Gold

Gold has broken the bottom level of the uptrend line after a long time.

Similar to Gold, Silver XAGUSD has broken the bottom level of the uptrend line after a long time.

Gold prices go for a good correction in the near term to 1880$ ahead of NFP payrolls.

Philadelphia Fed President Patrick Harker said that FED could be slowly and carefully scale back Bond purchases at the proper time.

But FED follows Proper patience in scaling back assets in the right manner, but inflation numbers rising also take to mind.

And Delta Fed President Robert Kaplan says tapering policy may soon be adapted than later. He is a non-voter of FED, but Words will affect the FED policy to change purchasing to a slower mode.

USD

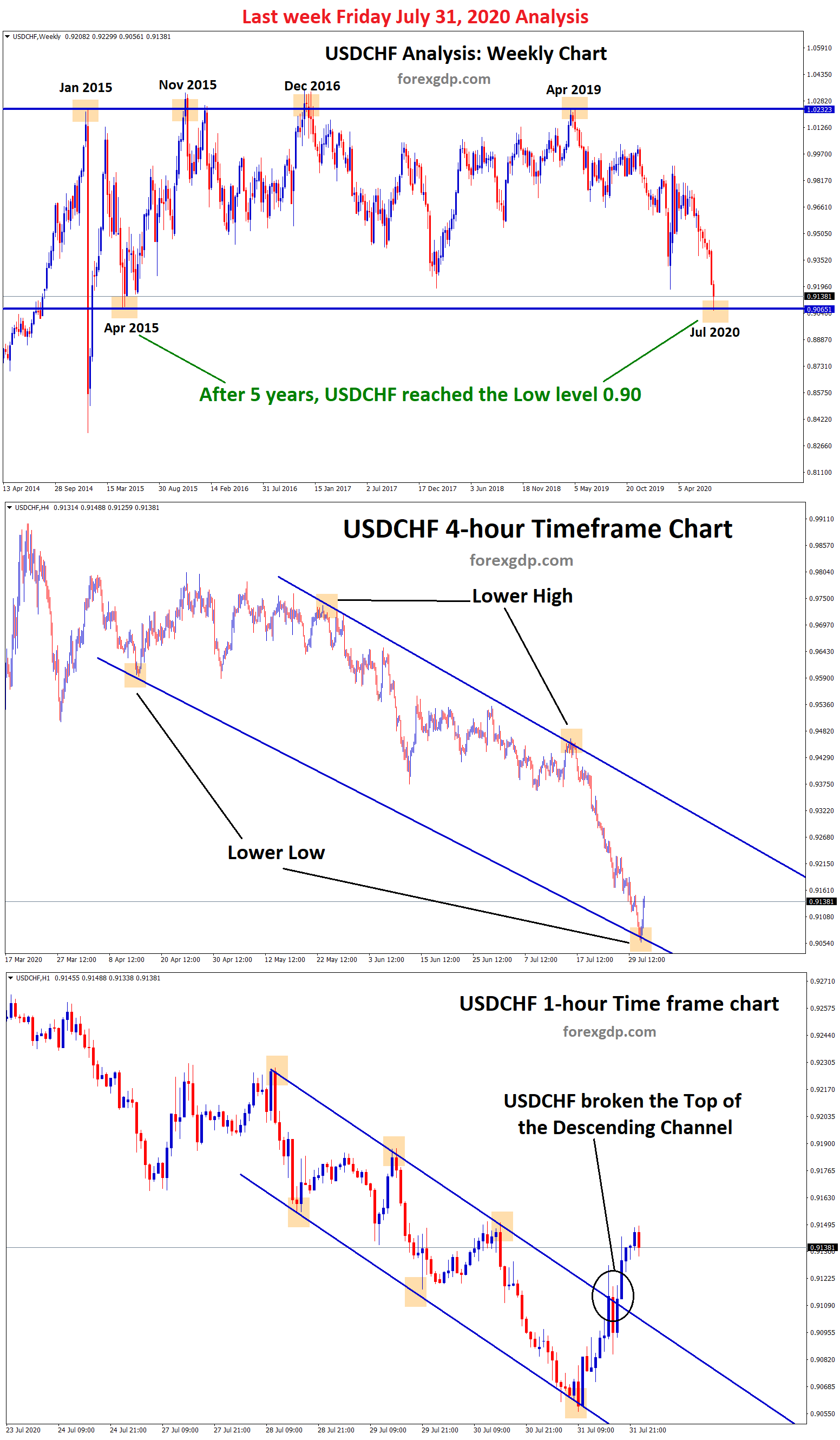

USDCHF trying to break the downtrend channel range.

US Dollar moved in the range-bound market as ahead of non-Farm payrolls to expected at 650000 this week. Last month 266000 printed versus 1 million jobs expected gets diminish by the report.

And Domestic data earnings supported US Dollar to Upside, but Inflation point of view fears surrounding US economy as No steps taken to control inflation numbers.

