Introducing EURGBP

The EURGBP currency pair is the combination of two quite popular currencies, the Euro and the British Pound Sterling. The Euro is the second most popular currency after the USD. It is the national currency for the EU states. The British pound is the fifth most popular currency. It is the national currency of the UK. Together, the EURGBP currency pair is the third most popular minor currency pair in the forex industry. The reason it is still considered a minor currency pair, despite being really popular, is because it does not contain the USD which is the most popular currency in the world. Only USD currency pairs have the advantage of being called major currency pairs. It is also important to note that because this pair does not contain the USD, it is also referred to as a cross-currency pair. In order to better understand how this currency pair works together, we must first understand who they are as individuals. Let’s get familiar with the EUR and the GBP.

The Euro

The Euro is a relatively new currency, having emerged in 1999. After the US dollar, it is the second most extensively used currency. The purpose of introducing this currency was to offer a unified currency for the EU’s member states in order to promote business between them. At first, EUR was only a digital currency.

Physical notes for this valued currency were not issued until much later. During its more than two decades on the market, this currency has been adopted by 19 of the EU’s 28 member states. Aside from these EU member nations, five more have adopted the Euro as their national currency. Because the Euro is a currency of several states rather than a single one, it has a much higher potential to be impacted by various countries getting engaged. Any odd behavior in any of the states might have a direct impact on this valuable currency.

The British Pound Sterling

The British Pound is the official currency of the United Kingdom, British Overseas Territories, and Crown Dependencies. It is the fifth most popular currency in the world in terms of the trading volume. It is also the world’s oldest currency and is sometimes referred to as the “Quid.” It is still one of the most important currencies in the world today. The pound was defined as equivalent to one pound of silver as early as 775AD. Following England’s defeat against France in 1694, the newly founded Bank of England began to produce Pound notes, which began to circulate.

The Bank of England is responsible for the production of this valuable currency. In the early 18th century, the value of the pound was linked to gold weight rather than silver weight. However, in order to finance its military activities during World War I, the government suspended the gold standard. It temporarily reverted to the gold standard after the war, but the beginning of World War II required the country’s currency to be fixed. The currency fix was broken in the 1970s, and the pound sterling is currently a freely floating currency

Why Trade EURGBP

The EURGBP is among the most popular minor currency pairs in this industry. It is unique in ways more than one. It’s quite intriguing to get the opportunity to trade currencies of EU states with a former EU state. It brings a little drama and stigma attached to it. Following are some top reasons why you should trade EURGBP:

Market Correlations

The EURGBP currency pair is lucky to be one of the few pairings in the forex industry that is related to quite a few different commodity markets. The UK is among the largest exporters of crude oil and automotive parts. Similarly, the EU is among the largest exporters of technology and electronics. Any changes to the demand for any of these products will have a direct impact on the EURGBP currency pair. This makes this pair quite interesting to trade as we get to analyze these commodities along with EURGBP and therefore understand how its markets move much more easily.

Interest Yields

The EUR is well-known for its high-interest rates, which are given by the European Central Bank.

These high-interest rates are considerably higher than those of market giants such as the United States and Australia. When compared to the EUR, the GBP has much lower interest rates. The UK’s low-interest rates are provided by the Bank of England. Traders are drawn to the EURGBP currency pair due to its high-interest yields as a result of these interest rates. This pair provides significant yields due to the large difference in interest rates between them. Because of the large payouts, traders frequently utilize a carry trade when trading this currency pair. Carry trade is the practice of selling a currency with a low-interest rate in order to purchase one with a higher interest rate.

Low Volatility

EURGBP is among one of the few currency pairs that are blessed with very stable market conditions. This probably has something to do with the fact that both the EU and the UK belong to the same region. The UK was even part of the EU at one point. Both of their markets operate the best at the same timings as well. These individual currencies have so much in common which makes it hard for them to contradict each other when trading. Due to this reason, they’re often found in stable market conditions with very low volatility.

EURGBP Trading Tips

As we’ve just discussed above, the EURGBP presents some unique trading conditions which can seem quite intriguing to some traders. Due to this reason, it is even more important to have good trading strategies that work with this dynamic duo. Following are some trading tips for EURGBP:

Trade Timing

Because the underlying countries are in roughly the same time zones and the markets open at roughly the same time, this EUR/GBP pair is one of the best in terms of trade timings. Unsurprisingly, the most interesting time to trade the EUR/GBP is when the London markets are open.

