Introducing EURCAD

EURCAD is among the minor currency pairs in the forex industry. It is the seventh most popular minor currency pair in terms of volume. It is also sometimes referred to as a cross-country pair. A cross-country pair is a currency pair that does not involve the United States Dollar. Usually, when a currency is traded for another, it is first traded with the USD. The USD is then further traded into the final currency which was needed. However, when a currency is directly traded for another without the involvement of the USD, it is known as a cross-country trade. And the currency pairs would be known as cross-country pairs. Both EUR and CAD are individually among the most popular currencies. However, they are still considered a minor currency pair when placed together due to not containing the USD. They are also considered a minor because they are relatively new compared to other pairs due to EUR only being introduced in recent times. Let’s dive into more detail on each of these currencies as individuals in order to better understand their trading conditions as a forex pair.

The Euro

The Euro is a relatively new currency that was established in 1999. It is the second most popular currency after the USD. The purpose of making this currency was so the member states of the EU had a common currency for easier transactions between each other. EUR was only a digital currency originally.

It wasn’t until a bit later on that they started printing physical notes for this valuable currency. In the 20 plus years that this currency has been in the market, it has been adopted by 19 member states of the EU out of the total 27 states. Aside from these member states, 5 other states outside of the EU have also adopted Euro as their national currency. Since the Euro is not a currency of a single state but of a number of states, it has a lot more opportunities to be impacted due to several states being involved. Any activity that is out of the ordinary in any one of the states can directly impact this valuable currency.

The Canadian Dollar

The Canadian Dollar is the national currency of Canada. Canada originally had been using the Canadian Pound as its currency since 1841. However, in order to improve relations with the United States, they changed their currency to the Canadian Dollar in 1858.

The Bank of Canada is responsible for the issuing of the CAD notes. The $1 note is popularly known as a ‘Loonie’ while the $2 note is popularly known as a ‘Toonie’. On its own, the Canadian Dollar is the eighth most popular currency in terms of the trading volume. It is also relatively stable as an individual currency as compared to the Euro as it isn’t impacted by several states, just Canada.

Why Trade EURCAD

Although this is a minor currency pair, it is still pretty popular among traders who have a more unconventional approach to trading. After all, not everyone wants to get involved with the big guns. Here are some top reasons why you might want to trade EURCAD:

Avoiding The US Market

Trading a currency pair that includes the USD brings a lot of challenges. The U.S. dollar is the most popular currency in the industry. Therefore, it is also impacted the most in case of any inconvenience. Any major economic event occurring anywhere around the globe has a direct impact on the value of the USD. Therefore, this causes any dollar currency pairs to experience unstable market conditions most of the time. In order to avoid any sudden fluctuations in market rates, some traders prefer trading currencies that don’t involve the USD. EURCAD is a great example of such a currency. Both EUR and CAD are individually among the most popular currencies around the world. When paired together, although still considered a minor, they are invincible.

High Volatility

EURCAD is among one of the most volatile currency pairs. Part of this can be blamed on the fact that their individual nations have no correlation with each other, whatsoever. What this means is the two nations have completely separate lives and what impacts one of them does not impact the other. This makes them highly volatile when placed together. Another reason for this volatility is the fact that not many traders trade this currency pair. This means that EURCAD has a low trading volume. A forex pair with a low trading volume is more susceptible to price swings when the market becomes volatile. This volatility is great for traders who use the scalping strategy as they’re able to take advantage of these constant price swings in order to make a quick profit.

Cross-Currency Pair

One of the best reasons to trade the EURCAD pair is because it is a cross-currency. Therefore, they can significantly diversify your asset portfolio. Using regular major currency pairs can get tiring after a certain period of time. you’ll be watching the same market patterns over and over again all day. Trading a cross-currency pair would be like a breath of fresh air. You’ll get to know how the markets move when the USD isn’t involved. You’ll also have the opportunity to perform cross-trades which we’ll get into in more detail later on.

EURCAD Trading Tips

Once you’ve stepped foot in the forex industry, chances are you’ll soon be bombarded with different people offering their trading tips and strategies for a fee. The market is so trendy these days and everyone wants to believe that their strategy is what will work the best. The truth is, every strategy can work as long as you stay focused and don’t lose hope. Every forex pair has its own way of thinking and moving. Once we understand this, only then we can move along to how to perfect it. Here are the top trading tips for this cross-currency pair:

Day Trading

Day trading refers to the trading strategy where you open and close a trade within the same day. All trades are to be closed before the market closes whether they close in a loss or in profits. Scalping is a common form of the day trading strategy. Traders would open a BUY and SELL position for the same currency pair at the same rate. This way they earn a profit in whatever direction the market would swing. When the market retreats, they earn a profit again with the alternative position that they opened. This strategy is great for EURCAD as this dynamic duo can become really volatile sometimes. During times of volatility, scalping is a great strategy to capture profits between the fluctuating market rates.

Swing Trading

Swing trading involves holding an asset for one or more days in order to profit from price fluctuations. EUR/CAD is frequently characterized by price fluctuations that establish well-defined ranges over lengthy periods of time. As a result, the pair is suitable for swing trading. Swing trading EUR/CAD involves selecting a range within which the pair’s movement is confined. Once you’ve determined the price range, you might sell when the price hits the top of the range (resistance) and purchase when the price reaches the bottom of the range (support) (support). When a pair is trading inside a range, the usual expectation is that when the price hits the resistance or support, it will not break through but will instead begin moving in the opposite direction of the barrier or support.

Carry Trading

Carry trading involves borrowing a low-interest-rate currency in order to invest in a higher-interest-rate currency. This allows you to lock in a larger interest profit on your investment. When employing the carry trade technique, you must first determine the funding and asset currencies. The funding currency is the currency that is exchanged in the transaction. Typically, this currency has a lower interest rate. The Euro has historically been an appealing funding currency. Going short, i.e. selling the euro while concurrently purchasing the Canadian dollar, is essential for successful EUR/CAD carry trading. When this occurs, you will be paid interest depending on the interest rate difference between EUR and CAD as well as the amount of your investment.

Factors Affecting EURCAD

Despite EURCAD being considered a minor currency pair, there are actually a couple of factors that impact its movement in the forex markets. They are explained below:

Interest Rates

Interest rate decisions are a major contributing factor towards the movement of EURCAD in the forex markets. Any rise in interest rates for the EUR will have a directly proportional impact on the EURCAD currency pair. Similarly, any rise in interest rates for the CAD will have an inversely proportional impact on EURCAD. A great example can be seen when the ECB decided on increasing its short-term interest rates. This had caused the EURCAD pair to increase in value. If the Bank of Canada decided on increasing their interest rates any more than what it already is, the EURCAD pair would decrease in value.

Unemployment Rate

Unemployment is also one of the biggest factors that contribute to the value of a currency pair. If a person is unemployed, it is a burden on the government’s end to provide basic necessities for them for survival. Therefore the more the number of unemployed people, the more burden it is on the government to use their reserves to provide for the unemployed people.

The higher the unemployment rate in the EU, the poorer will be its economy. This in turn would cause EURCAD to depreciate in value. Similarly, if the unemployment rate is low, the economy would be thriving and the value of EURCAD would also appreciate.

Commodity Markets

Canada is among the larger exporters of valuable commodities such as gold, crude oil, wood, and grain. Therefore their economy greatly depends on the export of these commodities in order to thrive and increase in value. Any changes to the market for these commodities such as demand or prices will have a direct impact on the EURCAD pair.

If the demand for crude oil increases, Canada will export more crude oil and therefore, EURCAD will decrease in value. If the demand for crude oil decreases, Canada will suffer as they wouldn’t be able to export them as much, and therefore, EURCAD will increase in value. This can be seen during the war between Russia and Ukraine where the demand for crude oil has increased which in turn caused EURCAD to decrease in value.

Gross Domestic Product

The Gross Domestic Product, or GDP, is a major contributor to any movements with this minor currency pair. GDP shows the overall performance of a country’s economy. A positive GDP value would signify that the economy is thriving. This would in turn attract investors to invest in the country’s economy which would therefore increase the value of that country’s currency. If the EU has a positive GDP, the Euro would increase in value which would cause EURCAD to also increase in value. The opposite can be seen in the case of CAD. If Canada displayed a positive GDP, the CAD would increase in value which would, in turn, cause EURCAD to decrease in value.

Financial Institutions

Both the European Central Bank and Bank of Canada are majorly responsible for any instability in the EURCAD marketplace. The ECB and BOC release monthly reports and statements regarding updates to any policy changes. These reports also display the economic and monetary forecasts for the upcoming short-term. Any positive results from the ECB will have a positive impact on the EURCAD. However, any positive results from the BOC will have an inverse impact on the EURCAD. The representatives of these individual banks also hold speeches frequently where they explain these results in more detail. These speeches are just, if not more, important in determining the direction of the EURCAD market. From ECB, Christine Lagarde who is the President of the institution is highly looked upon for her speeches. From BOC, Sharon Kozicki who is the Deputy Governor of the institution is highly looked upon for her speeches.

Most common questions asked by the forex traders about EURCAD :

Forex GDP, Babypips, Tradingview, Forexfactory.

EURCAD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

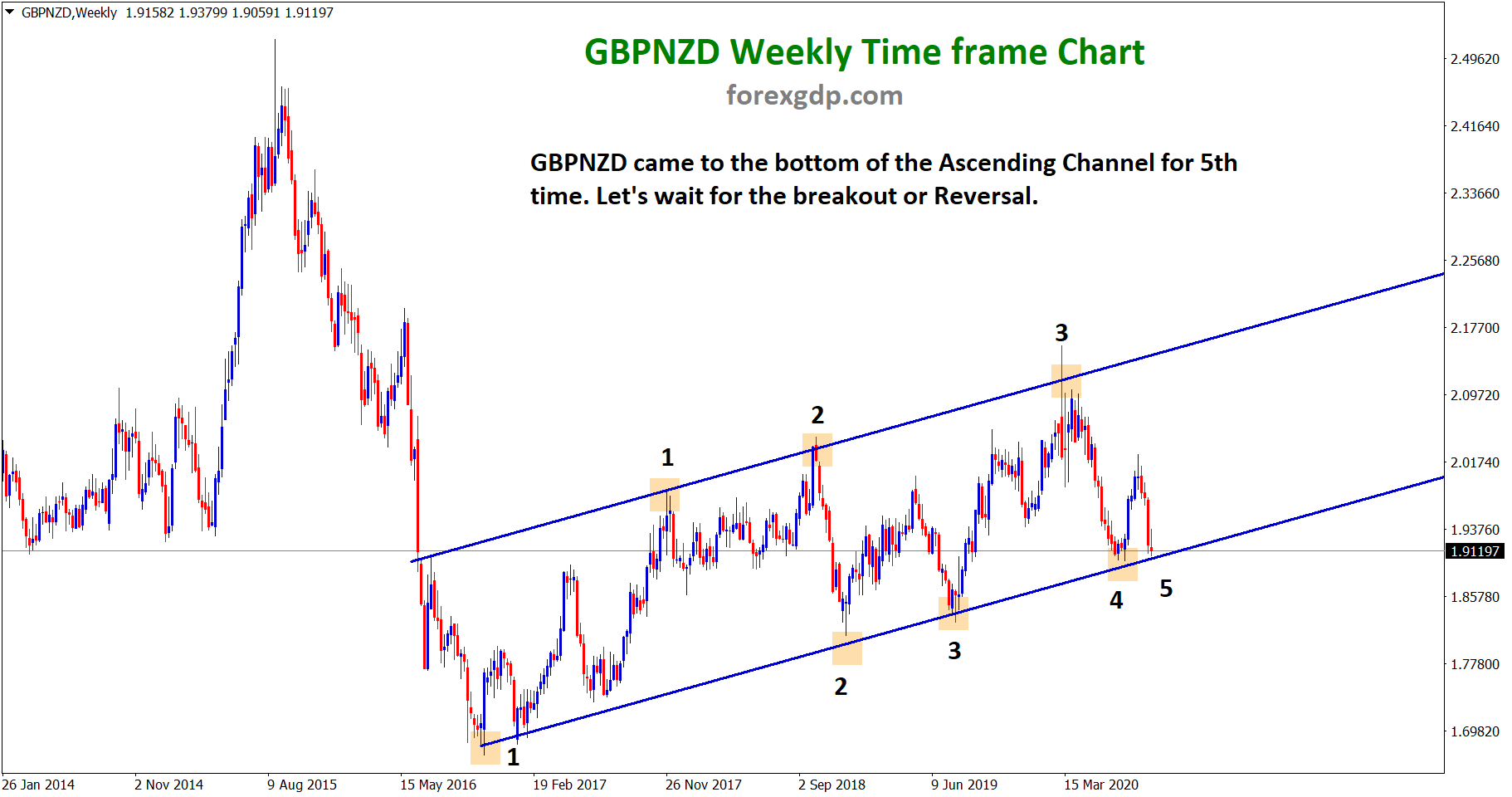

USDSGD, GBPNZD at the low-level, EURCAD in Ascending Triangle

Ascending Channel Analysis GBPNZD is moving in an Uptrend by forming higher highs, higher lows in the weekly time frame