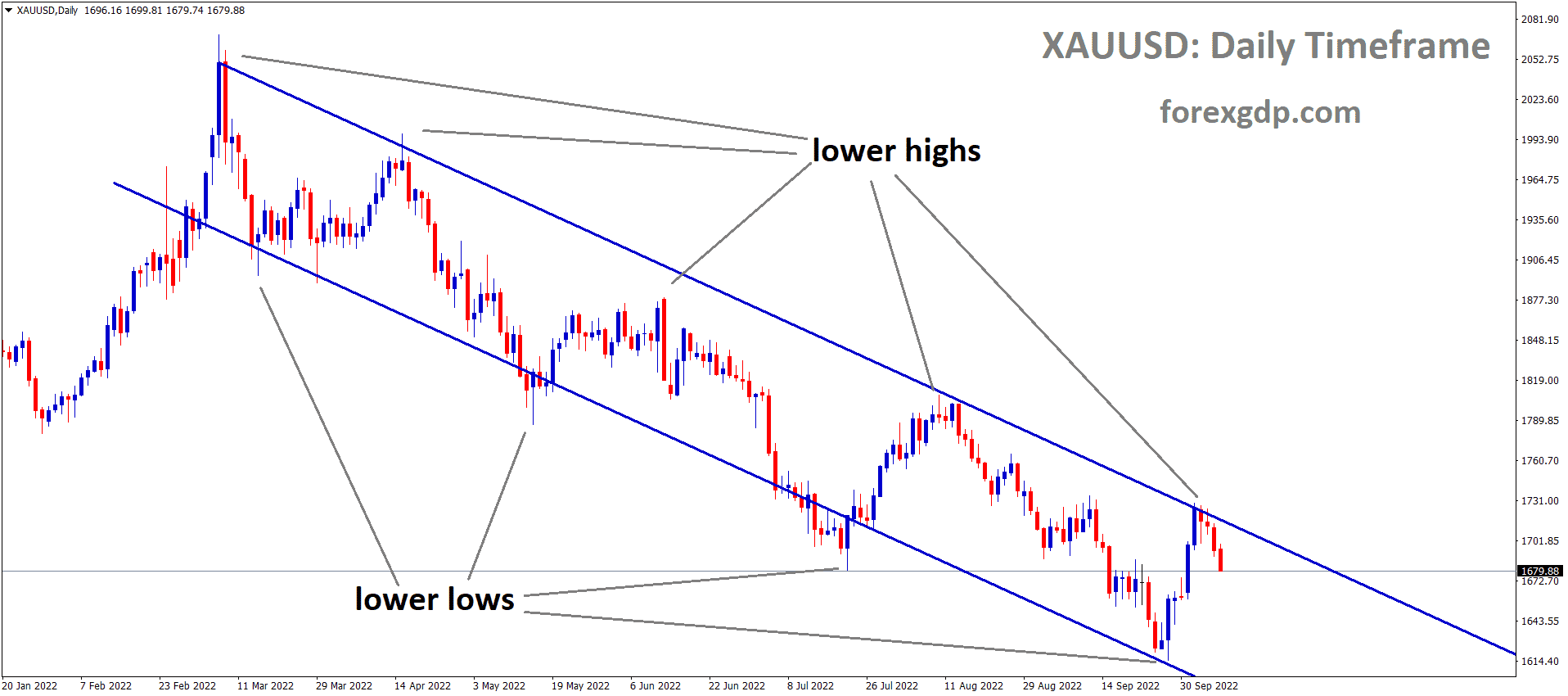

Gold: US Q3 GDP numbers disappointment

XAUUSD Gold price is moving at an Ascending channel and price standing at the higher low area of the channel.

XAGUSD Silver price is broken an Ascending channel and moving in the minor Descending channel, the market rebounded from Equal highs and Equal lows support area.

Gold prices are moving higher after US GDP news was released.

US Q3GDP released at 2% versus 2.7% expected. These sluggish numbers made disappointment to investors, and non-yielding assets like gold prices shot up.

Due to less consumer spending and Government spending less on Local governments and businesses, US GDP came down as lower.

And next week FOMC meeting will decide the tapering plans and rate hikes.

So Gold prices have been soaring high since starting of October month, today is the last day of the month, so some profit bookings may be seen in Markets.

US Dollar: US President Joe Biden announced $1.75 trillion Package

USDJPY has broken an Ascending channel, now the market has rebounded from the lower low area of the minor descending channel.

