Introducing AUDNZD

The AUDNZD currency pair is the combination of two quite popular currencies, the Australian Dollar and the New Zealand Dollar. The Australian Dollar is the seventh most popular currency after the USD. It is the national currency of Australia. The New Zealand Dollar is the tenth most popular currency. It is the national currency of Australia. Both these countries belong to the G8 which is why they’re extremely popular. The G8 are the top 8 most developed or industrialized countries in the world. They’re highly looked upon for their economic conditions. Together, the AUDNZD currency pair is the tenth most popular minor currency pair in the forex industry. The reason it is still considered a minor currency pair, despite being really popular, is because it does not contain the USD which is the most popular currency in the world. It is also important to note that because this pair does not contain the USD, it is also referred to as a cross-currency pair. In order to better understand how this currency pair works together, we must first understand who they are as individuals. Let’s get familiar with the AUD and NZD.

The Australian Dollar

The Australian Dollar, or AUD, is the official currency of Australia. It is the seventh most traded currency in the world. This is in terms of trading volume or the amount of trade that occurs with this currency pair. About 5.3% of daily trades in the forex industry involve this currency. In the currency market, it is denoted by the symbol AUD.

Australia is known for its exports of valuable commodities such as metals and energy resources. The most popular metal it exports is gold and the most popular energy resource it exports is oil. Since 1825, Australia has only used British coins as its official currency. They began using physical notes of the Australian Pound in 1910. However, in 1966, it changed its currency to the Australian Dollar in order to enhance relations with the United States. The Reserve Bank of Australia is in charge of issuing AUD notes.

The New Zealand Dollar

The New Zealand Dollar, or NZD, is the official currency of New Zealand. It is the tenth most traded currency in the world. About 1.6% of daily trades in the forex industry involve this currency. New Zealand is known as a commodity giant due to being a large exporter of dairy and agricultural products. They’re also a popular destination for tourists. Previously, New Zealand’s currency was the New Zealand Pound. The New Zealand Dollar maintained a fixed exchange rate with the US Dollar until 1985. After 1985, they were only allowed to use their own variable rates.

Their physical notes have undergone several alterations over the years in order to be more visually appealing while also being more secure. In 1999, New Zealand improved the quality of its banknotes from paper to polymer and plastic. This was done to make fake notes much simpler to identify. This also makes the notes waterproof and more difficult to disintegrate. Their notes are well-known for having extremely realistic coloring, and they are always improving the quality to make it more attractive.

Why Trade AUDNZD

The AUDNZD currency pair is fortunate to possess some unique features which make for some interesting trading conditions. Being a cross-currency pair, they’re given much more room to grow than the USD pairs. Following are some top reasons to trade AUDNZD:

Low Volatility

AUDNZD is among one of the few currency pairs that are fortunate to have quite a stable market. This probably has something to do with the fact that both Australia and New Zealand belong to the same region. Both of their markets operate the best at the same timings as well. They even export most of the same products since those products are well known in their territories. These individual economies of both Australia and New Zealand have so much in common. This is also mainly why both AUD and NZD are so similar which makes it harder for them to contradict each other when trading. Due to this reason, they’re often found in stable market conditions with very low volatility.

Commodity Correlations

A great reason to trade currency pairs like the AUDNZD is because of their correlations to other assets in the market. This can be seen in the case of the New Zealand Dollar which has great correlations to commodities which include dairy and agricultural products.

Their most popular dairy exports are whole milk powder. Similarly, their most popular agricultural exports are sheep wool. New Zealand is one of the largest exporters of these commodities. It can also be seen in the case of the Australian Dollar which has great correlations to commodities such as oil and gold. This is because they’re highly involved in the exports of renewable energy such as oil and safe-haven assets like gold. Therefore, it makes it even simpler to trade this pair as if we understand the direction of the commodities market, we can easily understand the direction of the AUDNZD market as well. We’ll get into more detail later on regarding how exactly these commodities will impact the movement of AUDNZD.

Market Predictability

The market conditions for AUDNZD are rather simple to forecast. This is because they are mostly affected by changes in their respective areas, which are Australia and New Zealand. Any changes occurring anywhere in the globe would have an influence on a pair containing the USD because USD is utilized as the standard currency for transactions worldwide. Similarly, any changes that occur anywhere in the 28 member nations of the European Union would have an influence on a pair that includes the Euro. As a result, keeping track of every place that may have an influence on a currency pair becomes rather demanding. Forex pairs that are just related to a particular area, such as AUDNZD, are significantly easier to forecast since we only need to evaluate their respective economies.

