There are several different trading strategies in the forex industry. Depending upon your goals with your trading account and your style of trading, one trading strategy could be more beneficial to you than another. Here are the top most popular forex trading strategies:

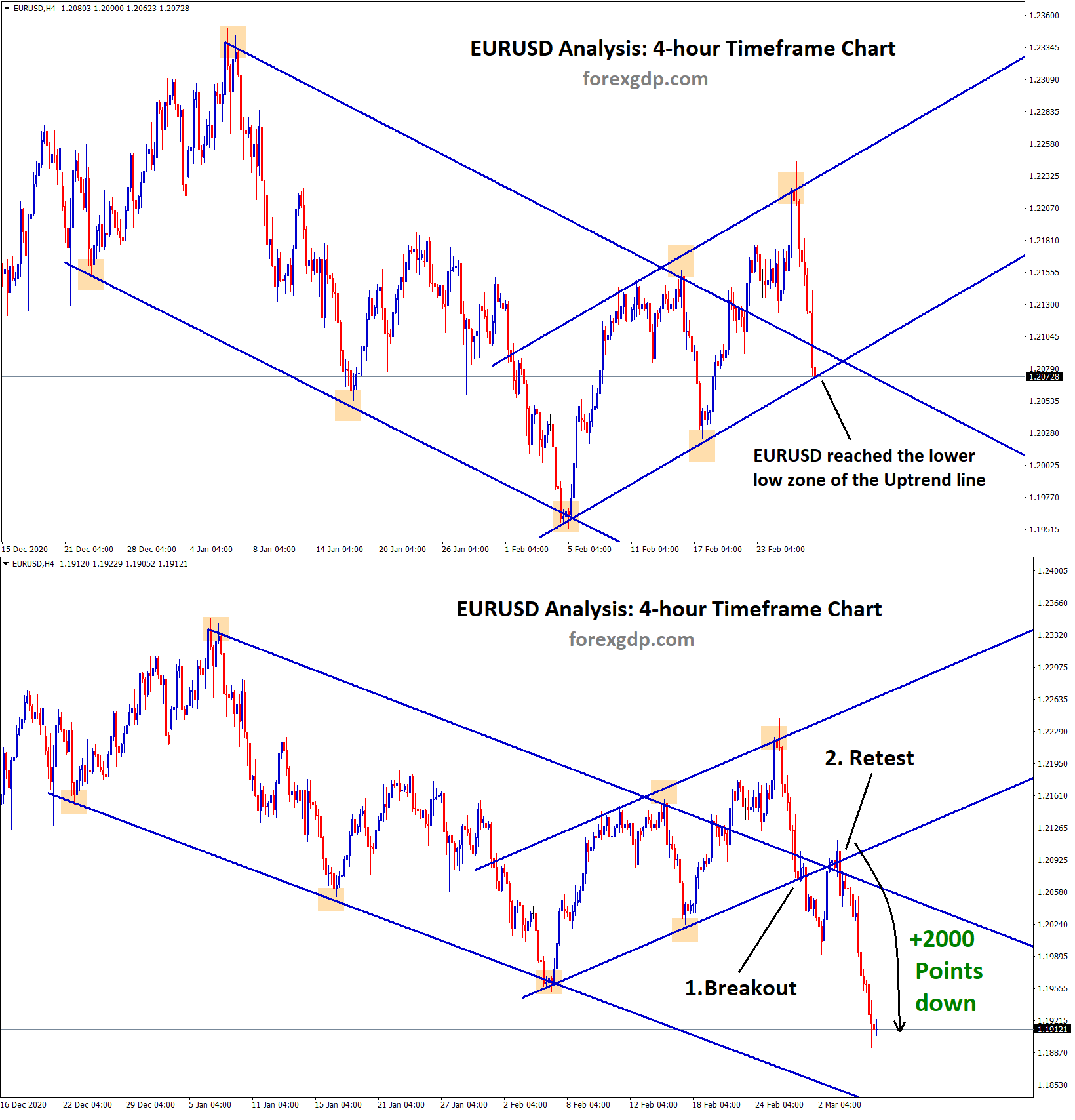

Breakout Trading

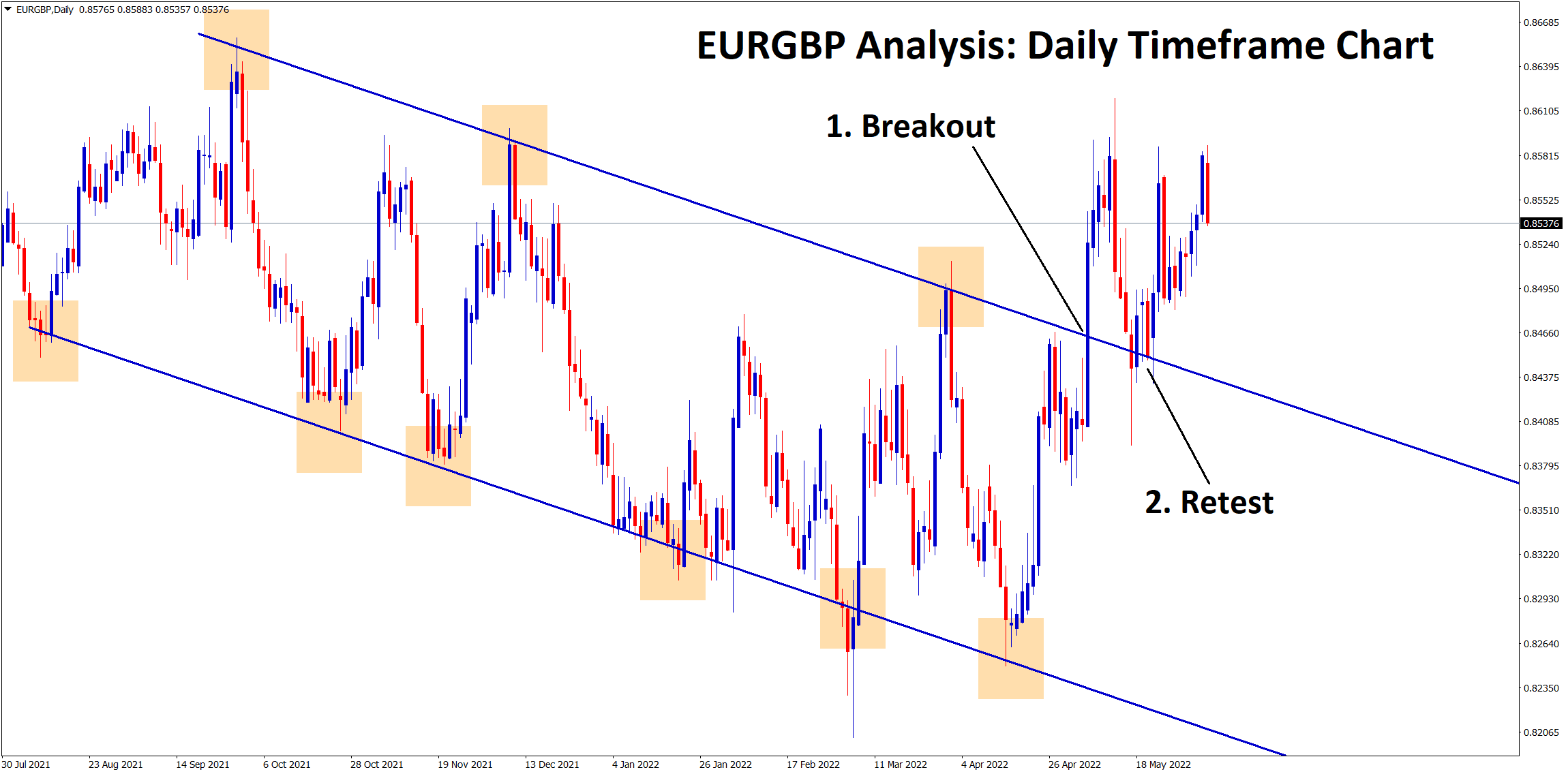

Because it is one of the easiest trading methods available, breakout trading is a fantastic alternative for beginners interested in forex trading. First, let’s look at what the term “breakout” means before we get into how it operates. If we want to keep things straightforward, we may define a “breakout” as any price movement that occurs outside of an established support or resistance region. Breakout patterns may occur when prices fall below support zones, which is referred to as a bearish breakout pattern.

