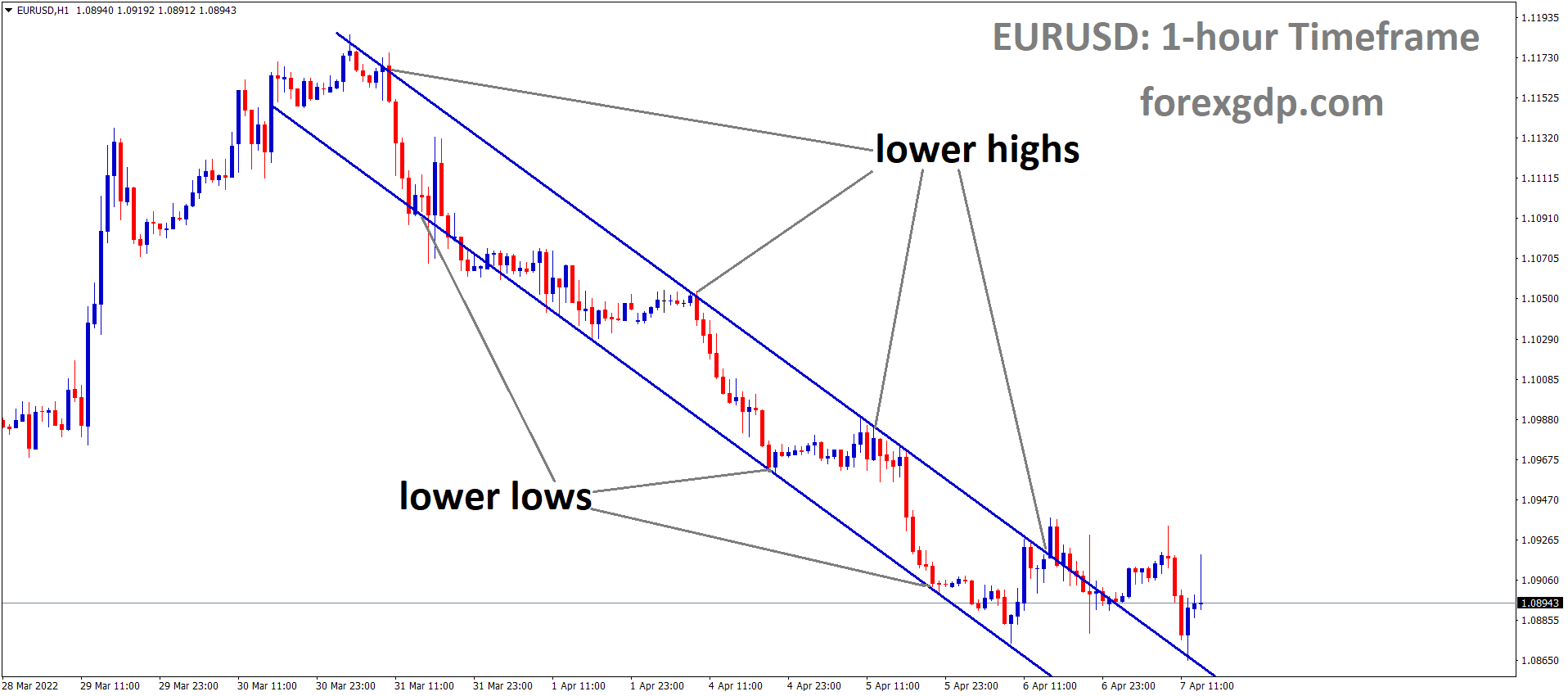

EURUSD is moving in the Descending channel and the market has retesting the Broken area of the Descending channel.

EURUSD Today

EURUSD has had quite a busy day as it takes in the release of the FOMC Minutes Meeting just early on Wednesday. This release proved to be as hawkish as expected and had caused the dollar value to rise which caused EURUSD to face bearish market conditions. The EURUSD currency pair is currently struggling to stay above support levels as it teases around the 1.089 region.

EURUSD is moving in the Box Pattern ,Market has rebounded from the Horizontal Support area of the Pattern.

