Forex Trading Strategies

Learn the Best Forex Trading Strategies from 20+ Years Forex Experts

The forex market is arguably the largest market in the world. As a result, forex presents a number of excellent opportunities for traders to take advantage of a global marketplace with much potential. However, to maximize your chances of success with retail investor accounts, you need the right forex trading strategies.

Contrary to popular belief, the forex market is not a get-rich-quick scheme, although savvy investors have grown their personal wealth through forex. Instead, it is a complex and competitive marketplace, and to succeed here, you need a clear strategy and plan.

Maintaining discipline is a crucial aspect of trading. To effectively do this, you need to work with well-reasoned and back-tested information. This will make it easier to understand price moves and make profits.

As a forex trader, you need to find out what type of trader you are. This will help you to create and implement good forex trading strategies effectively. Without effective forex strategies, you are likely going to enter trades instinctively and lose money.

In this article, we will outline the following;

- What forex trading strategies are and why you need them

- The different types of forex trading styles

- Their pros and cons

- Things to consider when choosing the best trading strategy for you

- And much more…

Let’s get right into it!

What are the forex trading strategies?

When it comes to trading, you cannot afford to rely on your instincts simply. Instead, you have to work with data and technical analysis to find accurate trade signals.

Forex trading strategies are techniques used by traders to determine how to trade during any given timeframe. Your trading style/strategy refers to your set of preferences. The preferences guide how long you keep a trade open and how often you will place a trade.

Every trader has a unique style that depends on what is in the trading plan. Later in the article, we will outline the different factors that influence individual trading styles and forex trading strategies. Forex styles provide in-depth analysis of market conditions and help traders to determine when to buy or sell a currency pair at a given time. These forex trading strategies can be either manual or automatic.

The manual system involves a trader looking for signals and interpreting them. Conversely, the automatic system requires little human effort. It simply involves the use of an algorithm that finds trade signals and executes trades on its own. Thus, automated systems do not rely on human emotions, and due to this reason, they improve performance.

While some forex trading signals may be available online, experienced traders may also develop trading strategies.

Why do forex traders need trading styles?

A trading style is one of the first and most important decisions that every trader will make. However, most new traders often ask the question, why?

Firstly, a trading strategy helps with money management. It enables you to understand how much you are willing to risk. Also, trading styles allow you to determine how much time you dedicate to trading. As a trader, you need to stay informed and understand the market intricacies. Your trading style is also essential because it helps you to find opportunities in market events constantly.

Timing and time frames are everything in trading, and they can mean the difference between success and failure. Strategies also help you take into account three critical components that are key to successful trading:

- Volatility: Shows your potential profit range.

- Liquidity: helps you to enter and exit trades at an attractive and stable price.

- Volume: this tells you how often a stock/asset has been traded over a set period.

Now that we know why you need a trading style, let’s go through the different types of trading styles.

Carry Trading

An FX carry trade involves trying to profit from the interest rate spreads between a currency pair. It involves borrowing low-yielding currency and using the borrowed currency to purchase a currency with higher returns.

This type of trade presents traders with two avenues to profit: differences in exchange rates and interest rates. However, traders also need to understand the risks involved in a carry trading strategy. For example, when the interest rate differential narrows or when the pairs move against traders.

To make the best of a carry trading strategy, traders need to utilize prudent risk management techniques. Also, it is essential to look for entry points in the direction of an uptrend. Interest rates are set by a country’s central bank and are influenced by a country’s monetary policy. Therefore, the interest rate differential between the traded currencies is crucial in this kind of trade.

In a carry trading strategy, the currency with a low return is called the funding currency, while the other is called the target currency.

PROS

- Carry trading is a long-term trade that is useful to analyze currency markets that exhibit a strong trend.

- Traders that use this strategy accrue gains in their active position.

- With this strategy, users can gain based on the total size of their position rather than the deposit used to open it.

- This strategy works great for stable currencies.

CONS

- In times of economic uncertainty, this strategy may pose a considerable risk.

- Traders can lose money when the target currency depreciates against the funding currency.

Key Takeaway: Carry trading is not for everyone, it requires risk management and an understanding of Macroeconomics.

