Introducing NZDUSD

NZDUSD is among the major forex pairs in the forex industry. It is the tenth most traded currency pair and is quite popular among traders worldwide. Almost every broker will have this dynamic pair available to you for trading. It’s quite surprising that this currency pair has managed to be placed under the major pairs. This spot is usually reserved for the currencies which show more movement. NZDUSD can be considered a relatively stable pair if compared to the other pairs in this list. Why it still made this list and why it’s so popular among traders is a question that’s probably hot on your mind right now. You’ll just have to read on to find out! Before we get into the good stuff, let’s get a little bit of historical background on each of these currencies as an individual. This will help make understanding them as a pair a lot easier.

New Zealand Dollar

NZD or New Zealand Dollar came into existence in 1967. Previous to this, New Zealand had been using the New Zealand Pound as their currency. Until 1985, New Zealand Dollar was in a fixed exchange rate with the U.S. Dollar. It was only after 1985 that they were allowed to use their own floating rates.

Over the years, their physical notes have gone through several changes to appear visually attractive but also have better safety. In 1999, New Zealand had changed the material of their notes into polymer and plastic. This was done to make it much easier to find fake notes. This also makes the notes waterproof and harder to tear apart. The prints on their notes are known to be really colorful and they’re consistently updating the design in order to make it more presentable.

United States Dollar

Although the introduction of the dollar is not particularly necessary, it would be inconsiderate not to do so. The US dollar, commonly known as the USD, is the most actively traded currency in the world. It is the most widely used currency and is frequently used as a standard currency for all monetary evaluations. The Federal Reserve Bank, or “Feds,” as they are more often known, issues this valued money. After they ran out of coins to pay the Civil War, the first paper dollar was printed in 1862. Many financial markets throughout the world now accept the USD as a mainstream form of payment.

Why Trade NZDUSD

There has to be a reason why this currency pair is so popular among traders. We did some research and have come up with some of the top reasons why you should trade NZDUSD:

High Interest Yields

New Zealand is known for its high interest rates provided by the central bank. These high interest rates are even greater than some of the market leaders such as the U.S., U.K., or even Japan. Due to these high interest rates, traders are attracted to the NZDUSD currency pair due to its high interest yields. The reason this pair has high yields is due to the fact that their interest rates have a great difference between them. Due to these high yields, a carry trade is the popular move used by traders when trading this currency pair. Carry trading refers to selling a currency with a low interest rate to buy one with a higher interest rate.

Safe-Haven Asset

Oftentimes, the forex markets will experience days, or even weeks, where the market is constantly unstable. The forex pairs would be constantly fluctuating in value with no real market direction being seen. These trading conditions can cause traders to lose a ton of money as they can never be sure when the market is going to flip. This is exactly why NZDUSD is very popular. It is one of the few currency pairs that don’t experience much instability. In fact, this dynamic duo actually increases in value when the other pairs are suffering. This is why it is also considered a safe-haven asset. Traders look to buy this currency pair when the economy is unstable as they know their investment is safe with it due to it being a very stable asset.

Market Volatility

You may be asking why NZDUSD is considered a major pair while being very stable and calm. One of the primary reasons is the predictability of its market. As you can see, the NZDUSD enjoys very steady market conditions most of the time. This is mostly due to New Zealand’s excellent economic structure. It does, however, exhibit instability on occasion. The great part is that these moments of volatility are extremely predictable. This indicates that experts are already ahead of the dynamic duo and can predict when this currency pair will exhibit volatile market circumstances. As a result, the NZDUSD is quite popular among scalpers, who take advantage of these periods of volatility to make a fast profit.

NZDUSD Trading Tips

Whether you’re a newbie or an established trader, you can never have too much practical advice to aid you along the way. At the end of the day, we are held liable for any losses, thus we must proceed with the utmost caution on our journey. We’re all here to make money for ourselves while also ensuring that our fellow traders can put food on the table whenever they decide to trade. Here are some of our top NZDUSD trading recommendations:

Carry Trading

Carry trading is one of the most popular trading strategies used for the NZDUSD currency pair. This is because the New Zealand Dollar has a significantly higher interest rate than the United States Dollar. Due to these differences in interest rates, this forex pair gives a high interest yield. Carry trading refers to selling an asset at a lower interest rate in order to buy another asset at a higher interest rate. It is important to note that although this strategy is perfect for this dynamic duo, it is still a pretty risky strategy and needs to be traded with extreme caution.