AUDNZD Trading Tips

As discussed above, AUDNZD has some pretty unique features which make for interesting trading. They, therefore, require unusual trading techniques in order to trade more successfully. Following are some top trading tips for AUDNZD:

Trade Timings

Because both Australia and New Zealand are in roughly the same region, their economies are active at about the same time. This makes it much easier to understand the best time to trade the AUDNZD currency pair. Most economic data that impacts the AUDNZD currency pair is released during the Asia session. The Asia session begins at 10 pm GMT with Sydney. However, the best time to trade the AUDNZD currency pair during the Asia session is at midnight at 12 am GMT. The activity increases significantly when there’s an overlap in trading sessions. This can be seen between the London and Tokyo session. They overlap for an hour when the Asia session closes with Tokyo and the European session begins with London. The market is generally more liquid during this time.

Economic Conditions

One of the greatest things to look out for when trading currency pairs like the AUDNZD is the economic news for their individual currencies. If there’s anything important upcoming in Australia or New Zealand, it would be best to hold any positions till we know the results of whatever we’re waiting for. This is because depending on the results of the reports or events, the value of AUDNZD may increase or decrease. It could even become extremely volatile and show itself on both sides of the market. It is therefore important to always know whenever someone is going to happen in these regions in order to be able to trade better.

Swing Trading

Swing trading involves holding an asset for one or more days in order to profit from price fluctuations. AUDNZD is frequently characterized by price fluctuations that establish well-defined ranges over lengthy periods of time. As a result, the pair is suitable for swing trading. Swing trading the AUDNZD currency pair involves selecting a range within which the pair’s movement is confined. Once you’ve determined the price range, you might sell when the price hits the top of the range (resistance) and purchase when the price reaches the bottom of the range (support) (support). When a pair is trading inside a range, the usual expectation is that when the price hits the resistance or support, it will not break through but will instead begin moving in the opposite direction of the barrier or support.

Factors Affecting AUDNZD

The AUDNZD currency pair belong to two countries that are quite similar to each other due to belonging to the same region. Due to this reason, their impacting factors usually correlate to one another. Top factors affecting AUDNZD include:

The Tourism Industry

New Zealand is among the most popular tourist destinations in the world. They’re known for their cool weather conditions, the mountain peaks, and the relaxing beaches. As a result, anything that impacts the tourism sector will have a direct impact on New Zealand’s economy.

During the holiday season when tourism is at its peak, people will be visiting New Zealand more often than usual. This will make the NZD increase in value and therefore, make AUDNZD drop in value. Similarly, during busy exam seasons, tourism will be at its lowest and people won’t be visiting New Zealand as often as usual. This will make the NZD decrease in value and therefore, make AUDNZD increase in value.

The Oil Markets

Australia is among the largest exporters of crude oil in the industry. They make up quite a large chunk of the world’s oil supply.

Therefore, any change in the demand for crude oil around the world will have a significant impact on Australia’s exports and therefore their economy as well. An increase in demand for crude oil would cause AUD to increase in value and in turn cause AUDNZD to also increase in value. Similarly, a decrease in demand for crude oil would cause AUD to decrease in value and in turn cause AUDNZD to also decrease in value.

The Dairy Markets

The AUDNZD currency pair is greatly impacted by any changes to the dairy industry. This is because New Zealand is the largest exporter of whole milk powder around the world. Their economy is largely dependent on the demand for this product. If the demand for this product increases, AUDNZD would suffer a decrease in value. Similarly, if the demand for this product decreases, AUDNZD will increase in value as New Zealand’s economy will face a decline. We can also look at this from a price point of view. An increase in price for these types of dairy products would decrease the value of AUDNZD and a decrease in price would cause AUDNZD to increase in value.

The Gold Markets

Australia is the third-largest gold exporter in the world. As a result, in order to thrive and develop in value, its economy is strongly dependent on the export of this valuable product. Any changes in the commodities market, such  as supply or demand, will have a direct impact on the AUDNZD pair.

as supply or demand, will have a direct impact on the AUDNZD pair.