US Dollar index fell 0.50% after US Q3 GDP data printed lower yesterday.

And in next week FOMC meeting, planning for rate hikes or tapering is more doubtful as US GDP shows lower reading concerns.

US Joe Biden announced a $1.75 trillion tax and spending package to the Economy of $3.5 Trillion packages announced.

So, the Budget is reduced than more expected keep US Economy slowing down once again.

ECB meeting makes no sounds on yesterday meeting but keeps slower the pace of asset purchases in coming months.

EURO: ECB meeting outcome

EURJPY is moving in an Ascending channel and the Market Has rebounded from a Higher low area.

In yesterday, ECB meeting outcome showed a Moderately lower pace of asset purchases under the pandemic emergency program is implemented.

And more inflation like to set for the fourth quarter as ECB Forecasted, no discussion happened on tapering or rate hike plan in the meeting.

Germany unemployment rate came at 5.4% versus 5.5% in the previous reading; Employment change shows -39k versus -20K Forecast.

Overall, the German economy shows drawback data; and in coming quarters, we can expect better numbers than now.

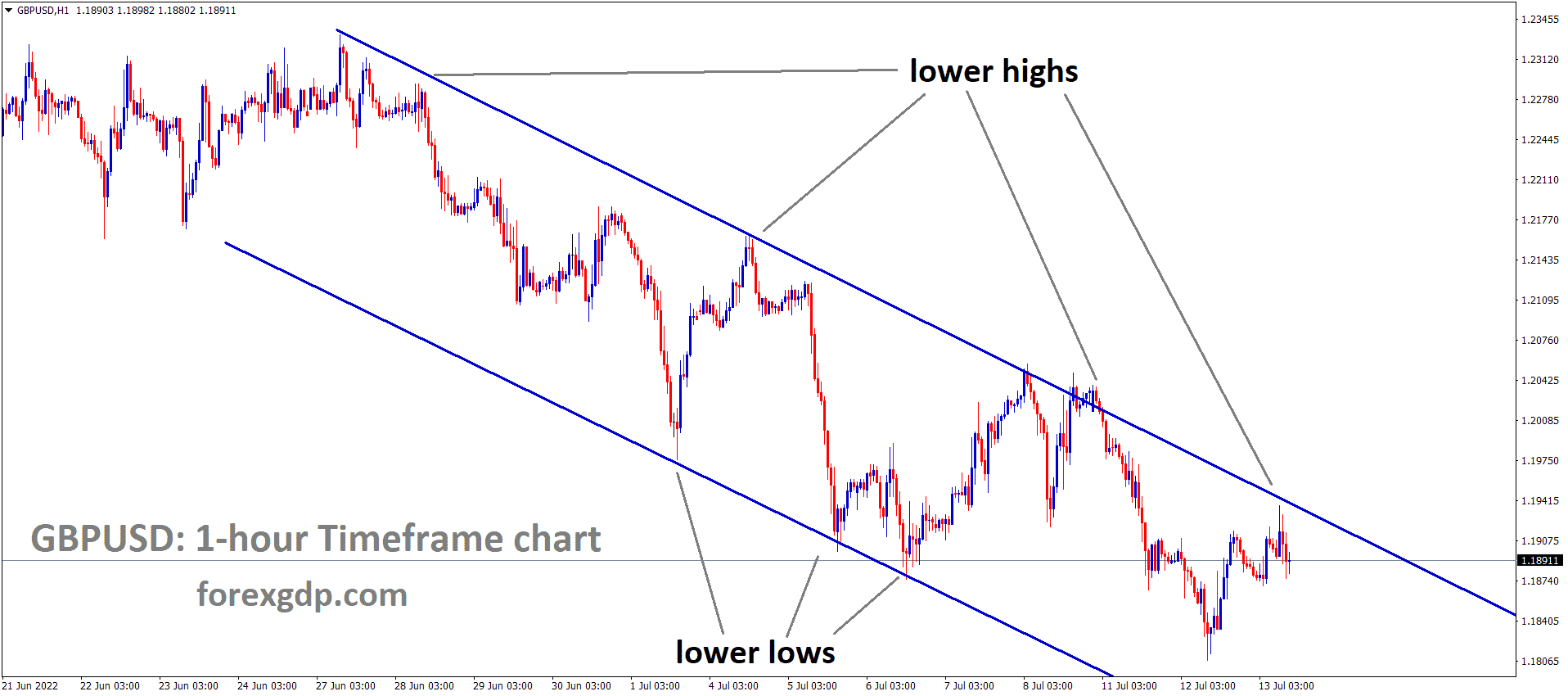

UK Pound: UK PM Johnson speech on NI Protocol

GBPNZD is in consolidation mode and the market has reached 2nd time to Previous support area and Consistently rebounded from Support area..

