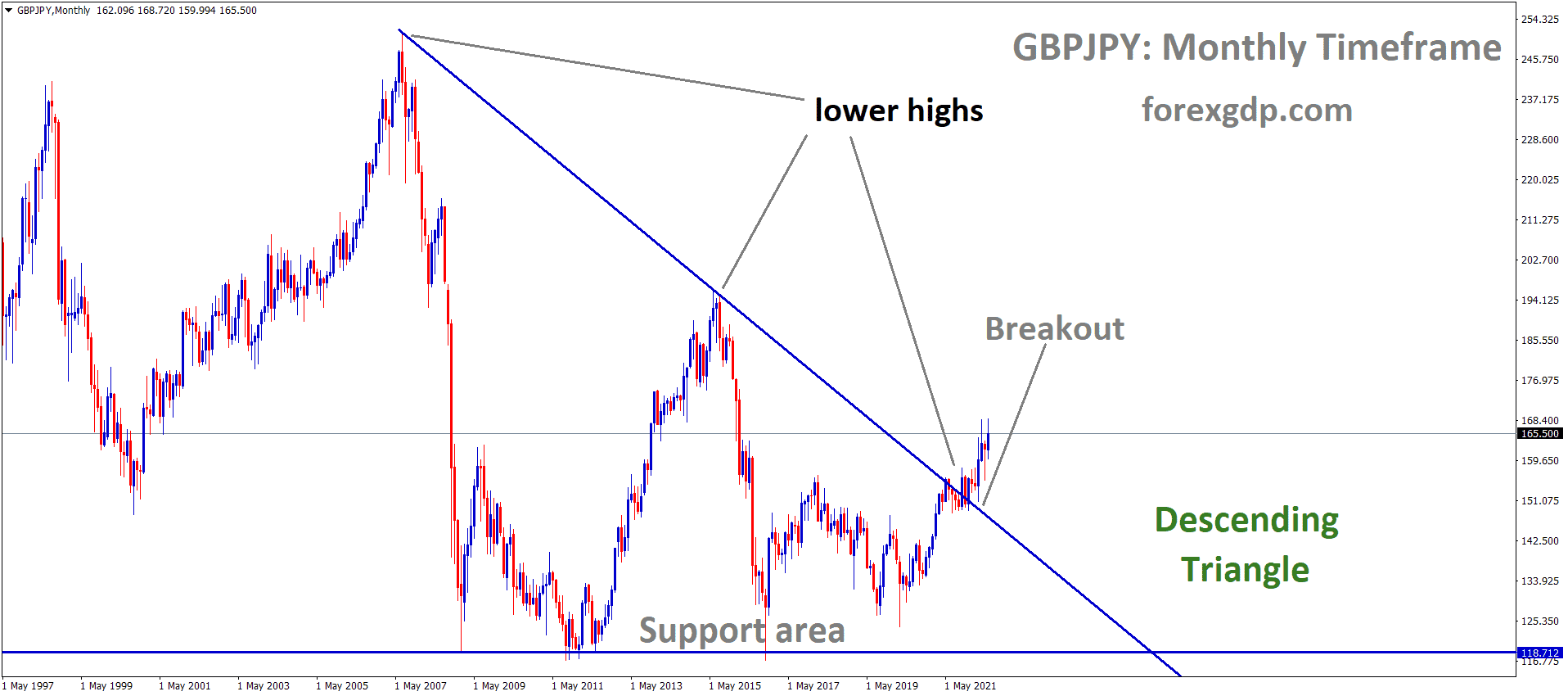

GBPJPY has Broken the Descending triangle pattern.

Where Is GBPJPY Today

The GBPJPY currency pair is in an uptrend today as a result of the recent reveal of the scholarship program for Indians as well as the speeches by representatives from the BOE and BOJ. As a result of these recent events, the GBPJPY pair faced an increase in its market value and is now teasing at around the 165.2 region.

