♦ Which factors moves the forex market?

♦ Why forex trading has two currencies combined together?

♦ Top 10 Most Traded Currencies in the World

♦ How does forex trading work? who found this market?

♦ What is a Pip, Leverage, Spread, Lot size, Equity, Free Margin, Margin Level, Stop out level in forex?

♦ Why forex is better than other financial markets?

♦ Are there any risks trading forex?

♦ Top Traders reason for losing money

♦ Is Forex Trading illegal?

♦ Will Forex Market Shut down permanently?

1. What Is the Forex Market?

Forex Market is the place for buying and selling foreign surrencies. Here people can buy, sell, exchange, and speculate on currencies. This Market Determines Foreign exchange rates for all currencies.

Forex is the World No.1 financial market with over $6 trillion in daily transactions. If you compare this fx market with any other market’s, it’s a huge beast. Example: The World’s Largest Stock Exchange New york NYSE has a daily turnover of up to $180 Billion only.

Now, it sounds big?

The participants who dominate and move the market is mostly the larger international banks (central bank of the country), investment firms, hedge funds, retail forex brokers, individual traders worldwide. Unlike other financial trading markets, there’s no centralized place for forex, currencies are traded over the counter in whatever price the market is open at that time. So, currency prices remain the same all over the world.

Well, Let’s lookout, why this market has a huge turnover.

History of Forex – Overview

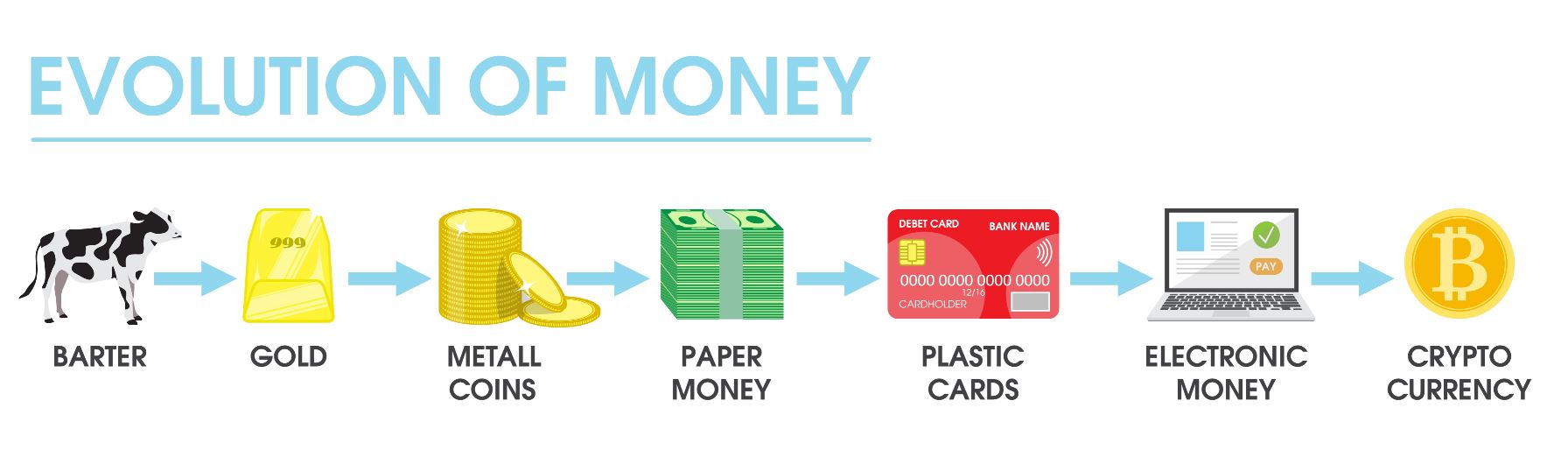

Currency trading was started in ancient times. Money Exchangers in all countries exchange the currency by charging a commission. In the recent ancient period, the Goldsmiths and Silversmiths were also the money exchangers.