Economic Indicators

In order to successfully trade this currency pair, there are a couple of economic indicators that you need to keep an eye on as they could impact market conditions. The Gross Domestic Product, or GDP, is an important factor to watch out for as it gives hints about the demand for the currency of a country. If the GDP of NZD is high, the demand for NZDUSD would be quite significant as well. However, if the GDP of USD is high, the demand for NZDUSD would be quite low. The Consumer Price Index, or CPI, is an important measure of inflation in an economy as it measures the change in price levels. This is important in analyzing the stability of the NZDUSD markets. We also have to look towards the Balance of Trade for each individual currency in order to understand if their products are in demand. This in turn will have a direct impact on their markets as well.

Support and Resistance Levels

The ability to identify and understand support and resistance levels is essential for succeeding with any trading strategy with any currency pair. Support levels refer to the lowest points in a chart pattern, whereas resistance levels refer to the highest points in a chart pattern. On a typical day, the NZDUSD chart does not move much. It would barely shift slightly up or down before returning to its original position. As a result, determining the support and resistance levels for this fascinating pair may be a little more difficult. But that’s all the more motivation to do so. It is also critical to understand why these support and resistance levels are crucial when trading this major currency pair.

Factors Affecting NZDUSD

Despite NZDUSD being considered among the stable major forex pairs, there are actually a couple of factors that impact its movement. Factors impacting the NZDUSD market include:

Dairy Market

The NZDUSD currency pair is greatly impacted by any changes to the dairy industry. This is because New Zealand is the largest exporter of whole milk powder around the world. Their economy is largely dependent on the demand for this product.

If the demand for this product increases, NZDUSD will be greatly benefitted. Similarly, if the demand for this product decreases, NZDUSD will fall in value as their economy will suffer. We can also look at this from a price point of view. An increase in price for these types of dairy products would raise the value of NZDUSD and a decrease in price would cause NZDUSD to fall in value.

Tourism Industry

New Zealand greatly depends on its tourism industry in order to thrive economically. They’ve recently been among the top destinations for tourists globally. This is mainly due to the great tour packages and other facilities that they offer. The more tourists that visit New Zealand annually, the better NZDUSD will perform. Similarly, if New Zealand starts to face seasons of slow tourism, NZDUSD will suffer as well. This can be seen during the COVID-19 pandemic when New Zealand had to shut its borders due to health and safety concerns. It had caused the tourism industry to face a major decline which in turn hurt this major pair as well.

Commodity Markets

New Zealand is among the largest exporters of valuable commodities such as Gold and Silver. Therefore their economy greatly depends on the export of these commodities in order to thrive and increase in value. Any changes to the market for these commodities such as demand or prices will have a direct impact on the NZDUSD pair. If the demand for gold increases, New Zealand will export more gold and therefore, NZDUSD will increase in value. If the demand for gold decreases, New Zealand will suffer as they wouldn’t be able to export them as much, and therefore, NZDUSD will decrease in value. This can be seen during wedding seasons in Asian countries where the demand for gold increases during wedding seasons which in turn causes NZDUSD to increase in value.

Unemployment Rate

Unemployment is a huge contributing factor to a country’s economy. If a person is unemployed, it is a burden on the government’s end to provide basic necessities for them for survival. Therefore the more the number of unemployed people, the more burden it is on the government to use their reserves to provide for the unemployed people. The higher the unemployment rate in New Zealand, the poorer will be its economy. This in turn would cause NZDUSD to depreciate in value. Similarly, if the unemployment rate is low, the economy would be thriving and the value of NZDUSD would also appreciate.

Interest Rate Decisions

Interest rate decisions are a major contributing factor towards the movement of NZDUSD in the forex markets. Any rise in interest rates for the NZD will have a directly proportional impact on the NZDUSD currency pair. Similarly, any rise in interest rates for the USD will have an inversely proportional impact on NZDUSD.

A great example can be seen when the Feds decide on increasing their short-term interest rates. This had caused the NZDUSD pair to decrease in value. If the New Zealand central bank decided on increasing their interest rates any more than what it already is, the NZDUSD pair would appreciate in value.

