Gold: FOMC meeting Forecast

XAUUSD Gold prices are moving in an Ascending channel and inside the major channel, the market price is moving in the minor descending channel and rebounded from the higher low area of the major ascending channel.

XAGUSD Silver prices are moving at the Bullish trendline and prices stand at the higher low area of the Trendline.

Gold prices are driving higher in the market and keep ranging between 1780-1815$, and US Dollar also keeps ranging ahead of the two-day FOMC meeting today.

US Dollar index keeps consolidation waiting for good results from FED, Whether the taper will happen or not.

China is facing issues over the demand for Oil, Electricity, Covid-19 and real estate concerns. So, Gold will be a clear hedge currency during Crisis time.

And also US FED tapering plan is the main component for gold prices. If US Dollar printing is reduced, then gold prices shoot down; if increased the printing of US Dollars, Gold prices get to shoot up once again.

US Dollar: FOMC and NFP data outlook

USDCAD is moving at the Descending channel and market price is long time consolidates inside equal highs and equal low areas.

USDCHF is moving in the Symmetrical triangle pattern.

US Dollar in consolidation mode for the last one month; and now waiting for the FOMC meeting outlook this week.

And US Domestic data shows moderate reading in last month; Employment rate seems moderate growth, and this NFP expected to 500k.

US Joe Biden plan of $1.7 trillion proposals will sanction this month, But the Debt ceiling is a major issue in the US Government.

This week NFP data and FOMC meeting are major key events for US Dollar to dictate directions.

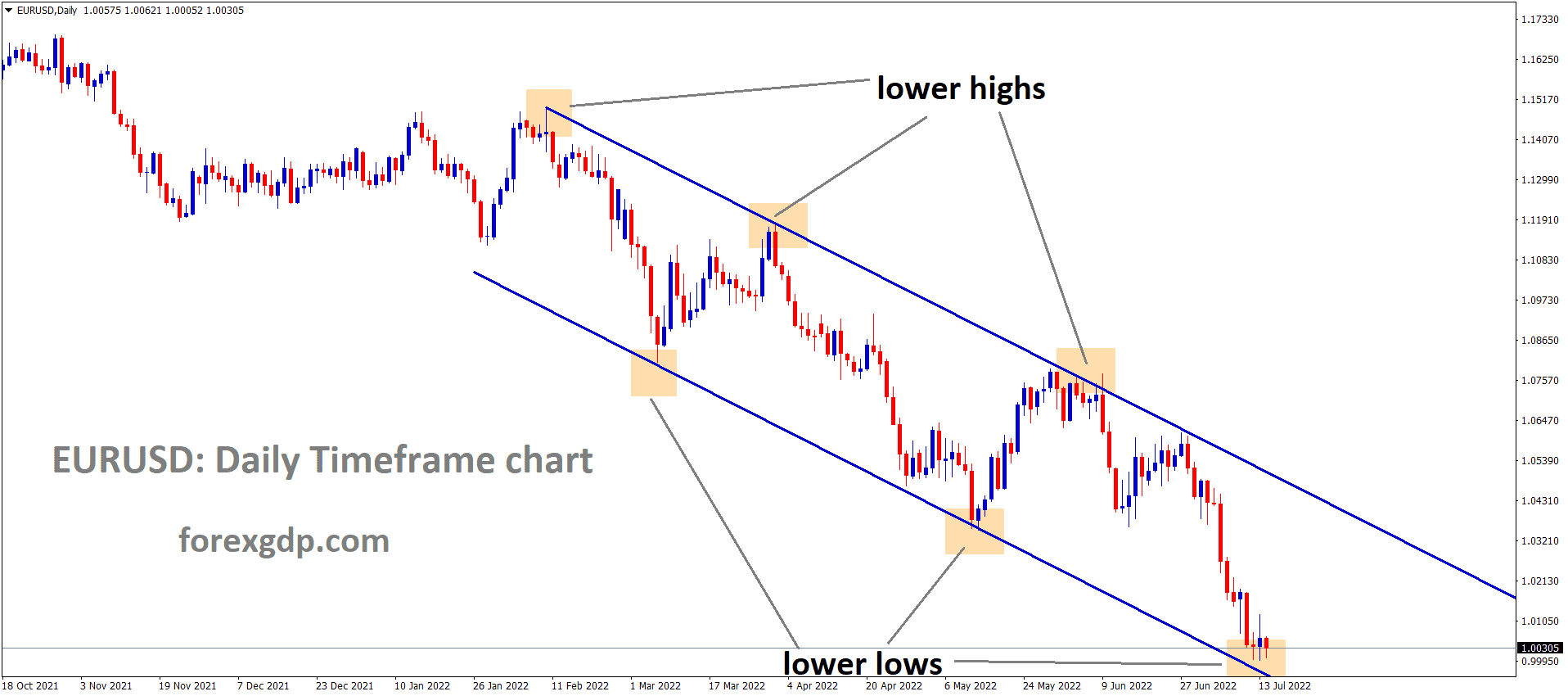

EURO: Covid-19 increased cases in Germany

EURAUD has broken the Descending channel.