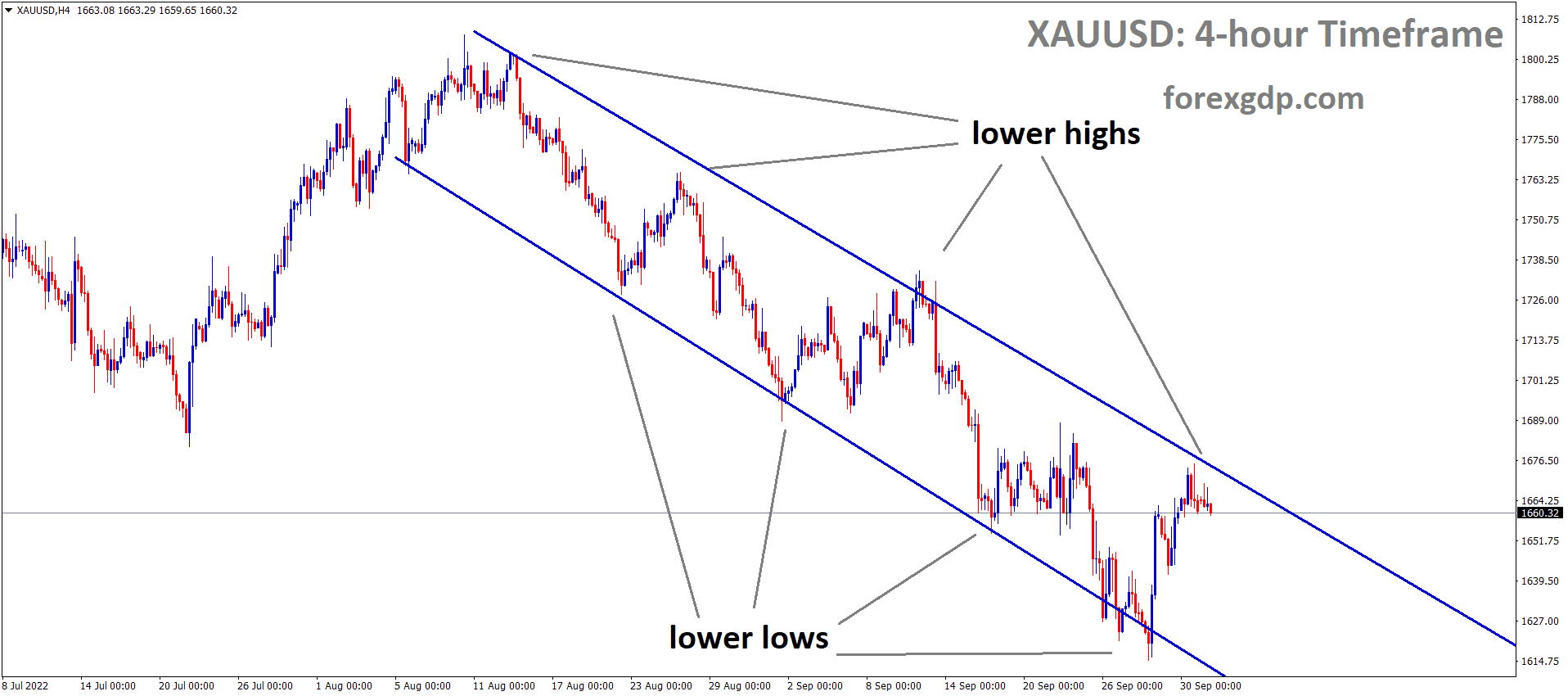

GBPJPY is moving in the Descending channel and the Market has reached the Lower high area of the channel.

The GBPJPY chart is showing some bullish market conditions. We may continue to see this pair increase in value throughout the day.

UK Scholarships For Indians

On account of the 75th anniversary of India, the UK government has announced that they’re going to be giving away 75 fully-funded scholarships to Indian students to come study in the UK from September. The scholarship is for a one-year master’s program to study any subject of your choice. Additionally, the British Council in India is offering around 18 scholarships for women in science, technology, engineering, and mathematics (STEM) covering over 12,000 courses across more than 150 UK universities.