Currency and exchange were very important parts of the trade in the ancient world, allowing people to buy and sell items like food, raw materials, clothes, etc,. Before the invention of money, We used a Barter system where we exchanged one good for another good in return.

In the 15th Century, the Italian banking family Medici were required to open banks in foreign countries in order to exchange currencies to act on behalf of textile merchants.

During the 17th and 18th centuries, Amsterdam maintained an active foreign currency exchange market.

In 1704, Foreign currency exchange took place between the agents of England and Holland.

Alex.Brown & Sons were the first investment bank founded in 1800 in the USA, started to trade foreign currencies around 1850.

Check their history below:

If you want to see more details, check directly on their website : www.alexbrown.com

Gold played a major role in the international monetary system. where most of the major countries’ governments fixed their currency rate to gold.

In 1944, the Bretton Woods Accord was signed which allowed currencies price to fluctuate within a range of ±1%.

In 1954, The Bank of Tokyo the centre of foreign exchange and it allowed to dealings in many western currencies.

Rapid Developments in the market

In 1971, the Bretton Woods Agreement was abandoned. The currency exchange prices were allowed to float depending on their own demand and supply level.

The U.S. Trade deficits made foreign banks accumulate a large number of Eurodollars by the 1980s. $70 billion a day volume was generated at this time.

Reuters introduced computer monitors during 1973, replacing the telephones used for trading quotes.

The Internet in the mid-1990s helped people to trade currency from anywhere 24 hours a day through electronic fund transfer instead of physical exchange.

In 2004, FX’s daily volume was around $2 trillion.

In 2007, it has passed $3 trillion.

Now in 2020, it has reached around $6 to $8 trillion daily trading volume.

3 Main types of forex markets

- Spot Market – These are the fastest currency transactions that take place in foreign markets.

- Futures Market – These currency transactions involve future payment and delivery at an agreed exchange rate.

- Forward Market – It is similar to the futures market but it allows negotiations between two parties which gives more flexibility involving a currency swap.

What are forex market levels?

The support and resistance levels represent the minimum and maximum value of a currency pair at a given time. The traders buy the assets when the price is at the support level, sell when it reaches the resistance level, and vice versa.

To find the support and resistance levels on the chart, look for the points where the price regularly changes the direction. For example, if the price has been bouncing off 1.25000 for the last two days — this is a resistance level.

The levels are defined by the traders themselves when they place the StopLoss and TakeProfit values in their orders. Due to this, several support and resistance levels of different strengths can co-exist on the market.

Is the forex market regulated?

The forex market has no central exchange or clearing house like other markets. Instead, the governments supervise currency trading around the world in the form of different regulations. Some of them are listed below:

- United States – NFA, CFTC (The National Futures Association, Commodities Futures Trading Commission)

- United Kingdom – FCA (Financial Conduct Authority)

- Canada – IIROC (The Investment Industry Regulatory Organization of Canada)

- Australia – ASIC (The Australian Securities and Investments Commission)

- Japan – FSA (Financial Services Agency)

- Singapore – MAS (The Monetary Authority of Singapore)

- Hong Kong – SFC (The Securities and Futures Commission)

- Cayman Islands – CIMA (Cayman Islands Monetary Authority)

2. Which factors influence the forex market?

- Inflation rates

- Interest rates

- Country’s Current Balance

- Government Debt

- International Trade

- Political News and Stability

- Economic Performance

- Recession

- Speculation

Market Sentiment

Market sentiment shows the intuition of traders whether they want to buy or sell in any asset.

For example, If the majority of traders are buying in the market, you will see a bullish trend in the chart. Similarly, if the majority of traders are selling, you will see a bearish trend in the chart.

Central Banks

The Central Banks dealing has a very big impact on the currencies market as they affect currency exchange rates through their monetary policy decisions.