Position Trading

Position trading is a strategy used over longer time frames that is focused on the fundamentals that influence cyclical trends. In addition, position traders often focus on long-term technical indicator data such as monetary policies, political events, and other factors that affect FX trends.

Position trading requires patience as it may take weeks, months, or even years to play out. However, the profit targets in these trades are significantly higher and could be up to hundreds of pips or points per trade. This is because position trading focuses on the longer length time frames for the movement of price. The goals of position traders are to observe significant shifts in prices and gain maximum profit.

A position trading strategy identifies potential entry and exit levels in the market. This is done by a combination of technical indicator data and fundamental analysis. As a result, traders that use a position trading strategy don’t need to worry about minor price fluctuations or pullbacks. Instead, they occasionally monitor trends to have a holistic view of the market.

Pros

- Position trading is less stressful as it requires less time investment from traders.

- Position trades are immune to short-term highs and lows (market fluctuations).

- Suitable for those that want to combine trading with their full-time jobs.

- It also mitigates market noise because with a position trade you open the position for long periods with no stop orders.

Cons

- Traders tend to miss out on short-term opportunities that day traders and swing traders have access to.

- Requires maximum capital requirements

- Lack of liquidity

Key Takeaway: If you are looking for a style that will help you avoid minor market fluctuations then this is for you. Position trading offers a holistic view of the market.

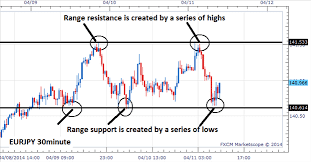

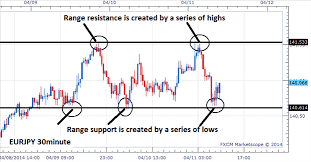

Range Trading

Range trading is becoming a more popular forex trading approach. The basis of this strategy is simple, traders identify overbought and oversold currency pairs. Then, they buy during support periods and sell during resistance periods.

This strategy works based on the concept of support and resistance. Range traders often rely on banded momentum indicators (e.g., stochastic oscillator) as identifiers of overbought and oversold conditions. With support and resistance levels, traders can create a bracketed trading range.

In trending markets, prices break previous resistance levels and create a stair-like support and resistance pattern. Meanwhile, price movement is sideways in a ranging market, and it remains bracketed between established support and resistance levels.

This strategy is an excellent fit in markets where there isn’t significant volatility. Although range trading can be implemented at any time, it is best in markets that lack direction.

Higher volatility often indicates turmoil. Therefore, to avoid false breaks, range traders rely on trade filters when entering a trading range. For example, range traders use Bollinger bands to monitor a trend and determine whether it is range-bound. Also, they use oscillators to determine the range of trading. In cases where the oscillator line touches the oversold boundary, then there is a potential long trade looming. On the contrary, the oscillator crossing the overbought boundary signifies a number of looming short trades.

PROS

- It is a consistent and rewarding strategy with a great risk-reward ratio.

- Range trading also provides a substantial amount of trading opportunities.

CONS

- This is another strategy that requires a significant time investment

- It is not advisable for beginners because it requires a proper understanding of technical analysis.

Key Takeaway: The logic behind this style is simple; buy during support periods and sell during resistance periods. However, it requires ample time.

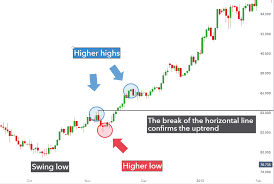

Trend Trading

A trend trading strategy remains one of the simplest and best forex strategies. This strategy involves trading based on the current price trend.

There are several tools that traders can use to follow trends. These tools can analyze specific markets such as currency pairs, equities, commodities, and treasuries. Trend trading is done with simple moving averages and exponential moving averages to determine the strength of the current trend.

To be effective, it is essential to spot forex trend direction, strength, and duration. These factors show how strong the trend is and give traders a hint on when the market may be primed for a reversal.

Trend traders simply want to know the best time to exit their current position and lock in profits. Thus, they work with resources such as technical analysis to define trends and only enter trades in the predetermined movement direction.

