Introducing EURNZD

EURNZD is among one of the minor currency pairs in the forex industry. It is also one of the least popular pairs on this list. EURNZD is placed 12th in ranking in terms of popularity. This means EURNZD has a very low trading volume which makes it even more prone to instability in case of any disruptions in their individual territories. EURNZD is also considered a cross-country pair. This means that it does not require the USD currency pair in order to be traded with each other. Trading EUR and NZD with each other directly, without USD as a third party, makes it a significantly more cheaper and efficient trade. On their own, both EUR and NZD are among the most popular currencies around the world. This can also be attributed to the fact that they both belong to countries in the G8. These are the most industrialized or developed countries in the world. Their currencies are therefore highly looked upon. Let’s dive into more detail on these currencies as individuals so we can further understand how to trade them with optimum results.

The Euro

Having entered the world in 1999, the Euro is among one of the latest editions in the world of currencies. After the US dollar, it is the second most frequently used currency. The purpose of introducing this currency was to offer a common mode of payment for the EU’s member states in order to promote easy business between them. At first, EUR was only a digital currency. Physical notes were not issued for this currency until much later.

During its more than two decades on the market, this currency has been adopted by 19 of the EU’s 27 member states. Aside from these EU member nations, five more have adopted the Euro as their national currency. Because the Euro is a currency of several states rather than a single one, it has a much higher potential to be impacted by various countries getting engaged. Any minor setback that is out of the ordinary in any of the states might have a direct impact on this minor currency.

The New Zealand Dollar

The New Zealand Dollar, abbreviated as NZD, was introduced in 1967. Previously, New Zealand used the New Zealand Pound as its currency. Until 1985, the New Zealand Dollar had a fixed exchange rate with the United States Dollar. They were only permitted to utilize their own floating rates after 1985.

Their physical notes have undergone various revisions throughout the years to be visually appealing while also being more secure. New Zealand changed the composition of its notes from paper to polymer and plastic in 1999. This was done to make it much easier to detect counterfeit notes. This also renders the notes waterproof and more difficult to break apart. The printing on their notes are well-known for being extremely vivid, and they are always upgrading the design to make it more appealing.

Why Trade EURNZD

Now if you tell someone that your choice of currency pair for trading is the EURNZD, they’ll probably look at you and think you’re crazy. In fact, most traders prefer to stick to the popular options which are the major currency pairs containing the USD. Minor pairs are usually forex pairs that people go to when they get bored of watching the dollar markets all day. However, only a select few professionals know that minor currency pairs are where the real profits are. There are a couple of reasons why you might want to trade these minors, more specifically EURNZD. Here are some top reasons to do so:

Cross-Currency Pair

As discussed previously, EURNZD is considered a cross-currency pair. Now what this means is that it does not include the USD when being traded with each other. The USD is the most popular currency in the world. It is often used as a type of third-party mediator when transacting between two other currencies. What this means is that a currency would first be converted into the USD before being converted into the final currency. This method is very time-consuming and also expensive due to the constant changing of rates. A cross-currency pair is when two currencies transact with each other without the presence of the USD. This method saves a ton of time and can also be significantly cheaper due to less interest rates being involved.

Market Predictability

It is much easier to predict the market direction of minor currency pairs like the EURNZD. This is because they are usually only impacted by any instability in their individual regions. The EUR would mainly only be impacted by anything out of the ordinary that occurs in the EU states. Similarly, the NZD would only be impacted by anything out of the ordinary that occurs in New Zealand. If this was a major currency pair that included the USD, it would be impacted by pretty much anything out of the ordinary that occurs anywhere around the world. This can prove to be quite stressful as it is nearly impossible to keep a lookout for any economic changes happening everywhere around the world. Therefore, it is much easier to predict the market direction of pairs like EURNZD as they like to keep to themselves instead of bothering with the rest of the world like the USD.

Market Correlations

Another great reason to trade currency pairs like the EURNZD is because of their correlations to other assets in the market. This can be seen in the case of the New Zealand Dollar which has great correlations to commodities such as gold and silver. This is because New Zealand is one of the largest exporters of these commodities. Therefore, it makes it even more simpler to trade this pair as if we understand the direction of the commodities market, we can easily understand the direction of the EURNZD market as well. We’ll get into more detail later on regarding how exactly these commodities will impact the movement of EURNZD.

EURNZD Trading Tips

The forex industry has been consistently growing over the years to now become the largest financial market in the world, significantly greater than even the New York Stock Exchange. On a regular basis, deals involving billions of dollars take place in this business. Now that there is a lot of money, there are a lot of individuals. The forex sector has attracted a large number of people. Everyone comes with their unique set of trading strategies. Everyone argues that their technique is superior and that it is the only way to generate a lot of money in a secure manner. It is vital to understand that practically any approach may work and bring you a lot of money if implemented correctly. As a result, you must select a trading strategy that will work best with your schedule in order to maximize earnings while retaining your sanity. The following are some of our best trading recommendations for the EURNZD currency pair:

Range Trading

Range trading is when you refer to support and resistance levels in order to understand when to execute a trade. The resistance levels are the highest points in a given chart. Similarly, the support levels are the lowest points in a given chart. Understanding where these highs and lows are is key to the range trading strategy. For example, if the price is approaching the resistance level and you believe it will hold, you can execute a SELL deal (go short). In contrast, if the price is approaching a support level that you believe will hold, you can execute a BUY deal (go long). If the price continues to fall below support, you can go short because the support level will no longer hold. Similarly, if the price continues to rise above resistance, you can go long because the resistance level will no longer hold.