Considering these situations, FED may consider the Inflation numbers and control by not buying assets anymore or down the asset purchases earlier.

FED meeting on June 16 will decide whether further asset purchases will support or withdraw from purchases is wait and see approach by investors view

Sterling is the best-performing currency in G10 peers and Up 10% against the Japanese Yen.

EUR

EURUSD broken the bottom level of the rising wedge, breakout and retest happened expecting fall.

EURAUD broken the top level of the Descending Triangle pattern.

In the higher timeframe view, EURAUD has broken the top level of the Ascending Triangle

Eurozone inflation Y/Y rose to 2.0% in May, from 1.6% Y/Y in April month above expectations of 1.9%Y/Y.

And Core inflations rose to 0.9% y/y for May month from 0.7% Y/Y in April month.

This is the first time since 2018 Eurozone faces higher inflation to 2.0%. But ECB has no stressed inflation numbers; oil prices in the sideways market from Jan to May month provide higher inflation in Energy prices.

But ECB moved for Dovish tone, and Tapering assets is more welcome to Eurozone in the upcoming meeting.

Europe GDP Growth

Germany economy minister Peter Altmaier sounded on Eurozone economy outlook projections.

And this crisis of Covid-19 much problems given to the economy and struck down from Stable.

We will reach 4% of real GDP Growth of Eurozone this year 2021 end.

And this Sounds of projections are good by the German economy minister, but businesses have to support the economy to encourage and flow up like pre-pandemic level.

GBP

GBPUSD ranging in the higher high zone.

UK Pound moves in the rangebound market this week ahead of non-farm payrolls this Friday.

And Domestic data in the UK performed well in the first quarter of 2021 as Vaccinations did well in the UK.

And also, because of Releasing lockdown in the UK at the June 21st end, the new variant of Covid-19 spread across the UK will be Vulnerable.

No other major Domestic news scheduled this week on UK Pound, and US Domestic news is the only key events this week to drive further UK pound directions.

Among G10 peers-UK Pound performed better than other peers.

CAD

USDCAD ranging up and down between resistance and support level.

Oil prices lifted 70$ per barrel, and demand created a high Globally other than India, Japan, Taiwan and Singapore.

And Canadian Dollar rose to 91 against the Japanese Yen last day as the Bank of Canada tapering of assets expectations makes an accumulation for investors.

But US Inventories shed to Lower and makes Saudi Oil production demands high. Anyhow Last year losses to 0$ per barrel Now recovered from Higher prices.

Next year-end, 100$ will reach US Oil is no doubted as India, Japan two major nations picked up from Pandemic, demand created higher after lockdowns. Oil currencies like Canadian Dollar will get benefitted more from Oil distribution revenues.

CADJPY may see a 100 mark by the 2022 first half of the Year.

JPY

USDJPY bounces back after retesting the broken ascending Triangle.

Japanese Yen tends to weaker as the Emergency of lockdown in Tokyo increases to June 20.

Due to this, US Dollar demand gets picked up, and USDJPY moved to 109.500-109.800 level.

UK Pound is real strength by Domestic data supports, and UK PM Johnson said June 21st is the last date for ending the Full region of lockdown in the UK.

GBPJPY made higher to 155.600-155.800 level as Domestic data from the UK supported as the economic recovery is faster than expected.

And Bank of England already said there would be hike rates if the economy were fuelled faster than our targets, definitely tapering assets and Hikes rates is possible.

This is the third central bank announced after RBNZ and Bank of Canada.

AUD

AUDUSD trying to break the support level in the 4-hour timeframe chart.

Australian Dollar moved in range-bound markets from last 1 month and In last 5 months-0.75-0.80 levels.

Inflation data rising in many global countries due to Supply and Demand mismatch in Productions and consumers.

This results in prices are increases in materials from household to corporate manufacturing raw material level.

And April Final retail sales came at 1.1% from 1.3% previous.

China also reported Caixin manufacturing index PMI and improved figure makes Consecutive gain for Services sector.

And the Chinese economy continues to jump up as reopening Post covid-19, But the US and UK stepped back from China because affections and stimulus spending of China is very lower than US and UK.

Anyhow, the Chinese economy improvement will see improvement in Australia and New Zealand. But they are unfavourable in the business race to US and UK.

NZD

NZDUSD at the support zone, wait for breakout or reversal.

There is no more important news for New Zealand Dollar this week, as US Domestic data will flow the prices of the New Zealand Dollar.

And RBNZ clearly stated last week of May month, there is rate hike soon in Second half of 2022 if the economy grows very well and Our Goals of the target will be reached.

China manufacturing PMI and Services sector improvement will drive New Zealand Dollar to higher,

And this month FED meeting will decide the Sideways market boost up the Trending market, most traders and investors expecting to FED meeting.

New Zealand Dairy products remain robust growth for the GDP of New Zealand country and during the pandemic crisis dairy products to China were more consumed is helpful for revenues in 2020-2021.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/forex-signals/