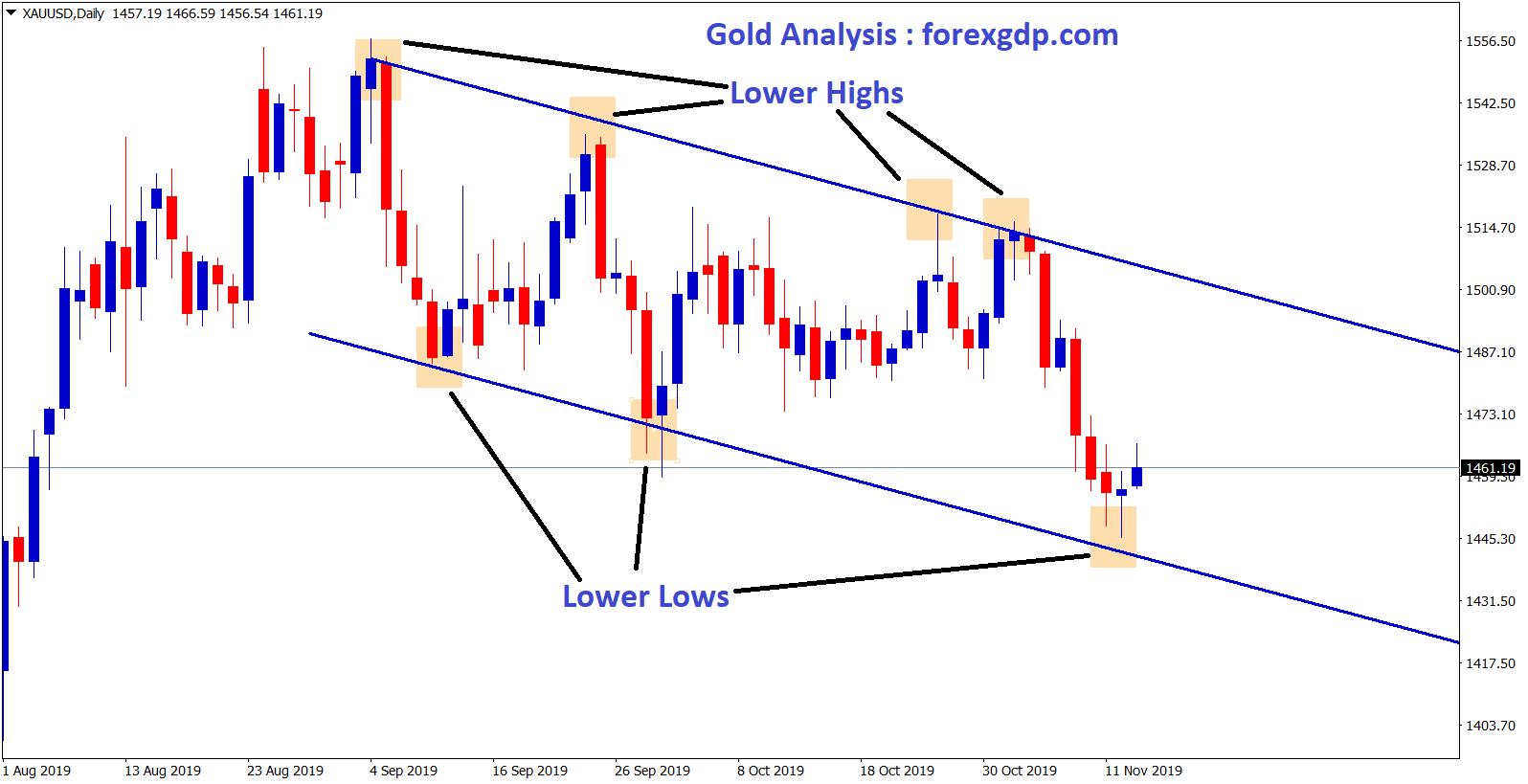

GBPJPY is moving in the Symmetrical triangle pattern and the Market has rebounded from the Bottom area of the Pattern.

