Gold: FED’s symposium meeting outcome

XAUUSD Gold price trying to break the lower high of the descending channel – wait for the confirmation of breakout or reversal.

XAGUSD silver price reached the lower high of the descending channel.

Gold Prices stood higher on Friday after 35$ up in a Single day as FED Speech shows Vain to Investor’s hawkish expectations.

And Inflation shows higher readings than the Fed’s goal of 2%, and the Economy suffers from Hot inflation in All areas from Raw material to End consumers.

So, all economists believe that FED’s Policy will do tapering assets to cool inflation running hot in the market, But Delta variant steep cases will pressure to FED tapering idea.

And Joe Biden infrastructure plan supports the US economy and job creation purposes.

Vaccinations for Second Dose now started for Preventing Delta variant; by considering this, FED might do tapering soon by early 2022.

And Gold prices are buying against inflation hedging purposes; once US Dollar is up by tapering or rate hikes, then gold prices got Fall in the market.

US DOLLAR: FED Comment on Dovish commentary in Friday meeting

USDCAD is going to reach the higher low of uptrend line in the h4 chart.

AUDUSD is trying to break the lower high of the descending channel – wait for the confirmation of breakout or reversal.

US Dollar shows steep fall on Friday as Domestic data like Michigan consumer sentiment shows negative numbers than expected, but Core PCE readings came in line with expectations.

With a mixed bag of US Domestic data unimpressed the investor’s Hawkish bias on FED move, Friday US FED Powell speech shows the dovish stance on tapering and rate hikes.

Still, time is not come to tapering now, and Delta variant shows fear in the market as any lockdown will happen or any stimulus required.

Considering the situation, once the Delta variant got arrested and the Economic of Domestic data reached our Goals, FED will do tapering and rate hikes.

Tapering may be seen in earlier of 2022 and rate hikes in 2023 earlier. So Other than US Dollar like Currencies, Equities shows higher in the market, US Dollar declines more.

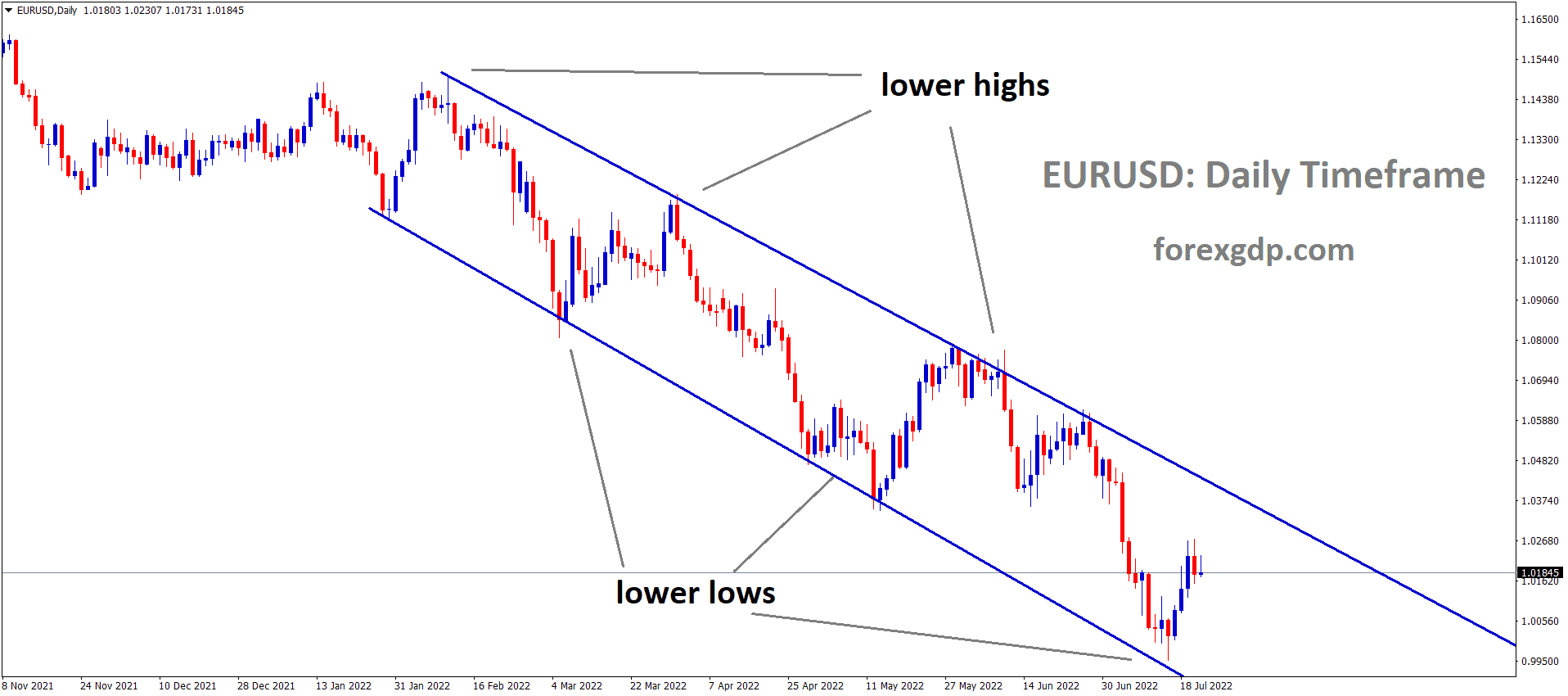

EURO: Eurozone Consumer Confidence data

EURGBP is moving in an uptrend line forming continuous lows.