Gross Domestic Product

The Gross Domestic Product, or GDP, shows the overall performance of a country’s economy. It is a major contributing factor to the movement of the NZDUSD pair. A positive GDP value would signify that the economy is thriving. This would in turn attract investors to invest in the country’s economy which would therefore increase the value of that country’s currency. If New Zealand has a positive GDP, the New Zealand Dollar would increase in value which would cause NZDUSD to also increase in value. The opposite can be seen in the case of the U.S. Dollar. If the United States displayed a positive GDP, the USD would increase in value which would, in turn, cause NZDUSD to decrease in value.

Most common questions asked by the forex traders about NZDUSD:

Forex GDP, Babypips, Tradingview, Forexfactory.

NZDUSD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

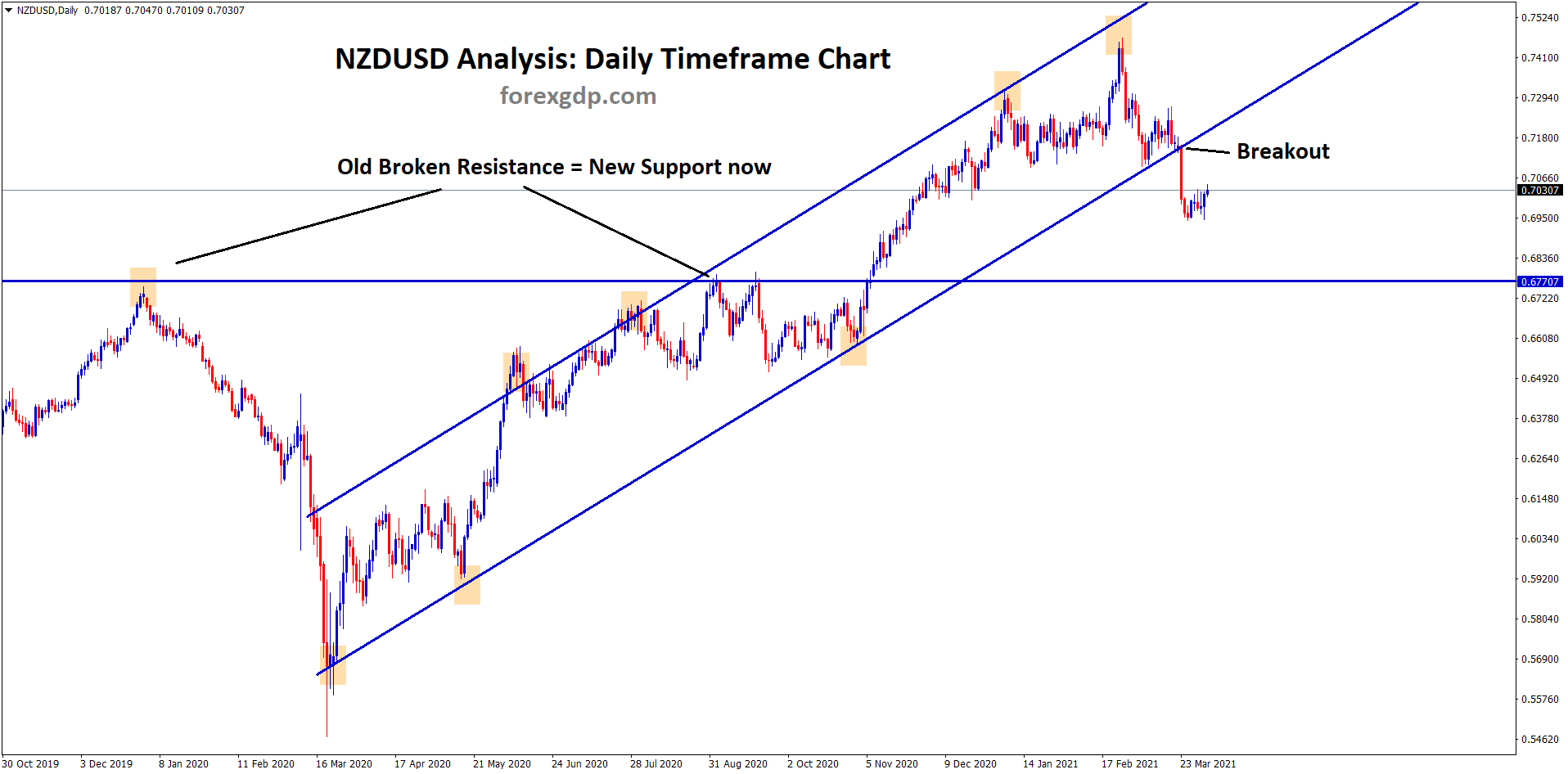

Breakout at the trend line and old resistance = new support now

NZDUSD Analysis Recently, NZDUSD has broken the bottom level of the Uptrend line. If NZDUSD continues to fall, then it

