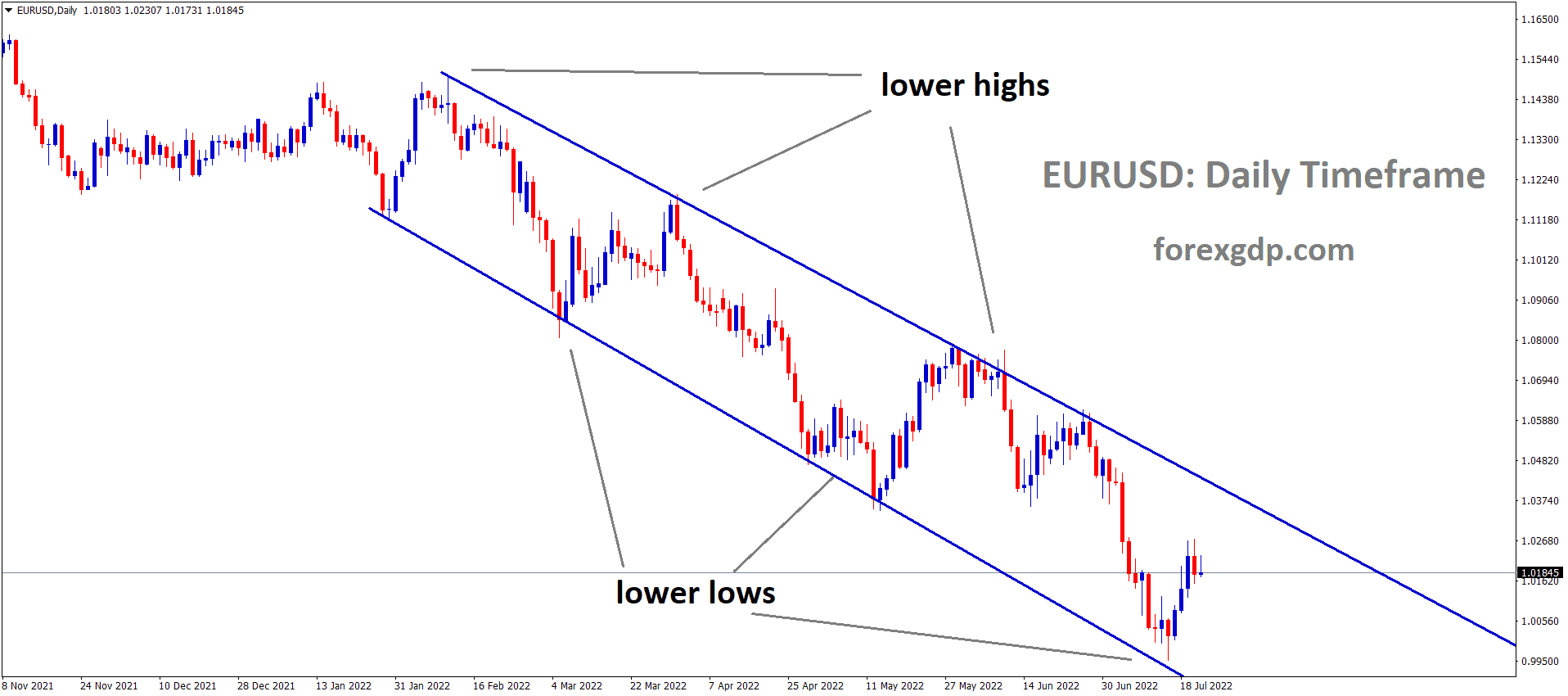

EURUSD is moving in the Descending channel and the market has rebounded from the Lower low area of the channel

Where Is EURUSD Today

The EURUSD charts are quite unstable today as a result of the news that the US had faced a rejected trade deal from the Middle East while the Feds and ECB both held speeches.

EURUSD is moving in an ascending triangle pattern and the market has reached the higher low area of the triangle pattern.

As a result of these releases, the EURUSD pair faced a high instability in its value and is now teasing around the 1.01 region. We may continue to see this pair be volatile throughout the day.