ECB made less dovish on monetary policy tools. And waiting for tomorrow’s FED decision, based on that ECB will take the right actions according to the situation.

In Germany Covid-19 infections increased.And German domestic data came in sluggish numbers and kept Eurozone significantly lower due to the weak data.

Supplier bottlenecks and Semiconductor shortages make manufacturer prices set higher to the consumer end.

And Russia promised to supply Gas to the Eurozone until Demand was completed.

EU soon talks to Iran about Oil supplies to compensate Fuel crisis in Europe.

UK POUND: Brexit Talks with France

GBPCHF is moving in an ascending channel and the market is standing at the higher low area of the channel and also fell from the lower high area of the minor Descending channel.

France set to stop the destructive measures on Britain Boats on French water and set to talks with Britain soon this month.

And France added 50 more licenses to Boats for Fishing in French waters; Britain will take action quickly on Fishing with France soon by this week is expected.

Brexit Negotiator David Frost like to speech with France on Northern Ireland protocol and Fishing rights on French Water

Japanese Yen: The meeting between BoJ and Japanese Government

EURJPY is moving in the Descending triangle pattern and price standing at the Equal lows and unequal highs of the pattern.

Japan Finance minister Suzuki had a meeting with Bank of Japan Governor Kuroda.

This meeting shows specific monetary policy from the Bank of Japan to decide and a joint statement between the Bank of Japan and the Japanese Government.

And they are building strong relationships to maintain between the Government and the Bank of Japan.

Bank of Japan to ensure financial stability as required by the Japanese Government.

No discussions on the Currencies topic in today meeting.

Canadian Dollar: Bank of Canada ended QE

CADJPY is Moving in the Descending channel and fell from the lower high area of the channel, market standing at consolidation range between Equal lows and Equal highs area..

Bank of Canada set to end the QE program surprisingly, and the rate hikes will soon be done.

And Oil prices are set to higher as demand increases Globally.

Tomorrow OPEC+ nations are meeting together to increase supply to compensate price volatility in markets.

EU and Iran will make a deal in the meeting, which is scheduled this month, to supply Iranian oil to the EU long after sanctions on Iran.

If the US agreed with Iran on sanctions, then Iran Oil supplies compensate Oil demand at the Global level.

Australian Dollar: RBA monetary policy looks at Dovish stance

AUDCHF is moving in the Descending channel and fell from the Lower higher area of the channel.

RBA monetary policy settings happened today and left rates unchanged at 0.10% and Abandoned the Yield curve control monetary policy settings.

And RBA keeps Government debt asset purchases at 4 billion per week until mid-February 2022.

And RBA Governor Phillip Lowe said there will be no changes in the rate of interest until 2024.

The 2 most populous city New South Wales and Victoria, released the lockdown restrictions.

In the coming 3rd quarter, GDP will see softer numbers on December 1st to dictate, due to more severe lockdowns in the city.

And the 4th quarter will be increasing reading due to the now released lockdown measures.

Inflation in Australia remains in control mode only they expected not to beat 2.25% until 2023 as Trimmed mean value.

New Zealand Dollar: NZ Borders are opened

GBPNZD is moving in the Descending channel and the market rebounded from the lower low area..

New Zealand Dollar keeps Consolidation mode in the last month after RBNZ do rate hikes in the previous month.

And Soon, more rate hikes will be seen in coming quarters as the Covid-19 pandemic will be decreased one by one.

New Zealand Border set to open with proper guidelines to enter and Quarantine period set to 7 days.

China issue on imports from Global countries due to Domestic demand increases as Electricity, Covid-19 and real estate concerns.

And Tomorrow FOMC meeting will dictate the Directions of NZDUSD in the market.

RBNZ Governor ORR Speech

New Zealand House prices are rising everywhere due to the low-interest-rate environment, Soon rates of Housing prices will be eased as RBNZ Governor speech today.

And More demand for the Housing sector due to lower interest rates, but the central bank need not be required to lower the housing prices soon.

It has a proper way to reduce housing prices by hiking interest rates and adequate regulations.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/