This would be during the London trading hours of 8 am to 5 pm. The EURGBP market is extremely volatile during this period. This is also when this currency pair faces the highest trading volume. About 35% of its trades occur within this time zone. Volatility begins to increase at 08:00, which coincides with the opening of European financial markets. The EUR/GBP pair also benefits from the fact that all of the major European banks have market operations in London, which is one of the main financial hubs in the world. Due to this reason, there is a high need to exchange GBP for euros on a regular basis.

Economic News

One of the greatest things to look out for when trading currency pairs like the EURGBP is the economic news for their individual currencies. If there’s anything important upcoming in the EU or the UK, it would be best to hold any positions till we know the results of whatever we’re waiting for. This is because depending on the results of the reports or events, the value of EURGBP may increase or decrease. It could even become extremely volatile and show itself in both sides of the market. It is therefore important to always know whenever someone is going to happen in these regions in order to be able to trade better.

Carry Trading

Carry trade is the practice of borrowing a low-interest-rate currency to invest in a higher-interest-rate currency. This allows you to lock in a higher rate of return on your investment. One of the most common trading methods for the EURGBP currency pair is carry trading. This is due to the EUR having a far higher interest rate than the GBP. Because of these interest rate discrepancies, this currency pair has a significant interest yield. It is crucial to note that, while this technique is ideal for this dynamic combination, it is still a high-risk strategy that should be traded with great caution. The currency that is exchanged in the transaction is known as the funded currency as it has a lower interest rate. Historically, the GBP has been a popular funded currency. Similarly, the EUR would be known as the funding currency. Together they form the EURGBP currency pair. When this happens, you will be paid interest based on the difference in interest rates between EUR and GBP as well as the amount of your investment.

Factors Affecting EURGBP

Although EUR and GBP technically belong to the same region and technically have the same likes and dislikes, exports and imports, allies and enemies, they are still individual currencies who when combined together, are impacted by a select few factors. Following are factors affecting EURGBP:

Financial Institutions

Both the European Central Bank and the Bank of England are majorly responsible for any instability in the EURGBP marketplace. The ECB and BOE release monthly reports and statements regarding updates to any policy changes. These reports also display the economic and monetary forecasts for the upcoming short-term. Any positive results from the ECB will have a positive impact on the EURGBP currency pair. However, any positive results from the BOE will have an inverse impact on the EURGBP currency pair. The representatives of these individual banks also hold speeches frequently where they explain these results in more detail. These speeches are just, if not more, important in determining the direction of the EURGBP market. From ECB, Christine Lagarde who is the President of the institution is highly looked upon for her speeches. From BOE Andrew Bailey who is the Governor of the institution is highly looked upon for his speeches.

Unemployment Rate

The level of unemployment in an economy plays a significant role in determining the market movements of its currency. Low levels of unemployment would signify that an economy is thriving and the country is doing great. High levels of unemployment would signify that an economy is struggling and the country is facing hard circumstances.

If the UK is facing low levels of unemployment, the value of GBP would rise and therefore, EURGBP would fall in value. Similarly, if the UK is facing high levels of unemployment, GBP values would drop, and therefore, EURGBP would increase in value.

Automotive Industry

The United Kingdom is a significant exporter of automobiles and auto parts. As a result, its economy is strongly dependent on worldwide demand for these goods. Any changes in demand for transportation vehicles and their subsequent parts and equipment will have an immediate impact on the pound’s value. If demand for automotive products declines, the UK will not export as many of them, causing the value of the EURGBP to rise. Similarly, if worldwide demand for automotive products increases, the UK will export them more frequently, and the value of the EURGBP will decline.

Crude Oil Industry

The United Kingdom is among the largest exporters of crude oil in the industry. They make up for quite a large chunk of the world’s oil supply. Therefore, any change in the demand for crude oil around the world will have a significant impact on UK’s exports and therefore their economy as well.

