Probably, you know by now that forex is a big market. We’re talking about a giant compared to other markets. GBP/USD is one of the most traded pairs in this giant market.

Why?

Because it combines currencies of the world’s largest economy, the U.S., and major economy, Great Britain.

So, that’s why people are drawn towards it.

In this guide, we’ll present an overall picture of GBP/USD, so you can grasp what the pair is all about.

History of GBPUSD

Let’s start our guide with the history lesson.

First, let’s discuss the British pound. The pound sterling comes from the Latin term Libra, which means “balance and weight.”

The Bank of England initially produced pound banknotes more than 300 years ago, and the notes have gone through several changes since then. The pound coin first debuted in 1489, during Henry VII’s reign.

Pound notes were circulated in England in 1694, shortly after the Bank of England was established, and the notes were originally handwritten.

The history of the USD began with efforts by the Founding Fathers to develop a national currency based on the Spanish silver dollar.

The Coinage Act of 1792, passed by the new Congress, established the United States dollar as the country’s primary unit of currency. It embraced the gold standard in 1900 and eventually cut all ties to gold in 1971.

Did you know that GBPUSD has a slang name, “Cable?” It is one of the most frequently traded currency pairings on the forex market.

But what’s the backstory of the name?

The whole affair began in the nineteenth century. There were no fiber optics back then. Instead, messages were sent over actual wires between London and New York.

An underwater cable was used to transfer the GBP/USD exchange rate. This concept was presented in the 1840s and put into action in 1858. As a result, GBP/USD became known as the Cable.

Exchange rate history

Now that you know the history of both GBP and USD let’s find out their exchange rate history.

As you can see, the rate hit an all-time low in 1985. Since then it made an upward movement, trading at around 2.06 in 2007, but sliding down afterward. The pair reached an all-time high in 1972 when trading at above 2.60 level.

When Britain decided to exit the European Union in June 2016, the GBP/USD fell sharply. The GBP/USD pair plunged 10% in one trading session and over 20% in the month, leading to the Brexit vote. At writing, the pair is trading at a 1.33 level.

Why is the GBP rate stronger than USD?

When you look at the chart, you see that since 1971, GBP has been consistently stronger than USD, which makes you wonder why GBP is stronger than USD?

There isn’t a single factor for this. Instead, what counts in terms of strength is how a currency’s value varies over time to other currencies.

For more than 30 years, one U.S. dollar has been worth less than one British pound. This pattern reflects deteriorating economic conditions in the United Kingdom, mostly due to Brexit, paired with a rising U.S. economy.

How to trade GBPUSD?

To trade GBP/USD, you need to open an account with the broker, deposit funds, and pick GBP/USD as your pair.

If the current quote of GBP/USD is 1.3300 indicates that one GBP is worth 1.33 dollars. We know forex pairs comprise base and quote currencies. So, here, the base currency is GBP, and the quote currency is USD.

Let’s give an example of how you can trade the pair.

Suppose you want to go short (sell) GBP/USD at 1.3300. Then, the market starts moving in your direction, and the EUR/USD rate becomes 1.3200. So, you make a cool 100 pips profit.

Let’s say the market doesn’t go in your favor and starts declining, and the rate becomes 1.3350. In this case, you lost 50 pips.

Factors affecting GBPUSD

There are a lot of factors that can affect the Cable. Knowing them will help you understand the pair better and make your trading positions accordingly.

Monetary policy

The central bank of a country uses monetary policy to govern money in the economy. The primary goal of monetary policy, notably comments and interest rate decisions issued by the Bank of England BOE and the U.S. Federal Reserve, is to stabilize the economy.

The monetary policy committee, or MPC, makes significant interest rate decisions in England. In the United States, the Federal Reserve is in charge of such policies. As a result, these announcements are among the most volatile market events for the GBP/USD pair.

Inflation

Many people use the term “inflation” without fully realizing what it signifies. However, one of the greatest causes for the pound’s decline against the USD is inflation.

Inflation raises the price of products and services over time, reducing the number of goods and services you can purchase with a currency in the future vs. now.

The rate of inflation in the United Kingdom and the United States may significantly influence the value of respective currencies.

Employment figures

GBPUSD traders should watch both the U.S. and U.K. unemployment rates. In addition, employment statistics are a very important economic report following a BOE or FED rate decision.

The higher the unemployment rate, the more damaging it is to the economy. As a result, any month-to-month changes in the unemployment data given by the BLS (Bureau of Labor Statistics) in the United States or the Office of National Statistics in the United Kingdom can create significant fluctuations in the GBPUSD currency pair.

