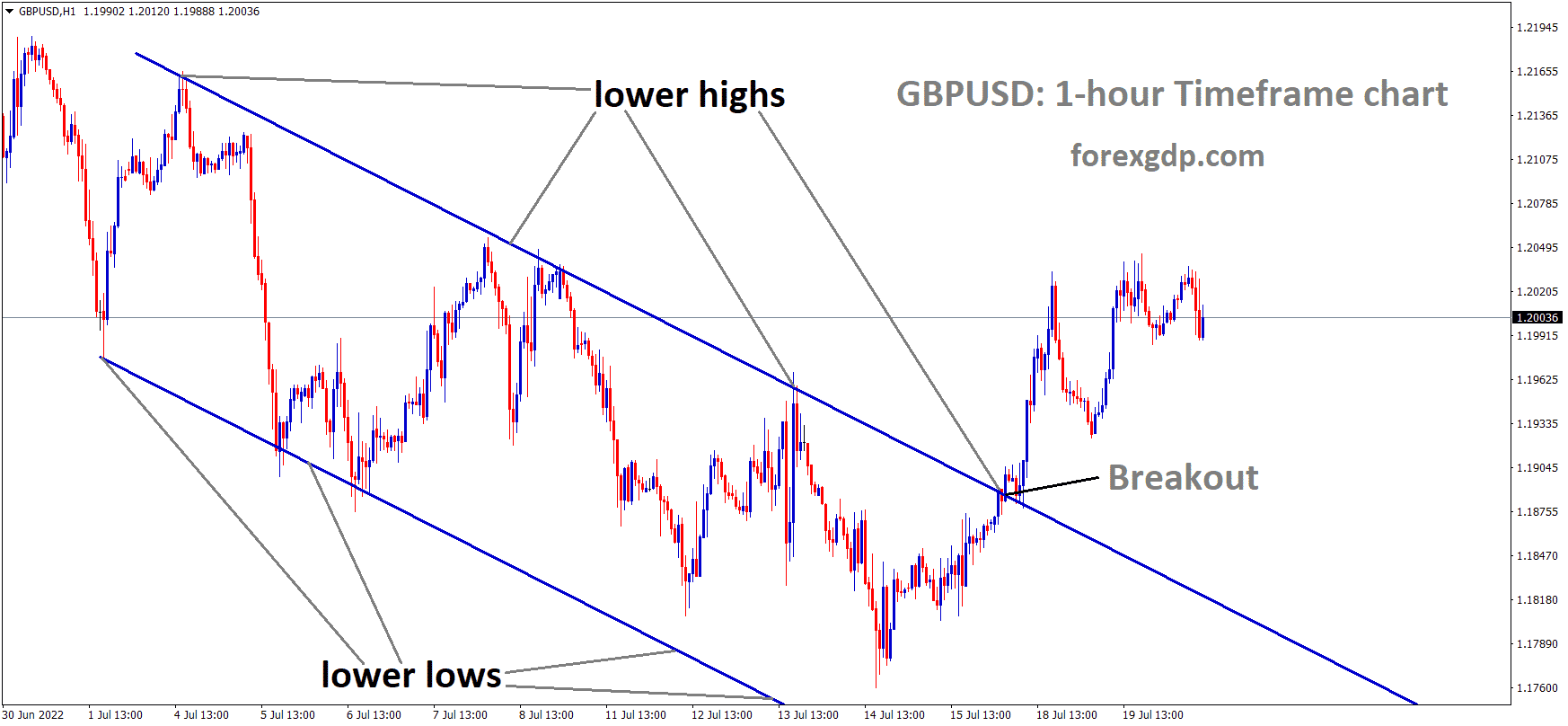

GBPUSD has broken the Descending channel in Upside.

Where Is GBPUSD Today

The GBPUSD charts are quite unstable today as a result of the release of the UK CPI data which shows the highest inflation in 40 years as well as speeches by the BOE.

GBPUSD is moving in an ascending triangle pattern and the market has rebounded from the higher low area of the Ascending triangle pattern.

As a result of these releases, the GBPUSD pair faced a high instability in its value and is now teasing around the 1.20 region. We may continue to see this pair be volatile throughout the day.

