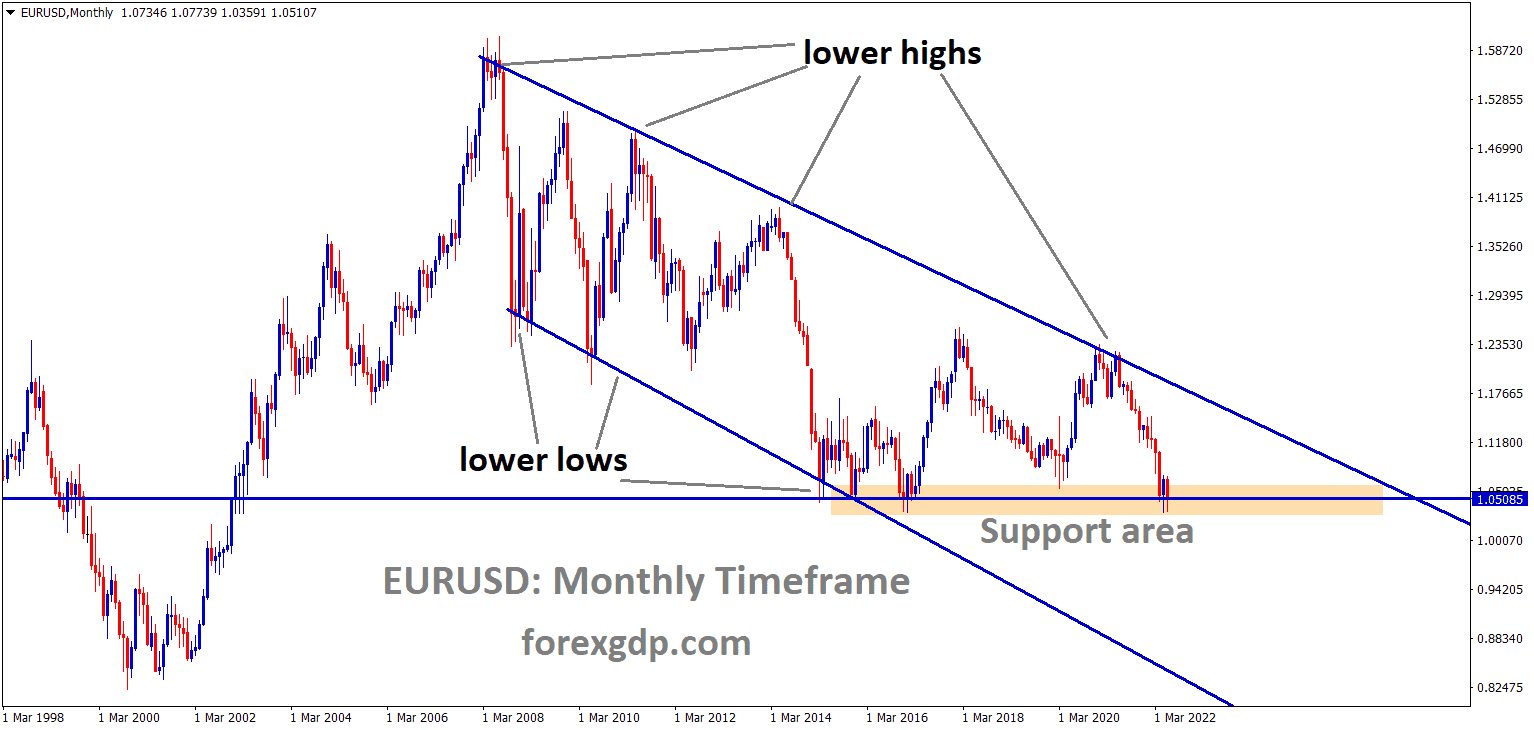

EURUSD is moving in the Descending channel and the Market has reached the horizontal support area of the Pattern.

Where Is EURUSD Today

The EURUSD currency pair is in an uptrend today as a result of the recent ECB Lagarde speech and talks on making Ukraine a member of the EU.

EURUSD is moving in an Ascending triangle pattern and the market has rebounded from the higher low area of the triangle pattern.

As a result of these recent events, the EURUSD pair faced an increase in its market value and is now teasing at around the 1.05 region. The EURUSD chart is showing some bullish market conditions. We may continue to see this pair increase in value throughout the day.

