Gold: Rising Debt funds makes worry for gold

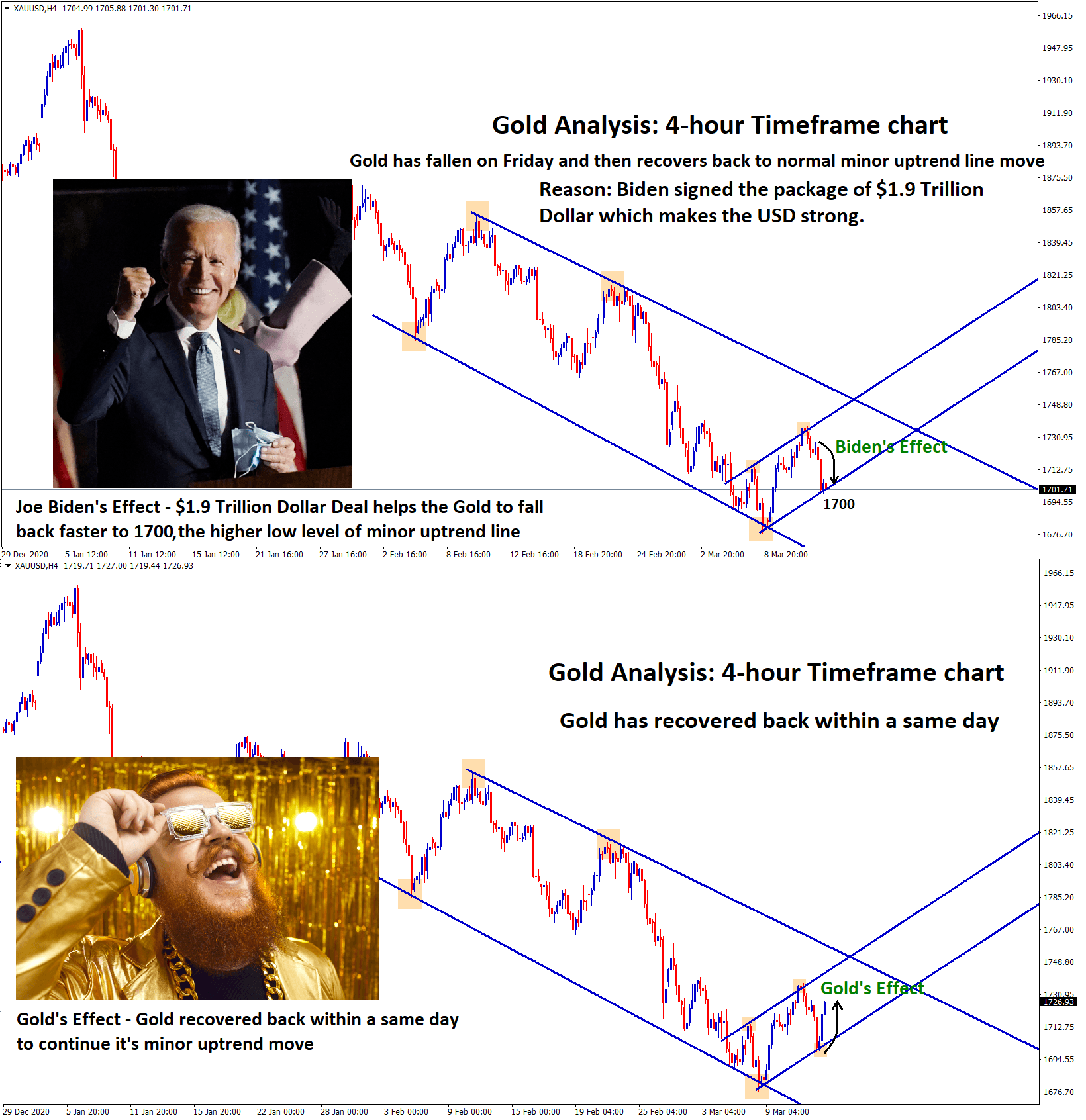

Gold is moving in an Ascending channel range for a long time in the 4-hour timeframe chart.

Gold prices remain higher as Box pattern formed as 1720 to 1833$ so keeps sideways market.

And Gold seems inflation hedge currency, but Debt markets are soaring higher as Rising yields make higher.

Interest rates in the coming months like to increase, and then gold prices will fall in the coming months.

Tapering assets planned were processed by FED and will announce after November 3 FOMC meeting.

