Gold

Gold XAUUSD is moving in an uptrend channel ranges.

Gold prices lifted to 1912$ mark yesterday and Monthly candle to close 2 days more and If it closed above 1906$ is confirmed for Trending Upside continuation pattern.

China imported 150 tons of Gold in the last 2 months, and SPDR Gold trust said money inflow for buyers more than sellers in the last 2 months.

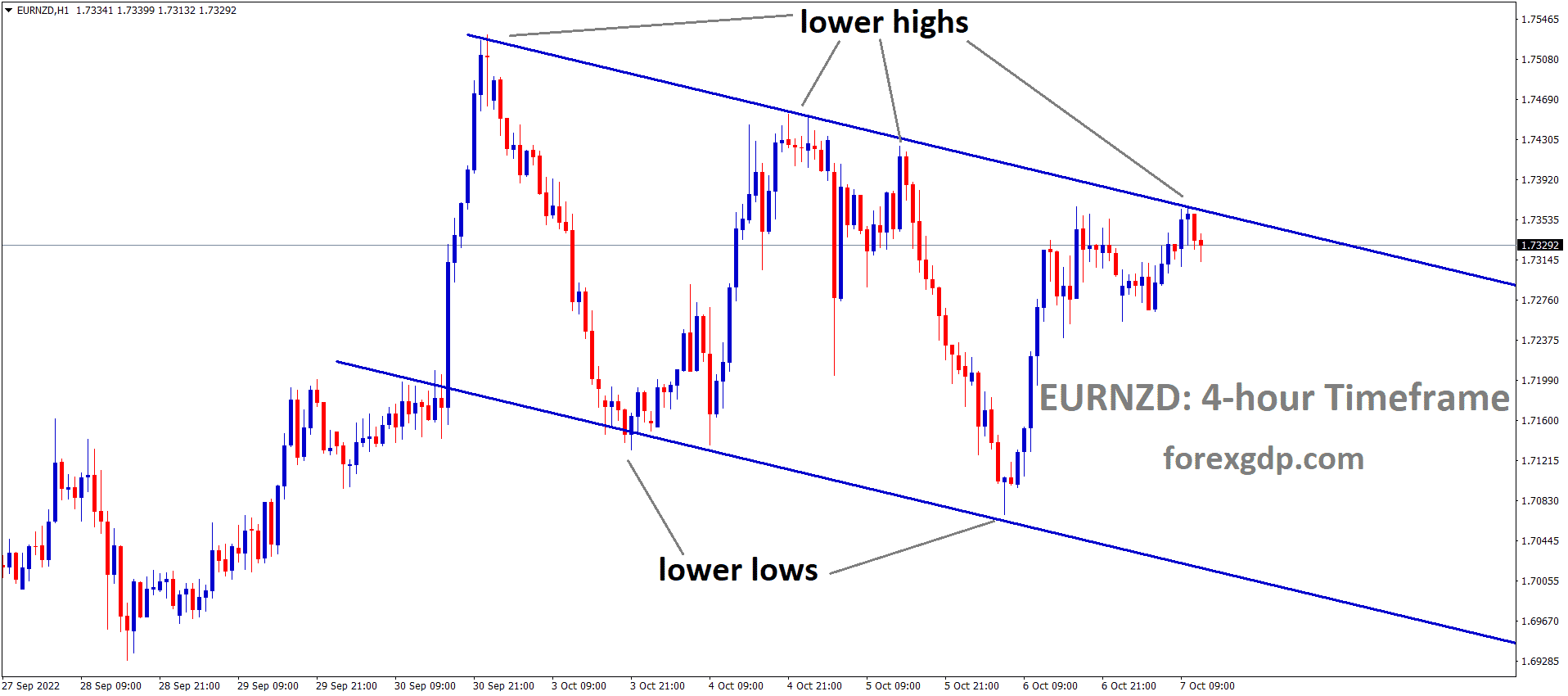

And RBNZ said last day Hawkish rates would be expected in 2022 end and given confirmation signal of central bank view.

But US FED plays an accommodative stance in tapering bets and hike interest rates.

As Gold prices fix in terms of US Dollar price fluctuations, any US Dollar falling will boost gold prices up.