Trading based on breakouts is a useful approach because they frequently signal the beginning of heightened market volatility. This is one reason why breakout trading is so essential. We may turn volatility into an advantage for us by waiting for a break in a price level and then joining a new trend just as it is getting started. The purpose of breakout trades is to join the market at the exact moment when the price makes a move that may be characterized as a breakout, and then to ride the trade for as long as possible until volatility reduces.

News Trading

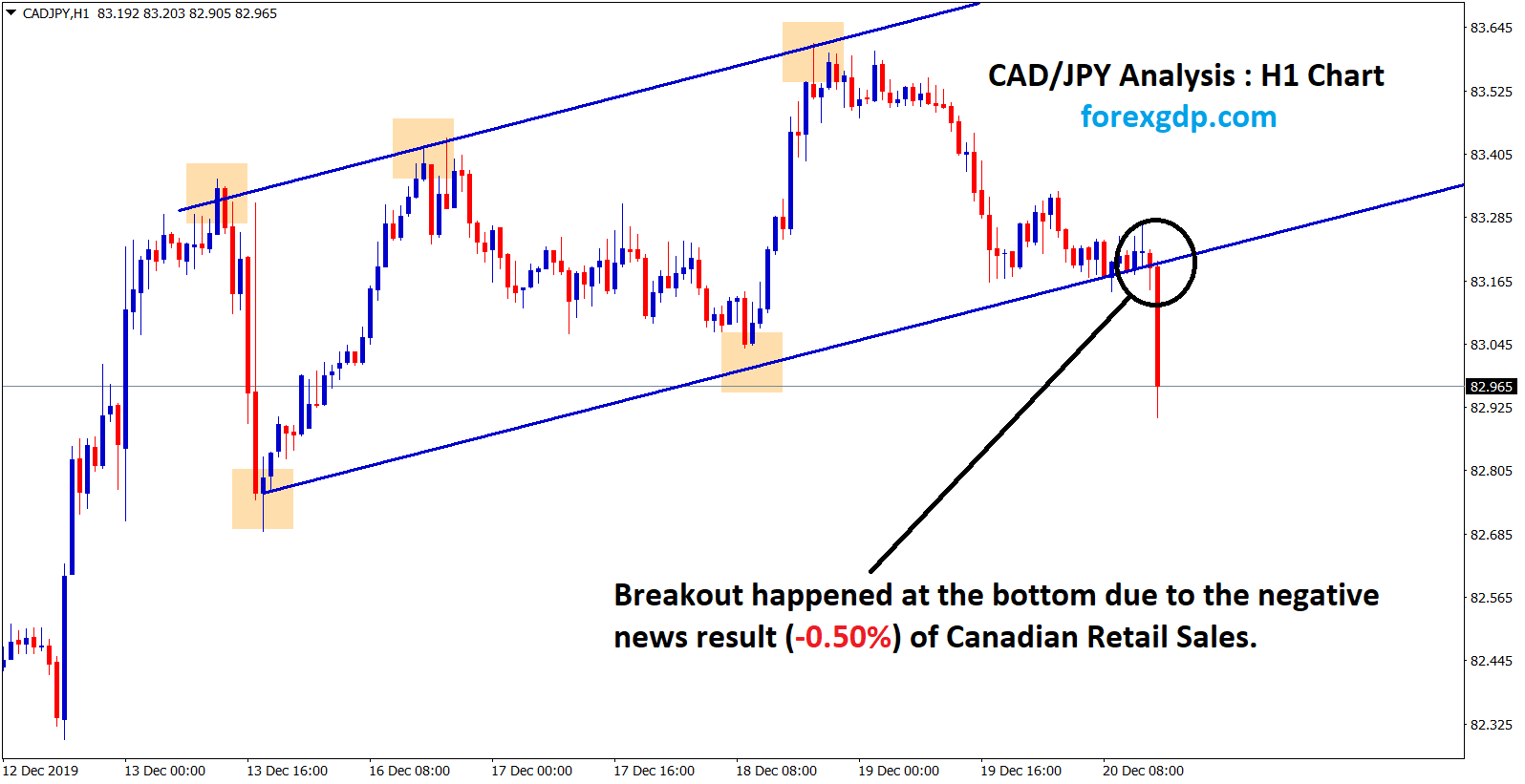

The foreign exchange market is an international marketplace, thus it is subject to the effects of economic events that occur throughout the world. Traders are better able to foresee short-term market moves, often known as breakouts when they have an understanding of economic news events and their possible influence on currency pairs. There is no single occurrence that is fundamentally more significant than any other.

Instead of concentrating on a single element, traders look at the relationship between the variables in question as well as the existing conditions in the market. It is important to keep in mind that the foreign exchange market, just like any other global trading sector, is susceptible to being impacted by unanticipated, isolated occurrences like natural catastrophes or shifts in government policy. These unforeseen occurrences, on the other hand, are not trustworthy indications that may be used in a news trading strategy.

Carry Trading

Carry trade is a sort of foreign exchange trading in which investors try to make a profit by taking advantage of differences in the interest rates offered by other nations. It is essential to keep in mind that despite its widespread use, there is always the possibility of experiencing losses. Because currencies that are acquired and kept overnight will pay a trader the interest rate offered by the interbank market, this method is profitable. When carrying out a carry trade, a trader will “borrow from” a currency with a low-interest rate in order to fund the purchase of another currency with a higher interest rate.

The objective of a trader employing this technique is to generate a profit from the spread between the two rates, which, depending on the level of leverage employed, may be rather significant. This trading strategy can be hazardous because these deals are sometimes highly leveraged and can be overcrowded. Because of the large interest rate spreads associated with these currency pairs, they are frequently used as trading pairs. Common trading pairs include the Japanese yen paired with the Australian dollar and the New Zealand dollar paired with the Japanese yen.