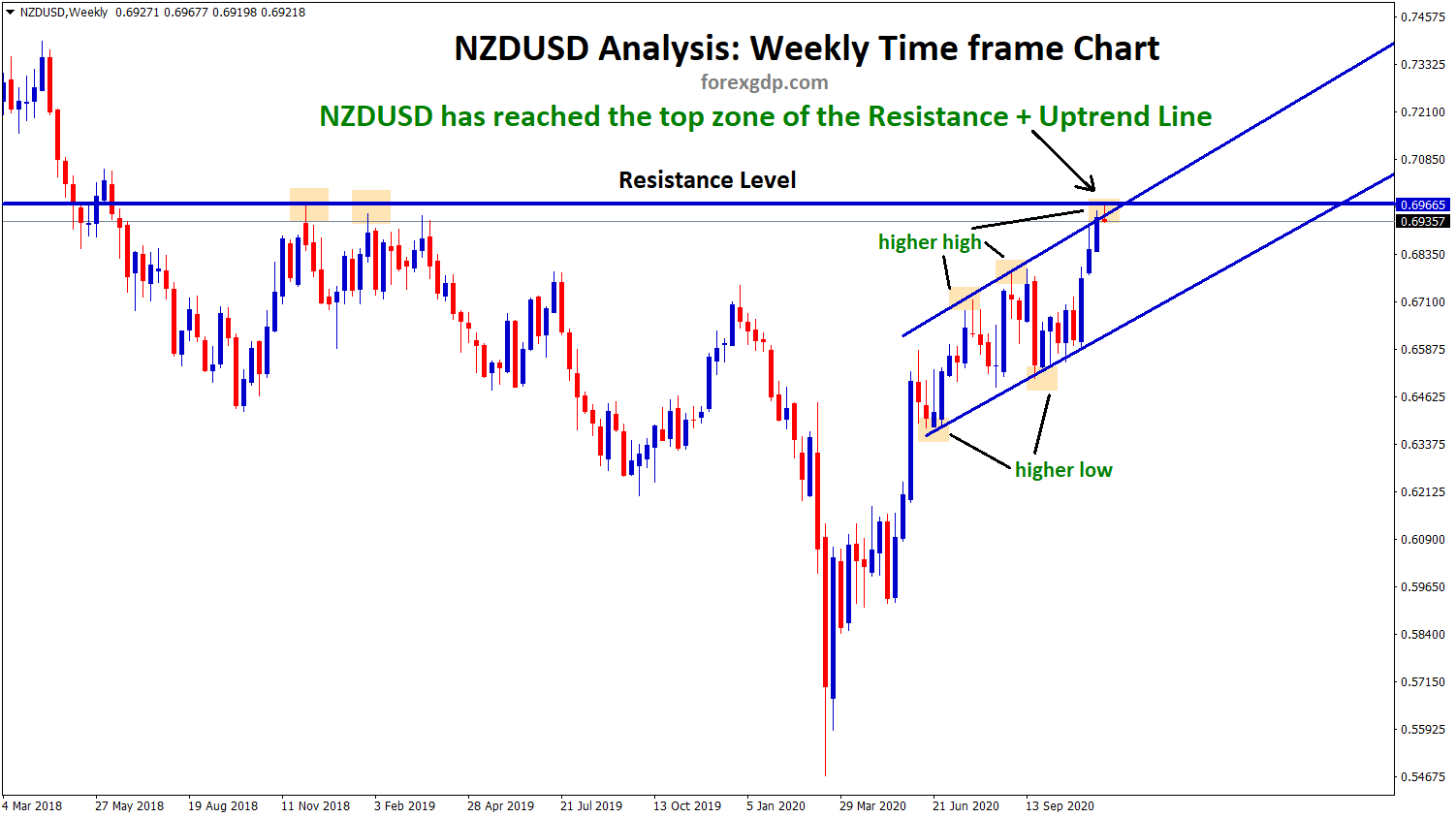

NZDUSD falling from the top of the Resistance + Uptrend Line

NZDUSD Analysis NZDUSD has reached the top zone of the resistance level + top zone (higher high) of the Uptrend

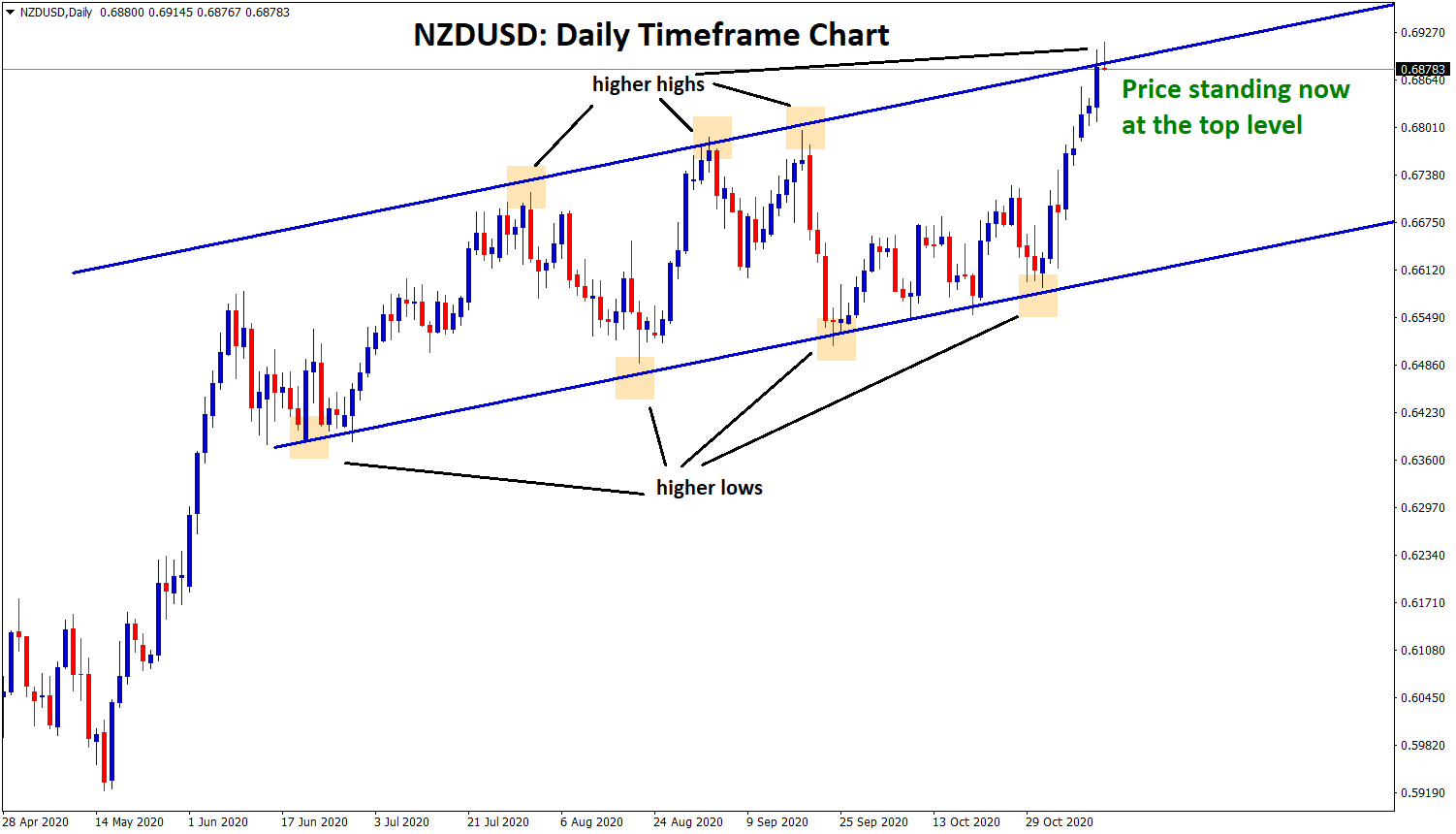

NZDUSD Standing at the Strong Resistance Level

NZDUSD Technical Analysis NZDUSD is moving in an uptrend by forming higher highs and higher lows. Now, the NZDUSD price

