What is A Head And Shoulders Pattern

A head and shoulders pattern is a graph arrangement that looks like a foundation with three peaks. The central peak is the tallest and the two peaks on either side of it are very similar in height. In the field of technical analysis, a head and shoulders pattern is the name given to a certain chart formation that indicates an approaching switch from a positive to a negative trend.

There is a universal agreement that the head and shoulders pattern is one of the most dependable trend reversal patterns. It is one of the numerous top patterns that warn, with varying degrees of precision, that an upward trend is nearing its end. The accuracy of these signals varies from pattern to pattern.

Parts of A Head and Shoulders Pattern

In order to successfully trade a head and shoulders pattern, you have to first understand that this pattern is formed from a combination of different parts and levels of trends. When all these parts combine together, a head and shoulder pattern is created. While a head and shoulders pattern can vary slightly, the parts that make up this pattern remain the same. Here are the parts of a head and shoulders pattern:

Uptrend

The very first part of a head and shoulders pattern is the uptrend. This is a trend that extends upwards before dropping back down to the base level. It is important to note that since this isn’t the main top in this pattern, it isn’t going to be the highest top either. The mountain that forms following this mountain is going to be the main head. You should also know that the longer the uptrend lasts, the more likely it is that the reversal that follows is going to be quite long as well.

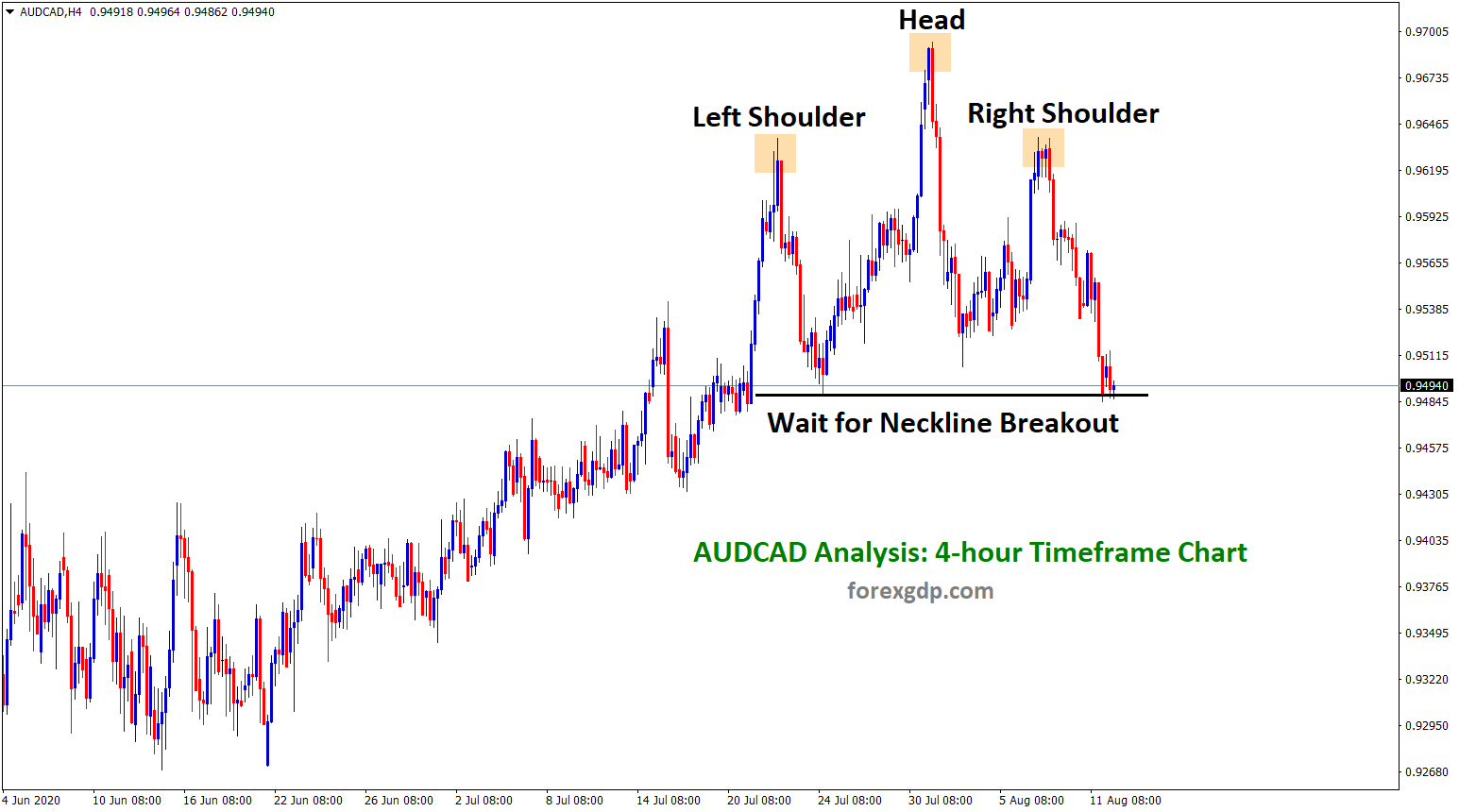

Left Shoulder

The left shoulder is the top-most point in the first mountain or left-most mountain that forms the head and shoulders pattern. This is formed after the uptrend comes to an end and a downtrend starts to form. The reason why it is called the left shoulder is that the mountain that comes after this mountain will have a top that is called the head. A head has two shoulders on either side. A left shoulder and a right shoulder. We’ll get into more detail on the right shoulder in just a bit.