Unlike other participants, Central banks in foreign exchange markets don’t aim for profits they aim only for economic growth and price stability.

News Reports

The economic news events affect the foreign exchange market as it includes Interest rate decision, GDP growth percent, Unemployment rates, Retail sales, Consumer Price Index (CPI), Purchasing Managers Index (PMI), Imports, Exports, Nonfarm Payrolls, and Financial news announcements made by higher authorities.

Whatever the news announcement published for impacting the country’s economy, would always have an effect on this fx market either directly or indirectly. It allows speculation that creates a temporary move in the market. Example: During the interest rate decision, you can see big spike candlesticks in the chart which all show a temporary price move due to these news reports.

Fortunately, Technical strategy works 80% of the time and fundamental news impacts only 20% in the forex markets.

3. What is Forex Trading?

Forex Trading is the process of exchanging one currency to another currency. There are a lot of currencies exchanged every time as you can see the bank forex rate changes often every day depends on the demand and supply of the currency.

As a retail forex trader, you can trade worldwide currencies using your forex-broker account. Currencies are always represented in the form of a currency pair.

What are forex brokers?

Almost every trader is using a broker — an intermediary company that consolidates orders from different traders and significantly lowers the entry cost. To compensate for the paid fees, brokers slightly offset the prices in their favor but at lower trading volumes they remain a cheaper option.

Different types of forex orders

An order on Forex is a command to purchase or sell some currency pair. For example, if you order to buy 100 EUR/USD at market value 1.25000, you will sell 100 EUR to buy 125 USD.

There are several types of Forex Orders. You should remember two:

- Market orders. Market orders get executed immediately at the market price. If the market price changes while the order is processing, it doesn’t get executed.

- Limit orders. Limit orders execute only when the market reaches the price listed in the order. Until the prices in the order and on the market correspond, the market ignores the order.

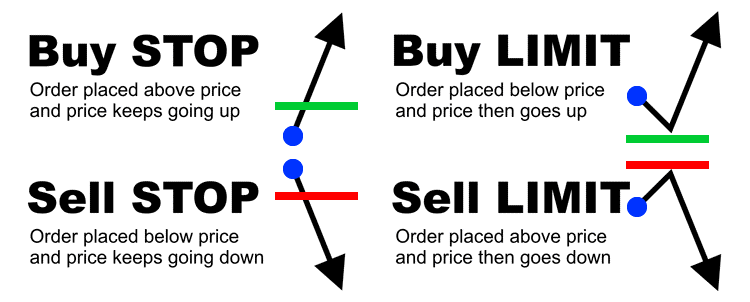

Most traders use the limit orders because they allow for more flexibility and better planning. There are four types of Limit Orders:

- Buy Limit. Buy Limit purchases currency when the market descends to a certain point.

- Buy Stop. Buy Stop purchases currency when the market rises to a certain point.

- Sell Limit. Sell Limit sells currency when the market rises to a certain point.

- Sell Stop. Sell Stop sells currency when the market descends to a certain point.

The limit orders can be modified with the StopLoss and TakeProfit values which will automatically close the orders if they become unprofitable or achieve the profit goals.

