Introducing EURCHF

The EURCHF currency pair consists of the Euro, or EUR, and the Swiss Franc, or CHF. The EUR is the national currency for the EU states while the CHF is the national currency of Switzerland. The EUR is the second most traded currency in the world while the CHF is the tenth most traded currency in the world. Together, the EURCHF is the seventh most traded currency pair in the world. The EUR is quite popular because it is the currency of quite a few member states in Europe as well as other states which are not part of the EU. The CHF is quite popular because Switzerland has a relatively strong economy which is attractive for storing financial assets. Let’s understand a bit about the historic significance of the Euro and Swiss Franc before we get into how to trade the EURCHF currency pair.

The Euro

The Euro is a new currency, having been introduced in 1999. It is the world’s second most common currency, after only the US dollar. The purpose of developing this currency was to offer the EU’s member states with a common currency to facilitate cross-border trade. EUR was once only a virtual currency. It wasn’t until much later that authentic notes for this valued method of payment were issued. In the more than two decades that this currency has been on the market, it has been adopted by 19 of the EU’s 28 member states.

Aside from these EU member states, five other nations have adopted the Euro as their national currency. Because the Euro is a collection of state currencies rather than a single state’s currency, it has a significantly larger potential to be impacted as a result of several governments’ engagement. Any odd behavior in any of the states has the potential to have a direct impact on this valuable currency.

The Swiss Franc

The Swiss Franc is both Switzerland’s and Lichtenstein’s national currency. It is just one of the currencies that have not been removed from the EU as a result of the adoption of the Euro. Switzerland desired to maintain its own currency, the CHF. In terms of trading volume, the Swiss franc is the tenth most popular currency.

It accounts for 1% of the industry’s daily transaction volume. It is also the seventh most often stored reserve currency in the world. The Swiss National Bank issues Swiss Franc notes. Switzerland is a preferred location for the storing of financial assets since it exhibits one of the world’s best private banking systems to ever exist. It is also a popular storing destination since Switzerland is thought to have one of the most stable economies in the world.

Why Trade EURCHF

Switzerland has one of the most stable economies in the world. The EU has the second most traded currency in the world. Together, the EURCHF currency pair brings some unique trading conditions which are favorable for most traders. Here is why you should trade EURCHF:

Interest Rate

The European Union is well-known for its high interest rates, which are determined by the European Central Bank. These high interest rates are far higher than those of other market participants such as the United States and Australia. Switzerland’s interest rates are significantly lower than those of the European Union.

Switzerland’s low interest rates are the responsibility of the Swiss National Bank. Their economy is generally stable, which accounts for their low interest rates. Because of the high interest yields on the EURCHF currency pair as a result of these interest rates, traders are drawn to it. This combination produces substantial profits due to the wide gap in interest rates. Because of the huge profits, traders typically use a carry trade when trading this currency pair. Carry trade is the practice of selling a currency with a low interest rate in order to purchase one with a higher interest rate.

Market Volatility

The EURCHF pair might see some of the most volatile market circumstances in the currency markets. This is attributable to a number of factors. The most important reason is because it has a high pip value. As a result, it is extremely sensitive to traders seeking to benefit from huge market changes. The second reason for this pair’s volatility is its low trading volume, which makes it less liquid. It has a limited trading volume since it is seen as a minor currency that is unrelated to the USD. A less liquid currency pair is more prone to market volatility since even slight changes in economic circumstances cause their rates to fluctuate rapidly.

Market Correlations

The linkages between currency pairings like EURCHF and other market assets are a strong incentive to trade them. This is seen in the case of the Euro, which has high linkages with commodities like electrical and mechanical machinery. These are the country’s most popular exports. It is particularly noticeable in the case of the Swiss franc, which has strong ties to items such as medications and watches. This is because they are involved in the exporting of these expensive goods. As a result, trading this pair becomes much easier since if we understand the direction of the commodities market, we can easily comprehend the direction of the EURCHF market. Later, we’ll look through how these commodities will impact the movement of the EURCHF currency pair in further depth.

EURCHF TRADING TIPS

Since the EURCHF belong to generally the same region, they’re impacted by most of the same changes that happen in their economy. This places them in quite a unique situation. Here are some top tips for trading the EURCHF dynamic duo:

Trade Timings

Although you can generally trade the EURCHF currency pair anytime as long as the market is open, there are certain timings that make the market conditions perfectly ideal for this dynamic duo. The perfect time to trade this pair is when the European markets are active. This would be considered between 8:30 am and 3:30 pm GMT. The reason this timing is so ideal is that if any changes were to occur in the economic or monetary policies of these individual countries, they would occur within this time zone. And so, this is why it is important to keep in mind trade timings when trading the EURCHF currency pair.