The UK government says that their objective with these kinds of scholarships is to bring students from India who were previously studying in smaller cities and who are going to be the first generation to get a master’s degree internationally. This is a huge milestone for many Indians and the UK wants to be a part of this celebration. This is one of the largest offerings ever received for scholarships from the UK.

Economists at the Business Standard reveal, “The fully-funded scholarships include tuition, living expenses and travel cost for a one-year-postgraduate program. The Chevening scheme is the UK government’s international awards scheme offered in 150 countries, aimed at developing global leaders since 1983. A minimum of two years’ work experience is required for candidates to be eligible for the award and details will be made available through the Chevening website. The UK government said that education is one of the mainstays of the diaspora living bridge between the UK and India, which connects people through common values and affinities. According to the latest official statistics, nearly 108,000 study visas were issued to Indian nationals in the year ending March 2022, almost double the number compared to the previous year.”

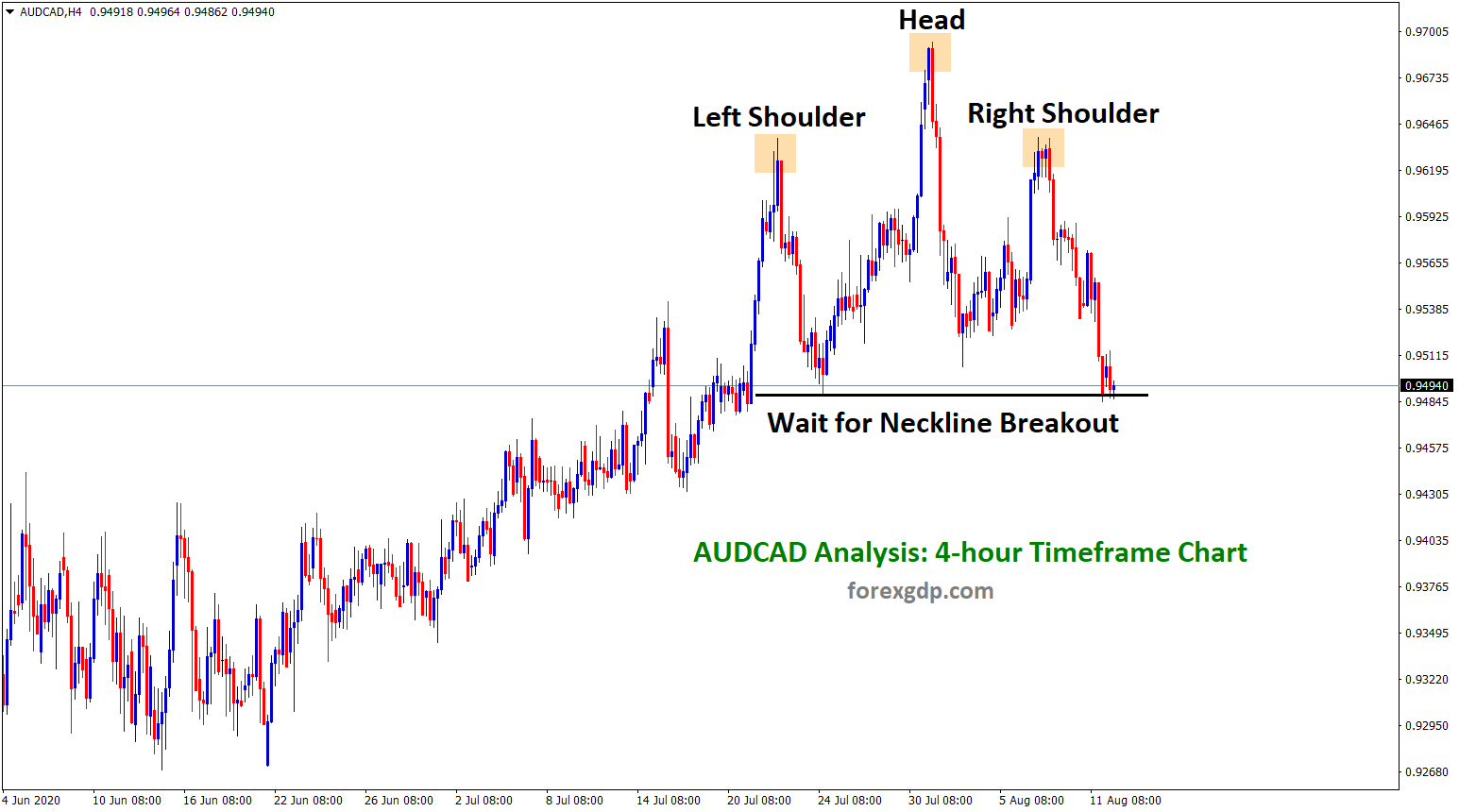

GBPJPY is moving in an Ascending channel and the Market has reached the higher low area of the channel.

BOJ Kuroda Speech

The Governor of the Bank of Japan, Haruhiko Kuroda, held a speech at the IMES conference earlier in the day. He states, “The first frontier is the acceleration of structural changes in the economy amid the prolonged pandemic. The digitalization and automation of society and the economy were in progress even before the pandemic, and having been accelerated by the pandemic, they have expanded and deepened rapidly. Along with this, a restructuring of supply chains has been observed. Also, since the effects of the pandemic were regressive, income inequality appears to have increased further, above its already increasing trend in some advanced economies. The fiscal burden for dealing with this issue has also increased. From an economic perspective, these structural changes may affect the potential growth rate, the natural interest rate, and the Phillips curve. The structural changes may have implications for the effectiveness of monetary policy and the appropriate responses. Central banks should therefore pay close attention to the changing economic structure and its potential impact on prices and the real economy.”

He further states, “In principle, it is the governments’ industrial and fiscal policies that play the primary role in addressing climate change issues. However, it is also important to consider how to make use of market mechanisms to ensure the effectiveness of these policies. One example is the emissions trading systems introduced in the EU and elsewhere. In Japan, national-level plans have been launched. The role of markets in evaluating firms’ efforts to tackle climate change is also important. In this way, the market function can promote changes in firms’ behavior.