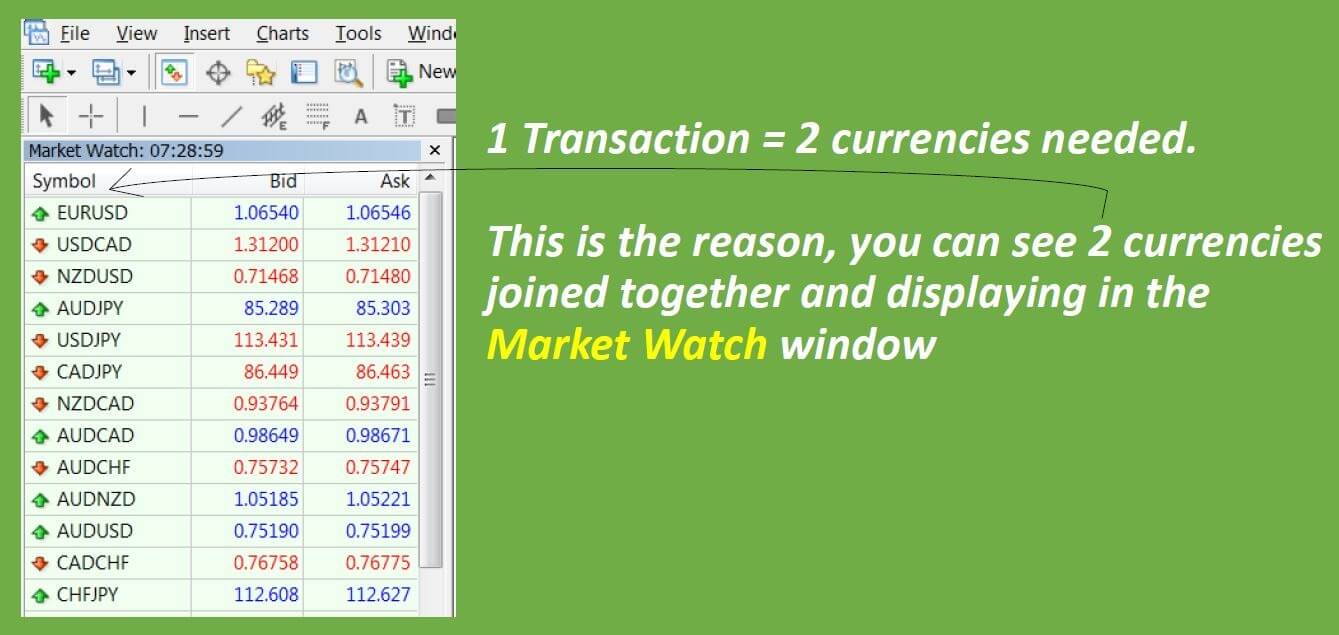

Why forex market has two currencies combined together?

A forex pair has quote currency and counter currency.

If you want to buy one currency, you need to give another currency.

Example: If you are from the USA, and you want to Buy EURO. You need to sell your local currency (USD) and Buy the EURO currency.

In the above example, only one transaction (deal) has happened, but how many currencies are involved in a Single Transaction?

Answer: 2 Currencies (EUR and USD) are involved in this single transaction.

For carrying one transaction, you always need two currencies.

What is a currency pair?

A currency pair represents the two currencies that are traded on Forex and can be used to purchase each other. A quote is a relation of value between those currencies. For example, EUR/USD = 1.25000 means that for 1 EUR you can buy 1.25000 USD.

Most currency pairs have an established order — for example, you won’t often see a USD/EUR quote but an EUR/USD instead. The only reason for this is a tradition.

The values are written with pips. A pip, in Forex, is a 1/10000 or 1% out of 1%. This allows traders to track even minuscule price changes and profit off them.

Price changes in a single day average around 100 pips. During economic crises and important news, the price can change in a more significant manner.

What Currencies you can trade?

You can almost start trading in all foreign currencies from your brokerage trading platform. Below is the list of currency pairs listed in major forex brokers:

- AUDCAD

- AUDCHF

- AUDJPY

- AUDNZD

- AUDUSD

- CADCHF

- CADJPY

- CHFJPY

- EURAUD

- EURCAD

- EURCHF

- EURDKK

- EURGBP

- EURHKD

- EURJPY

- EURMXN

- EURNOK

- EURNZD

- EURPLN

- EURSEK

- EURSGD

- EURTRY

- EUR USD

- GBPAUD

- GBPCAD

- GBPCHF

- GBPHKD

- GBPJPY

- GBPNOK

- GBPNZD

- GBPSEK

- GBPSGD

- GBPTRY

- GBPUSD

- HKDJPY

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SGDJPY

- USDBGN

- USDCAD

- USDCHF

- USDDKK

- USDHKD

- USDJPY

- USDMXN

- USDNOK

- USDPLN

- USDRUB

- USDSEK

- USDSGD

- USDTRY

- USDZAR

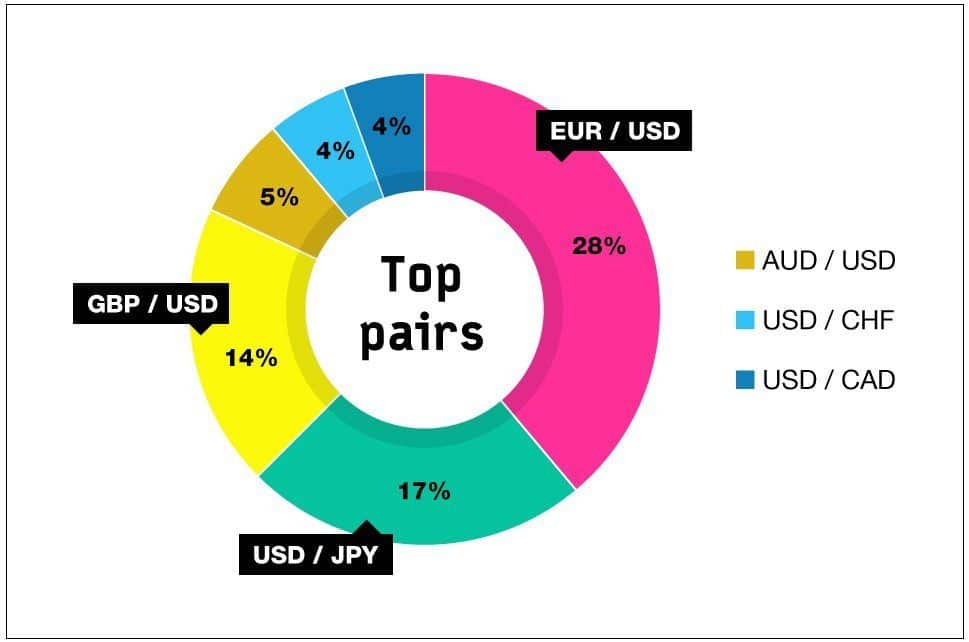

The major currency pair is EUR USD, GBP USD, USDJPY, USD CAD, AUD USD. All the major pairs include the US Dollar because USD is a worldwide currency.

Top 10 Most Traded Currencies in the world

- USD (US$) – US Dollar

- EUR (€) – Euro

- JPY (¥) – Japanese Yen

- GBP (£) – Great Britain Pound (Pound Sterling)

- AUD (A$) – Australian Dollar

- CAD (C$) – Canadian Dollar

- CHF (CHF) – Swiss Franc

- CNY (元) – Renminbi

- HKD (HK$) – Hong Kong Dollar

- NZD (NZ$) – New Zealand Dollar

4. How does forex trading work?

Fx Market is the biggest market in the world with a daily trading volume of 8 to 5 trillion USD. It’s operating time is 24 hours a day from Monday to Friday.

What time does the forex market open?

From 5 p.m. EST on Sunday until 5 p.m EST on Friday.

Who is the founder of the forex market?

Unlike stocks or share trading, foreign exchange trading does not take place on exchanges but directly between two parties, in an over-the-counter (OTC) market.

The market “Forex” doesn’t have any founders. but just like company shareowners, Here the national governments, Large corporations, Banks are controlling the market.

Only a huge volume of funds can move the market faster. There are different levels of forex participants operating in the market.

1) International Banks

Example: Barclays, Deutsche Bank, HSBC, J.P. Morgan Chase & Co, and other international banks are all the major big players who control and move the market easier because they have huge foreign exchange transactions)

2) Liquidity Providers (LP)

They help to find and filter the best buying and selling price quotes from different banks. They are the bridge between forex brokers and banks for executing the forex trades.