Economic Conditions

When trading currency pairings like the EURCHF, one of the most essential things to keep an eye out for is economic news for their respective currencies. If anything important is about to happen in the EU or in Switzerland, it’s best to hold off on taking any positions until we know the result of whatever we’re awaiting. This is because the value of EURCHF might fluctuate depending on the result of news or events. It might even become quite volatile, manifesting itself on both sides of the market. Switzerland is a generally stable nation with a stable economy so anything that would make its economy to fluctuate will be huge. It is therefore necessary to continually be informed of who is going to happen in these regions in order to trade more efficiently.

Carry Trading

The practice of borrowing a low-interest-rate currency in order to invest in a higher-interest-rate currency is known as carry trading. When implementing the carry trade technique, you must first choose your funding and asset currencies. The funding currency is the currency used in the transaction. This currency is frequently associated with a lower interest rate. The CHF has historically been a popular funding currency. It is crucial for effective EURCHF carry trading to sell the CHF while jointly purchasing the EUR. When this occurs, you will be paid interest based on the difference in interest rates between EUR and CHF, which is rather massive.

Factors Affecting EURCHF

As we’ve mentioned previously, the EUR and CHF belong to the same region and are impacted by most of the same factors. This can prove to be both beneficial and hazardous for their trading. Here are the factors affecting EURCHF:

Demand In The US

The US is the major customer of all EU exports. The EU relies on the demand of the US to be consistent in order to benefit from the sale of their exports. Any changes in the demand from the US in terms of receiving EU exports will have a significant impact on the value of their economy. If the demand for EU products is high in the US, the value of the EUR will increase. This would cause the value of the EURCHF to appreciate. Similarly, if the demand for EU products is lower than usual in the US, the value of the EUR will drop. This would cause the value of the EURCHF to depreciate.

The Tourism Industry

Switzerland is one of the world’s most popular tourist destinations. Any changes in the number of visitors visiting Switzerland will have a considerable influence on the value of the CHF currency.

More travelers visit Switzerland over the holiday season, raising the value of the CHF and causing the EURCHF to decline in value. Similarly, when it is not the holiday season, fewer people visit the country, leading the CHF to decline in value and, as a result, the EURCHF to begin to rise in value.

The Electronics Market

The European Union is a major exporter of electrical devices across the world. Any changes in global demand for these commodities will have a significant impact on the economies of EU member states. This is one of their largest contributors to GDP, hence it is quite important for many European nations. If global demand for electronics increases, the EU will be able to export more than usual, causing the EURCHF to gain value. Similarly, if global demand for electronics diminishes, the EU will be unable to export as much as it has in the past. As a result, the value of the EUR will decrease dramatically, as will the EURCHF.

The Pharmaceuticals Industry

Switzerland is one of the world’s leading exporters of pharmaceuticals. These are largely drugs, although other pharmaceutical goods are also offered. Any changes in demand for these items have a significant impact on the value of the Swiss economy. If global demand for medications and other treatments rises, Switzerland will be able to export them more often, boosting the CHF’s worth. As a result, the EURCHF currency pair’s value would drop. Similarly, if global demand for medicines and other goods diminishes, Switzerland will be unable to export as much as normal, causing the CHF to lose value. As a result, the EURCHF currency pair’s value would rise.

Financial Institutions

The European Central Bank and the Swiss National Bank are both to blame for any volatility in the EURCHF market. The ECB and SNB provide monthly reports and announcements that provide information on policy developments. These studies also provide economic and monetary projections for the near future. Any good ECB outcomes will have a good influence on the EURCHF currency pair. Any good SNB outcomes, on the other hand, will have an adverse influence on the EURCHF currency pair.

Representatives from these specific banks also give presentations on a regular basis in which they discuss these outcomes in further depth. These remarks are equally as crucial, if not more, in deciding the direction of the EURCHF market. Christine Lagarde, President of the European Central Bank, is well-known for her remarks. The Governor of SNB, Thomas Jordan, is also well regarded for his remarks.

The Watches Industry

Switzerland is also well-known for its timepieces, as well as its exports of them. They manufacture some of the world’s highest-quality timepieces. Their timepieces are quite popular in other countries, accounting for a significant chunk of their exports. Any changes in demand for these items have a significant impact on the value of the Swiss economy. If global demand for watches increases, Switzerland will be able to export them more often, increasing the value of the CHF. As a result, the value of the EURCHF currency pair would collapse. Similarly, if global demand for watches falls, Switzerland will be unable to export as many as it already does, causing the CHF to lose value. As a result, the value of the EURCHF currency pair would rise.