The NFP report, or Nonfarm Payrolls report for the United States, contains the most generally followed employment numbers.

Any large and unexpected variation from expert predictions can cause values in the GBP USD pair to rise or fall in the blink of an eye.

Political situation

A currency’s value is impacted by factors other than interest rates and inflation. As a result, even the most knowledgeable financial professionals can be caught off guard regarding political influence on a currency.

Like elections, Brexit, the US-China trade war, and others, many events influence the GBP/USD exchange rate.

Brexit has been one of the primary variables driving exchange rate volatility and the pound’s value against the U.S. dollar during the previous five years.

The impact of Brexit was notably visible immediately following the vote outcome, with sterling seeing its greatest single-day drop in 30 years.

GBPUSD correlation

The GBPUSD currency pair negatively connects with the USD/CHF currency pair and positively correlates with the EUR/USD currency pair. This is owing to the Euro’s, Swiss franc’s, and British pound’s positive connection.

Before the 2008 Great Recession, the GBP/USD was closely connected with the Australian and New Zealand dollars, as investors acquired these high-yielding currencies.

What’s the best time to trade GBPUSD?

The chart above illustrates the ideal times to trade the GBP/USD. 06:00 to 16:00 is an ideal time to trade the GBP/USD. There is enough movement to potentially profit while covering spread and commission charges.

However, if you can, day trade the GBP/USD only between 08:00 and 10:00 GMT and/or 12:00 and 15:00 GMT.

This will increase efficiency. You’ll see the largest changes of the day during these times, which implies more profit potential, and broker’s spread and commissions will have the least influence on prospective profit.

In addition, both London and New York are open during these times. Because there is a lot of volume coming in from two large markets, spreads are usually the tightest at this time.

Strategies for GBPUSD

When it comes to trading the GBPUSD, you can apply tons of strategies. Here are a few of them:

Trend trading

Trend trading is a strategy in which traders wait for a clear trend to form before taking a position. This is a trend when the price travels in one broad direction, such as up or down.

Trend traders take a long position when a pair is rising. An upswing is defined by higher swing lows and higher swing highs.

Similarly, trend traders may choose to initiate a short position when a currency pair falls in value. A downtrend is defined by lower swing lows and lower swing highs.

You must study price movement and other technical indicators to determine trend direction and when it may be reversing.

For an uptrend to occur, the price must rise above previous highs, and when the price falls, it must remain above the swing lows that preceded it. This shows that the main trend is upward despite price swings up and down.

The same concept applies to downtrends, with traders watching to see if the price makes lower lows and lower highs overall.

Pullback strategy

A pullback is price movement that occurs when a moving market retraces a portion of its gains before continuing in the same direction.

A pullback is not the same as a reversal, a more lasting move against the existing trend. You must assess if the price decline represents a pullback or a complete trend reversal.

The benefits of trading trend pullbacks include buying cheap and selling high. You’re buying low if we’re trading pullbacks in an upswing. Conversely, when we sell pullbacks in a downtrend, we are essentially selling high.

Breakout strategy

Any price change that happens outside of a set range is referred to as a breakout. This is referred to as support and resistance.

Prices can break out when they climb above resistance levels, which is known as a bullish breakout. They can also appear when prices fall below support levels, referred to as a bearish breakout.

Breakout trading is an important strategy since breakouts typically herald the start of increased market volatility. We may take advantage of volatility by waiting for a price level to break and then joining a new trend as it begins.

Breakout trades include entering the market just as the price makes a breakout and then riding the trade until volatility decreases.

What trading style mostly suits GBPUSD?

To apply the strategies we mentioned above for GBP/USD, you need to have a trading style. Here are mostly used trading styles for GBP/USD:

Day trading

Day trading is a common style of trading in which you buy and sell a currency pair in a single trading day to profit from price fluctuations.

Day trading is a sort of short-term trading, but unlike scalping, you typically only open one deal each day and close it at the end of the day.

Day traders often set aside money at the start of the day, focus on their trading strategy, and conclude with a profit or loss.

Scalping

You’ve undoubtedly heard the phrase “scalping.” if you’re new to F.X. trading. Scalping in the forex market is exchanging currencies based on various real-time indicators.

Scalping is the practice of profiting by purchasing or selling currencies for a short period and then closing the position for a little profit.

Its name is derived from the method through which it achieves its objectives. For example, a trader seeks to “scalp” a big number of little gains from a large number of trades over time.