We are also expecting the release of the ECB Meeting Minutes any time now though we should not get our hopes up as it is highly unlikely that this release will make EURUSD increase in value. Below we’ll go into more detail on the events that have occurred this past day and how they’ve contributed to the market conditions faced by EURUSD today.

ECB Meeting Minutes

The European Central Bank held a meeting in March where they revealed plans to increase the interest rates in order to combat the inflation crisis in the country. Inflation is currently at 5.1% and worst-case scenario, it could jump to 7.1% if matters between the two European countries don’t settle any time soon. The ECB has plans to increase the interest rates from -0.50% back to 0% in order to combat this ordeal. They had not increased it out of the negatives in over a decade. They were previously using a ‘wait and see’ approach but it seems like this approach is failing as it is becoming increasingly difficult for the common person to afford the basic necessities. The ECB Meeting Minutes will be released early on Thursday and will give a detailed account of what was discussed in the meeting held last month. There is little chance the minutes will do any major damage to this major currency pair since it probably won’t be revealing anything that we already don’t know.

Michael Hewson, Chief Market Analyst at CMC Markets UK had revealed her thoughts on the release of this data in a statement. Hewson reveals, “This hawkish pivot merely serves to underline what a bind the European Central Bank finds itself in. We’ve subsequently seen government bond yields push higher across the bloc, however, it’s difficult to really see what else the ECB can do at this point. Recent comments from a number of ECB policymakers suggest there is rising concern that the ECB is behind the curve and this week’s minutes could well offer insights as to how significant this concern is. ECB minutes are typically less exciting than the Feds. Yet unless the ECB is prepared to hike more aggressively, any EUR/USD rally on ECB FX-linked comments looks unlikely to last.”

FOMC Meeting Minutes

The highly anticipated FOMC Meeting Minutes was released early on Wednesday which turned out to be as hawkish as expected. The minutes revealed the monetary and economic policy changes that were discussed two weeks earlier in March. It revealed, just as expected, that the Feds would be continuing ahead with the interest rate increase to 0.50%. This would be the rate used for the upcoming quarters as well unless any changes occur till then. There were also hints towards a possible reduction in the balance sheet by a quite significant amount. The plan is to reduce the balance sheet by about $95 billion a month. $60 billion would be from treasuries while $35 billion would be from mortgage-backed securities.

The Feds Minutes reveal, “Participants agreed they had made substantial progress on the plan and that the Committee was well placed to begin the process of reducing the size of the balance sheet as early as after the conclusion of its upcoming meeting in May. Participants would have preferred a 50 basis point increase in the target range at the March meeting, citing the upsides risks to inflation. But ultimately opted for a 25 basis point hike, pointing to greater near-term uncertainty associated with Russia’s invasion of Ukraine.” Tim Ghriskey, Senior Portfolio Strategist at Ingalls & Snyder also had some words to say on this situation. Ghriskey states, “The Fed is determined to rein in inflation, and we just hope and pray that there will there will be a soft landing of the economy and not a hard landing that sends us into a recession.”

FEDS Brainard Speech

In anticipation of the FOMC Meeting Minutes, the Feds Lael Brainard had come out in a speech to reveal some hints on the policy changes and other decisions in order to calm down the crowd. Brainard revealed, “The FOMC will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting,” she said. “Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017-19.”

ECB Nagel Speech

In anticipation of the ECB Meeting Minutes, ECB’s Joachim Nagel had come out in a speech revealing exactly what was already expected by analysts so they weren’t fazed by it at all. “What we are seeing at the moment suggests that savers may soon be able to look forward to higher interest rates again”, he reveals. The entire Eurozone is facing an inflation crisis and it is becoming next to impossible to afford basic necessities. The war in Ukraine can be considered the root of all these issues we’re facing. Nagel’s speeches aren’t regarded as too important as he never reveals anything that isn’t already known to everyone else.

Upcoming Important Events

There are a couple of reports being revealed tomorrow that may prove to be important in understanding the direction of the forex markets. Canada will be revealing their Employment Change report which will reveal the change in the number of people employed in the past month. This is important in understanding the situation of the job market in the country. FOMC member Williams will also hold a speech early tomorrow regarding the decisions everyone heard about through the FOMC minutes that were revealed early on Wednesday.