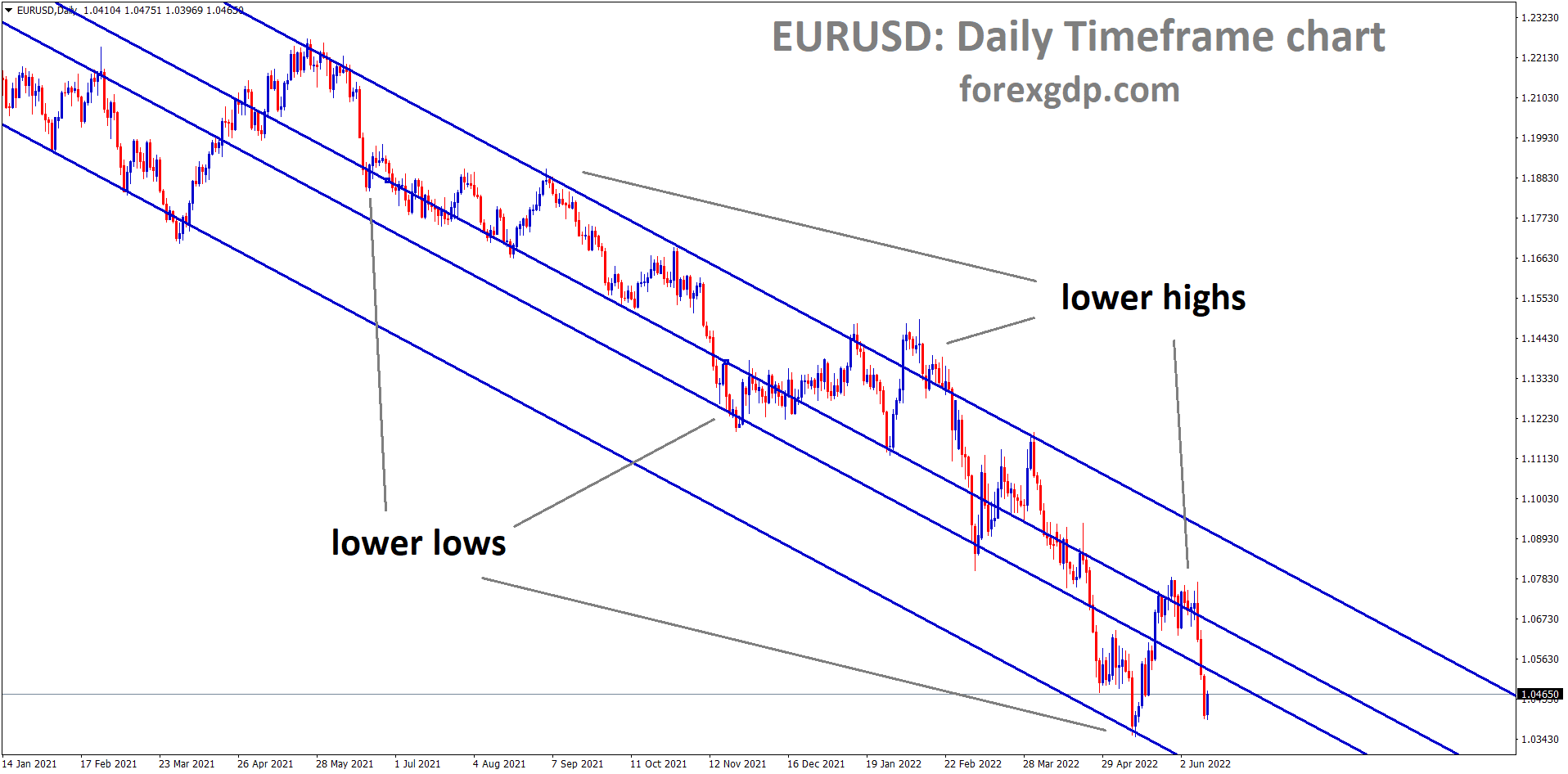

Where Is EURUSD Today

The EURUSD charts are on a downfall today as a result of the release of the Fed’s interest rate decision and ECB speech. As a result of these releases the EURUSD pair had faced a decrease in its value and is now teasing at around the 1.039 region. The EURUSD chart is showing some bearish market conditions. We may continue to see this pair fall throughout the day.

Feds Interest Rate Decision

The Feds recently released their interest rate decision which showed that they increased their interest rates by 75 basis points. This brought their interest rates from 1% to 1.75%. The last time they increased their interest rates was by 50 basis points so it was expected that this time around would be this much as well. However, the 75 basis points still comes as no surprise considering they’re trying to bring inflation under control as soon as possible. The Feds released a statement that reveals, “Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.”

They further reveal, “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt, and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that was issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective. In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Ukraine EU Membership

Just four days after Russia invaded Ukraine, Ukraine filed to become a member of the European Union. Now four months later, the process has finally begun. What’s quite important to note is that while the EU states are fully supporting Ukraine in this war with Russia, this does not necessarily translate to the EU states wanting Ukraine to join the team. In fact, most of the EU states are pretty skeptical about this decision as they don’t want a country at war to represent the EU. This is causing quite the tension between Ukraine and several EU states. The voting will happen very soon so we will soon find out who really supports Ukraine and who doesn’t.

Luke Gee from CNN reveals, “The question of whether or not Ukraine should join the EU and how Russia would react has been a contentious issue for years. In 2013, pro-European protests erupted after former Ukrainian President Viktor Yanukovych made a sudden decision to not sign an agreement with the EU that would pull Ukraine further into the EU’s orbit. Instead, he opted to pursue closer ties with Putin’s Russia. The following year, Russia invaded Donbas and illegally annexed Crimea. While most European nations are firmly behind Ukraine and have, to varying degrees, aided Zelensky in his war efforts, it’s far from certain that his wish will be granted. For political and procedural reasons, it is possible that the EU ultimately decides that now is not the right time. And even if they did agree with European Commission President Ursula von der Leyen’s opinion that Ukraine should be considered for membership, it could take years, even decades, for it to become a reality.”

ECB Speech

Fabio Panetta, member of the ECB’s executive board, recently held a speech at the European Payments Council’s 20th-anniversary conference where he talked about bringing European payments to the next stage. He states, “We have been clear from the outset that we see financial intermediaries having a crucial role in distributing and promoting the digital euro. By design, the digital euro will not crowd out existing private financial instruments. Rather, it will preserve the coexistence of central bank money and private money, supporting innovation by private intermediaries. Our digital euro project may therefore provide a suitable opportunity to establish the public-private cooperation that is needed to build the pan-European private retail payment solutions of the future. This would combine the comparative advantages of the Euro system in relation to large-scale payment infrastructure with the expertise of private sector partners when it comes to distributing payment products and interacting with end-users.”

He further states, “Over the past 20 years, the European payments market has become more integrated, more innovative, and more efficient. The successful transition from a fragmented payments ecosystem to a Single Euro Payments Area contributed to the smooth introduction of the single currency. And it was the combined knowledge and efforts of both public authorities and private intermediaries that made this possible. The Euro system is working on several fronts to meet these challenges, most notably by exploring the possible introduction of a digital euro and by implementing its retail payments strategy. In the coming months, we will step up our interaction with the private sector to explore the links between these two crucial projects. Combining our strengths and working together towards a common goal remains the best way to build a modern, efficient and inclusive European payment system for the future.”