USD

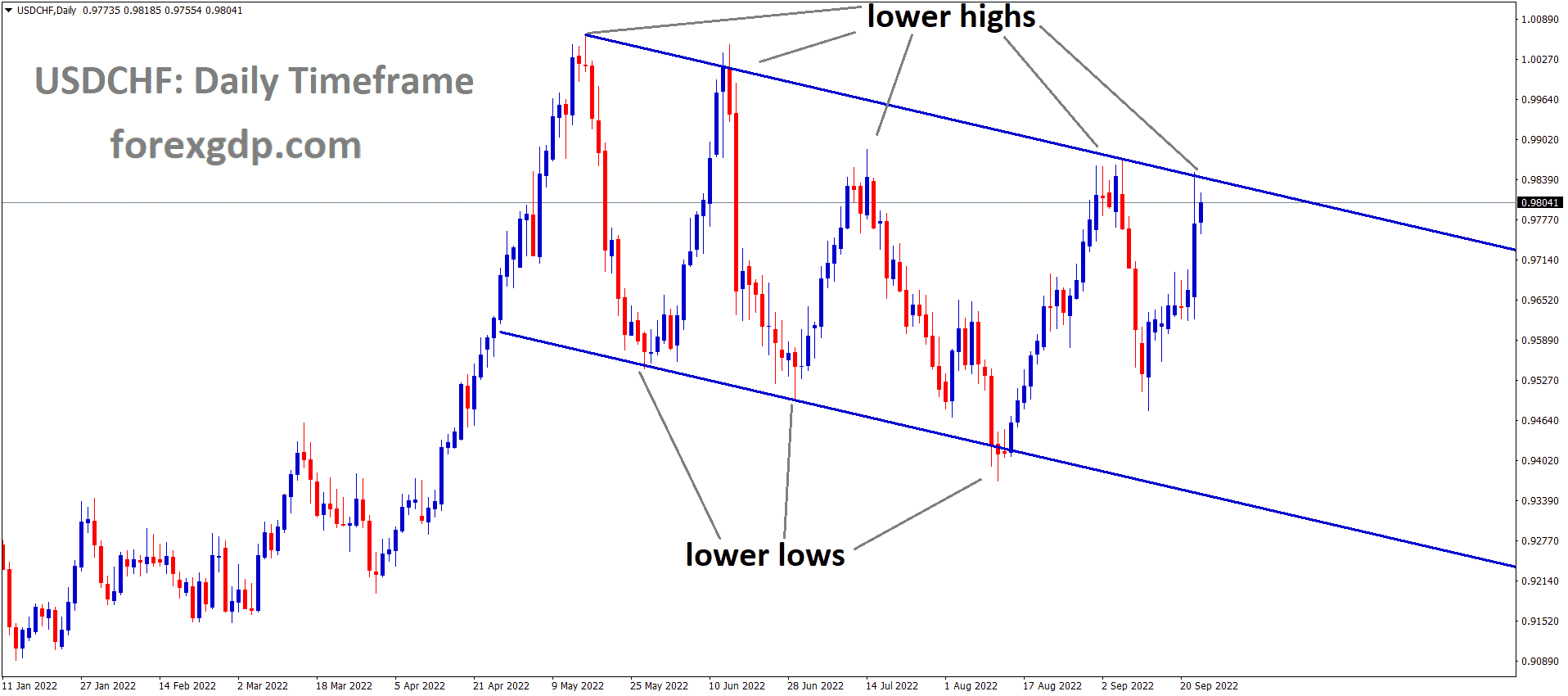

USDCHF formed a falling wedge pattern.

AUDUSD is still ranging in an uptrend line.

US Dollar rises after US-China trade talks started in the first round off Biden Presidency.

And US Core PCE inflation set on Friday and 2% expected inflation fears boosted US Dollar upside potential.

As FED continuous purchases of 120 billion of assets make worry for inflation rising and Consumer confidence data showing negative numbers brings cool to inflation fears.

And the average reading of employment data and Consumer confidence and Inflation is taken into the outlook for a 1-to-2-year time period for testing.

USDJPY headed to 109.200 level after a positive outcome of Domestic data is expected.

EUR

EURUSD has formed a rising wedge pattern.

EURUSD set to range-bound market for may month Fully between 1.21-1.22500.

Yesterday ECB member Fabio Panetta said inflation remains in a cool place and not in the fear mode of numbers; due to this, ECB will not taper asset purchases as all we expected.