If demand for gold grows, Australia will export more gold, leading the AUDNZD to appreciate. If gold demand declines, Australia would suffer since it will be unable to export as much of it, leading the AUDNZD to drop in value. This may be seen during the Asian wedding season when the demand for gold skyrockets. This season causes the AUDNZD to rise.

The Agriculture Markets

New Zealand is among the largest exporters of agricultural products. Their most popular agricultural exports are sheep wool and its derivatives. Any changes in the demand for sheep wool around the world will have a huge impact on New Zealand’s economy. The demand for sheep wool is usually high during wintertime. This would make New Zealand be able to export it more often which would make NZD increase in value and therefore, AUDNZD would decrease in value. Similarly, the demand for sheep wool drops significantly during the summers. This would make New Zealand not be able to export them as much as usual which would make NZD decrease in value and therefore, AUDNZD would increase in value.

Most common questions asked by the forex traders about AUDNZD:

Forex GDP, Babypips, Tradingview, Forexfactory.

AUDNZD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

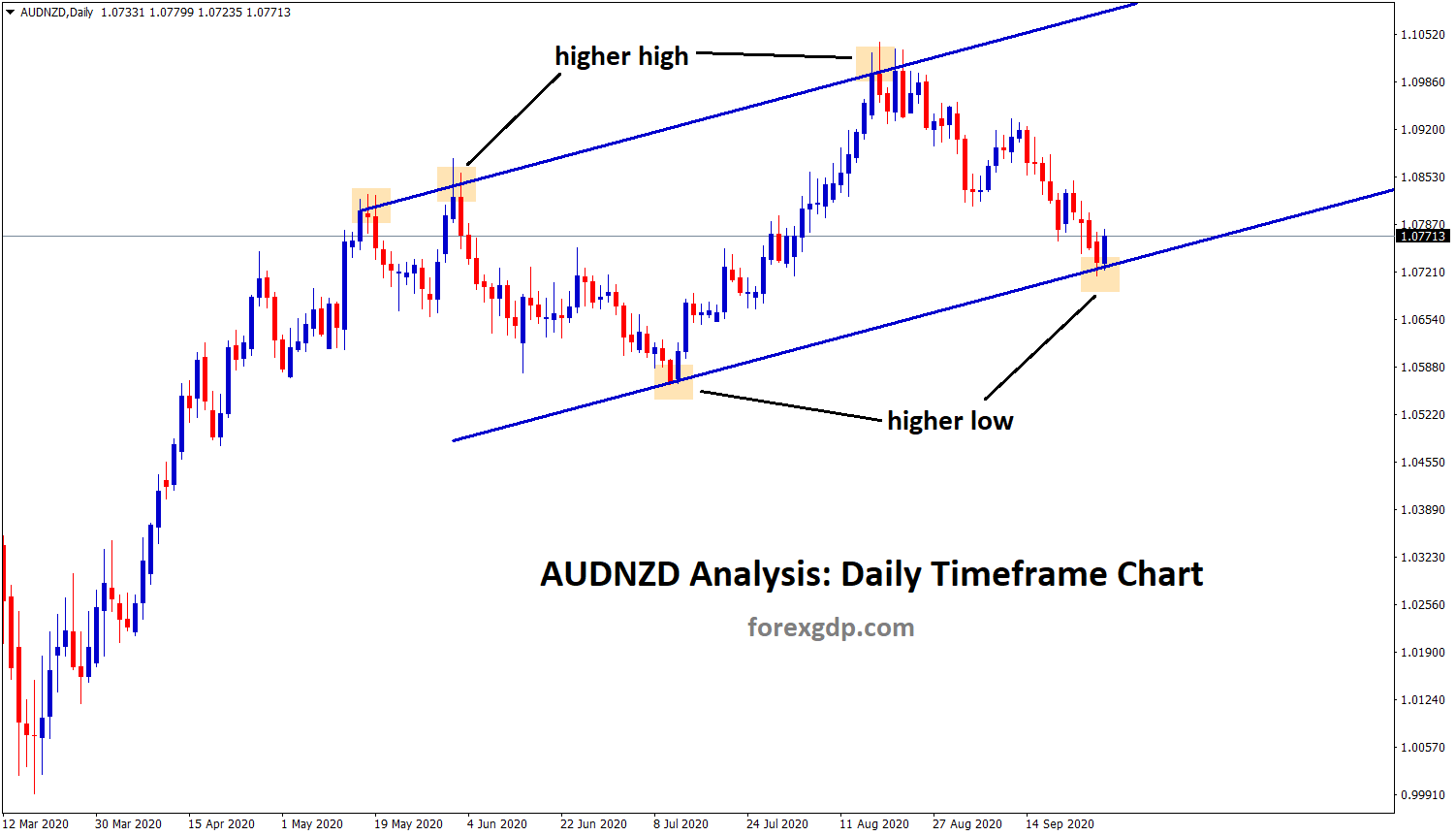

AUDNZD reached the higher low of the Uptrend line in D1 Chart

AUDNZD Long term Analysis AUDNZD reached a higher low of Uptrend line in the Daily time frame chart. Let’s wait

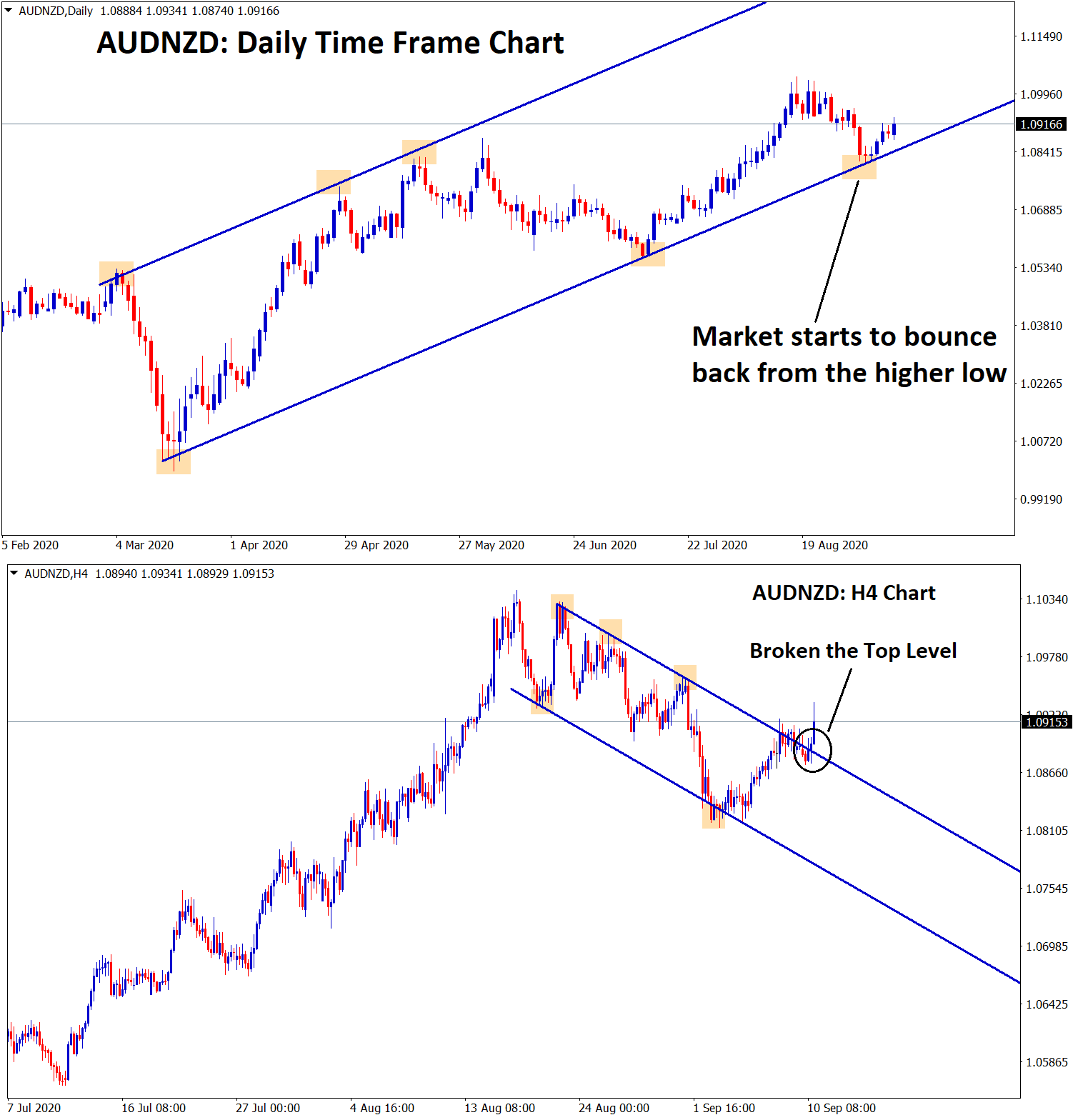

Reverse and Breakout Analysis of AUDNZD

AUDNZD Technical Analysis AUDNZD starts to bounce back from the higher low of Uptrend line in the daily time frame