GBPJPY is moving in an Ascending channel and the Market has reached the higher high area of the channel.

For example, the Bank of Japan’s Climate Response Financing Operations makes use of financial institutions’ expertise in assessing firms in the area of climate change. The financing operations also require financial institutions to disclose relevant information as a condition for supplying funds. These measures have been designed to help use market discipline in an effective way. The role of central banks may be considered from the perspective of market initiatives, such as promoting the development of financial markets related to climate change.”

BOE Cleland Speech

The executive director of the Bank of England, Victoria Cleland, held a speech at the Central Bank Payments Conference 2022 where she talks about the progress of a plan to make cross-border payments cheaper, faster and more transparent. This plan is set out in a roadmap created by the G20 group of countries. In this speech, he reveals, “And there is a crucial role for the wider public authorities. Central banks changing systems and policies and industry investing in changing operational procedures are just two pieces of the puzzle. There are also important regulatory, legislative, and other barriers that are overcome on a national and international level. For example, finance ministries will need to prepare legislative changes to deliver the benefits of the roadmap (e.g. on AML/CFT standards, data frameworks, and settlement finality protections). And international standard-setting bodies will need to ensure that these standards are aligned on a global level.”

She further states, “The financial system is global, with many of the most important issues requiring the involvement of international public authorities. The FSB, CPMI, the BIS Innovation Hubs, and a range of other standard-setting bodies will have a continued important role to play to reach the quantitative targets for cost, speed, access, and transparency of cross-border payments. They will need to enable best practice sharing between different jurisdictions, monitor the progress achieved on the roadmap, set out clearly what the industry needs to do, and explore what structures could achieve real change. The IMF and World Bank could also help by encouraging involvement and collaboration of non-CPMI countries and offering technical assistance. Enhancing cross-border payments is crucial to the global economy; tangible progress is already being made, and to really change the dial we need to work collaboratively. And we mean the three groups of stakeholders – central banks, industry, and public authorities – working towards a common vision.”