Introducing EURJPY

The EURJPY currency pair is the combination of two very important currencies, the Euro and the Japanese Yen. The Euro is the second most popular currency and the Japanese Yen is the fourth most popular currency. Together, the EURJPY currency pair is the seventh most popular minor currency pair in the forex industry. It accounts for 3% of the trading volume in the forex industry. The reason it is still considered a minor currency pair, despite being really popular, is because it does not contain the USD. Only USD currency pairs have the advantage of being called major currency pairs. It is also important to note that because this pair does not contain the USD, it is also referred to as a cross-currency pair. Let’s understand this currency pair individually to know more about what they bring to the table:

The Euro

The Euro is a relatively recent currency, having been formed in 1999. It is the world’s second most widely used currency, after only the US dollar. The goal of creating this currency was to provide the EU’s member nations with a single currency for simpler transactions between them. Originally, EUR was solely a virtual currency.

It wasn’t until much later that they began issuing real notes for this valuable currency. In the more than two decades that this currency has been on the market, 19 of the EU’s 28 member states have embraced it. Aside from these EU member states, 5 more countries have chosen the Euro as their national currency. Because the Euro is not a single state’s currency, but rather a collection of states’ currencies, it has a far greater potential to be influenced as a result of several governments’ involvement. Any unusual conduct in any of the states has the potential to have a direct influence on this important currency.

The Japanese Yen

The Japanese Yen is the official currency for the land of the rising sun, Japan. In terms of trading volume, it is the world’s fourth most popular currency. It is also the most widely used currency in Asia. The Japanese Yen has been in use since 1871. This makes it one of the world’s oldest currencies. Prior to the introduction of the JPY, Japan was relying on Spanish dollars.

It wasn’t until the Meiji government took over that they began printing their own money. The Bank of Japan is in charge of issuing JPY currency notes. It is also worth noting that the yen is one of the most affordable currencies in the area. The Japanese government has attempted to preserve these low rates in order to compete with other exporters by keeping its export rates low as well. However, due to the fast rise in the value of Japan’s economy, this is becoming increasingly challenging.

Why Trade EURJPY

EURJPY is both a minor currency pair and a cross-currency pair. This brings a lot of benefits to the table in terms of trading this dynamic duo. Following are some top reasons to trade EURJPY:

Market Correlations

A great reason to trade currency pairs like the EURJPY is because of their correlations to other assets in the market. This can be seen in the case of the Euro which has great correlations to the electronics industry. They’re popular for manufacturing and exporting electronics. It can also be seen in the case of the Japanese Yen which has great correlations to commodities such as technology and energy resources. This is because they’re highly involved in the exports of these valuable products. Crude oil is among their most popular export of energy resources. Therefore, it makes it even simpler to trade this pair as if we understand the direction of the commodities market, we can easily understand the direction of the EURJPY market as well.

Market Volatility

The EUR/JPY pair may exhibit some of the most turbulent market conditions in the forex markets. This is due to a combination of reasons. The biggest reason is that it has a high pip value. This makes it very vulnerable to traders attempting to profit from large market movements. The second reason for this pair’s volatility is because it has a low trading volume, making it less liquid. It has a low trading volume due to being known as a minor currency that is not involved with the USD. A less liquid currency pair is more vulnerable to turbulent market conditions since even minor changes in economic conditions will cause their rates to vary dramatically.

Cross-Currency Pair

One of the most compelling reasons to trade the EURJPY pair is that it is a cross-currency. As a result, it can greatly create a rich variety in the type of assets that you trade in this industry. Trading the same major currency pairs over and again might become repetitive after a while. You’ll spend the entire day watching the same market trends. Trading a cross-currency pair would be like taking a vacation to somewhere you’ve never been previously. You’ll learn how markets behave when the USD isn’t present. You’ll also be able to make cross-trades, which we’ll go over in more depth later.

EURJPY Trading Tips

As we’ve mentioned above, EURJPY is a cross-currency pair. It even belongs to economies that are at opposite ends of the time frames. This makes it quite interesting when figuring out the best ways to trade it. Here are some top trading tips for this dynamic duo:

Trade Timings

Although the EURJPY markets are open at all times for trading, that doesn’t necessarily mean that it should be traded at all times. Each currency pair has certain timings where it experiences the most volatility and market movements. This is because these timings are when their individual countries are awake and giving out economic data. Due to the JPY in this currency pair, the Tokyo session is great for its trading. The best time to trade in the Tokyo session is from 12 am to 6 am GMT. Before the Tokyo session closes, the European session begins. The best time to trade the EURJPY in this session is from 7:30 am to 15:30 pm GMT. This is when most economic data related to the Euro is released.

