Introducing CHFJPY

The CHFJPY currency pair combines two extremely important currencies, the Swiss Franc and the Japanese Yen. The Swiss Franc is the tenth most popular currency, with the Japanese Yen coming in fourth. The CHFJPY currency pair is the forex industry’s twelfth most popular minor currency combination. It accounts for 1% of the forex industry’s trading volume. Because it does not contain the USD, it is regarded as a minor currency pair. This comes despite its popularity. Only USD currency pairs have the distinction of being referred to as major currency pairs. It is also worth noting that because this pair does not include the USD, it is also known as a cross-currency pair. Let’s break down this currency pair separately to learn more about how it contributes to the forex space:

The Swiss Franc

Switzerland and Lichtenstein use the Swiss Franc as their national currency. It is one of the few currencies that has not been kicked out of the EU as a result of the formation of the Euro. Switzerland desired to maintain its own currency, the CHF. In terms of trading volume, the Swiss franc is the tenth most popular currency.

It accounts for 1% of the forex industry’s daily trading volume. It is also the sixth most frequently held reserve currency in the world. The Swiss National Bank is in charge of producing Swiss Franc notes. Switzerland is a preferred location for asset holdings since its private banking system is regarded as one of the greatest in the game.

The Japanese Yen

The Japanese Yen is the national currency of Japan, the country of the rising sun. It is the world’s fourth most popular currency in terms of the trading volume. It is also Asia’s most extensively used currency. Since 1871, the Japanese Yen has been in use. As a result, it is one of the world’s oldest currencies.

Japan relied on Spanish dollars prior to the creation of the JPY. They didn’t start producing their own money until the Meiji government seized over. JPY currency notes are issued by the Bank of Japan. It’s also worth mentioning that the yen is one of the least expensive currencies in the region. In order to compete with foreign exporters, the Japanese government has tried to maintain these low rates by keeping its own export rates low. However, due to Japan’s economy’s rapid growth in value, this is becoming increasingly difficult.

Why Trade CHFJPY

The CHFJPY currency pair may seem like it isn’t a good pair to trade due to only having a trading volume of 1% but this is only because most traders prefer trading the major currency pairs. A select few people know the true worth of the CHFJPY currency. Here are some top reasons to trade CHFJPY:

Market Predictability

Analyzing market conditions for the CHFJPY is rather straightforward. This is due to the fact that they are most influenced by changes in their respective countries, which are Switzerland and Japan. Because the USD is the standard currency for global transactions, any changes anywhere in the world would have an impact on a pair containing the USD. Similarly, any changes that occur anywhere in the European Union’s 28 member countries would have an impact on a pair that contains the Euro. As a result, maintaining track of every location that may have an impact on a currency pair becomes rather difficult. Forex pairs that are exclusively tied to a certain region, such as CJFJPY, are much easier to forecast since we just need to analyze their individual countries.

Market Volatility

The currency pair CHFJPY is one of the most volatile in the industry. Part of this can be attributed to the fact that their independent countries have little connection to one another. This means that the two countries live entirely distinct lives, and what affects one does not affect the other.

When they are combined, they become extremely volatile. Another factor contributing to this volatility is the fact that few traders trade this currency pair. This is due to their preference for trading major pairings that involve the USD. As a result, the CHFJPY currency pair has a low trading volume. When the market gets turbulent, a currency pair with a low trading volume is more vulnerable to price fluctuations. This volatility is beneficial to scalping traders since it allows them to capitalize on the continuous price changes in order to earn a quick profit.

Market Correlations

A great reason to trade currency pairs like the CHFJPY is because of their correlations to other assets in the market. This can be seen in the case of the Swiss Franc which has great correlations to commodities which include pharmaceuticals and watches. They’re also impacted by the tourism sector and economic changes. It can also be seen in the case of the Japanese Yen which has great correlations to commodities such as technology and crude oil They’re also highly impacted by any natural disasters that might occur such as earthquakes. Therefore, it makes it even simpler to trade this pair as if we understand the direction of the commodities market, we can easily understand the direction of the CADCHF market as well. We’ll get into more detail later on regarding how exactly these commodities will impact the movement of CADCHF.

CHFJPY Trading Tips

CHFJPY is quite a unique pair since it faces volatile market conditions despite having a low trading volume. Due to some of its unique features discussed above, there are certain trading tips you’ll need to be able to trade it to perfection. They are given below:

Trade Timings

Although you may trade the CHFJPY currency pair at any particular time when the market is open, there are certain times when the market circumstances are excellent for this dynamic pair. The best time to trade this pair is when both the London and New York markets are open. When both markets are open, the optimum time to trade CHFJPY is between 1 and 5 p.m. GMT. This schedule is good since both Switzerland and Japan will be awake during these times. As a result, timing is optimal since any changes in the economic or monetary policies of these specific countries would take place inside this time zone. As a result, while trading the CHFJPY currency pair, it is critical to consider trade timing.

Range Trading

Range trading is the practice of determining when to initiate a trade by using support and resistance levels. The resistance levels are represented by the highest points on a given chart. Similarly, the lowest points on a specific chart are the support levels. Understanding where these highs and lows are located is crucial to the range trading strategy. For example, if the price is reaching a resistance level and you feel it will hold, you might place a SELL order (go short). If, on the other hand, the price is reaching a level of support that you feel will hold, you may enter a BUY transaction (go long). If the price falls below support, you can start a short position because the support level will no longer be valid. Similarly, if the price continues to rise over the resistance level, you may go long since the resistance level will be invalidated.

Day Trading

Day trading is a trading strategy that involves opening and closing a deal on the same day. All transactions, whether profitable or not, must be completed before the market closes. Scalping is a common day trading strategy. Traders would open a BUY and SELL position for the same currency pair at the same rate. This allows them to profit no matter which way the market swings. When the market falls, they profit from the alternative position they took. This strategy is great for CHFJPY since this unpredictable pair may be fairly volatile at times. During times of volatility, day trading, more specifically scalping, is a good strategy for collecting profits between fluctuating market conditions.

Factors Affecting CHFJPY

Both Switzerland and Japan belong to two completely different regions of the world. Due to this reason, they’re impacted by factors that are unique to just their own regions. Following are the top factors affecting CHFJPY:

Financial Institutions

Both the Swiss National Bank and the Bank of Japan are majorly responsible for any instability in the CHFJPY marketplace. The SNB and BOJ release monthly reports and statements regarding updates to any policy changes. Any positive results from the SNB will have a positive impact on the CHFJPY currency pair.

However, any positive results from the BOJ will have an inverse impact on the CHFJPY currency pair. The representatives of these individual banks also hold speeches frequently where they explain these results in more detail. These speeches are just, if not more, important in determining the direction of the CHFJPY market. From SNB, Thomas Jordan who is the governor of the institution is highly looked upon for his speeches. From BOJ Haruhiko Kuroda who is the Governor of the institution is highly looked upon for his speeches.

Unemployment Rate

The unemployment rate has a significant impact on the value of the CHFJPY currency pair. This is especially true for the CHF, as Switzerland is well-known for its exceptionally low unemployment rate. Any changes in the number of individuals employed in a nation will have an influence on the country’s economy. This is due to the fact that the more individuals who are unemployed, the more the government must provide for them from its own budget. This weakens the worth of a country’s economy drastically. If the unemployment rate in Switzerland rises, the CHF will fall in value, causing the CHFJPY pair to also fall in value. Similarly, if Japan’s unemployment rate rises, the value of the Japanese Yen will fall, causing the CHFJPY pair to rise in value.

The Watch Industry

Switzerland is also well-known for its clock and watches manufacturing. They manufacture some of the world’s highest-quality watches. Their watches are highly popular abroad and hence account for a significant portion of their exports. Any changes in demand for these items have a significant impact on the value of Switzerland’s economy. If the global demand for clocks and watches grows, Switzerland will be able to export them more often. As a result, the value of CHF would increase which would also make the value of CHFJPY increase. Similarly, if global demand for clocks and watches drops, Switzerland will be unable to export them as much as normal, causing the CHF currency to lose value. As a result, the value of the CHFJPY would also drop.

The Technology Industry

Japan is one of the world’s biggest technology exporters. They are also the largest manufacturer in the market. As a result, any shift in demand for technology products will have an immediate impact on the Japanese economy and, by extension, the CHFJPY. If worldwide demand for technology increases, Japan will export more than usual, leading the JPY to rise in value. As a result, the EURJPY would lose value. Similarly, if demand for technological products falls, the JPY falls in value, leading the CHFJPY to rise in value.

The Crude Oil Industry

Over time, Japan has risen to become the world’s third-largest supplier of crude oil and natural gas. Their economy is heavily reliant on global demand for these items. Any changes in crude oil consumption will have an influence on Japan’s economy. If global demand for crude oil rises, Japan will export it more frequently, causing the JPY to appreciate in value.

The value of the CHFJPY would fall as a result of this. Similarly, if demand for crude oil is lower than normal, Japan will be unable to export as much, causing the JPY to decline in value. This would raise the value of the CHFJPY.

The Pharmaceuticals Industry

Switzerland is one of the world’s leading exporters of pharmaceutical items. These mostly consist of medications, although other pharmaceutical goods are also included. Any changes in demand for these items have a significant impact on the value of Switzerland’s economy. If the global demand for medications and other pharmaceuticals rises, Switzerland will be able to export them more often, increasing the value of the CHF. As a result, the value of the CHFJPY would rise as well. Similarly, if global demand for medications and other pharmaceuticals diminishes, Switzerland will be unable to export them as much as normal, causing the CHF to lose value. As a result, the value of the CHFJPY would plummet.

Most common questions asked by the forex traders about CHFJPY:

Forex GDP, Babypips, Tradingview, Forexfactory.

CHFJPY Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

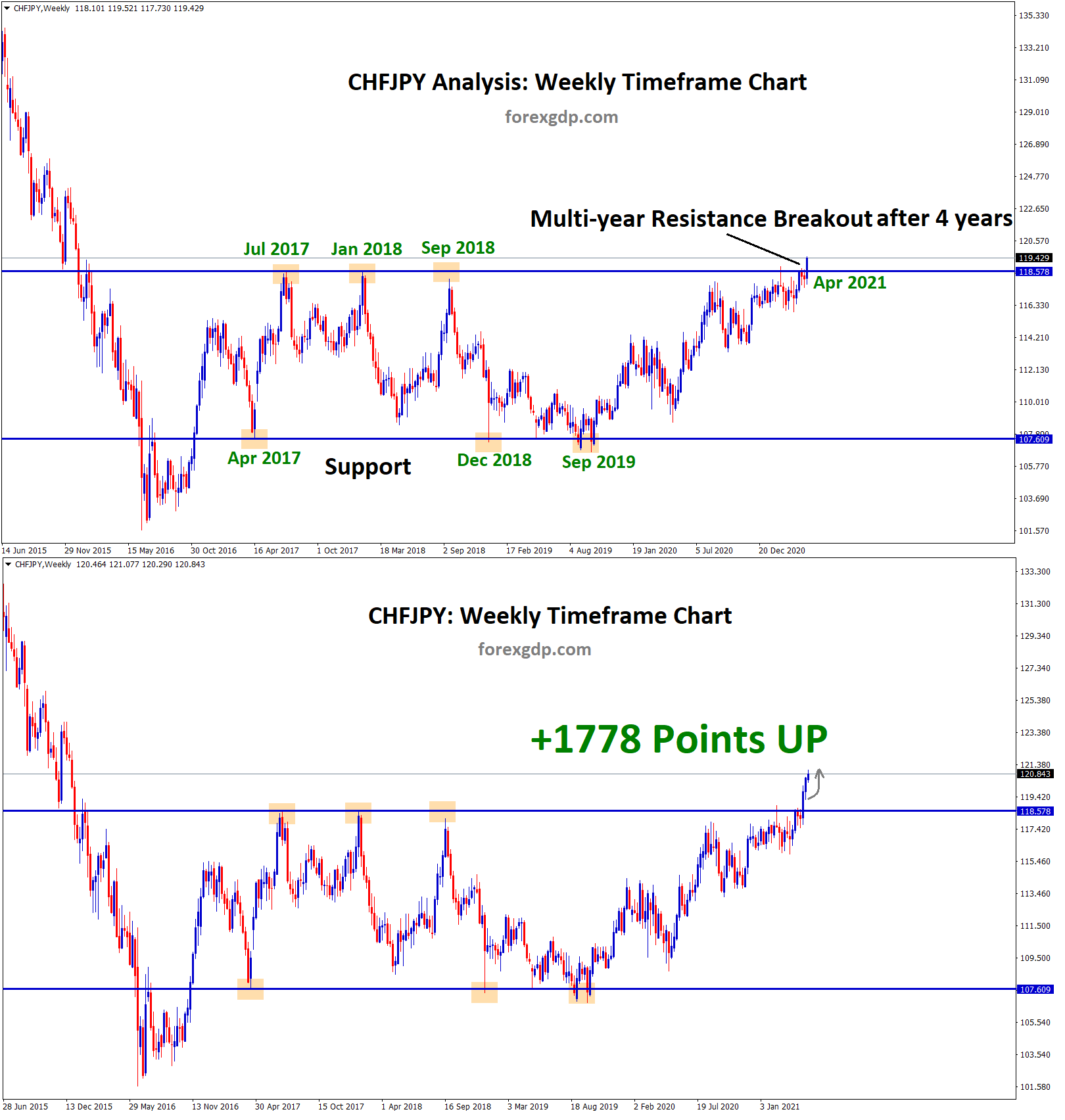

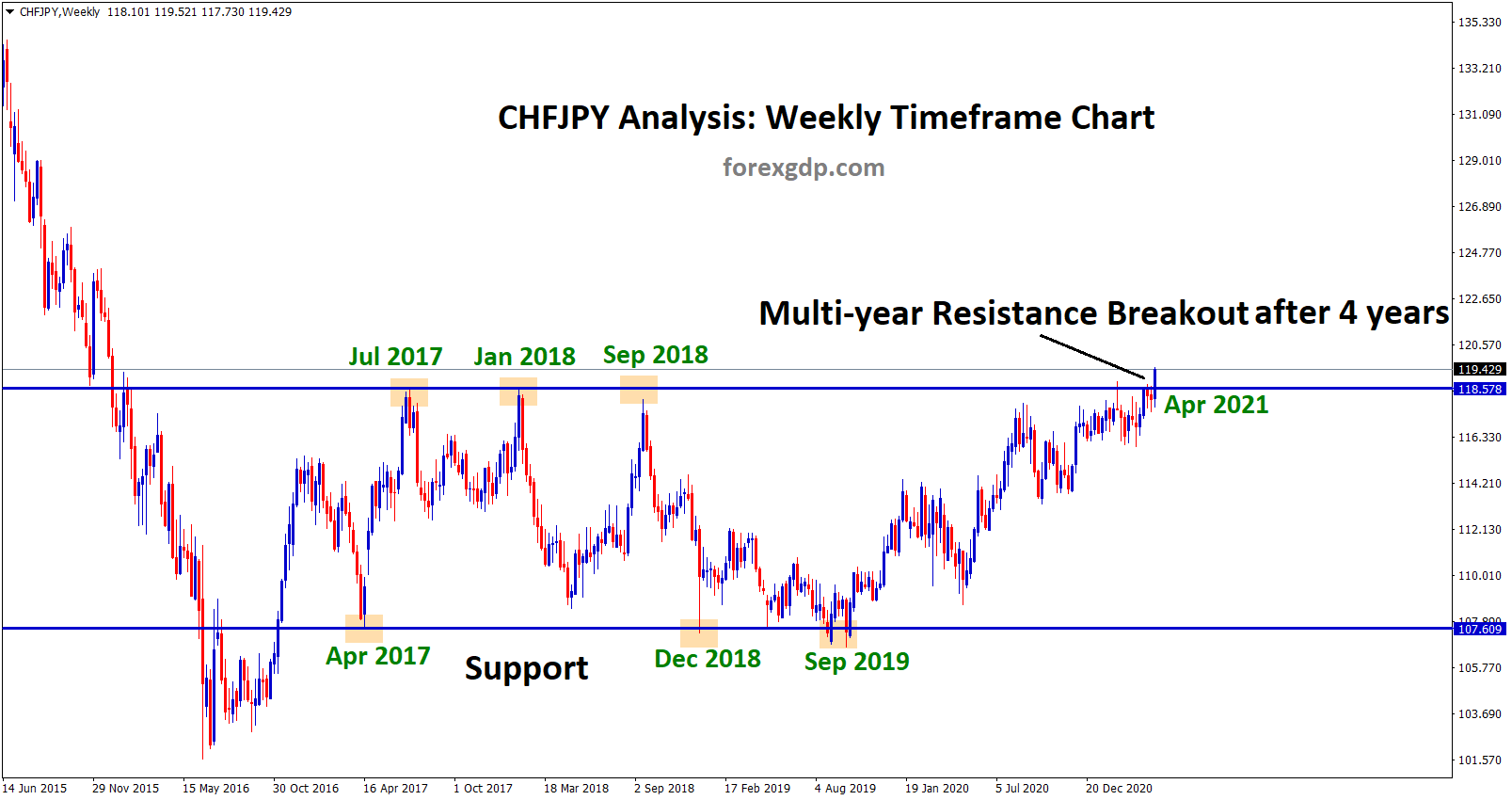

+1778 points achieved after breaking the multi-year resistance on CHFJPY

Multi-year Resistance Breakout After 4 years, CHFJPY has broken this multi-year resistance level in the weekly timeframe chart. In the

Multi-year Resistance breakout after 4 years on CHFJPY

A big Bull run going to happen After 4 years, CHFJPY is breaking this multi-year resistance level in the weekly

Trump and Biden’s Poll – Forex Trade Setups to Watch

EURUSD Analysis EURUSD reached the top zone (lower high) of the descending channel. Inflation data for September month will put