Downtrend

Following the formation of the left shoulder, we’re going to go back into a downtrend with the head and shoulders pattern. The point where this downtrend ends is going to be what’s called a neckline. This neckline is very important when determining the best point to execute a trade with the head and shoulders pattern. We will get into more detail on the neckline in just a bit.

Head

After the downtrend of the left shoulder which goes till the baseline, the market is going to start to form the head. The head is the top-most point of the head and shoulders pattern. It is also the high point of the middle mountain in this formation. The formation of the head begins from an uptrend significantly high. This forms the high point called the head. Following the formation of the head, the market begins a downtrend again and falls back to the neckline. This is the same neckline or baseline where the left shoulder had fallen just a bit earlier.

Right Shoulder

Following the formation of the middle mountain or the head, we now move on to the last or right-most mountain in this strategy. This is called the right shoulder. After the head closes at the neckline, the market goes into an uptrend again. However, this uptrend won’t reach as high as the uptrend that formed the head. It will be more or less close to the height of the left shoulder. Once the uptrend reaches its end, the market will now begin a downtrend. Unlike the previous two mountains, this downtrend will not end at the neckline. Instead, it will cause a breakout which we will get into more detail in just a bit.

Neckline

We’ve mentioned neckline quite a bit in this article so it’s probably time we explain what exactly this is. The neckline in a head and shoulders pattern is the baseline we consider when we expect a breakout. This is the low point that the head and left shoulder reaches when completing their downtrend. In a head and shoulders pattern, we’re expecting a breakout after the completion of the right shoulder. In order to understand when this breakout takes place, we look towards the neckline as a base. If the market values drop below the neckline, we can say that a breakout has taken place.

Formation of A Head and Shoulders Pattern

At this point, we’ve pretty much understood what exactly is a head and shoulders pattern and what makes up its many different parts. However, we also need to discuss why exactly this pattern is formed. This is because this will further help us understand what move to make with this trading. The entire concept of a head and shoulders pattern is based on the fact that the market is losing its buying power and gaining more selling power.

What this means is that traders who have placed buy trades in the market are decreasing and those who have placed sell trades are increasing. The shoulders signify the buyers trying to push above the head and failing because the selling power is too strong. The market becomes fully engulfed in its selling power once it breaks from the neckline and continues in a downtrend.

Head and Shoulders Breakout

One of the most important parts of a head and shoulders pattern is the breakout. This is when the market value drops below the neckline after the formation of the third shoulder. The reason why the breakout is the most important part of this pattern is that it is what confirms this pattern in the first place. If the breakout doesn’t occur, there would be no head and shoulders pattern. The three mountains would have no significance and they would just be regular highs and lows in the trading chart.

This is because of this breakout that we can accurately say that a head and shoulders pattern has taken place. It is a common mistake among beginners where they assume that a head and shoulders pattern is confirmed once the right shoulder is formed. This isn’t true and it is actually confirmed after the right shoulder breaks the neckline in a downtrend and continues falling.

How To Enter A Trade With The Head And Shoulders Pattern

Now to the real reason why you opened this article. While this is one of the most popular methods of forex trading through a strategy, not many people actually know how to enter a trade with it properly. Our goal is to explain this strategy to you in simple terms so you can easily understand and apply it in your forex trading. There are two main ways of entering a trade with the head and shoulders pattern. They are as follows:

First Entry Method

The first method of entering a trade with the head and shoulders pattern is the most common approach and is followed by pretty much most traders who use this strategy. In this method, you enter a sell trade immediately after the market values cross under the neckline. Most people prefer this strategy as they believe it’ll give them the most profits. However, you should know that this method is pretty risky as you could put yourself in danger of being in a false breakout. This is also why the second strategy we’re going to discuss below is safer.

Second Entry Method

The second method of entering a trade with the head and shoulders strategy is actually not that common and it is only known by a select few traders. However, I believe it to be much safer and more accurate than the first method. In this strategy, you don’t immediately enter a sell trade after the market values fall below the neckline. Instead, you wait for the values to retouch the neckline after dropping slightly. This is to ensure that you don’t enter a trade in a false breakout. False breakouts are actually pretty common so we should avoid them as much as possible.

Inverse Head and Shoulders Pattern

Just like the head and shoulders pattern, we also have the inverse head and shoulders pattern. This pattern is just like the head and shoulders pattern, except flipped upside down. So, the mountains become upside mountains and form a W sort of shape instead of an M sort of shape.

When a breakout occurs in the inverse head and shoulders pattern, we are looking to enter the trade with a buy deal instead of a sell deal. The rest of everything else works the same just opposite as well. The parts and strategies for the head and shoulders pattern also relates to the inverse head and shoulders pattern.

Forex signals are a great way to get profitable trades, even if you don’t know how to analyze chart patterns yet. Expert analysts will provide you with appropriate risk management strategies, so you don’t make the top forex mistakes like every trader. Don’t trade all the time. Trade only at the best trade set up with Forex GDP.