In Foreign Exchange Trading, Pip value can be a confusing topic for most of the forex traders because you need to do mathematical calculation depend on the exchange rate. A pip is a unit of measurement for currency movement and is the fourth decimal point in most currency pairs.

For example, if the EURUSD moves from 1.1012 to 1.1013, that’s a one pip change. But nowadays, most of the forex brokers provide fractional pip(pipette) pricing, so you’ll also see the fifth decimal in the currency pair.

Table of Contents

What are Pips in Forex Trading?

The Smallest decimal price measurement in the exchange market is known as Pip.

PIP = Point In Percentage

Pips definition

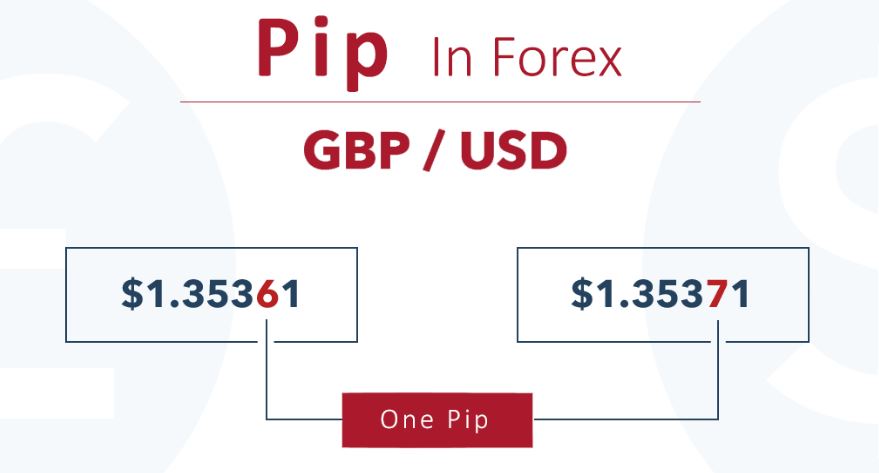

For most of the currency pairs, Pips are counted in the fourth place after the decimal in price quotes. Example: 0.123(4) Here, the fourth digit is considered as Pip.

In Japanese Yen currency pairs such as USDJPY, GBPJPY, AUDJPY, EURJPY, the pips are counted in the second place after the decimal in price quotes.

Example: 107.58

Here the Second digit after the decimal dot is “8”. So, the second digit 8 is considered as a pip.

These are pips meaning depend on different decimal places.

Why pips are important in forex trading?

Pips are important to measure the distance market travelled from one price to another price. Pip value matters because it affects risk.

If you don’t know how much a pip worth, you can’t precisely calculate the ideal trade position size and you may end up risking too much or too little on a trade.

Pips are measurement unit in forex trading similar to the distance measurements like Centimetre, inch, metre.

Pip’s are important depending on the value of the exchange price. For each currency pair, the pip value differs depend on the exchange rate of the currency.

What are Pipettes?

Pipettes are 1/10 (one-tenth) of a pip.

One pip equals ten pipettes. Pipettes are also known as Points.

1 pip = 10 pipettes (points)

For example, 200 pips = 2000 points

pip is used to calculate 4 digit decimal value in currency pairs. Example: 0.1234

Points (or) Pipettes are used to calculate 5 digit decimal value in currency pairs. Example: 0.12345

Traders often use pips or points to refer their gains and losses in forex trading.

How do Pips work in practice?

In the currency market, the value of a currency pair is measured in the name of “Pip”

One pip = 0.0001 (smallest price change)

2 pip = 0.0002

3 pip = 0.0003

Example: If EURUSD moves from 1.1282 to 1.1283, that is 0.0001 USD increase which is one pip move.

Measurement of Pipettes (points)

In the forex market, the fifth decimal value of a currency pair is measured in the name of “Points or Pipettes”.

One Pipette = 0.00001 (Very smallest price change in 5th decimal place)

2 points = 0.00002

3 points = 0.00003

Example: If GBPUSD moves from 1.33522 to 1.33523 that is 0.00001 USD increase which is one pipette move.

PIPS Value

Each currency has its own price value, it’s necessary to calculate the value of a pip for that particular currency pair.

