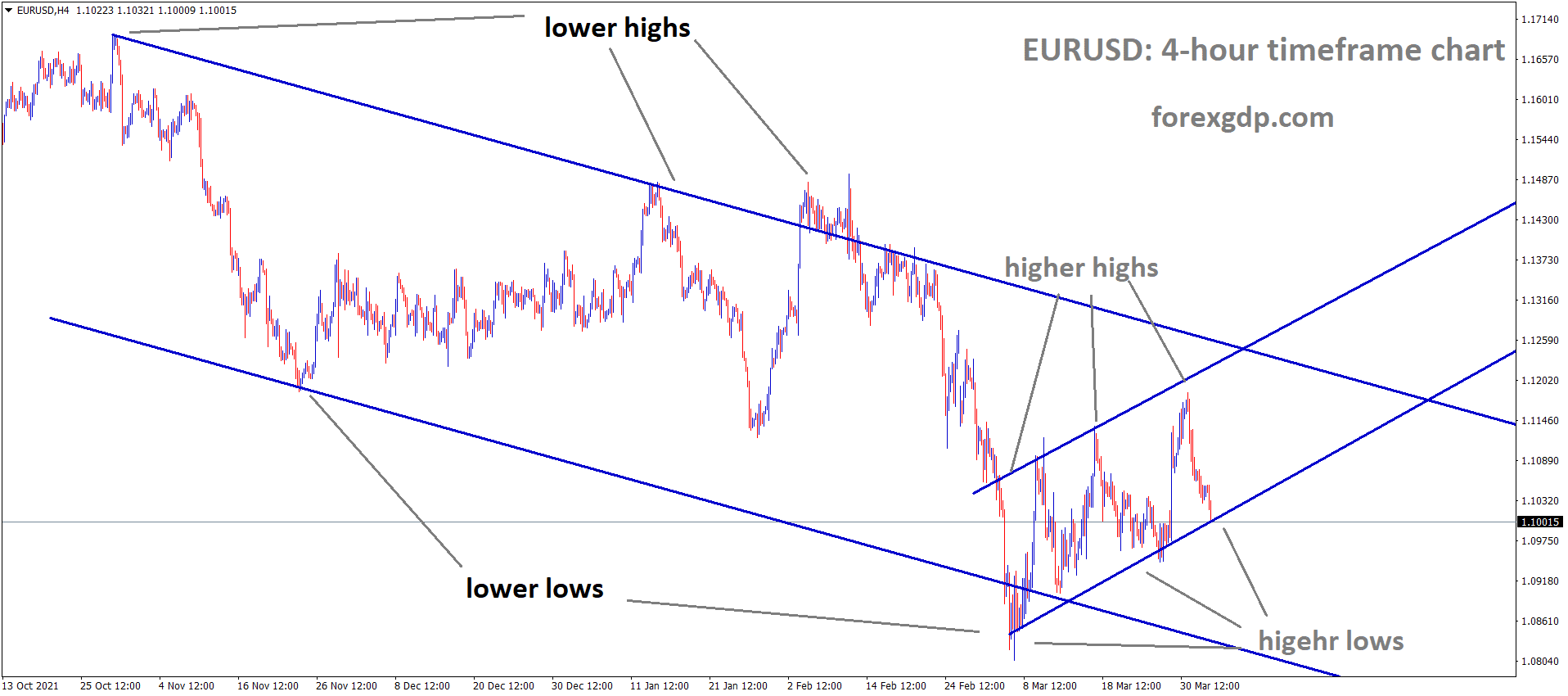

EURUSD is moving in the Major Descending channel and Market is reached the Higher low area of the minor Ascending channel.

EURUSD This Past Week

EURUSD started the week off pretty optimistic as we can clearly tell the market was showing bullish market conditions as it continued onwards in an uptrend. It faced slight bumps along the way but overall, it stayed firm on its goal to reach the top. The EURUSD currency pair managed to reach a high of 1.18 before things started to go south for this major stakeholder in the industry. The entire reason it was showing positive market conditions at the start of the week was that peace talks were held between the two countries in Istanbul where they actually reached an agreement for once. A ceasefire was agreed upon temporarily due to which EURUSD started rising in the markets. However mid-way through the week, Russia had once again begun invading Ukraine due to which the value of this major forex pair started plummeting once again. Read on to find out more details on this massacre.

