Gold: Delta Variant

Gold bounces back from the support zone and the market is ranging now.

Gold Prices remains correction after hit at Fib ratio of 61.8% at 1830$, Now Another correction to the lower point of 1764$ as 61.8% fib ratio.

According to Fundamental analysis, US Dollar makes dominant player as Risk Aversion takes place in the market.

Gold Prices remains lower as Globally Delta Variant spread and Vaccination rollout are slowed down in Asian Countries.

US and UK are dominant Vaccination rollouts, and Freedom Day announced in the UK as free from mask.

Gold remains Demand slower as Once again Risk Aversion happened in the market, Chinese GDP came lower at 7.9% versus 8.1% expected.

US Dollar: Risk Aversion Fears by Delta Variant spread

USDCAD flew up to the higher high zone of an Uptrend line.

USDJPY is still moving between the channel ranges.

US Dollar index heads towards 93 levels as Strong Retail sales printed last week.

Risk aversion of Delta variant takes place after vaccination rollout is done. This causes much fear of economic recovery now.

Once Again, all markets fell for the Delta variant, and the economy may face a double-dip recession this time as expected.

10-year treasury yield prices higher as FED said Dovish comments, But Rising inflation numbers makes Confident for Rate hikes in 2023.

EURO: German producer Price data

EURGBP is trying to break the range, but it’s still in a range from a long time.

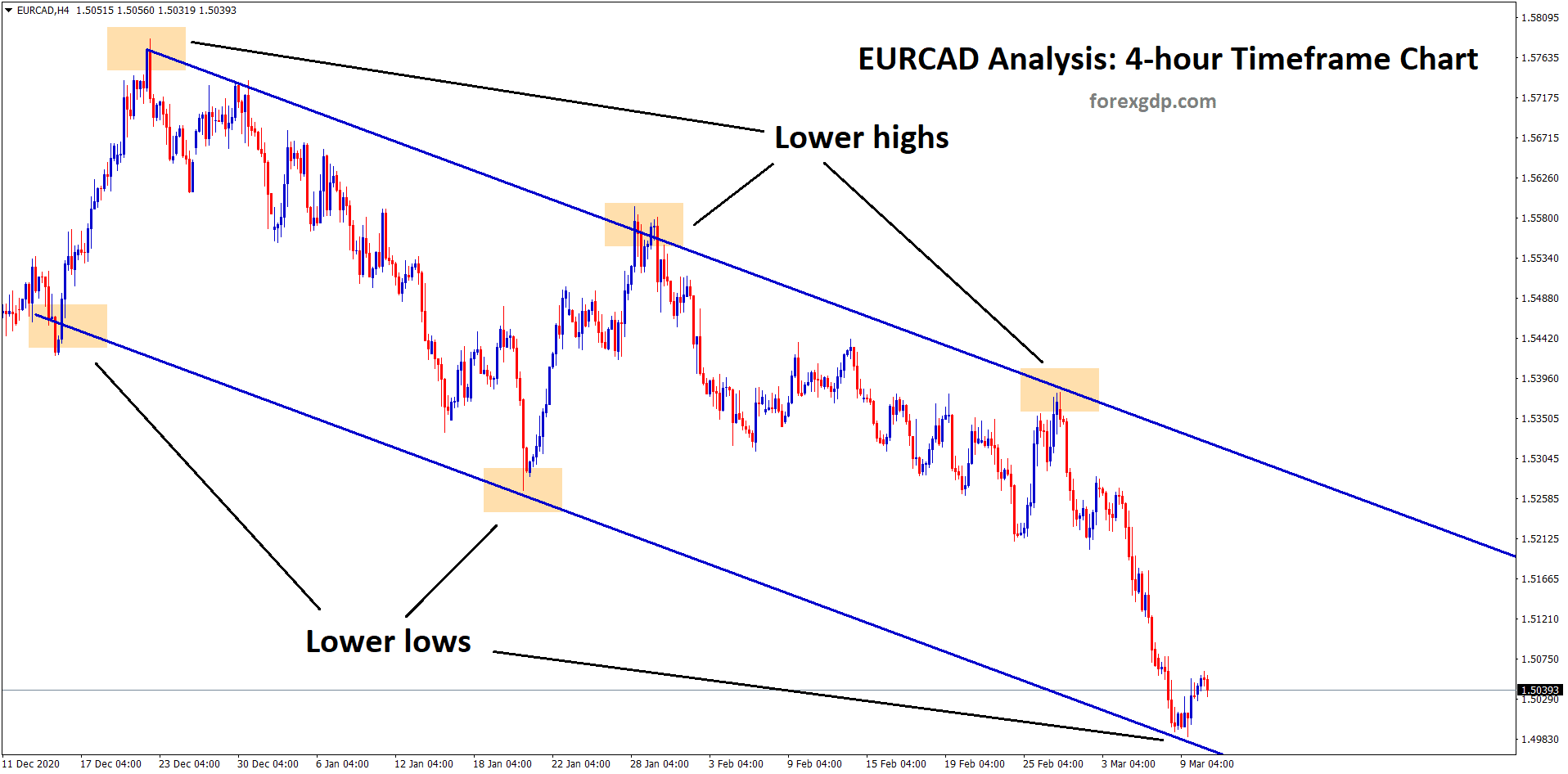

EURCAD flew up to the higher high zone of an uptrend line.