US DOLLAR: US FED Cleveland Mester speech

USDCAD is moving in a descending channel range.

NZDUSD has broken the top of the descending channel and it’s consolidating at the higher high area of the range.

Cleveland FED Governor Mester said to reporters that tapering assets in the near term will do and does not hike interest rates in the near term.

US Financial system plays a healthy process, and US Domestic data performed well.

And Q3 economy data shows less high, but US GDP is 5-6% higher in 2021.

Inflation prices will come down as the year passes, and in 2022, end inflation will come lower.

US FED achieved the goal of the inflation target of 2% and employment rate to near goals.

US Dollar keeps lower as US inflation rate keeps higher in last week.

Euro: ECB pushed for human resources in Banks

EURUSD is moving in an Ascending channel range in the 1-hour timeframe chart.

EURCHF after retesting the broken ascending channel, price hits the support area in the daily timeframe.

European central bank pushed for Banks to enhance their human and financial resources in post Brexit operations.

Due to more employment rate and spread of Employment in all sectors in equivalent, priority-based is more important.

And UK PM Johnson agreed to talk about the Northern Ireland protocol issue.

And ECB pushes human resources to implement in various sectors made a positive impact for Eurozone.

UK Pound: Rate hikes expectations increased

GBPAUD is bouncing back after hitting the higher low of the uptrend line.

Bank of England monetary policy settings to be changed in November meeting and rate hikes for 25Bps points chances increased much higher.

And the latest public sector borrowing data came at lower than higher expected as UK Pound 21.8 billion than 22.6 billion expected. And this figure is worse numbers since 1993.

This public sector borrowing data would not affect the UK Budget presented by Rishi Chunak, Finance chancellor, on October 27.

And UK Pound lifted higher more to 1.38 level as rate hikes expectations.

Canadian Dollar: Inflation rate higher

CADCHF has reached the horizontal resistance area after breaking the descending channel range.

Canadian inflation data came at higher than expected as 4.4% than 4.3% expected.

So, the Bank of Canada is expected to raise rates or taper assets in the next monthly meeting.

And China Evergrande crisis fears more as resales of property to Hopson developments is failed.

And Global energy crisis makes more inflationary pressures, and Domestic data comes at moderate in Canada.

Oil prices support the Canadian Dollar Day by day since US Inventory shows higher.

Japanese Yen: Bank of Japan declared Financial stability is normal

USDJPY is trying to make a correction from the important resistance area in the Higher timeframe chart (weekly timeframe)

USDJPY has broken the bottom of the ascending channel in the Smaller timeframe chart (1-hour timeframe)

Japanese financial stability is normal only not affected by pandemics, as the Bank of Japan declared.

And Real estate developments to increase and more credit loans to be concentrated and likely to be rectified in coming months.

The destabilization of foreign currency has made an impact on Japanese Financial systems.

Even after pandemic subsidies, lower interest rates and more stimulus injections will be downward pressure for financial profits.

Due to the pandemic situation, financial institutions make less profit as the Economy does not support overcoming.

Australian Dollar: NAB Business confidence came lower

AUDUSD is making a small correction after hitting the higher high of the range.

National Australia Bank business confidence data shows -1 reading printed as 5 expected and previous reading is 17.

Australian Dollar keeps higher after Downbeat data printed.

And US FED Governors makes a positive hint at the tapering of assets in the upcoming FOMC meeting.

Due to the lockdown imposed in Australia, Business confidence keeps lower than expected in Q3 of 2021.

RBA Governor already stated Q4 of 2021 Australian Economy would perform well and erased all losses in previous quarters.

China Evergrande bonds seek 3 months extension

China ever Grande sales of some units to Hopson developments were failed earlier day.

But some breathe taking news is Evergrande bonds of 260 million issued by Joint venture Jumbo fortune enterprises gives three months extension after Evergrande gives more collateral to the company.

Now fears little cool after the extension of debt clearance to three months’ time period.

And the massive burden of debt created by China Evergrande after the pandemic crisis affected the Chinese GDP in the coming quarters.

New Zealand Dollar: Credit card spending data lowered than expected

GBPNZD is bouncing back after hitting the horizontal support area.

New Zealand Dollar keeps higher as New Zealand Card spending numbers came at lower.

And this is because a massive lockdown in Auckland impacts spending in Shops, and due to this, retail sales data might be slow in this month.