EURCHf reached the lower high area again in the desending channel – wait for breakout or reversal.

EURUSD moved higher to 1.18 level last week as Friday US Data came in Lower level as Michigan Consumer sentiment shows lower readings.

Friday US Core PCE readings also came in line with the expected rate, So US Dollar declines more as Data disappointed.

And the outcome of the Jackson Hole Symposium disappointed the Investor’s view of the Hawkish tone.

As FED’s Powell claimed that Delta variant shows steep in Economy, so tapering in this situation is harmful to economic recovery, Will wait and Do tapering based on Domestic data and Covid-19 Data to reach our Goals.

Europe Consumer confidence came in line with expectations today, and Manufacturer’s confidence levels came in the line of 40%.

This week non-Farm payrolls data is much more important for US FED QE tapering bets in September month.

ECB and FED showing Delaying the interest rates hikes and tapering, But FED may soon do tapering before ECB based on time and structure to come in the economy.

ECB’ Villeroy Speech

ECB Governing Council member and Bank of France Head Villeroy said that Interest rates unchanged is favourable for the economy.

And there is no higher inflation rate at this stage. No PEPP is stepped back during this tough situation.

France and Eurozone will come back from the pandemic at least earlier in 2022.

And Financing Conditions are improved since June, no Urgency seen in tapering of PEPP in upcoming meetings.

ECB will discuss More favourable conditions for the Euro economy.

UK POUND: Vaccinations rate in the UK

GBPUSD is moving between the descending channel range in the H4 chart – wait for the breakout from this triangle pattern.

GBPAUD has broken the bottom level of the uptrend line, now it’s trying to test the horizontal support area.

UK Pound makes higher as US FED speech disappointed Hawkish idea on Friday.

And In the UK, vaccinations progressing well, and Zero lockdowns initiated, So the Delta variant increases step by step, creating fear in the UK economy.

70% of the population got 1st Dose, and the Remaining 80% of the population are waiting for Second Dose.

If Second Dose is completed in the UK, then Free from the pandemic and soon will do rate hikes in earlier 2022.

Canadian Dollar: the Gulf of Mexico was attacked by Hurricane

CADCHF is moving in a descending channel range.

Canadian Dollar rose higher as Oil Prices pullback seen in the market. As the Gulf of Mexico was attacked by extremely dangerous Hurricane flows, Oil production stopped makes Higher demand for Oil in the Market.

And China now controlled the Delta variant; oil consumption turned higher in support of Oil Prices.

And Oil Prices are higher supportive to Canadian Dollar as Exporting Oil and Revenues from oil nation.

USDCAD dropped 0.30% on Friday after FED Powell unimpressed investors’ minds of hawkish tone.

Japanese Yen: More Lockdown extended in Japan

USDJPY is moving between the Ascending triangle pattern.

Japanese Yen makes higher as US Dollar set to lower.

But Japan facing tough lockdown in many regions as the Delta variant spread more. Vaccinations are pushed higher in many regions, and Japan’s domestic data is more affected by Lockdown’s problems.

And US Dollar declines by Friday as FED will not give hopes of tapering in the near month; due to this, US Dollar got Weaker, and the Japanese Yen got Positive after US Data was released.

This Week NFP data is a clear outline for FED move on tapering decision as economists expected.

Australian Dollar: Domestic data outlook

AUDCAD is making some correction from the lower high of the desending channel.

EURAUD hits the higher low and previous support area – wait for the confirmatin of reversal or breakout.

AUDUSD set to higher as US Domestic data Failed to impress last Friday.

And Australia set to report for second Quarter Business inventories and Company Gross profits today.

According to a Bloomberg survey, business inventories are expected to come at 1.3%, and Company gross profit comes at 3.0%.

So many lockdowns in New South Wales and Sydney regions as Daily cases stood at 1200; due to this situation, retail sales dropped to 2.7% in July.

Australian Lockdown costs more jobs and Businesses; if Vaccinations are 70-80% done, then National lockdown will be set to release.

New Zealand Dollar: New Zealand PM announced Another 2 weeks lockdown.

NZDUSD hits the lower high of the minor descending channel – wait for reversal or breakout.

New Zealand PM Ardern said another two weeks lockdown was imposed on Auckland as Level 4 Covid-19 cases attacked.

And rest of the country decided on Level 3 and extended for another one-week lockdown.

Daily cases hit 558, and Outside households now decreased; once the situation is controlled, then the Whole lockdown will be released.

New Zealand Dollar set to higher after US Dollar declines on Friday.

Swiss Franc: US Dollar selling Pressure benefitted Swiss Franc

CHFJPY is consolidating between the SR levels inside the channel lines..

Swiss Franc rose to higher after US Domestic data got negative numbers on Friday.

And USDCHF dropped to 0.50% as US Dollar got weaker against the Swiss Franc.

As FED Powell Told, there is no hurry for Hike rates and Tapering since Delta variant rose day by day.

Swiss Franc Domestic data shows the lesser number and US Dollar prices lower benefitted Swiss Franc.

No rate hikes and QE tapering in the Hot inflation market makes Selling pressure on US Dollar.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/