Trend Trading

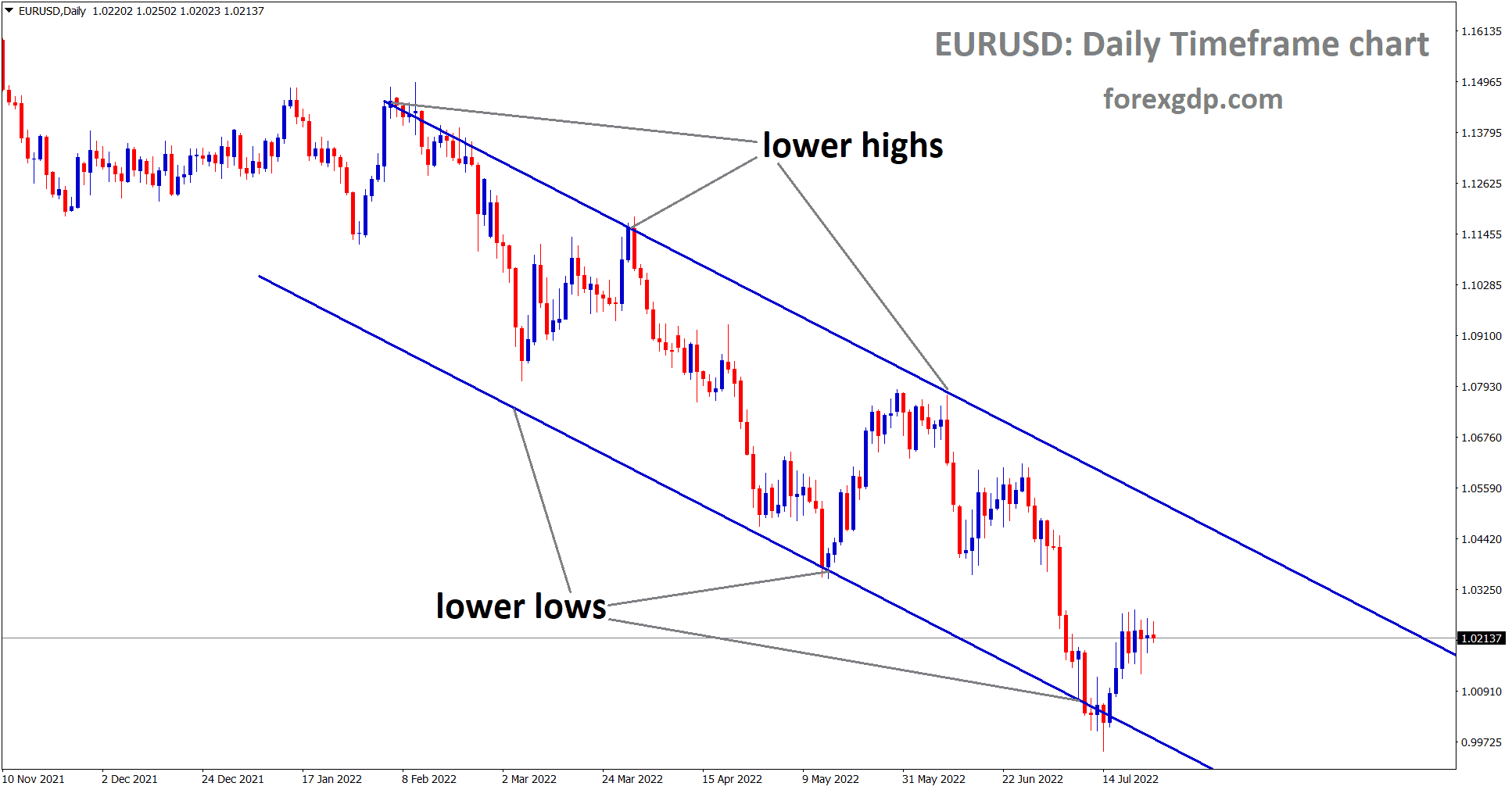

Trading with the trend is one of the most straightforward and dependable tactics in foreign exchange trading. Traders need to first determine the overall trend’s direction, length, and strength before they can successfully accomplish this goal. They will be able to determine how strong the present trend is and when the market may be ready for a reversal by taking into account all of these elements.

In a trend trading approach, the trader is not required to know the precise direction or time of a reversal in the trend. They only need to know when to get out of their existing position in order to maximize their gains and minimize their losses. Even when a market is going in a particular way, there will still be instances of minor price variations that move in the opposite direction of the trend. A trader should be prepared to tolerate tiny losses with the understanding that their returns will ultimately exceed losses as long as the underlying trend is maintained. This is true even if the losses are temporary.

