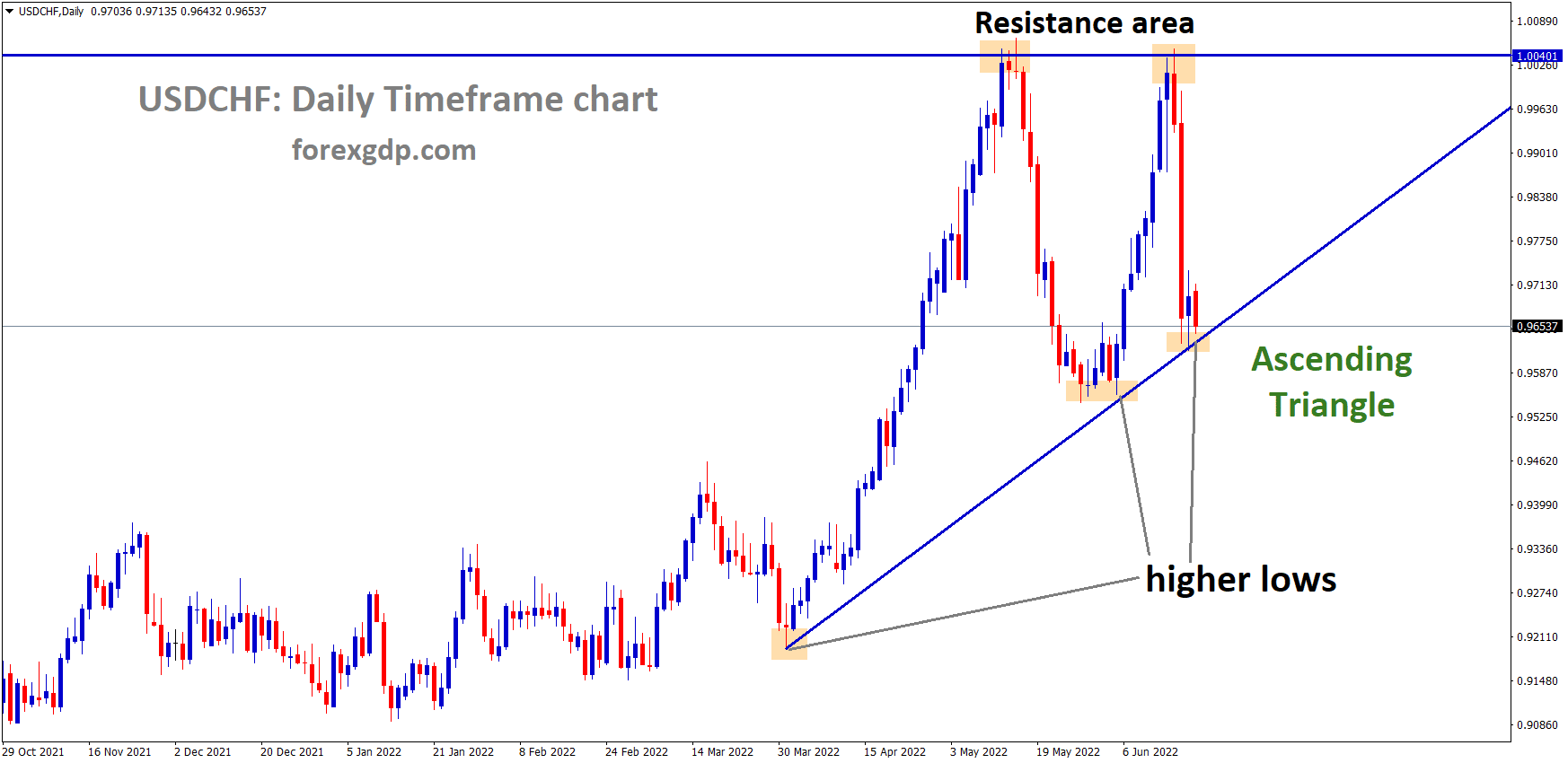

USDCHF is moving in an Ascending Triangle Pattern and the Market has rebounded from the higher low area of the Triangle pattern.

Where Is USDCHF Today

The USDCHF currency pair is on a rise today as a result of the interest rate decisions by the Swiss National Bank which increased its rates for the first time in 15 years. As a result of this decision, the USDCHF pair faced a slight drop in its market value and is now teasing at around the 0.965 region. The USDCHF chart is showing some bearish market conditions. We may continue to see this pair decrease in value throughout the day.