Positions trading

Many position traders look for solutions that eliminate all of the risks.

Why?

Because they aim to remain here for the long term.

Position trading is the most time-consuming sort of trading. Position traders hold positions for months or even years at a time. Then, they enter the trades and then forget it (not literally).

Rather than scalping for a few pips, the goal is to remain calm and wait for larger profits. This is a type of trade that is identical to investing.

Final thoughts

So, now you know everything about GBP/USD.

If you are looking to trade the pair, you must understand the abovementioned factors. In addition, the Cable is one of the most traded pairs, so any news from both sides of the pond can impact the pair.

Most common questions asked by the forex traders about GBPUSD :

GBP/USD currency is impacted by the news like Brexit, Bank of England BOE announcements, etc.

Yes, it is suitable for all types of investors due to it’s good price volatility and movement every year.

The common Currency “USD” causes the correlation between Euro and pound to move in the same direction. but the internal economic impacts drive the euro and pound sterling differently.

Yes, a few pairs like USDCHF, USDJPY has a negative correlation with GBPUSD price movement.

1 GBPUSD lot size equal to 100,000 Units of USD.

Yes, pivot point price levels work well on GBPUSD – suitable mostly for Intraday trading.

UK session in the forex market is the best time to trade the GBPUSD currency pair.

GBPUSD forecast is done perfectly by the forex experts team like Forex GDP, Forex Factory traders.