As a trend trader, you don’t need to have a fixed view of the market’s direction. If you have enough information to determine the direction of trends, then you can mitigate risks. However, you need to stay alert because trends change. After all, you don’t want to be caught up in market reversals.

Success in trend trading requires patience and discipline. You need the patience to follow the trends and discipline to understand when the system has stopped working.

To reap the benefits of trend trading, you need to see it as a long-term approach. There are instances when you may incur small losses even when you invest in the direction of a strong trend. You need to withstand these small losses and understand the profits will eventually surpass losses.

PROS

- It is an excellent strategy for people with limited time

- Trend trading provides several trade opportunities

- Losses can be mitigated by placing stop-loss orders

- It is a more reliable and consistent strategy

CONS

- There may be risks of small short-term losses

Key Takeaway: To thrive using trend trading methods, you need to master the direction, strength, and duration of forex trends.

Day Trading

As the name implies, day trading is the process of trading currencies in one trading day. It is an excellent option for those that want to settle between scalp trading and position trading. It is far less intense than the former and the length of time needed is less than the latter.

For a day trader, the goal is to enter and exit positions on the same trading day. This is a great way to avoid the risks of significant overnight moves. In day trading, traders close each trading day with either a gain or loss. They hold trades for minutes or hours, and they frequently monitor positions throughout the day.

Day traders often rely on small daily gains and build profit over time. To be successful trading forex as a day trader, you need to identify trends and market conditions with indicators such as MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and the Stochastic Oscillators.

Day trading is applicable in all markets. However, it is primarily used in forex. Apart from indicators, some factors that influence day trading include news, economic statistics, money supply, elections, GDPs, and other factors that impact the market.

PROS

- Minimizes risk because no positions stay open after the trading day

- Provides numerous trading opportunities

- As a day trader, you are your boss, and you can work from anywhere

- It provides an opportunity to earn comfortably from a number of trades

CONS

- Due to its fast execution requirements, day trading is not suitable for beginners

- Day traders lose money frequently

- It requires split-second timing and is unsuitable for people who cannot entirely focus on markets during market hours.

Key Takeaway: Day trading is the ideal option for those that want to play it safe. It is not as intense as scalp trading and less lengthy than position trading.

Swing Trading

Swing trading is a forex trading strategy that attempts to capture short-to-medium-term gains in the FX market. While day traders hold positions for less than a day, swing traders hold positions for several days. Thus, when breakouts occur, swing trades could last as long as a few weeks, or sometimes, even months.

A swing trader can take profits using an established risk/reward ratio. They often use fundamental analysis and analysis of price action. Unlike day trading, swing trades do not require you to be glued to your screens. A swing trading strategy gives you the necessary time to make higher profits than day trading.

Swing trading often involves positions that have been held for at least one night. This is why margin requirements are higher. Nothing guarantees absolute success in the FX market. Therefore, swing trading may also result in losses.

Also, swing traders do not need to rely on state-of-the-art trading platforms and tools. Instead, swing trading relies on using trends and momentum indicators. While day traders need to be seasoned experts at analyzing forex markets, beginners can spend ample time and get the hang of swing trading as a forex trading strategy.

PROS

- Swing trading requires less time to trade than day trading

- It helps traders to leverage short-term profit potential on each trade

- It simplifies the trading process

- It also has the proper risk-reward ratio

CONS

- Unexpected market reversals may result in poor performance and substantial losses due to leverage.

Key Takeaway: Although swing traders spend less time monitoring trades, they can make higher profits than day traders.

Scalping

Scalping is another popular trading style that focuses on smaller market movements. It is a short-term form of trading where positions are open for a few minutes at the most. Traders that use a scalping strategy (scalpers) hope to make quick gains through a number of short-lived trades. Scalping is a strategy that works best with tools such as Bollinger bands, moving average, and Relative Strength Index, to name a few.

Traders that use scalping are focused on making the most of intraday price movements in each trading session. In addition, scalping is the preferred forex trading style for many due to its liquidity and volatility.

Investors that use this method often rely on markets where the price action is constantly moving. Indicators can provide crucial details and help traders identify entry and exit points. In addition, long-term and short-term indications help scalpers spot a variety of potential opportunities (especially when it is a volatile market).