And also, China GDP data slower than the previous quarter makes New Zealand Exports revenues slow down.

Another rate hike is expected in next month monetary policy meeting, as RBNZ planned.

As employment rate and inflation rate continuously pace higher support for New Zealand economy growth.

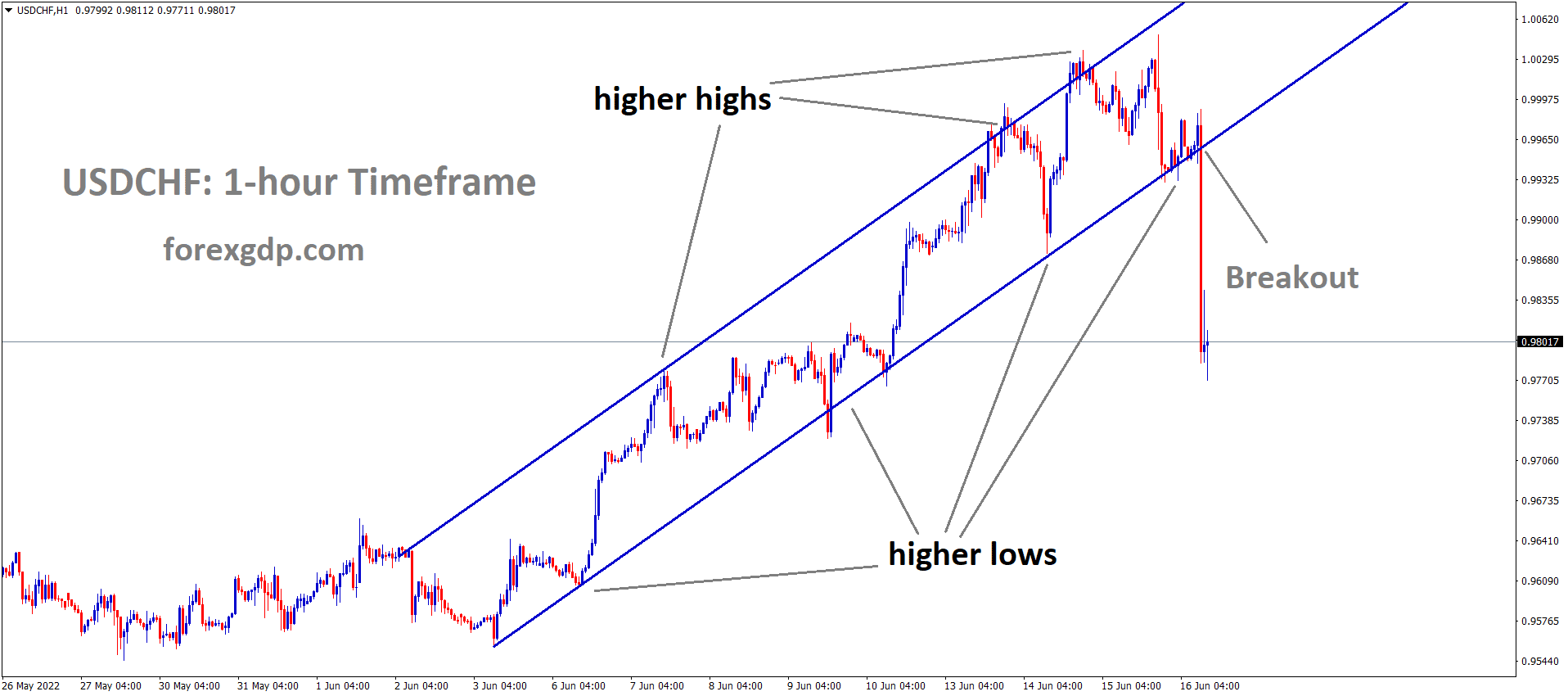

Swiss Franc: Inflation under target level in Swiss Economy

AUDCHF is moving in an Ascending channel – now price hits the higher low area of the channel line.

Swiss franc keeps higher as moderate domestic data comes; Vaccination rates are moderate.

Easing lockdown in more areas keeps retail sales higher and consumer spending higher.

But inflation reading is still below the 2% target of the Swiss national bank forecast.

US Dollar keeps lower after US FED doubtful for tapering assets in next month and due to this CHF keeps higher against US Dollar.

And US Cleveland Mester said Tapering could be expected in the coming months, but rate hikes are not until 2022 end.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/