GBPUSD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

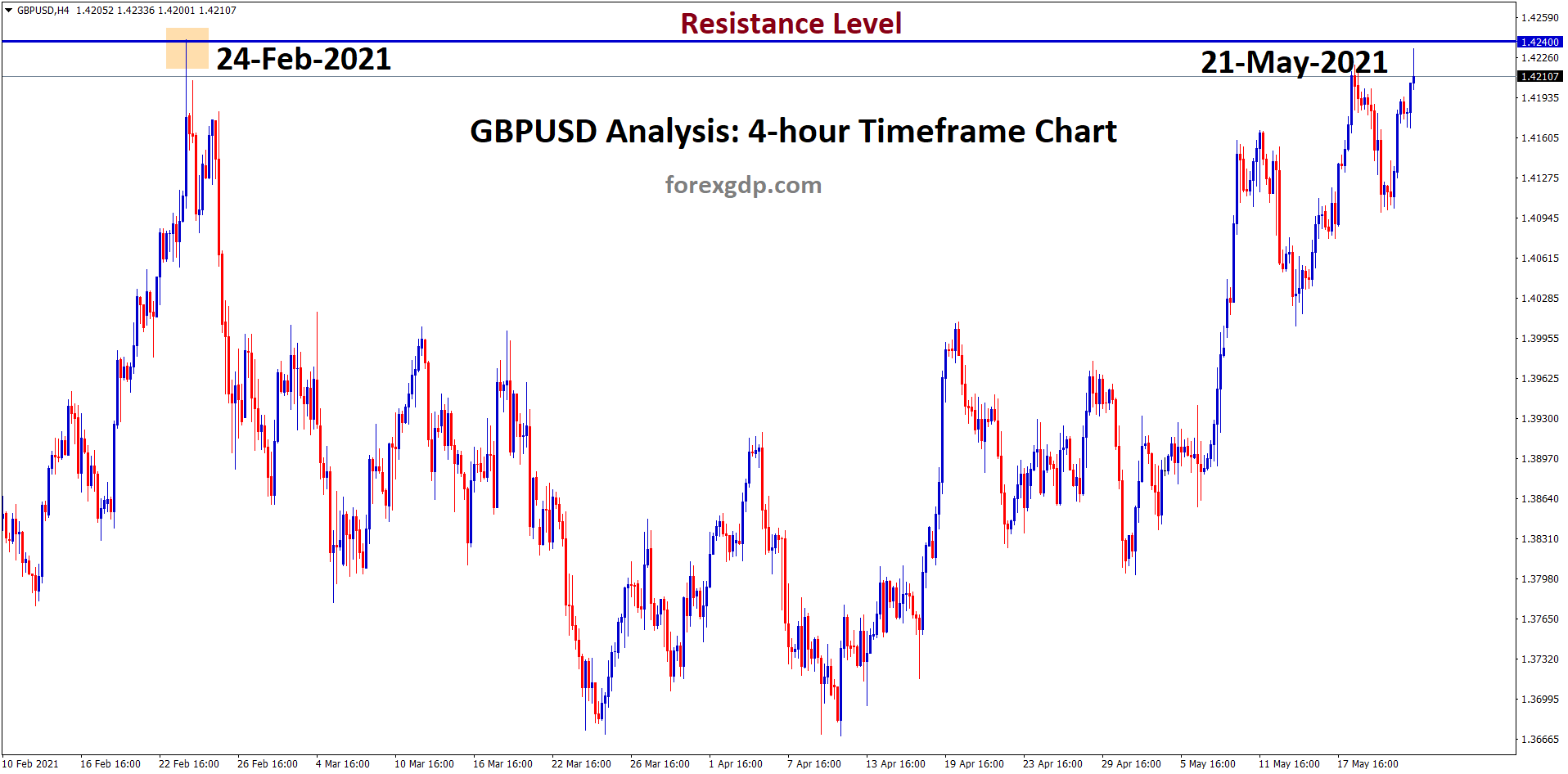

GBPUSD reached the Resistance level after 3 Months

GBPUSD hits the Major Resistance level after 3 months. In another Uptrend view, From the last 2 weeks, GBPUSD is