Retracement Trading

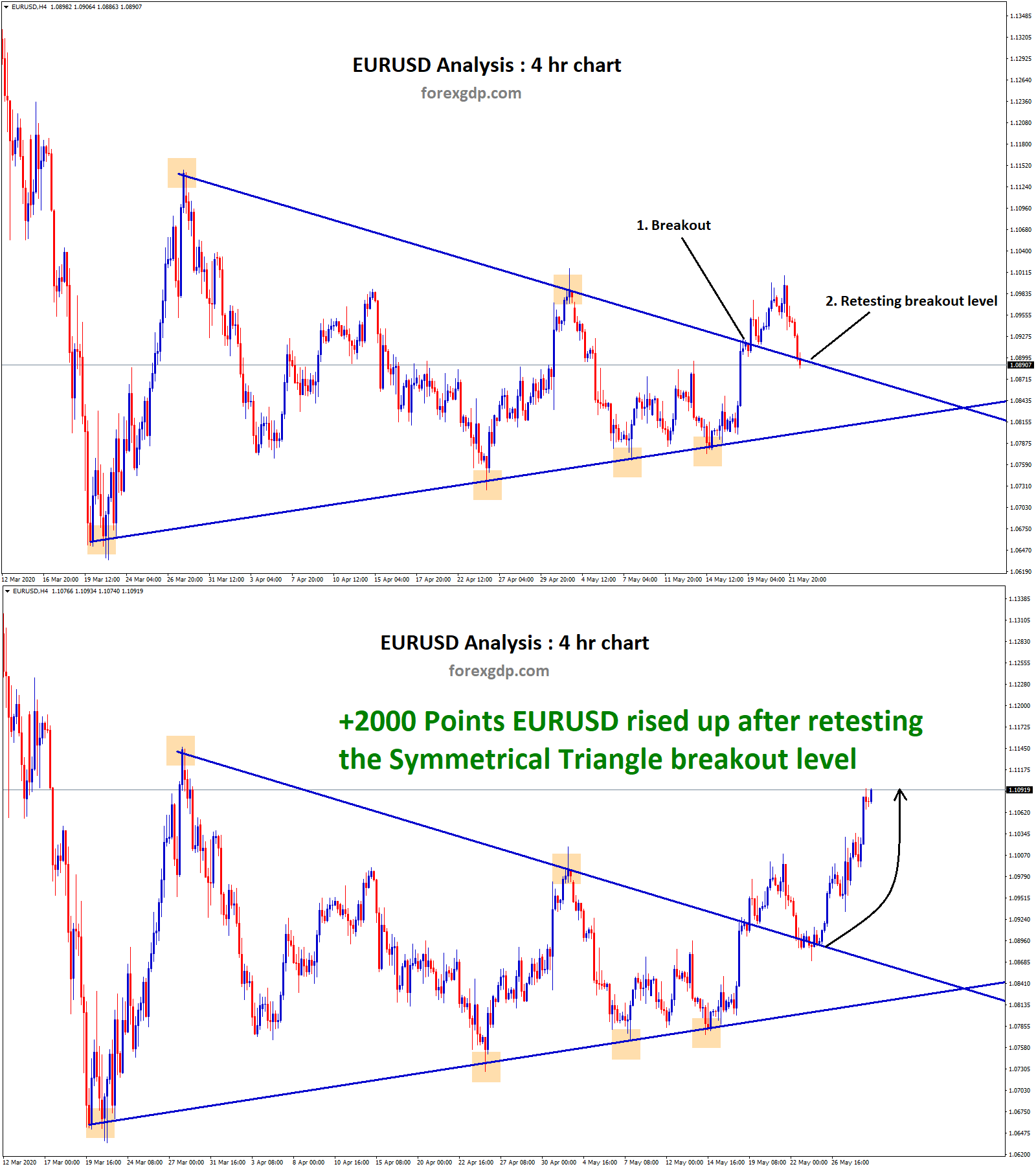

A retracement is an event in which prices move in the opposite direction for a limited period of time before continuing in the same direction as the predominant trend. Traders make use of technical analysis in order to recognize the possibility of retracements and differentiate them from reversals. If the trader believes that a momentary decline in price or an increase in price will turn out to be a retracement, then they may choose to maintain their present position in the belief that the current trend will eventually triumph.

On the other hand, if they believe that the market movement is an early indication of a trend reversal, they may choose to exit their current position and enter into a new one in accordance with the trend reversal. This would be the case if they anticipate that the market movement is an early sign of a reversal. Fibonacci retracements are a useful tool for determining when to join and exit a trade as well as what position to take; nevertheless, they should never be utilized in isolation. Those that are the most effective at trading retracement do so by employing other technical indicators to corroborate breakout and reversal signals.

Momentum Trading

Both momentum trading and momentum indicators are built on the concept that significant price moves in a single direction are a reliable predictor of the likelihood that the price trend will continue in the same direction for an extended period of time.

In a similar fashion, deteriorating movements are a sign that a trend has lost its momentum and may be on the verge of changing direction. There is a possibility that momentum techniques will take into consideration both price and volume, and they frequently make use of visual analytical tools such as oscillators and candlestick charts.

Moving Average Crossover

Moving average (MA) is a straightforward method for doing technical analysis that helps smooth out price data by generating an average price that is continuously updated. This average may be calculated over a range of time periods, from 20 minutes to three days to 30 weeks or any other amount of time that the trader chooses. Moving average tactics are widely popular and can be adapted to any time period, making them suitable for both short-term traders and long-term investors.