An increase in demand for crude oil would cause GBP to increase in value and in turn cause EURGBP to decrease in value. Similarly, a decrease in demand for crude oil would cause GBP to decrease in value and in turn cause EURGBP to increase in value.

Electronics Industry

The EU is among the largest exporters of technological and electronic products. Any changes in the demand for these products around the world will significantly impact the economies of the EU states. This is one of their largest contributors in terms of GDP and therefore it holds great value for these European states.

If the demand for electronics increases around the world, the EU will be able to export them more than usual which will cause EURGBP to increase in value. Similarly, if the demand for electronics decreases around the world, the EU won’t be able to export them as much as usual. This will make the value of the EUR drop and therefore EURGBP will also face a sharp decline.

Most common questions asked by the forex traders about EURGBP:

Forex GDP, Babypips, Tradingview, Forexfactory.

EURGBP Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

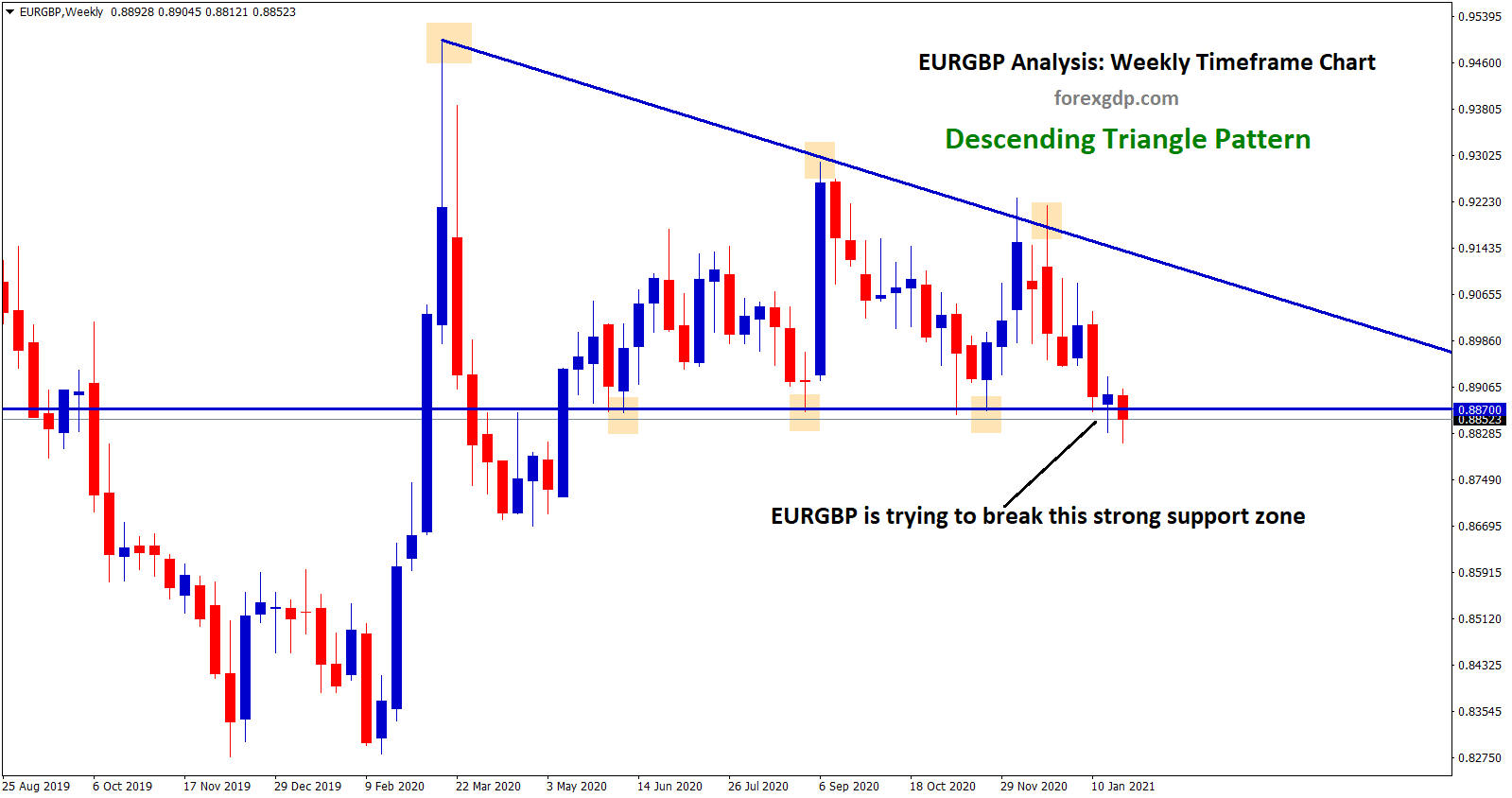

EURGBP trying to break the Support zone of the Descending Triangle

EURGBP Analysis EURGBP has formed a descending triangle pattern in the weekly time frame chart. Now, EURGBP is trying to

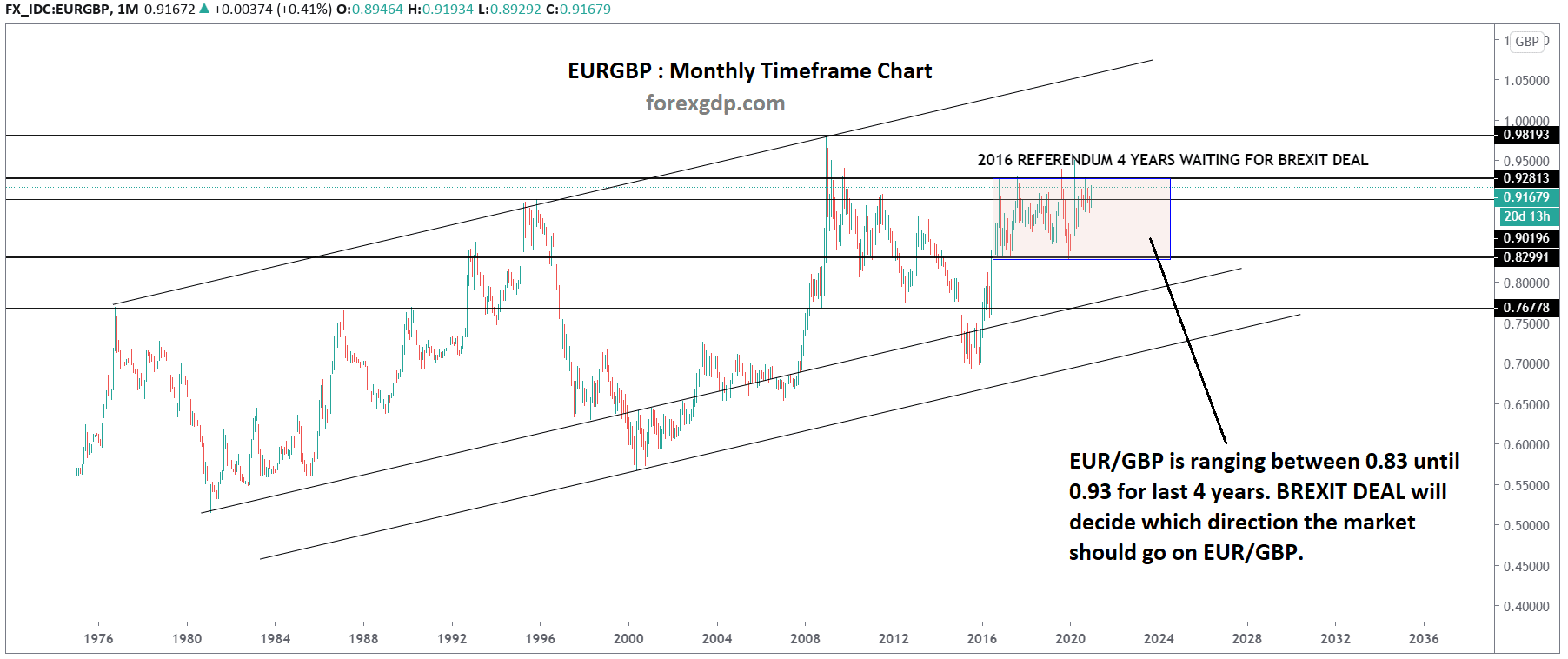

Brexit deal is going to decide the direction on EURGBP

EUR/GBP Analysis EUR/GBP is ranging from 0.83 until 0.93 for last 4 years. BREXIT DEAL will decide which direction the