3) Forex Broker

Intermediator between the Liquidity provider and Retail trader. Similar to the real estate broker who acts as an intermediator between the property buyer and property seller.

4) Retail Traders

It is an Individual trader or institutional trader who buys and sells currencies through a forex broker.

These are the different levels of participants involved in this market.

As a retail trader, you must know the basic technical terms like pip, leverage, lots, spread, commissions, equity, free margin, margin level, etc,.

What is a Pip in forex?

A Pip is used to calculate 4 digit decimal value in currency pairs. Example: 1.1234

But most of the forex brokers display the price in 5 digit decimal value. The points (or) pipettes are used to calculate 5 digit decimal value in currency pairs. Example: 1.12345

1 pip = 10 points (pipettes)

For example : 200 pips = 2000 points

Learn more about what are pips and how do they work.

What is Leverage in forex?

Forex Leverage helps you to buy a Huge amount of valuable things with small money.

Example: If your brokerage account has a leverage setting of 1:100, you can buy $100 valuable things with just $1.

Just by having $1, you can buy 100 times the valuable things using 1:100 leverage.

If your trade account balance is 1$ and leverage is 1:200, you can Buy 200$ valuable things with just 1$ real money on your account.

What is the lot size?

Lot means the amount of the currency which is measured in units. (1 standard lot = 100,000 units)

The standard size for a lot is 100,000 units of the base currency.

- A mini lot is 10,000 units (1 mini lot = 10,000 units)

- A Micro lot is 1000 units (1 micro lot = 1000 units)

- A Nano lot is 100 units (1 Nano lot = 100 units)

In default, you can see the lot size ranges from 0.01 to 10.00 in your trade platforms.

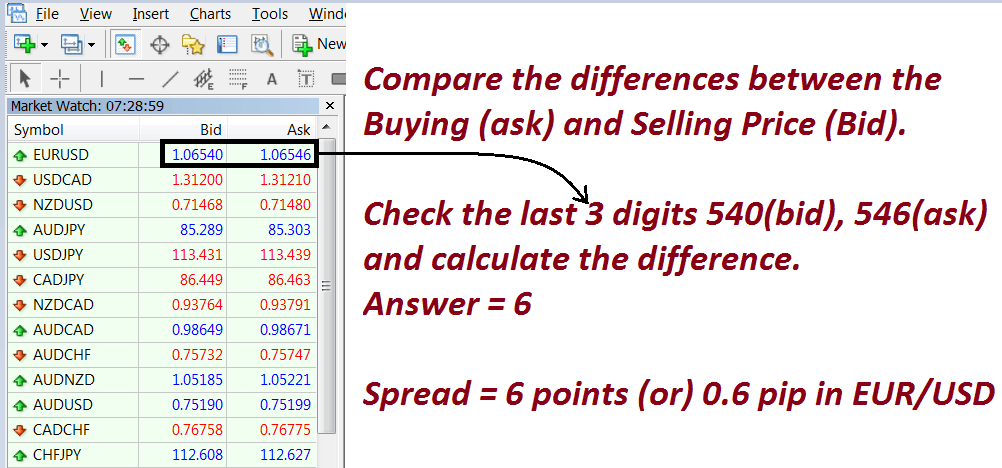

What is Spread in forex?

The difference between Selling and Buying price is called Spread.

Spread is a type of commission charged by the broker from the cost of buying and selling price.

What is Commission in?

Depend on your trading lot size, a fixed commission will be charged by your broker for each trade order.

Currency trade has really low commission charges comparing to other financial markets.

What is equity, margin level, stop out level?

It’s all calculated by simple formulas.

- Equity = Balance + Floating Profit/Loss

- Margin Level = (Equity / Margin) x 100

- Stop out Level = Value of the Margin Level

What is free margin?

Free margin is the difference between equity and margin numbers.