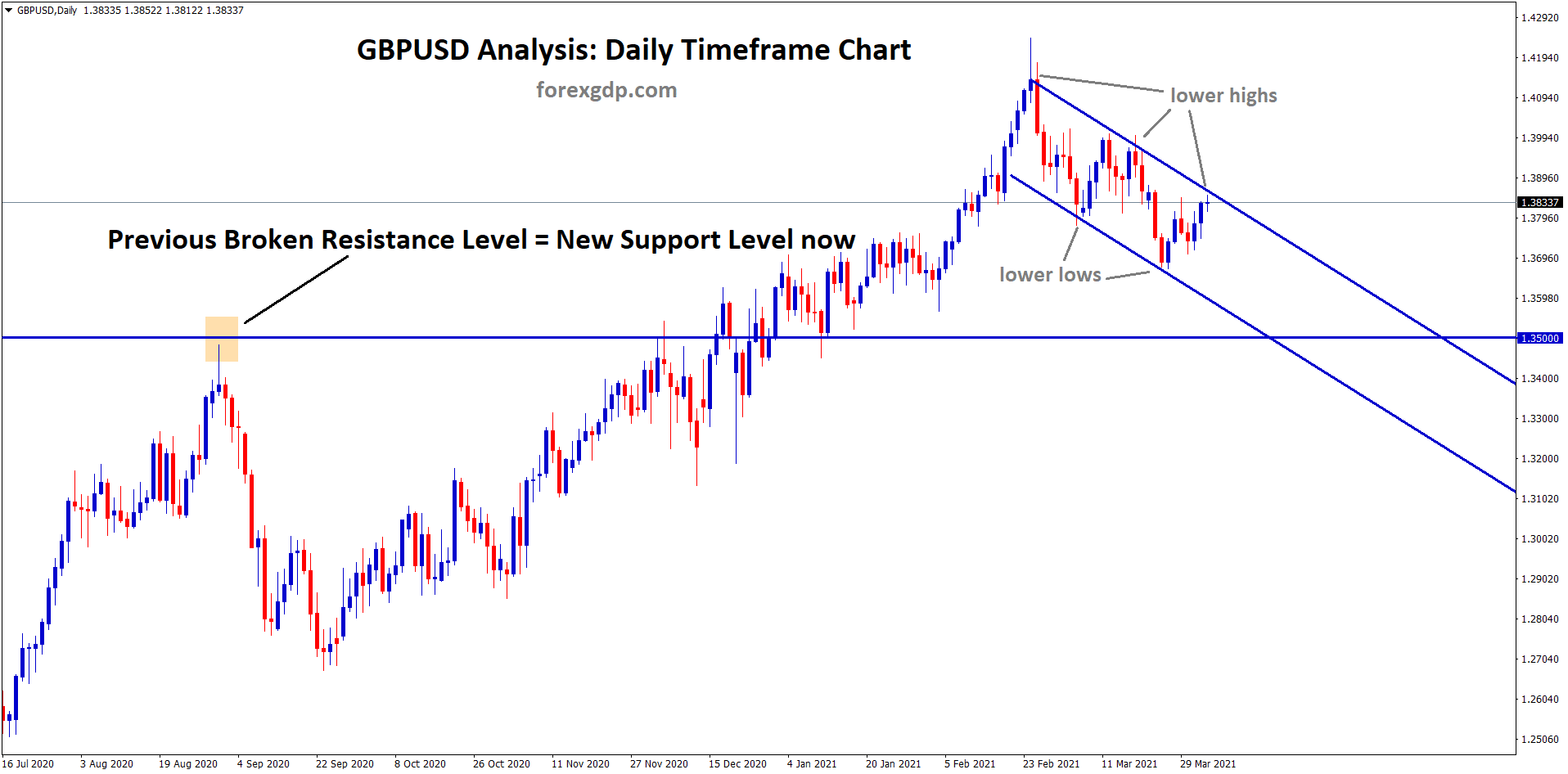

GBPUSD descending channel moving towards the Retest zone 1.35

UK Government announced 400 Million for a Loan UK Government has announced the 400 million pounds as Grants and Loans

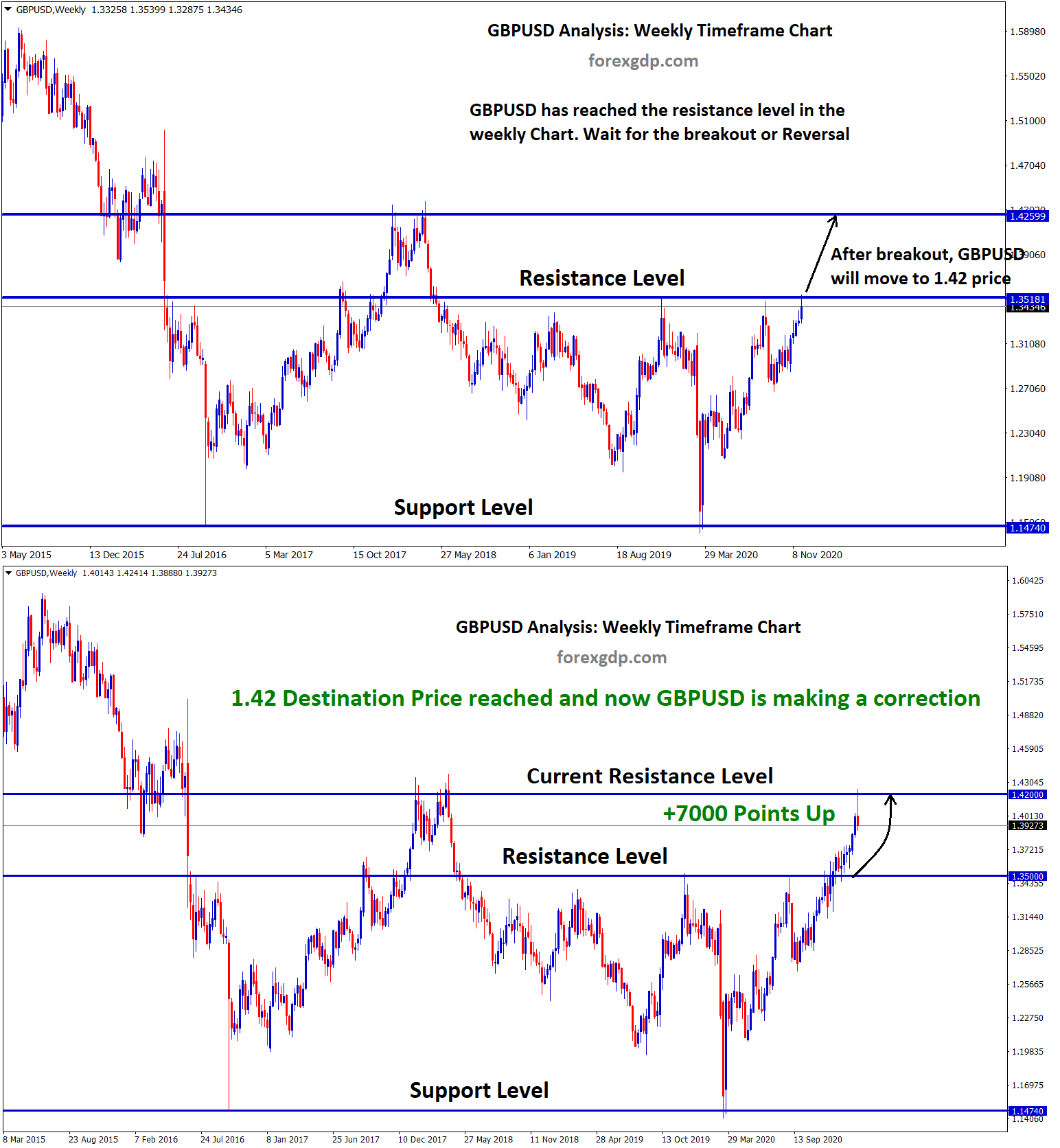

GBPUSD hits the destination resistance 1.42 after the breakout of 1.35 price

GBPUSD Resistance Analysis As per our previous GBPUSD analysis (click here to see), GBPUSD has broken the strong resistance level