EURUSD makes weaker as US Dollar shines from last 3 months.

German Producer prices came at a higher than estimated range of 1.3% monthly and 8.5% over the last 12 months.

Current account surplus in Broader Euro Area compressed to Euro 4.3 billion in May month.

This week housing starts, and building permits in the table to watch.

FED Dovish comments make US Dollar stronger in the near term, the main reason for Delta Variant.

Again, starting from Covid-19 new type spread across Globe creates panic across investors.US Dollar, and Japanese Yen makes more safe currency to buy in pandemic time.

UK POUND: Brexit on Northern Ireland Protocol

GBPJPY hits the horizontal support zone.

GBPCHF is at the support zone and lower low level of descending channel hits.

UK Pound faces tough selling pressure this week as Brexit negotiations on Northern Ireland Protocol goes against Euro Zone.

And UK Brexit Negotiator David Frost makes Significant changes in Northern Ireland Protocol; this will create tensions against Europe.

Highly Contagious Delta Variant spread across the UK and UK health minister, UK PM and UK Finance minister are affected by this variant, and they are under Quarantine.

EURGBP makes significant higher after 3 months of Sideway range and makes Broke out Upper side as Strong key.

MPC Members view on policy meeting

UK MPC members Haskel and Mann said there is no hurry for tapering or tightening monetary policy conditions because now the only market shows economic recovery if we tighten monetary policy settings, then economic recovery reverts to Pandemic level.

So rate hikes and tapering assets are not possible until Full wake up to the normal zone.

UK Pound more struggle for Higher side and Correction may be possible until 1.32250 level.

Canadian Dollar: OPEC+ Deal

CADCHF hits the old resistance which may act as a new support soon (In the history, At The current zone where more times market made the reversals).

Canadian Dollar makes Lower after OPEC+ Deal compromised with 4lakhs barrel producing per day from August Month.

And CADJPY down from 2-3% from last week, USDCAD up from 2-3% lower level.

Bank of Canada tapers the asset purchases from C$3 billion to C$2 billion. Delta variant affected more in Global side.

So Demand for Fuel came to a low, and the OPEC+ Deal is agreed for Higher output per day, which causes more supply in Oil Side, and Prices came lower level after reaching higher highs last month.

USDCAD still we see upside as 3% from the current level of 1.27500-1.30500 level.

Japanese Yen: CPI Data

CHFJPY going to reach the higher low level of an Uptrend line – Wait for the confirmation.

Japanese Yen rising as Inflation data crossed the Wires of expectations. Data printed at 0.2%Y/Y versus 0.1% in May month.

Yen posted stronger gains as Risk Aversion progress at the Global level.

CPI data reflects the Bank of Japan to alter its monetary policy settings as a trajectory way.

Australian Dollar performed well as Domestic data performed well, but more lockdowns were imposed in Sydney, Victoria and New South Wales.

Lockdown announced in Tokyo

In Japan, officials announced a state of emergency in Tokyo and banned Spectators in Olympics as cases severed in Japan. Until Covid-19 issues are solved, the Japanese Yen remains a safe currency to hold on to.

Bank of Japan said whatever support is required for the economy, the Japanese Government stand and do well for people.

Slower Vaccination Rollouts causes the Japanese Economy to slump Down day by day; if focus on Vaccination, then Japan will recover from All issues.

Australian Dollar: Delta Variant and RBA meeting minutes

AUDCHF hits the support and lower low of the descending channel.

AUDUSD pair lost most of its gain around 2% in one day as Delta Variant spread across Sydney and most populous state Victoria.

And more Lockdown is possible in the coming days that will be pressure given for the Australian Dollar.

Vaccination slower rollout causes main reason for Spread of Delta Variant.

13 new Cases raised in Victoria state made more cautious for incoming to Australian Airport.

RBA meeting minutes are nothing different from July 5 meeting; the same repeated speech happened. No rate hikes until 2024 is a clear statement printed.

People Bank of China cut 0.50% lending rates to support a slower economy the action was taken.

And US Dollar stood at 3.5 months top as 10-year treasury yields give positive returns and Diminished the US FED comments on Dovish policy.

New Zealand Dollar: Delta Variant

AUDNZD hits the support and bouncing back from the lower low of the descending channel.

Delta variant spread across Global level causes China to exports down as weak demand from Asian Countries.

New Zealand Dollar shows good correction after US Dollar makes more positive mode as Fears across Globe sustains.

Australia announced Sydney and New South Wales lockdown for 2 weeks; due to this, New Zealand Tourism was stopped at the front after checking Quarantine and then Allowed.

New Zealand Dollar faces selling pressure as Exports to China were dull as Chinese GDP causes lower numbers.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy