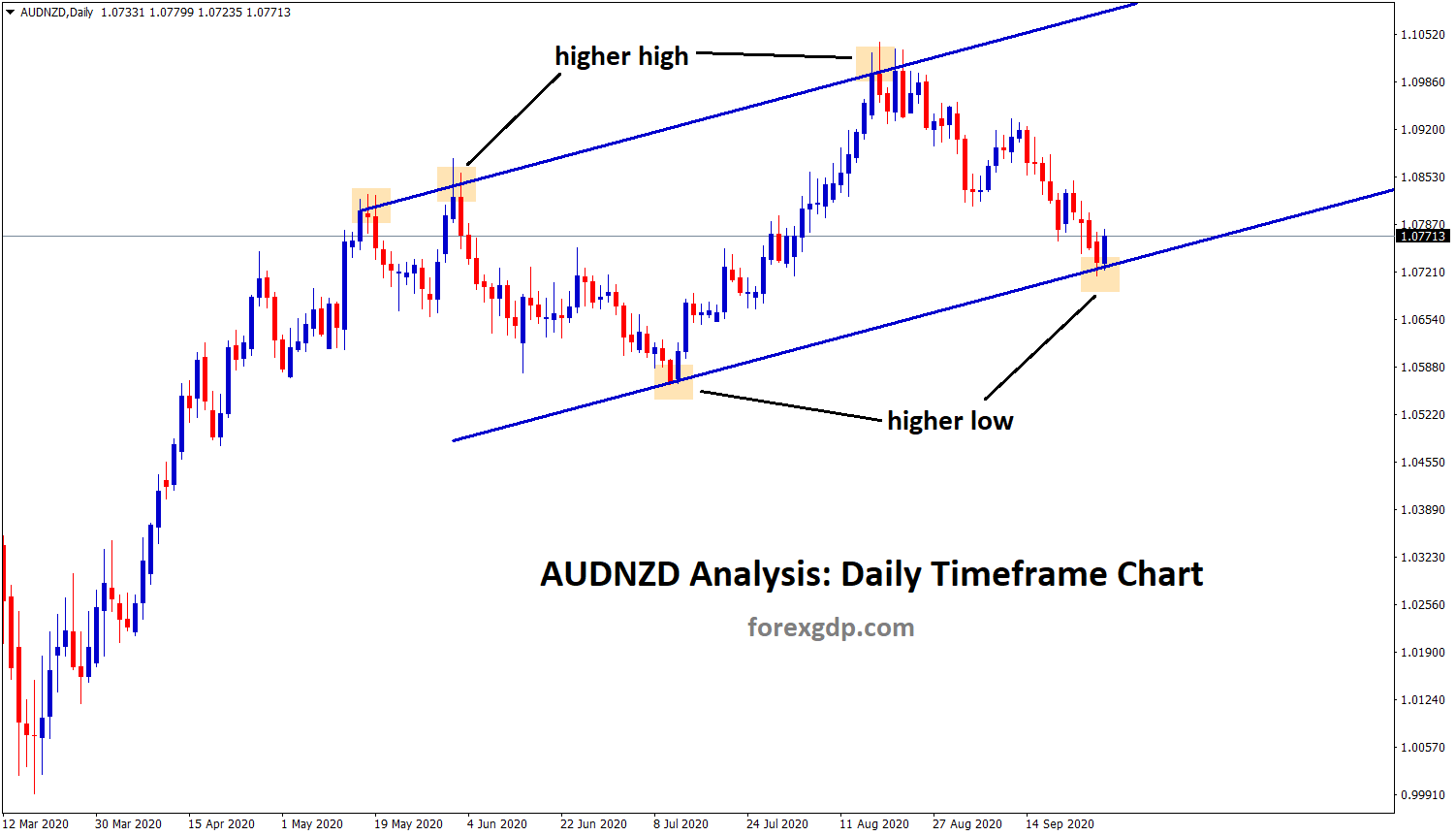

AUDNZD Long term Analysis

AUDNZD reached a higher low of Uptrend line in the Daily time frame chart.

Let’s wait for the confirmation of Reversal or Breakout.

Australia planning for easing of coronavirus restrictions in Melbourne.

October 6 Australian monetary policy meeting expects to cut interest rates to 0.10% from 0.25% now, this will help for Government purchasing of the bond-buying program to achieve the 3-year target.

Upcoming manufacturing PMI release for September and retail sales data for August may move the AUD further.

As the Reserve Bank of New Zealand (RBNZ) has a negative interest rate on the table. If the economy gets worsen then Government will take necessary action to come back to keep the unemployment steady.

Still, negative interest rates are in hands of RBNZ to apply come back from the pandemic.

AUD and NZD both are making corrections. but in AUDNZD pair, we can see the market reached the higher low. expecting some bounce back from this zine.

Get Each forex signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Don’t trade all the time, trade only at Best Setup. Join Free now. Let result speaks on your trading account. Start to receive the forex signals now: forexgdp.com/forex-signals/