And We can expect further additional stimulus will be injected if the pandemic goes worsen.

FED reverses back Repo funding facility to $450 billion from $350 billion in a month ago. This shows Tapering of asset purchases and hike of rates soon by FED will be expected.

US FED hawkish tone and ECB Dovish tone makes EURUSD to consolidated around 1.21-1.22500 level.

GBP

GBPJPY has broken the top of the falling wedge pattern and also broken the top of the trend line

EURGBP is moving in an Ascending channel range.

UK Pound lowering stance after UK PM Boris Johnson former chief advisor Dominic Cummins testimony before parliament.

And from testimony How PM Johnson mismanagement of covid-19 handling under the UK Government may outcome expected.

EU-UK Brexit deal on Irish protocol was also set to discuss.

Due to this, GBPUSD lowered more about 1% this week as Uncertainty prevails in the Testimony meeting.

And Vaccinations cured more population, and the economy set to stable back at June 21 end as Lockdown will be released completed at June 21 end.

CAD

EURCAD is moving in an uptrend range.

Canadian Dollar moved in narrowing range as Oil prices in consolidation market movement.

And US Dollar moved in the ranging market ahead of US Q1 GDP and Core PCE inflation numbers to publish this week.

USDCAD jumped as Bounce back after reached the toughest support of 1.20 level of 2016. May see good falling if breaks 1.20 level and may see the targets of 1.18 level in 3 months.

And Bank of Canada may go for another tapering by the 2021 year-end if domestic data moves very well.

JPY

USDJPY bounced up from the critical support and start to continue it’s uptrend.

CHFJPY is going to break the higher resistance soon.

Bank of Japan official said concern over FED that they must have sufficient Dollar funds through Commercial banks is healthy for US Dollar demand. Otherwise, Demand increased much more for US Dollar came, and prices become unstable.

Bank of Japan view is Higher US Interest rates will raise funding costs, and Dollar liquidity will not be affected.

As Dollar funds are a major risk in one of three risk factors in Bank of Japan, Credit costs and Losses on securities is stood on

AUD

AUDJPY is bouncing back from the higher low level (bottom) of the major uptrend line.

AUDJPY is breaking the top level of the minor channel and start to continue it’s uptrend.

Australian Dollar set to lower ahead of Chinese Industrial profits results scheduled today.

And If the results are in impressive numbers, it would make higher for Australian Dollar and reverse if missed the expectations.

Commodity prices of Iron ore plunged 20% in the last 2 months and made an impact on the Australian Dollar to further rising concern.

And US Dollar rising factor affected Australian Dollar moved for ranging market for the past 1.5 months.

The Australian city of Victoria set for lockdown after the spread increased in Melbourne.

Due to this Australian Dollar waited for further direction after the Covid-19 lockdown in Melbourne and Chinese data.

US-China Trade deal:

Chinese Commerce Ministry Spokesman Gao Feng said there were healthy talks of Phase one trade deal between Sino-US progress.

This news came after the First virtual call between US Trade representative Katherine Tai and Chinese Vice-premier Liu He.

And China claims to Raise offshore limits for Borrowing Foreign banks.

The Phase one trade deal talks keep smooth outcome expected and Supported for AUDUSD Upside move.

NZD

Yesterday, the Reserve bank of New Zealand decision of Hawkish projections in the second half of 2022 will keep it higher. The Above 0.73-0.74 target is possible in the next 3 months if domestic data performed well in New Zealand.

Although the New Zealand PM and Foreign minister warned exporters who trade with China, the relationship between Wellington and Beijing is deteriorating day by day.

And the Outlook of the economic progress well; but China relationship with New Zealand gets a worrying factor.

CHF

CADCHF is standing at the major lower high level of the Downtrend descending channel.

Swiss Franc keeps a range-bound market against the Japanese Yen, and This year may see the target of 123 level after 5 years broke out of 118 level.

And USDCHF flows in Downtrend mode as Swiss Franc Weightage increasing day by day.

As US Dollar weakness provided strong support for the Swiss Franc and USDCHF may be expected to Downside fall of 0.89-0.88500 next month.

Switzerland National bank started slightly on FX markets intervention to adjust the Swiss Franc to stabilize foreign currencies inflows.

And Vaccinations are progressing slower, But easing Lockdown in more parts helped the economy to be recovered.