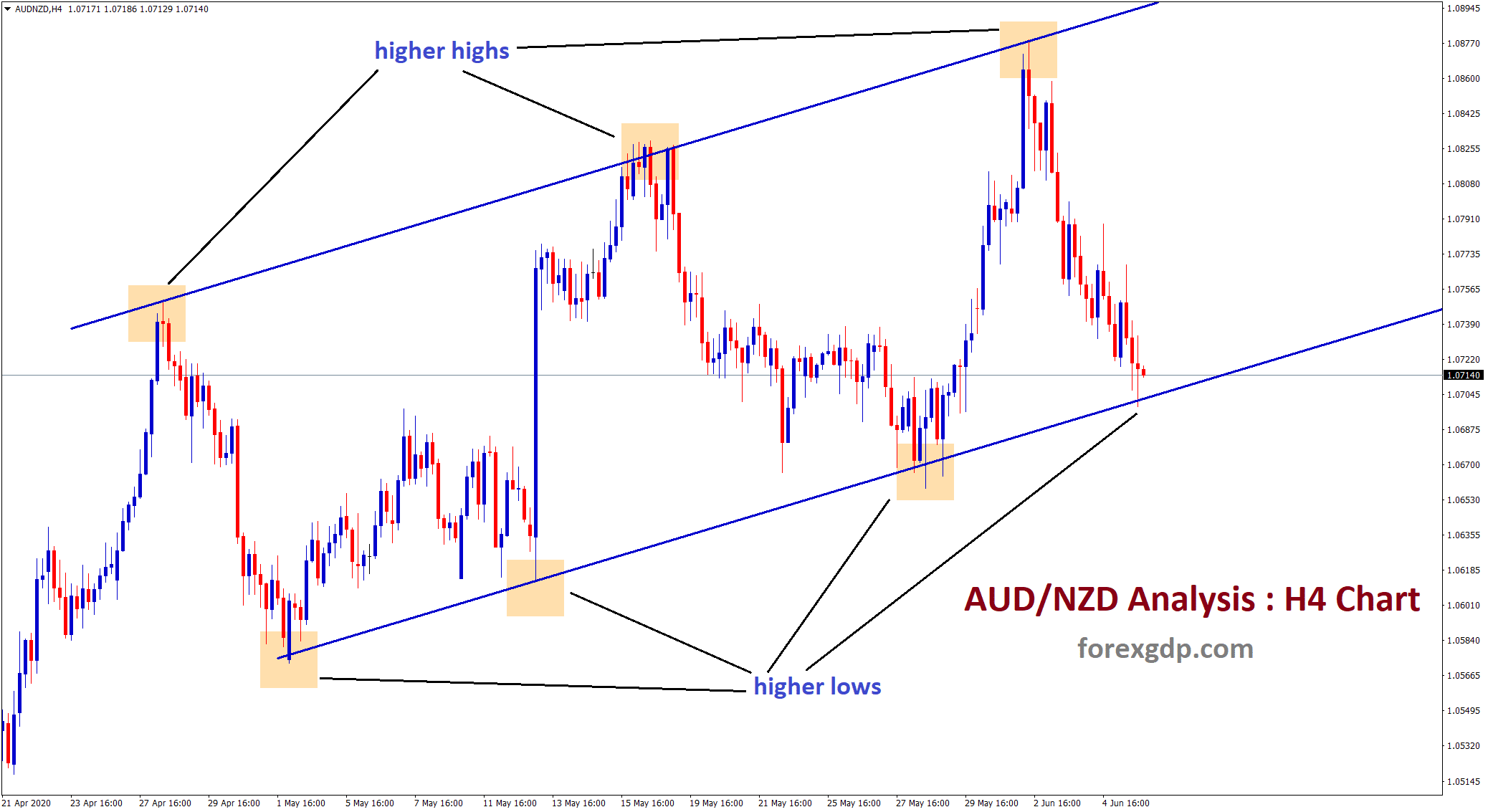

AUDNZD forming higher highs higher lows

AUDNZD Up Trend Line Analysis AUDNZD is moving in a strong uptrend in H4 chart. Higher high, higher low forming