Feds Powell Speech

Feds Chairman Jerome Powell recently held a speech where he talked about the inflation crisis in the country. He reveals, “Inflation remains well above our longer-run goal of 2 percent. Over the 12 months ending in April, total PCE (personal consumption expenditures) prices rose 6.3 percent; excluding the volatile food and energy categories, core PCE prices rose 4.9 percent. The available data for May suggest the core measure likely held at that pace or eased slightly last month. Aggregate demand is strong, supply constraints have been larger and longer lasting than anticipated, and price pressures have spread to a broad range of goods and services. The surge in prices of crude oil and other commodities that resulted from Russia’s invasion of Ukraine is boosting prices for gasoline and fuel and is creating additional upward pressure on inflation. And COVID-19-related lockdowns in China are likely to exacerbate ongoing supply chain disruptions. Over the past year, inflation also increased rapidly in many foreign economies, as discussed in a box in the June Monetary Policy Report.”

He further states, “Overall economic activity edged down in the first quarter, as unusually sharp swings in inventories and net exports more than offset continued strong underlying demand. Recent indicators suggest that real gross domestic product growth has picked up this quarter, with consumer spending remaining strong. In contrast, growth in business fixed investment appears to be slowing, and activity in the housing sector looks to be softening, in part reflecting higher mortgage rates. The tightening in financial conditions that we have seen in recent months should continue to temper growth and help bring demand into a better balance with supply. The labor market has remained extremely tight, with the unemployment rate near a 50‑year low, job vacancies at historical highs, and wage growth elevated. Over the past three months, employment rose by an average of 408,000 jobs per month, down from the average pace seen earlier in the year but still robust. Improvements in labor market conditions have been widespread, including for workers at the lower end of the wage distribution as well as for African Americans and Hispanics.”

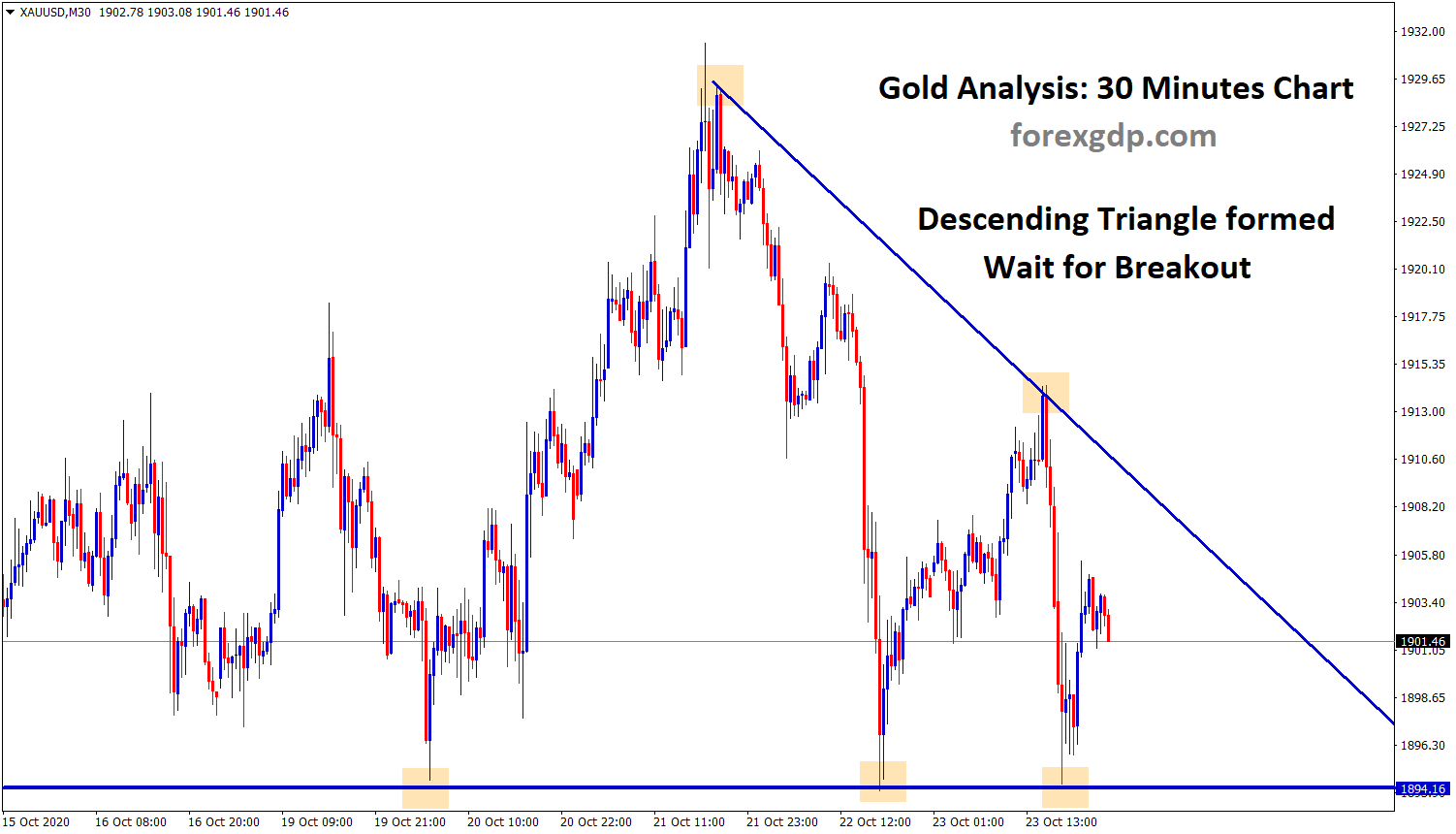

EURUSD is moving in the descending triangle pattern and the market has reached the horizontal support area of the pattern

US Trade Deal Rejection

China has been slowly taking over trade deals with every country it can get. This is angering the US as they don’t want China to become a bigger superpower than them. One of the deals China got was the Middle East. The US has tried to have talks with the Middle East to convince them to give them the deal instead of China. However, these talks were unsuccessful and the Middle East decided to stick with China.

Economists at the Foreign Policy reveal, “Recent initiatives have suggested Beijing may be inching toward greater political engagement. A four-point proposal from Chinese Foreign Minister Wang Yi on the Israeli-Palestinian conflict, put forward amid the May 2021 conflict between Israel and Hamas, was intrinsically interesting merely because the minister spoke out on substantive strategic questions like a two-state solution, a Palestinian capital in East Jerusalem, and the importance of U.N. Security Council action to resolve the Israeli-Palestinian conflict. But the four points themselves—much like the work of Xi’s special envoy for Middle East peace—were completely generic, exhorting dialogue, an end to “violent acts against civilians,” and other peace process bromides.”

EURUSD is moving in the Descending channel and Descending triangle pattern, Market has fallen from the Lower high area of the Descending channel and Reached the Horizontal support area of the Triangle pattern.

ECB Speech

The European Central Bank recently released the findings of a bank-leading survey. This survey reveals, “According to the banks surveyed, access to money markets, securitization and particularly debt securities deteriorated, in net terms, in the second quarter of 2022, reflecting the tightening of financial market conditions for banks. By contrast, access to retail funding improved slightly over the same period. In the first half of 2022, euro area banks’ non-performing loan ratios had a small net tightening impact on credit standards for loans to enterprises, but there was no reported impact on loans for house purchases and consumer credit or other lendings. Across most of the main economic sectors, euro area banks indicated a more pronounced net tightening of credit standards for new loans to enterprises. They also reported a net increase in demand for loans or credit lines across all main economic sectors, in line with the reported overall increase in firms’ demand for loans in the first and second quarters of 2022.”

It further states, “The euro area bank lending survey, which is conducted four times a year, was developed by the Euro system in order to improve its understanding of bank lending behavior in the euro area. The results reported in the July 2022 survey relate to changes observed in the second quarter of 2022 and expected changes in the third quarter of 2022 unless otherwise indicated. The July 2022 survey round was conducted between 10 and 28 June 2022. A total of 153 banks were surveyed in this round, with a response rate of 100%. In the context of high uncertainty, continuing supply chain disruptions and high energy and input prices, banks cite perceptions of increased risk and lower risk tolerance as factors behind the net tightening of credit standards for firms. As monetary policy is becoming less accommodative, euro area banks also reported that their cost of funds and balance sheet constraints had contributed to the tightening of credit standards for loans to firms and households. For the third quarter of 2022, they expect a net tightening of credit standards for loans to firms of a similar magnitude to that in the second quarter (18%). In addition, euro area banks expect credit standards to continue to tighten for both housing loans (24%) and consumer credit (13%).”