However, being a scalper is not for everyone, and you need to check your personality to be sure that it fits. Without the right temperament, you may find yourself lagging. To be a successful scalper, you need to be quick to react and think on the go.

To be a successful scalper, you need a trading platform that allows fast buying and selling. Fast trading systems give you reliable access to the market makers and allow you to trade with the touch of a button.

PROS

- Provides a large number of trading opportunities

- Provides small but regular profits

- It is a great trading style for folks who are trying to live off forex trading

- Scalping also provides benefits from lower risks per trade

- Profit is not dependent on a great deal of market movement

CONS

- Scalpers need to dedicate a lot of time and attention to trading

- Scalpers cannot afford to stay in the trade for too long

Key Takeaway: This style of trading is time-consuming because trades are always happening. Scalping is a great way to consistently make quick gains by holding positions for as briefly as possible.

Price Action Trading (PAT)

As the name implies, it is one of the common trading techniques that monitors price movement. Price action trading looks primarily at the market’s price history, ignoring other factors influencing a market’s direction. PAT is a form of technical analysis that compares current market prices to recent or past prices. However, other economic factors affect prices, although it is not necessary to examine these factors to trade.

PAT focuses on the price chart patterns, which are a reflection of economic data and world news. Therefore, there is no point in using lagging price indicators. Instead, Price Action Trading strategy charts provide enough signals to develop a high probability trading system. By interpreting charts correctly, traders can predict future price movement.

Most traders don’t see price action as an indicator but rather as a data source upon which other tools like price charts are built. However, it has its limits too. Price actions are often subjectively interpreted by traders. Therefore, two traders can arrive at different conclusions analyzing the same price action.

To successfully trade with price action, you need to learn the difference between a trending and a consolidating market when examining a chart. In addition, price movements can help traders determine a market’s underlying bias and uncover (potential) trends. Thus, price actions represent significant market moves and serve as a way to understand markets summarily.

PROS

- Traders work with a pure chart and can avoid being distracted by multiple indicators.

- Analysis based on price action provides the information upon which indicators are based on.

CONS

- It can be very subjective; each trader may see different outcomes of price actions.

- It is not meant for newbies.

Key Takeaway: Universally, price determines the movement in FX markets. That is what makes this strategy such a great one to uncover market biases and predict potential trends.

Retracement Trading

A Retracement refers to a TEMPORARY reversal in price within a major price trend. In terms of trading, retracements help to confirm trends and find great trades.

Retracements are a great addition to your arsenal of forex tools and you should know how to spot them.

Fibonacci retracement levels are horizontal lines that show you the possible support and resistance levels. The Fibonacci tool is an effective predictive tool that is most effective when the market is trending. With this tool, you can identify the future direction of price.

The Fibonacci sequence is derived from mathematical relationships between numbers In the sequence. It is a short term strategy that breaks down the daily charts. With this style, traders make use of the immediate trend while looking for potential counter trend moves (retracements)

PROS

- It is a great option for part-time traders

- It is a great option to use with other indicators and technical signals

CONS

- It is not foolproof, there are also many instances of losses.

Key Takeaway: Success with this strategy requires patience. Although some may consider this strategy to be risky. However, with enough money management and set trading goals, you are on course for success.

Transition trading

Of all the trading strategies mentioned, this is probably the least popular. However, it is an effective strategy that many traders rely on. This is because it is a low-risk, high reward strategy. With transition trading, you enter a trade on lower timeframes and increase your target profit if the market moves in your favor. Conversely, you can trail your stop loss in cases when market movements do not favor you.

The main idea of transition trading is to find an entry on the lower timeframe and plan your exit when it moves in your favor. To use this style effectively, you need to understand how to work with multiple timeframes. Popular Singaporean trader Rayner Teo introduced this strategy. He is the founder of TradingwithRayner, and he has more than 100,000 traders on his blog every month.

PROS

- High risk-to-reward ratio

- Lowers risk because your entry is on the lower timeframe

CONS

- It is not suitable for anyone who doesn’t have a proper understanding of multiple time frames.

- In most cases, most of your trades will not lead to monster winners.