The difference in pips between the bid price and ask price is called Spread.

How is Pip value calculated?

Pip values are calculated depend on the USD Currency pairs and Non-USD currency pairs.

Forex Pip Calculation Formula

The value of the pips for your trade can vary depending on your trading lot size. What is pips in foreign exchange rates are well defined now with formula?

A standard lot (1 lot) = 100,000 units

A mini lot (1 lot) = 10,000 units

A Micro lot (1 lot) = 1000 units

A Nano lot (1 lot) = 100 units

1) If USD is the quote currency, use below formula (Example: EURUSD, GBPUSD, AUDUSD)

(Units: 1 lot = 100 000, 0.1 lot = 10 000, 0.01 lot= 1000)

Formula: 1 pip = 0.0001 x units

Example: If 1 lot placed in EUR/USD

1 lot = 1 lot x 10,000 = 100,000 units

1 pip = 0.0001 x 100,000 units = 10$

For 1 lot placed in EUR/USD, 1 pip = 10$

2) If USD is the base currency. (Example: USDCHF, USDCAD, USDJPY)

Formula: 1 pip = 0.0001 x units/quote

Example: If 1 lot is placed in USD/JPY at 124.20 price

1 lot = 1 lot x 100,000 = 100,000 units

1 pip = 0.01(JPY pairs) x 100,000/124.20 = 8.05$

For 1 lot placed in USDJPY, 1 pip = 8.05$

Note: For Japanese Yen pairs, the pips are counted in the second decimal places in price quotes.

3) If it is a Cross currency pair which is a NON-USD Currency pair like EURGBP = (EURUSD/GBPUSD)

Forumula: 1 pip = 0.0001 x units x quote currency quote (GBPUSD)

Example : 1 lot buy in EUR/GBP pair

1 lot = 0.0001 x 100,000 x 1.5590(GBP/USD quote price)

1 pip = 0.0001 x 100,000 x 1.5590 =15.59$

For 1 lot placed in EURGBP, 1 pip = 15.59$

Each pip value differs depend on the exchange rate and value of the fx pair. One pip movement equals to different pip value in foreign exchange market.

What is a pip is all calculated depend on the price moves happening on basis point, price interest point, interest rates, value change in currency markets,

But for United States, US dollar pip move is calculated depend on different formula as shown above. Example: Euro US dollar is the most traded currency pairs in the world. The Next step in forex trading involves mostly USD currency trades GBP USD, USD JPY, USD CAD, AUD USD, etc. CFDs in trading platform accounts prices also calculated in the form of pip terms.

Depends on investing products, services, advice, lot sizes, basis points, risks information, benefits, offers by the fx broker company leads to best trading experience in trading platforms with great results. However top tier regulation required from top countries to safeguard client funds. what is the pip in exchange rate of decimal places in usd cad, usd chf is having non-USD in counter currency.

Conclusion

Traders measure profit or loss position in pips or points.

You must know the pip value to know the risk of your each trade position.

Pip value is useful for both short term and long term trader.

In JPY pairs, the pips are counted in the second place after the decimal in price quotes. Eg.108.35

But in other pairs, pips are counted in the fourth place of the decimal in price quotes. Eg.0.1234

In US brokers, the pip value is higher and FIFO rule applied to your trading account for all US residents.

FAQ

100 pips worth = $1000 for 1 standard lot in EURUSD currency pair.

You can’t make fixed pips every day. Instead, you will make more or fewer pips depending on the market movement. If the market moves more, you will make more pips, if move less, you will make less pips on your trading account.

100 to 500 pips every week is possible to make weekly in forex trading. You can’t make consistent of 500 or 1000 pips every week. Depend on the market volatility you will make more or less pips on your trading account.

It depends on your trading lot size. Example: if you have 1000 USD account, if you place 1 lot, you just need only 100 pips to double your money. If you place 0.10 lot, you need 1000 pips to double your account and for 0.01 lot, 10,000 pips are required to double your money.

30 to 600 pips per trade are possible with swing trading. Scalpers aim for 5 to 30 pips. Long term investors aim for 1000+ pips.