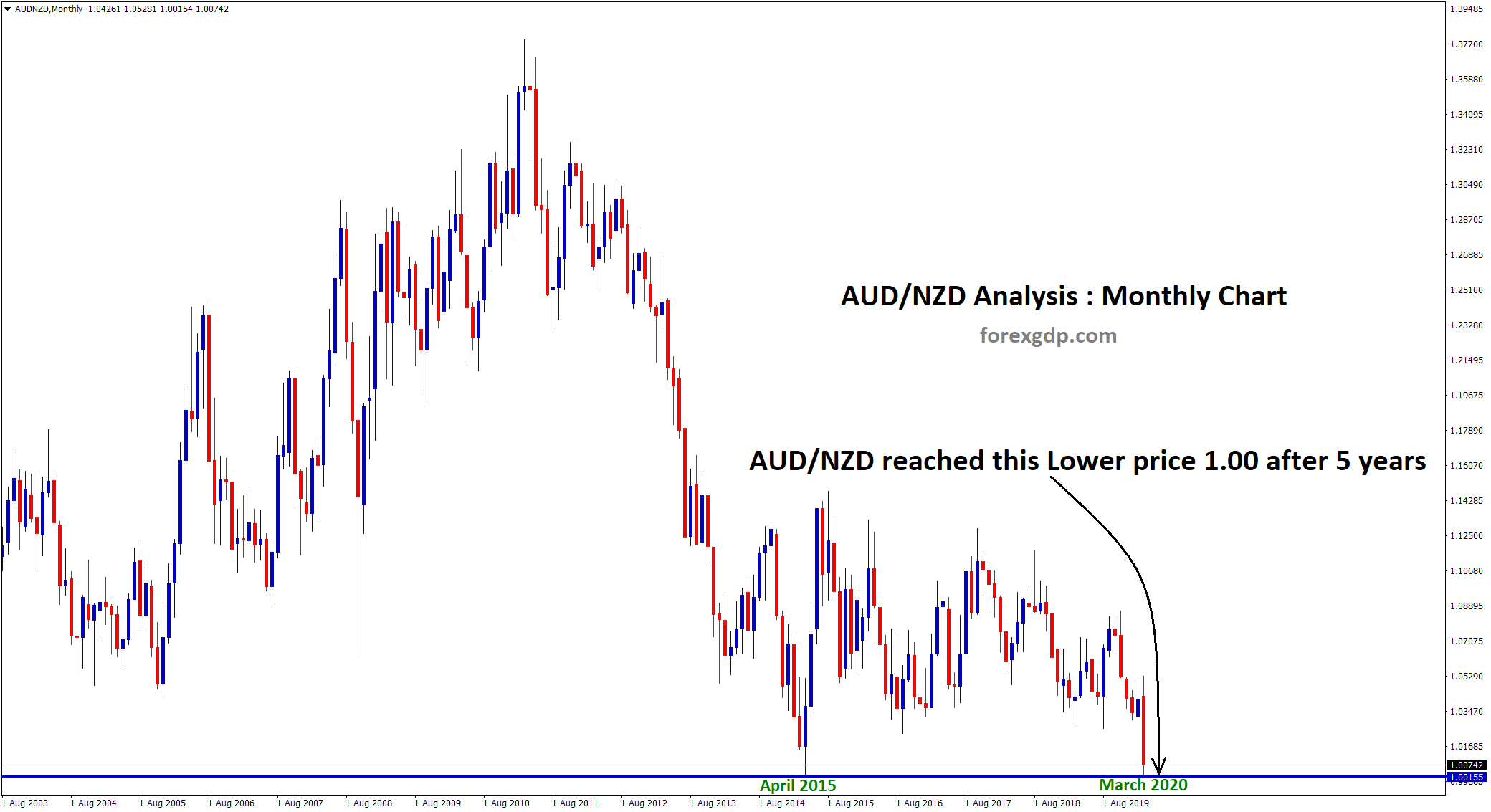

AUD/NZD hits 5 year low. Good to Buy?

AUD NZD Technical trade Analysis in 5 years AUD/NZD reached the lower price 1.00 after 5 years. On April 2015,