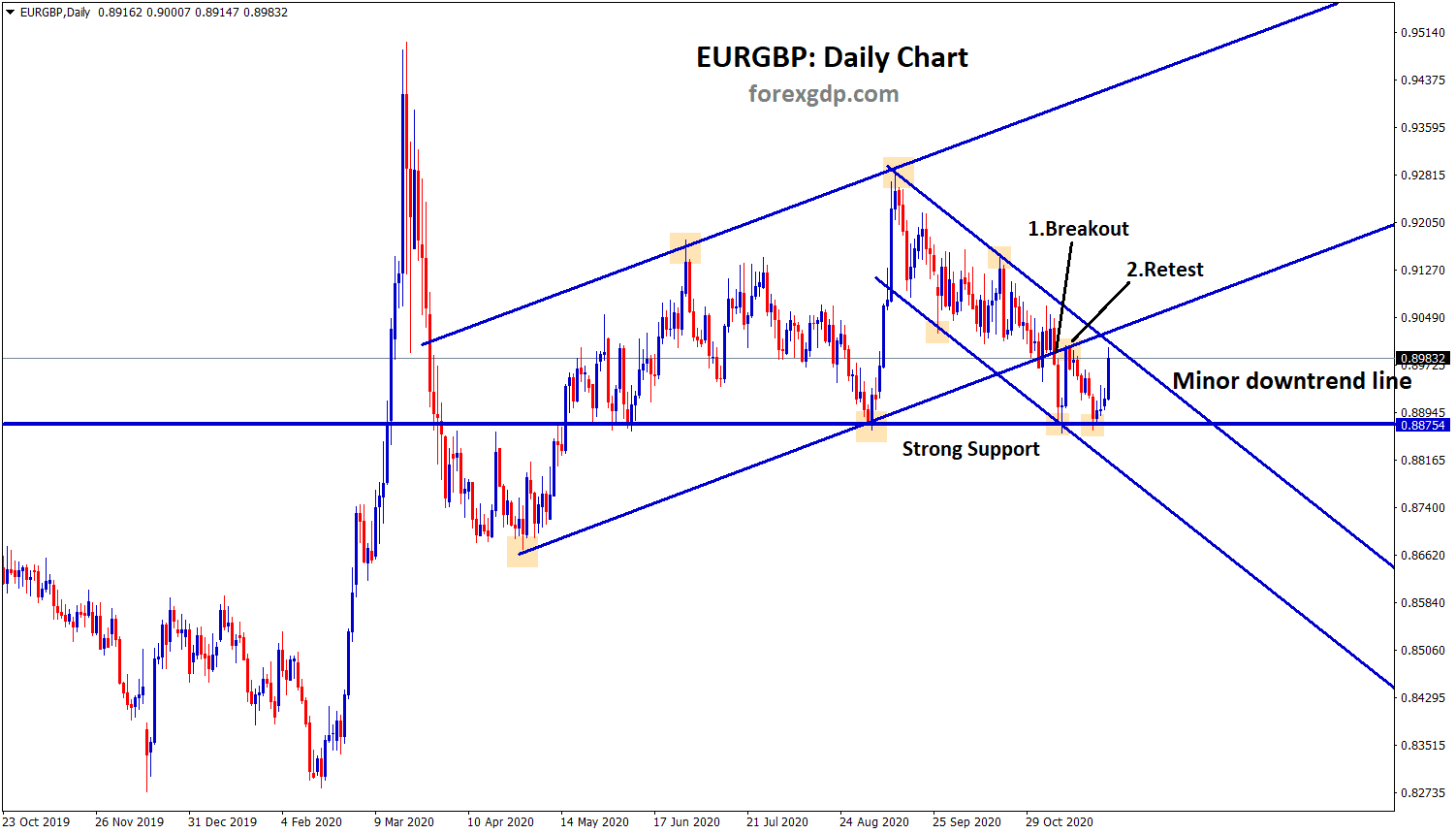

EURGBP bouncing back from the Strong Support

EURGBP Technical Chart Analysis EURGBP has recently broken the bottom zone of the Ascending channel and retested the broken level.