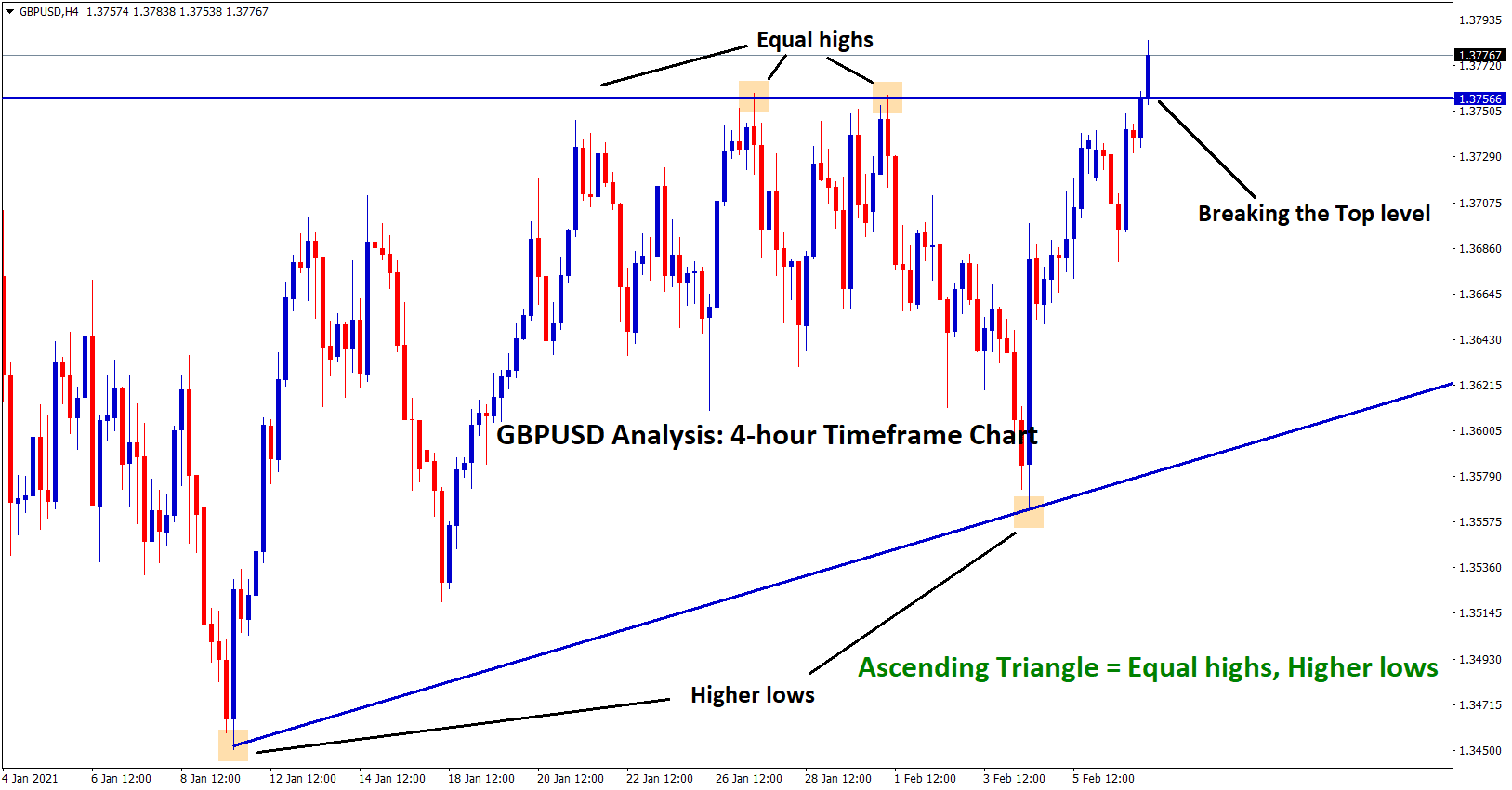

GBPUSD is breaking the top of the Ascending Triangle

GBPUSD Analysis Ascending Triangle pattern is formed in GBPUSD by creating Equal highs and higher lows. GBPUSD is breaking the