Economic Conditions

One of the most important things to keep an eye out for when trading forex pairs like the EURJPY is economic news for their respective currencies. If something major is coming up in the EU or in Japan, it’s preferable to hold any positions until we know the outcome of whatever we’re waiting for. This is due to the fact that the value of EURJPY may rise or drop based on the outcome of the news or events. It may even become exceedingly volatile and manifest itself on both sides of the market. To be able to trade more effectively, it is therefore critical to always be aware of who is going to happen in these areas.

Day Trading

Day trading is a trading approach in which you open and close a trade the same day. All deals must be finalized before the market closes, whether they end in a profit or a loss. Scalping is a popular type of day trading style. Traders would open a BUY and SELL position at the same rate for the same currency pair. This allows them to benefit regardless of which way the market swings. When the market falls, they profit from the alternative position that they opened. This method is ideal for EURJPY since this dynamic pair may be quite volatile at times. Scalping is an excellent approach for generating profits between shifting market rates during times of instability.

Factors Affecting EURJPY

EURJPY is a unique currency pair that belongs to two very different regions. Therefore, they’re impacted by factors that are unique to themselves. Here are some top factors impacting the EURJPY currency pair:

Financial Institutions

Both the European Central Bank and the Bank of Japan are majorly responsible for any instability in the EURJPY marketplace. The ECB and BOJ release monthly reports and statements regarding updates to any policy changes. These reports also display the economic and monetary forecasts for the upcoming short-term. Any positive results from the ECB will have a positive impact on the EURJPY currency pair.

However, any positive results from the BOJ will have an inverse impact on the EURJPY currency pair. The representatives of these individual banks also hold speeches frequently where they explain these results in more detail. These speeches are just, if not more, important in determining the direction of the EURJPY market. From ECB, Christine Lagarde who is the President of the institution is highly looked upon for her speeches. From BOJ Haruhiko Kuroda who is the Governor of the institution is highly looked upon for his speeches.

Natural Disasters

The earthquake situation in Japan has a significant impact on the movement of the EURJPY currency pair. Japan is particularly vulnerable to earthquakes and other natural calamities. This is connected to their geographical location on Earth. As a result, Japan experiences more earthquakes than any other country. And whenever there is an earthquake, their economy suffers as a result of numerous locations requiring repairs and rebuilding. Every time there is an earthquake, they suffer losses in the millions of dollars. As a result, if the Japan Meteorological Agency detects an earthquake, the JPY falls in value, causing the EURJPY to rise in value. Similarly, if the agency declares that there will be no earthquakes in the near future, JPY rises in value, causing EURJPY to fall in value.

Electronics Industry

The European Union is one of the world’s top exporters of electrical devices. Any changes in global demand for these items will have a considerable influence on the economy of the EU member states. This is one of their greatest contributors to GDP and so has tremendous significance for many European countries.

If global demand for electronics rises, the EU will be able to export more than normal, causing the EURJPY to appreciate in value. Similarly, if global demand for electronics falls, the EU will be unable to export as much as before. As a result, the value of the EUR will fall, and the EURJPY will also fall sharply.

Technology Industry

Japan is one of the world’s leading exporters of technology. They are also the industry’s largest manufacturer. As a result, any change in demand for technological items will have a direct influence on Japan’s economy and, by extension, the EURJPY. If global demand for technology grows, Japan will export more than normal, causing the JPY to appreciate in value. The EURJPY would lose value as a result of this. Similarly, if demand for technology items declines, JPY will fall in value, causing EURJPY to climb in value. Watching this space is therefore key for a successful day of trading EURJPY.

Unemployment Rate

Unemployment is also one of the most important elements influencing the value of a currency pair. When a person is jobless, the government bears the task of providing basic essentials for their existence. As a result, the greater the number of jobless individuals, the greater the responsibility of the government to spend its reserves to care for the unemployed. The greater the unemployment rate in the EU, the worse its economy will be. This, in turn, would lead the EURJPY to lose value. Similarly, if the unemployment rate is low, the economy will thrive, and the EURJPY will rise in value.

The Crude Oil Markets

Over the years, Japan has grown to become the third-largest exporter of crude oil and natural gas around the world. Their economy is greatly dependent on the demand for these products around the world. Any changes to the demand for crude oil will have an impact on Japan’s economy.