BOE Bailey Speech

Andrew Bailey who is the governor of the Bank of England recently held a speech at the Mansion House Financial and Professional Services Dinner where he talks about the impact of four recent shocks on our economy. He states, “Monetary policy has to be set taking into account the scale of this shock to real income while keeping our focus on inflation and inflation expectations. Returning inflation to its 2% target sustainably remains our absolute priority. But we recognize a trade-off in a situation of high inflation and weakening growth. In my view, this trade-off explains why we have raised Bank Rate progressively since last December in increments of 0.25% after the first rise. We have judged what we need to do in the face of these very big external shocks which, assuming Bank Rate following the market path used for the May MPR forecast, will see inflation fall very rapidly next year, and return to target in 2023, and then go below target.”

He further reveals, “But other things may not be equal, and we have been clear that we see the balance of risks to inflation as on the upside. Here, I would pick out the risks from domestic price and wage setting, and this explains why at the MPC’s last meeting we adopted language which made clear that if we see signs of greater persistence of inflation, price and wage setting would be such signs, we will have to act forcefully. In simple terms, this means that a 50 basis point increase will be among the choices on the table when we next meet. 50 basis points are not locked in, and anyone who predicts that is doing so based on their own view. We do not pre-announce Bank Rate decisions for the very simple reason that MPC decisions are based on deliberation at the time among nine people focused on returning inflation to the 2% target sustainably. It so happened that we have stopped using our own transportation to move bank notes around this country, and our fleet of three vehicles was due to be taken out of service.”

The UK CPI Data

The UK released its CPI data earlier today which shows a significant rise in inflation from the previous term. The CPI numbers were at 9.1% just previously and they’re now at 9.4%. This is despite the fact that it was forecasted to be at 9.3%. What these numbers show is that the UK is facing record-breaking inflation which numbers reaching the highest it has been in about 40 years. This is nothing to be proud of and is truly causing unimaginable suffering to the people of the UK who do not live above their means at the moment. The sooner the BOE solves the inflation crisis, the sooner the world can go back to its original state.

CNBC reveals, “U.K. inflation hit yet another new 40-year high in June as food and energy prices continued to soar, escalating the country’s historic cost-of-living crisis. The consumer price index rose 9.4% annually, according to estimates out Wednesday, slightly above a consensus forecast among economists polled by Reuters and up from 9.1% in May. This represented a 0.8% monthly incline in consumer prices, exceeding the previous month’s 0.7% rise but remaining short of the 2.5% monthly increase in April. The most significant contributors to the rising inflation rate came from motor fuels and food, the ONS said, with the former soaring 42.3% on the year, the highest rate since before the start of the constructed historical series in 1989.”

BOE Saunders Speech

Michael Saunders who is a member of the Monetary Policy Committee at the Bank of England also held a speech recently at the Resolution Foundation where he talks about how he is near the end of his term on the committee responsible for setting interest rates. He states, “A key advantage of having a Monetary Policy Committee rather than a single decision-maker is that the combined insight and knowledge of a group of experts will usually exceed that of any individual. And genuine individual accountability of MPC members is probably only possible if votes are publicly disclosed. The current system also helps to ensure that uncertainties and disagreements over the economic outlook and risks (and hence the appropriate policy stance) are brought to the surface and discussed. Arguments get tested in debate among Committee members and external speeches. This is likely to improve the quality of policy decisions and economic forecasts. Moreover, credibility would be eroded if central bankers disagree in private on the appropriate policy stance but feel they should hide such disagreements to give a false public appearance of unanimity.”

GBPUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

He further states, “It is worth noting that, while the pandemic and Brexit have reduced labor supply significantly since end-2019, the prospect that demographic factors would reduce labor supply growth in this decade and the next existed before Covid. However, Brexit and Covid probably have reduced the likelihood that either inward migration or older age participation could rise enough to allow the UK to avoid these demographic constraints. Moreover, the recent shocks from Brexit, Covid, and energy prices have absorbed so much focus that the UK’s demographic shift may (I suspect) have crept up somewhat unnoticed for many businesses, who otherwise might have implemented measures to adapt. The paths for participation and the workforce in this simulation are fairly similar to the central forecast in the May MPR. Hence, to the extent that adverse cyclical effects do materialize, this analysis implies downside risks for participation and the workforce versus the May MPR forecast.”