Russian Invasion In Ukraine

Over the weekend, it was discovered that Russia had once again invaded Ukraine despite agreeing to a temporary ceasefire in the peace talks that were held in Istanbul. President Zelensky had warned that Putin was not to be trusted and that we need to keep our guard up even if he agreed to a ceasefire. This proved to be true as Russia had once again started attacking the civilians in Ukraine. Due to these invasions and breaking the agreement to a ceasefire, the EU is in discussions of imposing further sanctions on this European superpower in order to bring them back under control.

French President, Emmanuel Macron had a few words to say on this current crisis between the two European countries. Macron states, “What happened in Bucha requires a new round of sanctions and very clear measures in order to bring back peace in the region.” Paul Donovan, Chief Economist with UBS also spoke in a statement regarding this matter. Donovan states, “Unless the sanctions target energy supplies to Europe, or firms from other countries (e.g. China or India) doing business with Russia, the marginal economic impact (of new sanctions) is likely to be limited.” Ulrich Leuchtmann, Head of Forex at Commerzbank had been analyzing the situation and states, “More sanctions of course also mean that the risk of energy disruptions in Europe rises. This is because of our own sanctions or because Russia might get completely serious with its counter-sanctions rather than just changing the payment mode for natural gas. In my view the risk of significant euro weakness increases.”

ECB Schnabel Speech

Isabel Schnabel, Governing Council member at the European Central Bank (ECB) held a speech late on Friday where she discussed how the ongoing economic conditions will impact the policy decisions that need to be made in the future. She mentions the inflation crisis, war between Ukraine and Russia, the COVID-19 pandemic, and oil shortages in her speech on Friday. Schnabel believes these factors to be the main reasons why the monetary policies are going to be tighter and higher than ever. She warns the people that it’s going to be really tough for the next couple of months due to having to increase the interest rates. However, she reassures them that this is only a temporary hurdle while seeking the permanent solution.

In her speech, Schnabel states, “Monetary policy responded to the pandemic by launching a series of forceful measures that collectively provided much-needed liquidity to banks and financial markets. These measures were successful in restoring and stabilising financing conditions at levels that provided material support to growth and thus countered the rapidly building downward pressure on inflation. Even though the forecasting community, including central banks, has severely underestimated the persistence of inflation, it is still reasonable to assume that part of current elevated inflation will vanish over time even without monetary policy action.

US Unemployment Data

The US Unemployment data came out late on Friday which revealed the percentage of people in the country who are currently unemployed and seeking work. This is an important measure of the economic situation in a country as it reveals if there are enough jobs being created to meet the growing demand of the workforce. It also measures if there are enough people to cover the jobs created in the country. This report comes out on a monthly basis and last month it came out to be 3.8%.

This month, the forecasted percentage of unemployed people seeking work was 3.7%. However, the actual results revealed these numbers to be 3.6%. This is lower than expected which means the job industry is doing much better than expected and definitely much better than previous numbers. This is positive news for the USD and we can expect it to show slightly bullish market conditions.

EURUSD Today

EURUSD is currently facing bearish market conditions due to several factors that we just discussed above. The major factor is the fact that Putin is not to be trusted as he invaded Ukraine even though he agreed to a ceasefire just days ago.

EURUSD Market has reached the lower low area of the Falling Wedge Pattern.

Russian officials refuse to accept that they invaded Ukraine despite there being several pieces of evidence pinned against them for doing so. The EURUSD currency pair is now teasing around the 1.100 region and it is expected that this will go much lower today and even tomorrow considering that the EU is in talks of placing further sanctions on this European superpower.

Upcoming Important Events

There are a couple of events upcoming tomorrow that we need to look out for as they may impact market conditions. The Reserve Bank of Australia will release its monthly statement regarding any changes to its monetary policies and its thoughts on the current and future of the economy of the country. The UK will be releasing its weekly Services PMI and Manufacturing PMI reports. These are meant to measure the activity levels of the purchasing managers in their individual industries. The US will also be releasing its non-manufacturing PMI which will reveal the economic conditions in the non-manufacturing sector.