Swiss Interest Rates

In a record-breaking turn of events, the Swiss National Bank increased its interest rates for the first time in 15 years. The biggest thing we’re learning from this situation is the true depth of the inflation in the economy. Switzerland never had any issues with their interest rates yet now they suddenly have to increase them in order to combat inflation. The Swiss National Bank increased its interest rates by half a percentage point to make it go from -0.75% to -0.25%. In their monetary policy statement, SNB reveals, “The SNB is tightening its monetary policy and is raising the SNB policy rate and the interest rate on sight deposits at the SNB by half a percentage point to −0.25% to counter increased inflationary pressure.

USDCHF is moving in the Box Pattern and the Market has Fallen from the Horizontal resistance area of the Pattern.

The tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the SNB policy rate will be necessary for the foreseeable future to stabilize inflation in the range consistent with price stability over the medium term.”

The statement further reveals, “In its baseline scenario for the global economy, the SNB assumes that energy prices will remain high for the time being, but that there will not be an acute energy shortage in the major economic areas. The positive development of the economy should thus continue overall. Owing to the increased prices for energy and food, coupled with the supply bottlenecks, inflation is likely to remain high for some time. However, the importance of these factors should diminish over the medium term. With monetary policy also becoming increasingly tighter in many countries, inflation is likely to gradually return to more moderate levels. The war in Ukraine has thus far had a comparatively little adverse impact on economic activity in Switzerland. The effect has been most clearly felt in the higher energy prices and in the supply bottlenecks. “

US-China Rivalry

When the US withdrew their military from Afghanistan, it lost a major place in Asia as a superpower. This gave China the advantage to take over and slowly place its military bases in different countries in Asia. The US and China are currently battling to become world superpowers. They will do anything to stop the other from spreading their control over the globe. China currently has a pretty good hold over the Middle East. This is disturbing the US which is looking to take over control and leave China behind. Economists at the ASPI have been following this story and reveal. “As a major fossil-fuel producer, the Middle East is clearly important to the US. In fact, it is sky-high energy prices that have forced Biden to try to patch up his relationship with Saudi Arabia. Until recently, Biden was shunning Crown Prince Mohammed bin Salman, the country’s de facto ruler, over his alleged role in the murder of Saudi journalist Jamal Khashoggi in Turkey in 2018.”

They further reveal, “ As China builds up its technological and innovative capacity, it can present itself as a more reliable source of technology and a safer investment destination. It is telling that no Middle Eastern country has banned the Chinese telecom giant Huawei’s 5G networks, despite strong American lobbying. While the case for a new Middle East strategy focused on diplomatic and economic engagement is strong, any attempt by Biden to implement one will meet significant resistance. Befriending dictators will lead to charges of hypocrisy—the last thing Biden needs months before midterm elections in which his Democratic Party is unlikely to perform well—and protectionist sentiment remains strong in the US. But if Biden frames the shift as part of a larger strategy for winning the new cold war with China, he might have a chance.”

SNB Jordan Speech

Following the release of the monetary policy statement, the Swiss National Bank Chairman, Thomas Jordan, held a speech where he went over some of the details that led to this decision. He reveals, “I will begin with our monetary policy decision. We have decided to tighten our monetary policy and raise the SNB policy rate and the interest rate on sight deposits at the SNB by half a percentage point to −0.25%. In doing so, we are seeking to counter increased inflationary pressure. The tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the SNB policy rate will be necessary for the foreseeable future to stabilize inflation in the range consistent with price stability over the medium term. To ensure appropriate monetary conditions, we are also willing to be active in the foreign exchange market as necessary.”

He further reveals, “In our baseline scenario for the global economy, we assume that energy prices will remain high for the time being, but that there will not be an acute energy shortage in the major economic areas. The positive development of the economy should thus continue overall. Owing to the increased prices for energy and food, coupled with the supply bottlenecks, inflation is likely to remain high for some time. However, the importance of these factors should diminish over the medium term. With monetary policy also becoming increasingly tighter in many countries, inflation is likely to gradually return to more moderate levels. Since the last monetary policy assessment, the development of the Swiss franc exchange rate has also contributed to the rise in inflation. The Swiss franc has depreciated in trade-weighted terms, despite the higher inflation abroad. Thus the inflation imported from abroad into Switzerland has increased. Another consequence of this depreciation coupled with significantly higher inflation abroad is that the Swiss franc is no longer highly valued.”