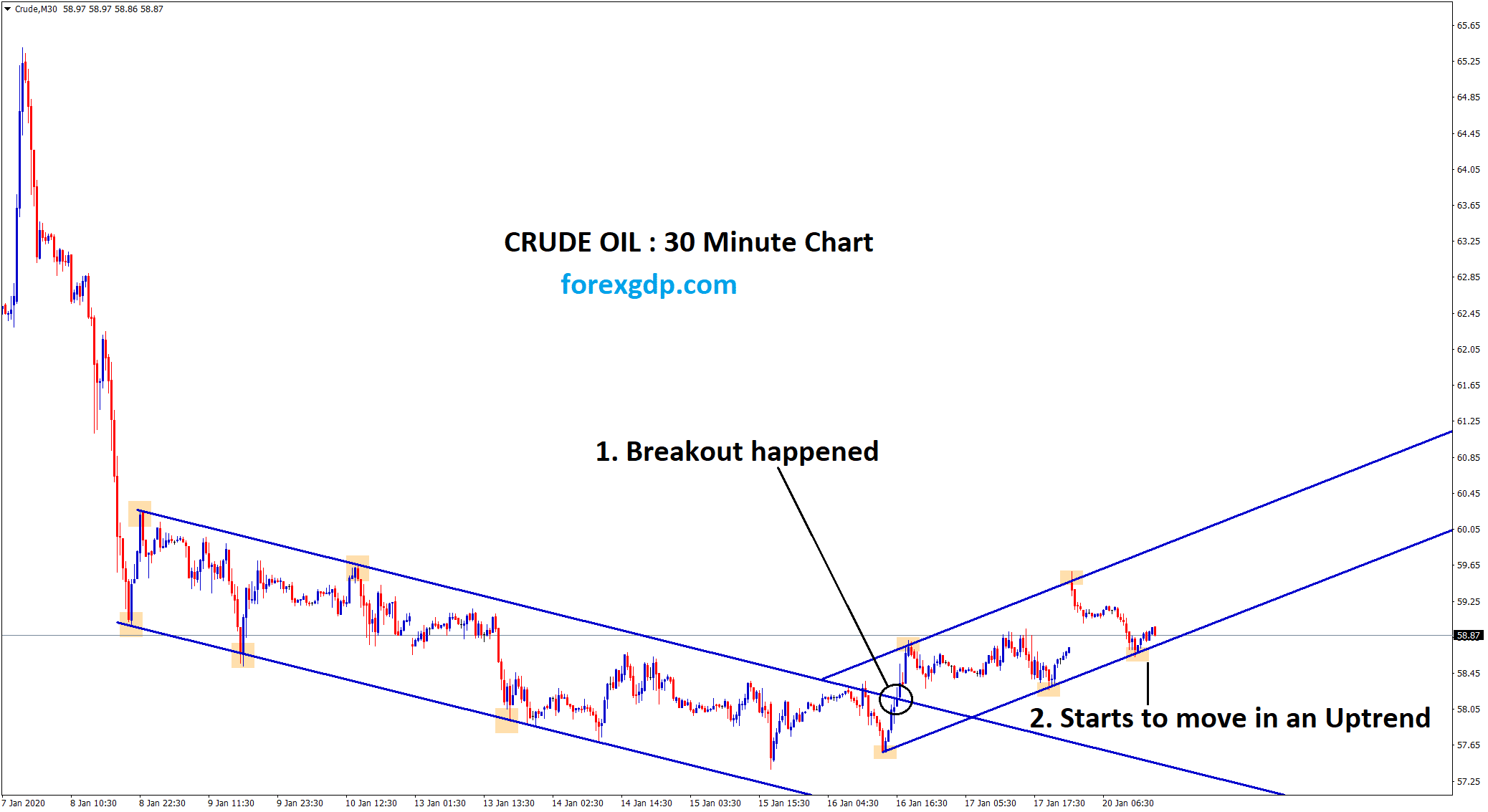

USDCAD is moving in a strong uptrend, crude oil price leads to CAD weakness.

Crude Oil prices were down as the OPEC+ meeting was scheduled this week. Canadian Dollar pushed down to 0.50% today after Oil prices fell by 5%.

US and Global nations hand over for Releasing Oil reserves is the main drawback for OPEC+ countries.

Increasing supply from Oil nations is not possible, But Demand nations make solutions for increasing supply by sharing Oil reserves with everyone.

So, this will impact the Demand risks to come down and Supply increase.

Japanese Yen: Covid-19 Third-wave hits Global nations

USDJPY is moving in a rising wedge pattern in the 4-hour timeframe chart.

Reserve Bank of New Zealand, Assistant Governor Christian Hawkes, said New Zealand Economy is performing very resilient..

10-year Government Bond yield fell over 5% after the news was released.

During crisis time, the Japanese Yen and Swiss Franc were made higher for Safety purposes by the investor’s side.

And Japan has announced a hefty stimulus to the economy for recovering soon from the pandemic. Oil prices finally fell by 5% today and made some breathing relief for Japan Government.

The Energy prices soaring makes difficulties in Manufacturing and productions areas.

And the Transports make much cost to ship one place to another place due to fuel costs higher.

Australian Dollar: Retail sales data came at higher than expected

AUDJPY has reached the higher low in the daily timeframe chart.

Australian Retail Sales data (October) came at 4.9% versus 2.2% expected and 1.3% previous. This reading shows a heavy boost for the Australian economy.

In October, most populated cities like New South Wales and Victoria were eased with lockdown restrictions by the Australian Government.

And the Australian Q3 GDP is scheduled next month earlier, and this Q3 shows Dull numbers forecasted because of Lockdown imposing periods are high.

By Considering these scenarios, RBA already predicted Q4 GDP is a more robust outcome than Q3.

So Q4 is more expectations on Strong numbers than Q3 report.

And Iron ore prices are higher day by day due to China economic recovery in the medium phase from the Slower phase.

The energy crisis made China slow down the Economy recovery.

New Zealand Dollar: RBNZ Assistant Governor Speech

EURNZD hits the lower high area of the descending channel in the daily timeframe chart.

Reserve Bank of New Zealand, Assistant Governor Christian Hawkes, said New Zealand Economy is performing very resilient.

And market reached Our expected inflation level; Covid-19 is a big risk to the economy. But New Zealand Economy have tackled, and the comeback from the pandemic is better than expected.

Rate hikes are continuous picked on the table due to better-performing employment rates and inflation rates in the market.

And Tapering is another tool in the next meeting and will help to strengthen New Zealand Economy.

Swiss Franc: Swiss Q3 GDP came at higher than expected

USDCHF fell from the horizontal resistance and the top of the symmetrical triangle in the daily timeframe chart.

Swiss GDP Q3 report released as 4.1% versus 3.2% forecasted and more than expected numbers made higher for Swiss Franc.

Due to this, USDCHF Dropped 0.70-0.75% earlier as the news came more robust numbers.

And Swiss economy performing well after easing lockdowns, and vaccinations are effective for all ages of people.

The third wave spread in Eurozone make comfort pick for safe currency like Swiss Franc.

And Swiss Franc remains a popular pick for investors at crisis times.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/