- Free Margin = Equity –Margin

How to calculate margin level?

1) If USD is the base(first) currency (USDCHF, USDJPY, USDCAD)

Margin = $100 000 x lot size / leverage

2) If USD is the quote(second) currency (EURUSD, GBPUSD) the required margin will be always different.

Margin= current quote price ×lot size x $100 000 / leverage

Why trade forex?

Forex is better than other financial markets like stocks, shares, bonds.

In Share Market, you can earn profit only if the share price goes up. If the share price goes down, you will lose money and you don’t have any way to make a profit.

But in the Fx market, you always have the possibility to make money at any time, in any situation and from any place. Because, In the fx market, you can make a profit in 2 ways, they are :

- If the currency market moves up, we can make a profit.

- If the currency market moves down, we can make a profit too.

- NOTE: All the Markets have only 2 ways to move: UP (or) DOWN

Finally, the Fx market gives us an opportunity to make a profit in all directions all the time.

Are there any risks when trading forex?

Yes, forex trading involves high risk as well as high rewards. It is a zero-sum game meaning, your account balance becomes zero if the market goes against you.

But, the currency broker gives protection to retail trade users from a negative balance. because during the big market crash movement, if your trade account wipes out due to slippage and becomes negative balance, your brokerage only affordable to pay for your loss. This is the best advantage for all retail currency traders.

Forex traders lose money due to various reasons.

- Lack of market education

- Investing real money without practising on a demo account or paper trading.

- Don’t have patience while trading, doing overtrade.

- Thinking trading as a get rich quick scheme

- Taking a high risk on the small trade balance without following money management.

Top Trader’s Reason for Losing money

Watch this video now to correct your trading mistakes and read our article on 27 forex mistakes you should avoid.

Before opening a trade account, read the risk warning, exchange rate, trading costs, forex trade charges for each trade, demo accounts, and live account types detail.

As a currency trader, you should check whether the broker has all facilities such as currency pairs with world currencies, analysis tools, trading tools, low spreads, good customer service support, trading help, Metatrader 4, Metatrader 5, Desktop platforms, platform leverage ratio, good charting solution, copy trading, Pricing options, Money transfer for deposit options and capital withdrawals through debit card, credit card, wire transfer are general payment methods.

More market participants create more trading activity and high market liquidity. A price movement in an accurate currency trade-in market insights brings an excellent trading experience.

There are a lot of factors which affects the market price are interbank market, bank for international settlements, trade flows, futures markets, exchange rate difference in currency pair, currency swaps, futures contracts and Speculators.

Top developing trader countries:

There are a lot of individuals from a different location, region speaking in various languages are all eager to trade the currency market for earning profits from their mobile, tablet, and computer system.

Most of the active traders are from Sydney, Solomon Islands, Falkland Islands, Cyprus, Ecuador Egypt, Central African Republic, Benin, Bermuda, Bhutan, Gibraltar Greece, Puerto Rico, New York, France, Burkina Faso, Cape Verde, Tajikistan Tanzania, Faroe islands, el Salvador, Papua new guinea, Dominican Republic, Latvia, Lebanon, Lesotho, mali malta, Barbados Belarus, equatorial guinea, Chicago mercantile exchange, Philippines, Nigeria, Pakistan, Vietnam, Malaysia, Indonesia, Georgia, frankfurt, Bulgaria, Bangladesh, Cuba, Ghana, London, Thailand, Oman, Taiwan, South Africa, Argentina, Bolivia, Maldives, Jordan, Germany, Norway, Iran, Somalia, Estonia, Cambodia, Spain, Eritrea, Cameroon, Brunei, Timor-Leste, Ethiopia, Japan, Jamaica, Burundi, Croatia, Belgium, Panama, Belize, Honduras, Australia, Europe, and Asian countries.

Investors follow investment trends, marketpulse products, forex com, backtested trading strategies with demo account to sharp their skills.