Key Takeaway: To effectively leverage this style of trading, you need to learn how to work with multiple time frames. It is great for traders who have an in-depth understanding of the market.

Grid Trading

Grid trading is a strategy that seeks to capitalize on normal price volatility in an asset. This is done by placing buy or sell orders at particular (set) intervals above and below the base price. The orders placed above and below the set price subsequently create a grid of orders. Although it works with other kinds of markets, grid trading is most commonly associated with the FX market.

The idea of creating grids is to profit from trends or ranges. With this technique, traders benefit from the natural movement of the market. When the market constantly moves in one direction, your position to capitalize on it may become larger. As the price rises, your position grows because the grid triggers more buy orders. Eventually, the trader has to decide when to close the grid and collect profits. Timeliness is crucial in grid trading because price could reverse direction, and this may result in losses.

PROS

- Requires little forecasting of marketing direction

- It can be easily automated

- It is a popular style in volatile markets

- This strategy can be applied to more than one instrument

CONS

- It can result in significant losses if stop-loss limits are not adhered to

- Traders always have to keep the available margin in mind

Key takeaway: Volatility is a constant in the forex market and the best traders make the best of it. With grid trading, you can profit from the natural movement of the market.

How to choose the best forex trading style for you?

Every novice trader that is looking to chart a course for success in forex needs to answer this question. There are several options to choose from, and it is crucial to make informed decisions. In this part of the article, we will look at how you can choose the best style for you – based on your experience, ability, and confidence.

To do this effectively, you need to consider the following:

- Time frame – to determine the best strategy for you, consider how much time you can invest in trading. Strategies like day trading require regular attention, and if you cannot afford to spare several hours daily, you shouldn’t go for it.

- Personality – your personality plays a huge role in determining the trading style you opt for. For example, aggressive people can opt for choices such as scalping, while quiet ones should opt for long-term styles.

- Experience – this is what sets the amateurs apart from the pros. Your trading experience determines your choice of FX style.

- Frequency of trading opportunities – when choosing your strategy, you must consider how frequently you want to open positions. If you are looking to open a higher number of positions, you should focus on a forex scalping strategy.

- Position Size – in determining the best trading style for you, consider the ideal trade position size for you. This will help you to choose the kind of strategy that you use.

- Risk – this is one of the most important factors to consider before choosing your ideal FX strategy. How much risk can you take?

Bottom Line

Currency exchange is all about identifying opportunities and capitalizing on them to make money. Success in using a forex trading account is dependent on several things. However, the most important one is a forex strategy. Even if you understand the technicalities of a forex bar chart, if you approach the market without a strategy to support your trading, there is a high chance of losing money.

Indeed, you do not have to work with a single trading style/strategy. However, when you have a proper understanding of how strategies work, you can become consistent and disciplined. Each strategy has its unique benefits and pitfalls. FX styles come in all forms and sizes; therefore, you need to test-drive them before you start using any of them to trade in a live trading account.

As a forex trader with 20 years of experience, I could say: “There is always an opportunity to make profits in the forex markets, there is always ups and down in the market. Whatever happened in the market doesn’t matter, what you…YOU… have made at the end really matter.”

Whatever the big market movements you have missed in the market, never worry about it. Trading opportunities will always arrive soon.

Remember that even the best forex trading strategies will work only if you trade with patience!

Doing overtrade kicks out your patience and usually leads to the loss of all your forex trading account in a very short time. If you are busy having other works, we recommend you choose long term trading strategies. Long term trading is best to make more money because you will act as an investor in your forex trading account.

Disclaimer: The information provided in this article does not constitute investment advice and should not be taken as such.

FAQs

No, there isn’t a general best trading system or style suitable for all investors. However, depending on your knowledge, personality and what you hope to achieve, you can find a number of resources and trade ideas that will fit your ability and the type of trade scenarios you want to manage.

For short-term profits, scalping is the most profitable forex strategy. It takes advantage of the continual highs and lows in the market.

It is usually recommended that newcomers to forex retail investor accounts start with swing trading as it is the easiest and one of the best forex trading styles.

Position trading. Position traders usually possess a strong background and knowledge in finance and economics.