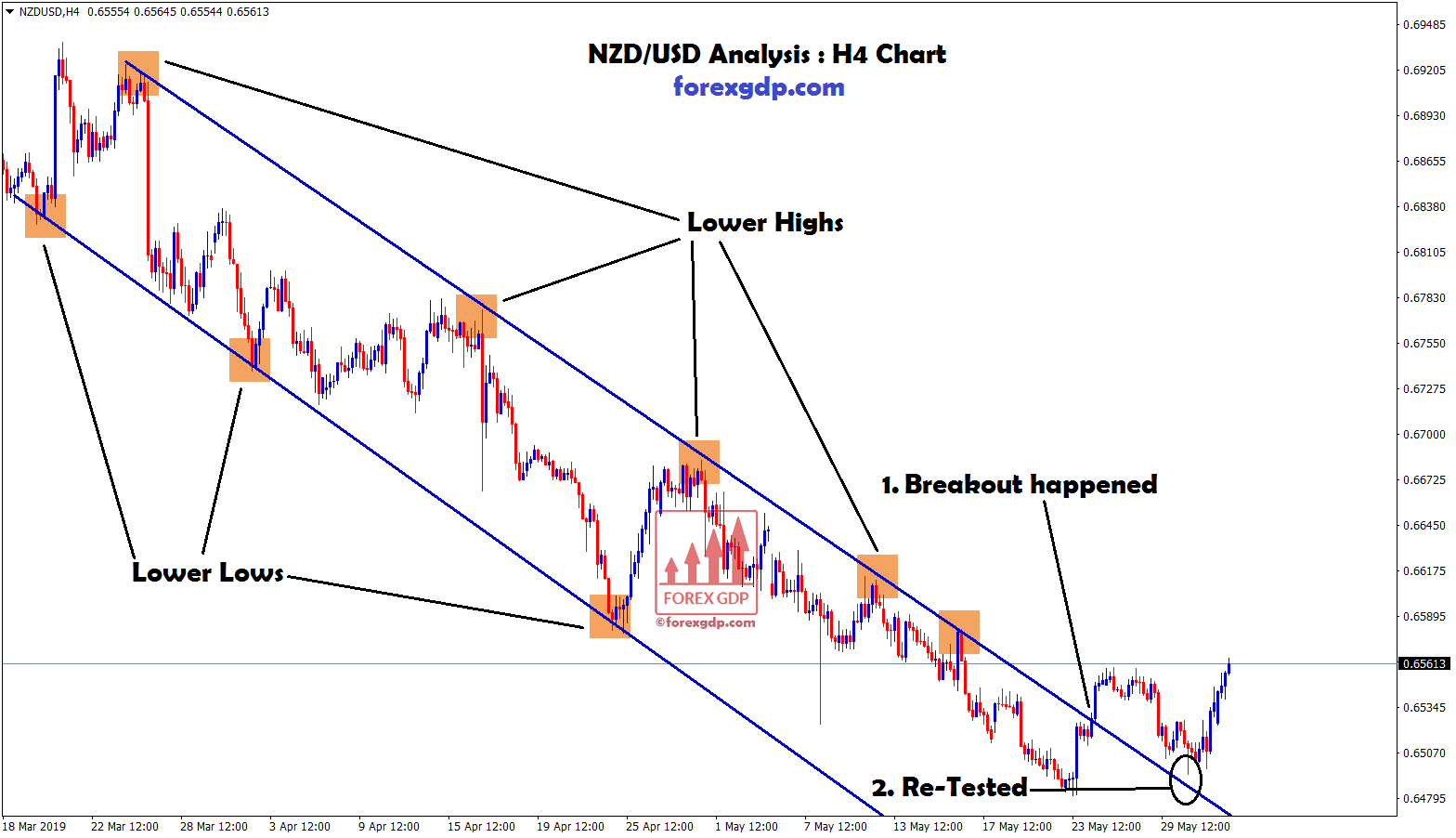

+1165 Points Profit Reached Successfully in NZD/USD Buy Signal

NZD/USD Analysis : NZD/USD has moved in a downtrend by forming Lower Highs and Lower Lows in H4 Chart. Now,