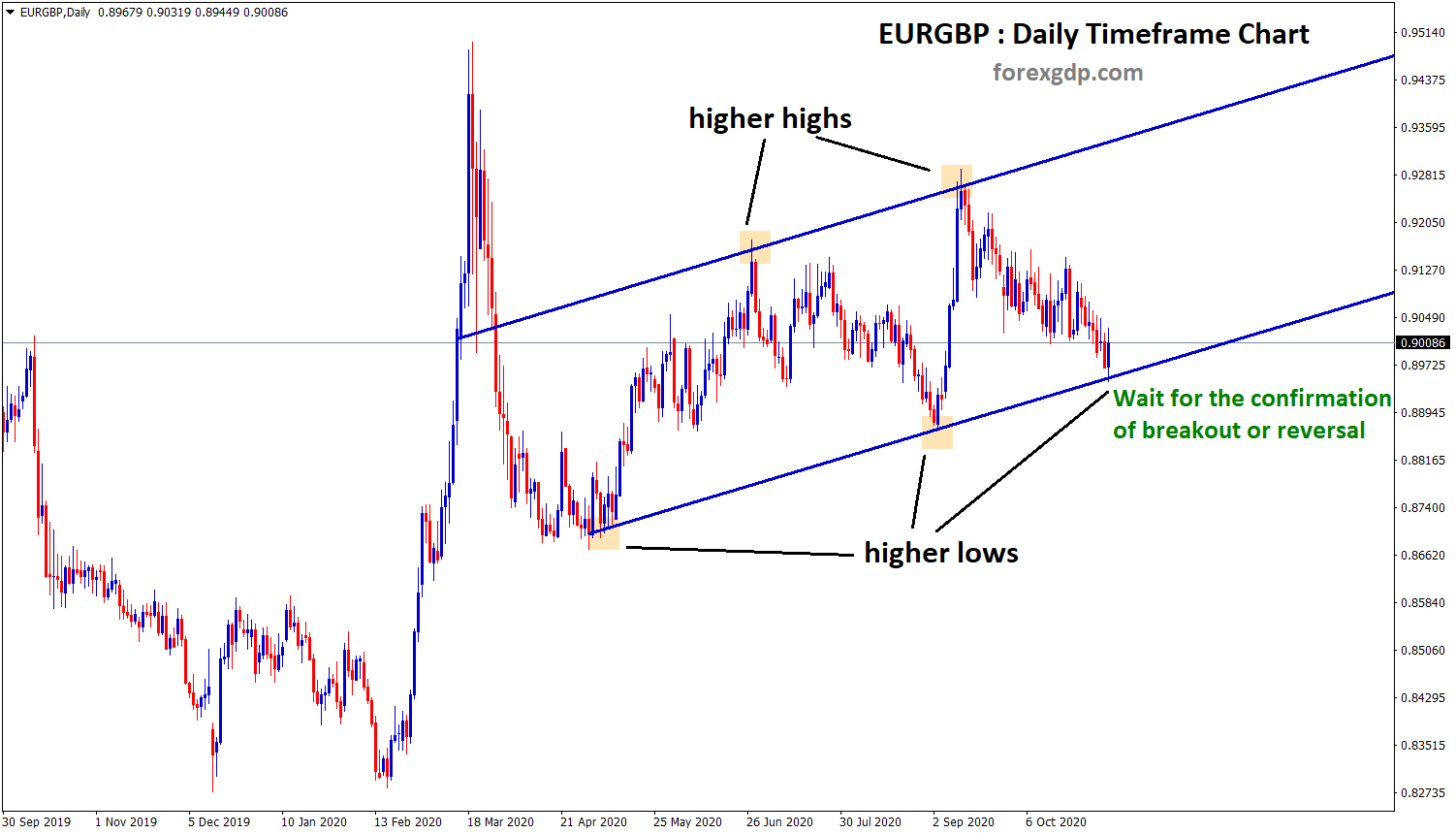

EURGBP standing at a higher low level of the Ascending Channel

EURGBP Ascending Channel Analysis EURGBP is moving in an Ascending channel by forming higher highs, higher lows in the daily