ECB Lagarde Speech

Early on Thursday, President of the European Central Bank Christine Lagarde held a speech at the ECB Forum on Central Banking 2022. She discussed price stability and policy transmission in the euro area. Her speech reveals, “The ECB is conducting monetary policy in an incomplete monetary union, in which its policy has to be transmitted through 19 different financial and sovereign bond markets. The yields on those sovereign bonds provide the benchmark for pricing all other private sector assets in the 19 Member States and ultimately also for ensuring that our monetary policy impulse reaches individual firms and households. If spreads in some countries respond in a rapid and disorderly way to an underlying change in risk-free rates, over and above what would be justified by economic fundamentals, our capacity to deliver a single monetary policy is impeded. In this situation, a change in the policy stance can be followed by an asymmetric response of financing conditions, regardless of the credit risk of individual borrowers.”

She further reveals, “The normalization of our monetary policy will naturally lead to rising risk-free rates and sovereign yields. And, as euro area sovereigns are starting from different fiscal positions, it can also lead to a rise in spreads. But in order to preserve the orderly transmission of our policy stance throughout the euro area, we need to ensure that this repricing is not exacerbated and distorted by destabilizing market dynamics, leading to a fragmentation of our original policy impulse. That risk of fragmentation is also affected by the pandemic, which has left lasting vulnerabilities in the euro area economy. These vulnerabilities are now contributing to the uneven transmission of the normalization of our policy across jurisdictions. This decision lies squarely within the ECB’s tradition. In the past, the ECB has made use of separate instruments to target inflation and preserve the functioning of the monetary policy transmission mechanism. Measures to preserve transmission could be used at any level of interest rates so long as they were designed not to interfere with the monetary policy stance.”

EURUSD is moving in the Descending channel and the Market has Fallen from the Lower high area of the channel.

Ukraine Member Status

Ever since the war began in Ukraine, Ukraine had immediately filed to become a member of the EU. They knew being an EU member could help their economy immensely as right now the value of the Ukrainian economy is dropping quite significantly. But what Ukraine didn’t anticipate was how long it would take. It can actually take decades to become a member of the EU, depending on the relations with other EU members. Turkey has filed to become a member since 1999 and it has been over 20 years yet talks are frozen. A couple of other countries have filed to become EU members after Turkey and their talks haven’t even begun yet. President Zelenskyy knows how long the process can take which is why he pleaded with the EU members to help expedite the process. Certain EU members are wary about allowing Ukraine the membership status as they don’t want to be associated with a war-struck country. It is unclear if the EU will actually expedite the process or if Ukraine has to wait at the back of the line for several years.

CFR Expert Mathias reveals, “There is some unease due to the sense that Ukraine is leapfrogging over other countries that have a clear European future. At the same time, it is understood in most capitals that Kyiv’s road remains long and fraught and that widespread feelings of solidarity with the Ukrainian people justify such a move. This is true in Eastern Europe and the Baltics, but also in countries such as France, which has long been more skeptical of EU enlargement. Ultimately, all twenty-seven EU leaders enthusiastically endorsed Ukraine’s candidacy. Thus, despite the possibility that Crimea and parts of Ukraine’s Donbas region could remain under Russian control for the foreseeable future, Ukraine’s contested borders should not be an impassible hurdle for Kyiv. There is one big difference with Cyprus, however, that makes Ukraine’s case harder: Turkey is an EU candidate country, while it is hard to imagine Russian President Vladimir Putin ever applying for EU candidate status.

Feds Recession Plans

EURUSD is moving in the Descending triangle pattern and the market has reached the horizontal support area of the Pattern.

The US is currently eyeing the Feds like a hawk as they try to understand if the Feds are even doing anything to prevent a recession. With all the hard interest hikes that are happening every session, it is unclear if the Feds even realize that this could directly lead them into the jaws of a recession. It is believed that the Feds are not thinking about the recession issue at the moment. They want to focus on first solving the issue on hand which is inflation and once this is resolved, they may shift to figuring out how to solve the recession crisis. The US citizens seem to be more worried about the upcoming recession than the current inflation at the moment.

San Francisco Fed President Mary Daly reveals in an interview, “Many are worried that the Fed might be acting too aggressively and maybe tip the economy into recession. I am myself worried that left unbridled, inflation would be a major constraint and threat to the U.S economy and continued expansion. The Feds are tapping the brakes by raising interest rates to cool demand. We are working towards that as quickly as we possibly can, and hopefully, Americans everywhere will start to see some relief in their pocketbooks. I expect the economy to slow but not stop growing. We need to move expeditiously. In terms of our next meeting, I think 50 or 75 basis points is clearly going to be the debate.”