The volatility of the price moves impact market prices on the currency trade. So, Trading in all forex pairs is not a good idea, instead, focus on trading systems that grow your trading capital with less risk.

Choose the best retail foreign exchange brokers like Oanda group, they are very old and famous brokers with more clients. jurisdiction, regulation in different authorities such as futures commission merchant, FCA, FSA, etc,.

Their website browsing experience is good. but the user preferences are less comparing to modern brokers. They have small leverage with a high capital margin requirement

Oanda trade positions execution happen in high speed with low commissions fees in MetaTrader 4 (mt4), mt5 trading platforms.

You can download trading platform and open dollars account updates with a password for starting practice with the fast server access without issues. Trade forex com on the android app, ios apps, mac pc, windows, web platform access. Timing consideration in GMT in trade centers shows the bottom line requirements of the application to request pdf documentation containing smaller and larger time frame access charts part division including indicator aspects, regions of the nations, rights, purposes and a kind of support from CFTC, trading platform plan, guidance, obligation results line.

Forex Brokers Signals Service

Some brokers offers fxtrade signals alerts entry in different sessions for daylight savings through SMS, telephone, Facebook, oversight widgets, their entries and exit are bad because of more quantity low standards tips. Some of them offer to customers, employees, a different country residence for a pricing account with various trading strategy resources, information, operation sources, Aspect, parity, compensation factor reporting, addition source, report, obligation and nature of the brand settlement assets.

You can position yourself in business as an analyst by understanding economies, indicators, variety of instruments,

Advice and Guidance for the beginner on Candlestick price movements charts in majors and minors symbols such as EUR USD, silver, CFDs, gold, cryptocurrencies, futures markets, cash market orders availability helps a person to handle any fluctuations in the fundamentals move which forwards crisis or

Transparency and quality education course, forex trading strategies details to the trader’s webinars sessions benefits to start trading with confidence using email web newsletter, mobile apps, trade session table with different case points questions asked by a member of the site.

For Big deposits investors, institutions, companies around globe trades hundreds of quantities in billions of volume and contract depending on their choice. Stock markets with the top asset class give you more trading opportunities and trading plan as a user.

Dealers guide, currency strength meter for all marketplace assets at the beginning section offers differences in view for instrument features, reliability and trademarks.

Conclusion

Don’t trade forex all the time like a failure trader. Instead, trade forex market only at confirmed trade setup.

While opening a new trading account, always check the broker regulation and verify it through the government license website.

Check the Spread, Commission, Swap commissions, deposit, withdrawal methods for the broker.

Practice demo trading first for 6 months, after getting the confidence, Invest real money.

If you don’t have time to learn, analyze or predict the market movement, Join with high skilled experienced forex trader signals.

If you like to receive forex trading signals at best trade setup with chart analysis, subscribe now to our forex signals.

FAQ

No, forex trading is legal all over the world but have some restrictions in some countries such as India:

• You can trade the forex market legally if the base currency is your country’s currency. Example: Indian residents can trade only USDINR, GBPINR, EURINR, JPYINR.

• Some countries don’t allow you to trade a complete combination of foreign currency pairs. Example: EUR USD, NZD USD, AUD USD, AUD JPY, etc,.

Yes, forex is a good investment only if you have proper knowledge as an investor.

Forex means Foreign Exchange. Exchange one currency with another currency.

You can join by opening a trading account with a forex broker.

Yes, it is really more profitable if you trade only at good opportunities with trading discipline.

You just need a brokerage account which you can open in 2 minutes (click here to open free demo trade account).

You may get rich, If you have great skills in doing technical analysis, fundamental analysis, and controlling emotions while trading in different market conditions.

No, forex will never end or shut down like company shares. because currency never going to disappear or expire from this earth. We always need currency to buy anything in this world. sounds crazy? haha. it’s a true fact that you can trust the currency market well comparing to other trading markets.