If the demand for crude oil rises around the world, Japan will export them more often which will cause JPY to increase in value. This would cause EURJPY to drop in value. Similarly, if the demand for crude oil is less than usual, Japan won’t be able to export them as much which will cause JPY to fall in value. This would cause the value of EURJPY to increase.

Most common questions asked by the forex traders about EURJPY :

Forex GDP, Babypips, Tradingview, Forexfactory.

EURJPY Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

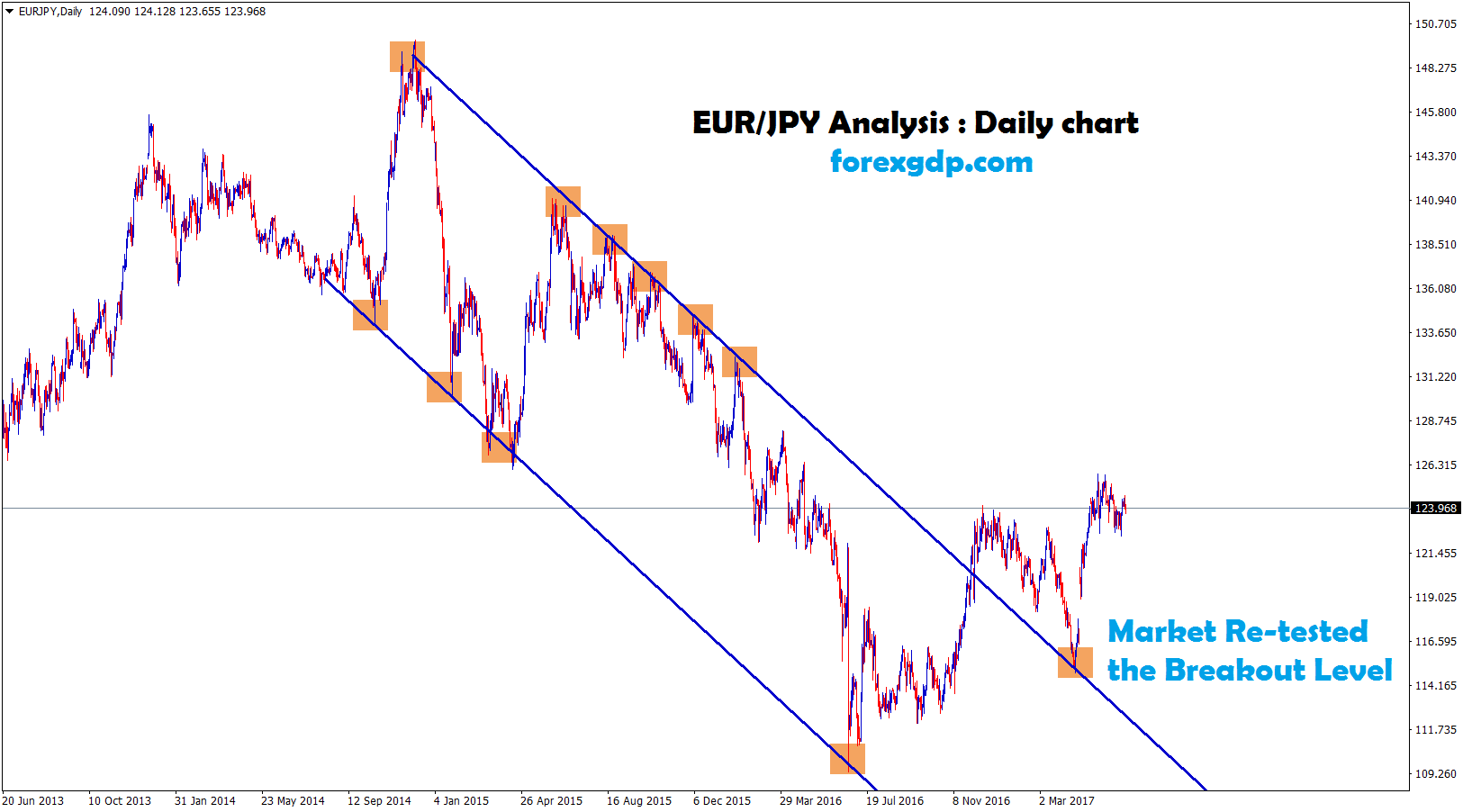

+3333 Points made in EUR/JPY After breakout from the range

EUR/JPY Analysis : After EUR/JPY breakout from the range in daily chart, market Re-tested the breakout level and went up