UK Pound made some gains in the market yesterday as US GDP data printed at lower numbers than expected.

Next week Bank of England monetary policy meeting data shows rate hike expectations higher; UK Chief economist Pill had already forecasted inflation to higher as 5%.

So higher reading of inflation kept in pressure for the Bank of England and might make some adjustments in Monetary Policy tools.

And UK PM Johnson said that he would invoke Article 16, if the rapid progress of the Northern Ireland protocol speech was not solved.

And this Brexit talks of non-compromise speech from Britain PM makes worry for Eurozone Side.

Post-Brexit deal over NI Protocol concerns

UK PM Johnson set to trigger Article 16 to avoid some supports to Northern Ireland protocol in the post-Brexit deal.

Due to this, some fears of the relationship between Europe and the UK.

Now the members of Both sides are talks progressing, whether to invoke article 16 or not.

Britain side clearly said whatever talks with Europe and France are ready to face and hear for talks.

And France had already seized Britain Boat in French waters, Britain warned against France earlier.

Yesterday also some boats were seized and due to this France and UK relationship are in fear.

Canadian Dollar: Iran oil supplies concerns for Oil Market

Crudeoil is moving in an Ascending channel and the Market has rebounded from a Higher low area.

Canadian Dollar has been in consolidation mode at the resistance area for the last 2 weeks, and it will breakout or breakdown based on November 3 US FOMC meeting.

And Oil prices are slightly down after the EU and Iran wanted an Oil supply deal, So talks will begin on next month as expected.

And the Overall oil demand trend will be changed to the supply trend if Iran supplies Oil to the Eurozone.

Canadian Domestic data performed well in October, and soon Bank of Canada may do rate hikes in earlier 2022.

Japanese Yen: Industrial Production fell down in 3rd straight month

NZDJPY is moving in the Descending traingle pattern and the market gets narrower.

Japanese Government officially said production output is not expanded as much as forecast, due to supply shortage and Chips constraints.

Japanese Industrial output fell for a third straight month due to Auto sector concerns by supply shortage and Chipset’s shortage.

And Factory production fell by 5.4% due to the Global Chip’s shortage and China crisis in three factors.

And the Chip making companies in China, which shutdown during in 2020 pandemic crisis, may not be easier for lifting up.

So Chip shortage will be continued until the ramp-up of Chip production in China.

Australian Dollar: Retail sales data and other domestic data favors AUD

AUDCHF is moving in an Ascending trendline and fell from the resistance area, standing at the higher low area of Trendline.

Australian Retail Sales data came at 1.3%m/m for September against 0.40% Expected.

And Australian 10-year yields crossed a high of 2.12% from 1.85% last day.

Australian economy shows recovery mode on the way, next week RBA meeting scheduled, additional tapering or rate hike announcement is expected.

And Yesterday, US GDP displayed disappointing numbers of 2% against 2.7% expected, So the US Dollar index slumped down 0.50%, and the Australian Dollar rebounded to 0.50% as higher.

More easing restrictions on the Australian Border makes it easier for travelling tourists, and Businesses will be improved.

New Zealand Dollar: RBNZ Governor Speech

AUDNZD is moving in an ascending trendline and the market has rebounded from the higher low area.

The Reserve Bank of New Zealand Governor Adrian Orr said monetary policy settings are set to ease globally, and now the current environment is different from a pandemic, with rate hikes and tapering of stimulus.

RBNZ is the First bank among Developed nations to make rate hikes before earlier. So New Zealand Economy keeps a fast pace of recovering mode as easing lockdowns in main regions.

And the quarantine period for Tourists visits to New Zealand is reduced to 7 days from 14 days, supporting Tourism revenue, but they are more cautious on the Covid-19 virus spread.

Swiss Franc: US Domestic data underperformed last day

EURCHF is moving in the Descendingchannel and Market standing at the weekly support area.

Swiss Franc performed higher and formed a higher high after breaking the previous resistance line yesterday, as US GDP data came at sluggish at 2% versus 2.7% forecasted.

And US FOMC meeting is scheduled next week; in this meeting, tapering speech expected more as US Inflation triggered to 4.8% this month.

And Today, US Personal spending expenditure data to publish and positive reading makes USD bullish and reverses if printed Negatively.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/