A moving average is often constructed for the purpose of establishing the direction of an existing trend, in addition to locating support and resistance levels. It is common for technical traders to produce a trading signal whenever the prices of assets cross over their respective moving averages. For instance, a trader could decide to sell when a price either bounces off the MA or crosses it from above in order to achieve a closing price that is lower than the MA.

Scalping

Within the context of intraday trading, “scalping” refers to a method in which market participants buy and sell currencies with the intention of generating micro profits from each transaction. Scalping tactics in foreign exchange are often founded on a continuous examination of price movement as well as a familiarity with the spread. When a scalper purchases a currency at the current ask price, they do so with the belief that the price will climb sufficiently to cover the spread and allow them to generate a little profit.

This is because the spread is the difference between the bid and ask prices. However, in order for this method to be successful, they will need to wait for the bid price to increase above the initial ask price before they can flip the currency and do so before the price starts to fluctuate again. When you make a number of deals on a daily basis, even a small amount of profit from each trade may soon accumulate into a sizeable sum. Managing such a high number of transactions, however, comes with its own set of unique issues.

Grid Trading

Grid trading is a breakout trading strategy that looks to profit from a new trend while it is developing. This strategy aims to trade in a grid. Grid trading, in contrast to other breakout trading systems, does not require the trader to have prior knowledge regarding the future course of the trend. Traders employing a grid trading method do so by constructing a web of stop orders both above and below the current price. Because these orders are arranged in a grid, it is virtually guaranteed that a corresponding order will be executed regardless of the direction in which the price changes.

The most apparent benefit of using this technique is that you do not need to know which way the market will go in order to profit from it, nor do you need to stay glued to your computer in order to do so. Even if there is no imminent need for action, grid trading nevertheless requires cautious management. In the event that your profit-taking values are not immediately triggered once a position has been created, this might leave you exposed to the possibility of incurring losses. When the trend becomes clear, it is essential to cancel any outstanding orders in the opposite direction as soon as possible in order to avoid accruing interest in positions that are not lucrative.

Fundamental Analysis

Traders use something called fundamental analysis to determine whether or not a currency is overpriced or undervalued by looking at the economic fundamentals of a country. They utilize the information to try to acquire a view of how the value of the currency will likely fluctuate in the future in relation to another currency, and they use the information.

The fundamental analysis process can be difficult since it involves looking at a variety of aspects of a nation’s economic statistics to determine how those aspects will likely affect future trade and investment patterns. Concentrating on a handful of the most important indications will make it much easier to understand. Retail sales, GDP, industrial output, CPI, inflation, purchasing managers index data, housing data, and a variety of other statistics may all have a significant impact on an economy and its currency. These are just some of the most important indicators that can have such an impact.