Most common questions asked by the forex traders about EURCHF:

Forex GDP, Babypips, Tradingview, Forexfactory.

EURCHF Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

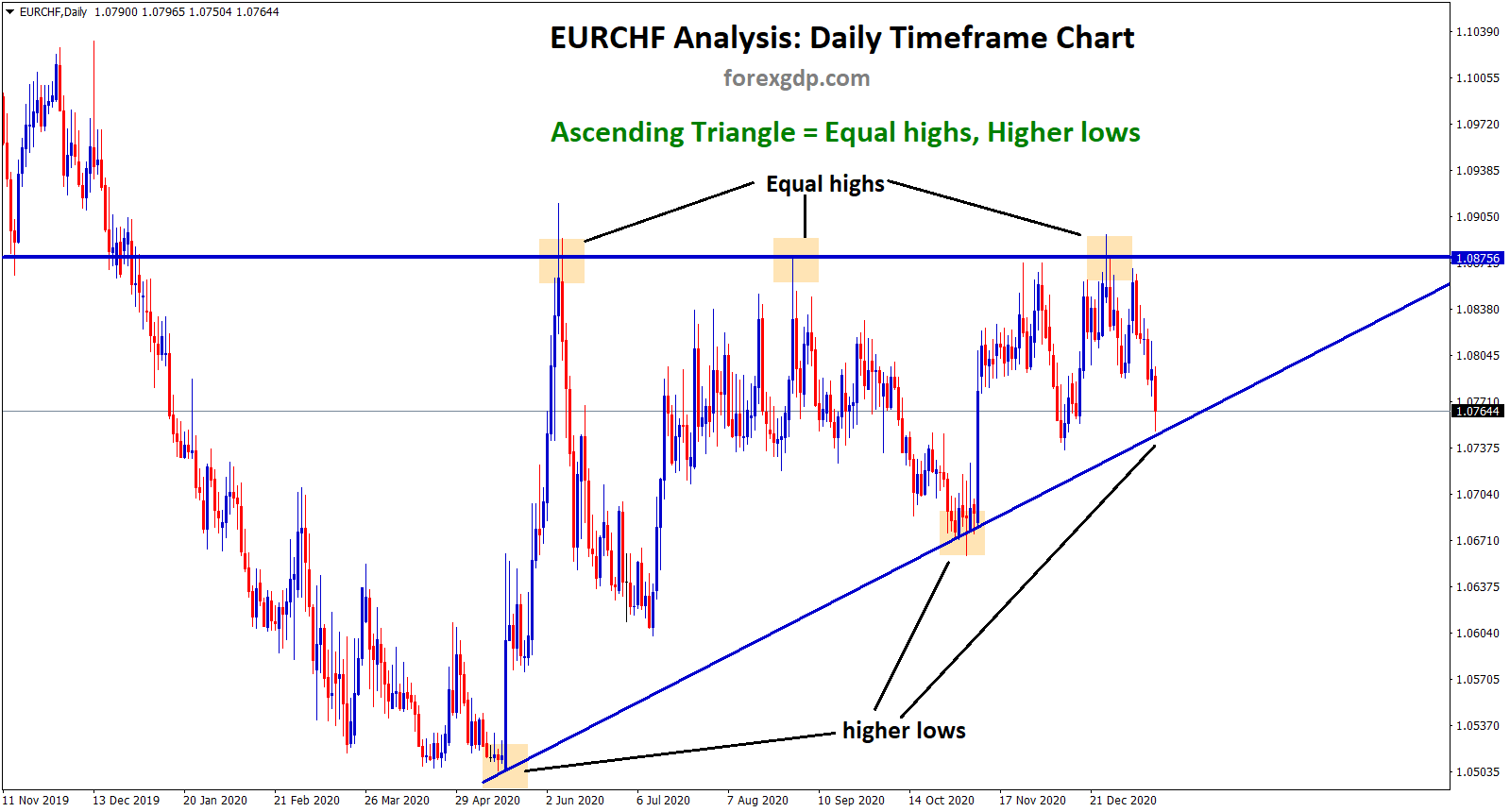

EURCHF has reached the low level of the Ascending Triangle

EURCHF Analysis Ascending Triangle Pattern has formed in the EUR/CHF. Now, EURCHF has reached the bottom zone of the Ascending