Range Trading

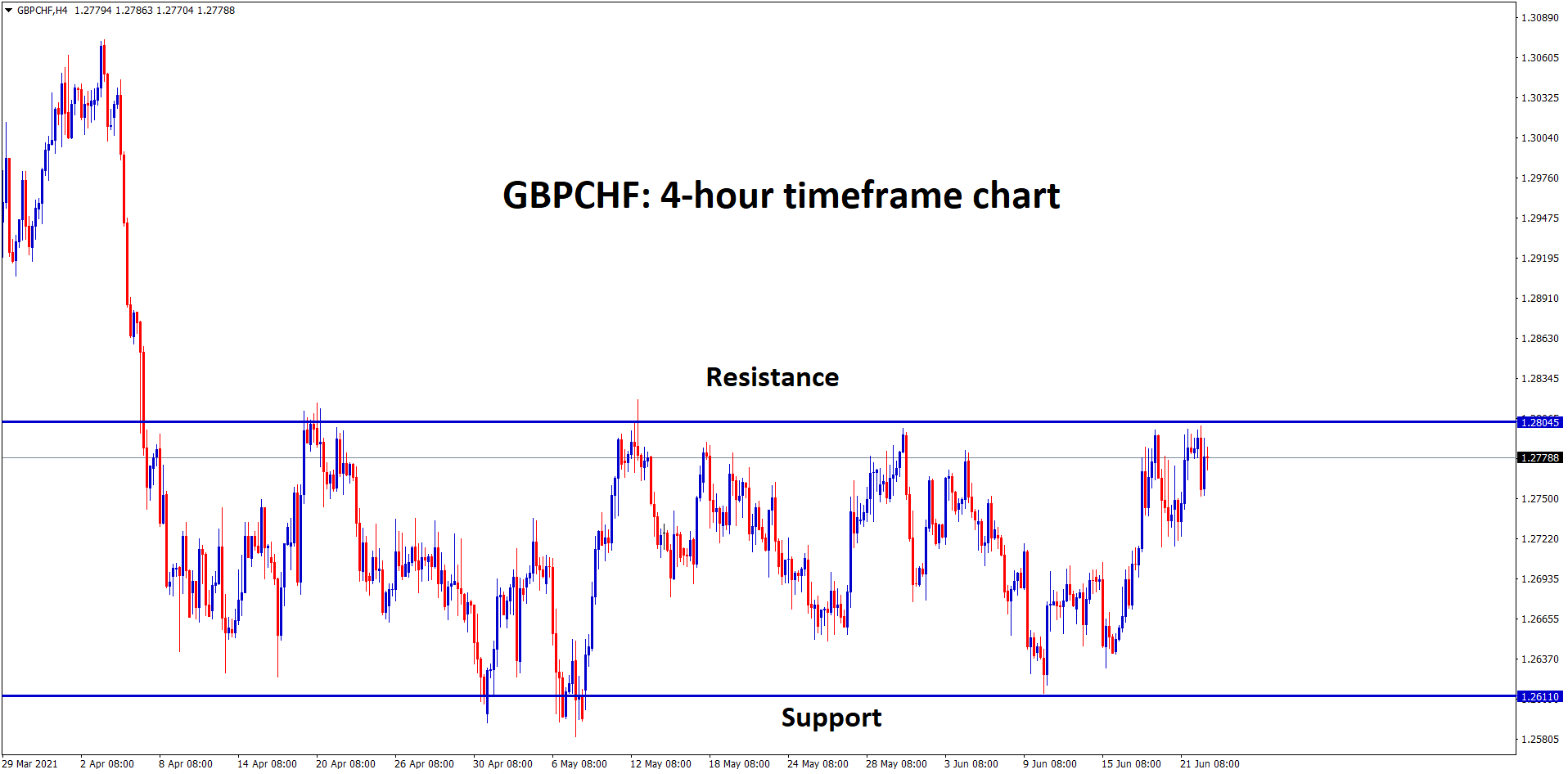

Trading in a range is a straightforward and common method that is based on the premise that prices will frequently remain inside a consistent and foreseeable range for a specific amount of time. It is most successful in markets with economies that are stable and predictable, as well as currencies that are not frequently affected by unexpected news occurrences.

Range traders rely on their ability to buy and sell at the highs and lows of resistance and support on a consistent basis, often making the same transactions many times over the course of one or more trading sessions. Trend traders and range traders may utilize some of the same instruments, such as the relative strength index, the commodities channel index, and stochastics, to find favorable trade entry and exit levels.

Position Trading

Position trading is a trading method in which traders maintain their position for a lengthy period of time, which can range anywhere from a few weeks to a few years. This method is used as a trading strategy for the long term, and it needs traders to adopt a macro view of the market and be able to withstand tiny market changes that are in opposition to their position. Position traders almost often employ a method known as trend following.

They depend on analytical data to identify markets that are trending and to establish the optimal entry and exit locations within such markets. They also carry out a fundamental study in order to uncover microeconomic and macroeconomic circumstances that have the potential to impact the market and value of the asset that is under consideration. The capacity of the trader to comprehend the market in issue and their skill in risk management are the two most important factors that determine whether position trading is successful or unsuccessful. Some position traders favor using a target trading strategy because it allows them to “lock in” earnings at predetermined time periods.