Trend Trading

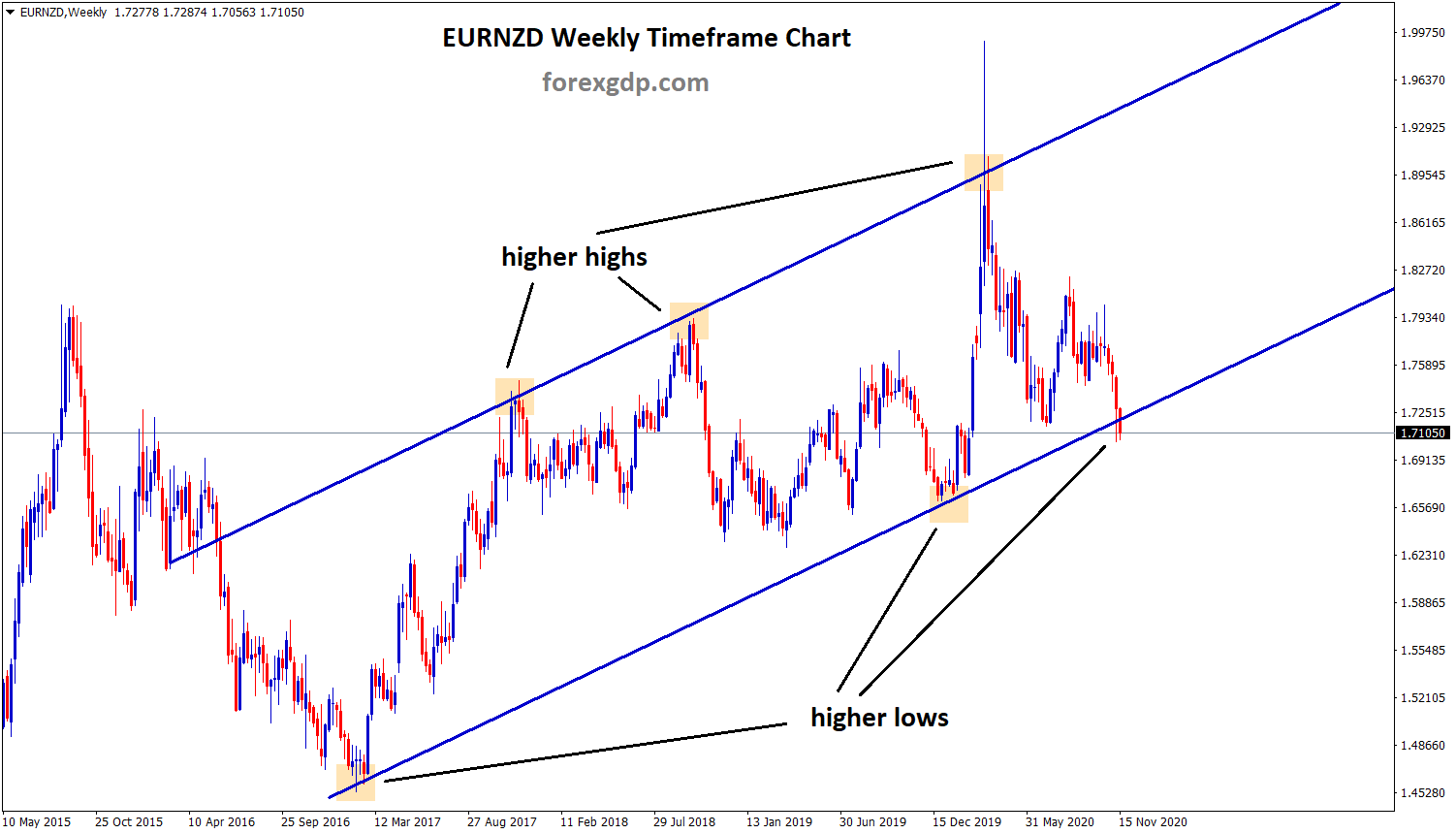

Trend trading is when you refer to market movement patterns in order to understand when to execute a trade. Trends can easily be identified, especially when looking at more longer timeframes. The most common trends to look out for include when the market is moving upwards consistently or even downwards consistently. An upward trend can be identified when the highs are getting higher and the lows are getting higher as well. Similarly, a downward trend can be identified when the highs are getting lower and the lows are getting lower as well. Therefore, this way you can identify trend patterns in EURNZD and therefore perform trend trading.

Pullback Trading

Pullback trading occurs when the market temporarily breaks away from its trend which gives you the opportunity to enter the market at a good price. When trading a pullback, you need to first identify when the market is going to pull back. If EURNZD is moving in an uptrend and briefly breaks and falls slightly, this gives you the opportunity to enter the market through a BUY trade at a good price. Similarly, if the market is moving in a downtrend and briefly breaks and jumps slightly, this gives you the opportunity to enter the market through a SELL deal at a good price. This is therefore a simple yet effective strategy for the EURNZD.

Factors Affecting EURNZD

Like every currency pair, there are a couple of factors that move its markets. After all, the forex markets wouldn’t exist otherwise. Traders depend on these factors to influence movement in the markets as this is the only way they’ll make their money. Following are the biggest factors influencing the EURNZD charts:

The Australian Economy

Australia is New Zealand’s biggest trading partner. Most of New Zealand’s traders occur with this major continent. Therefore, any changes to the Australian economy would directly impact New Zealand and therefore EURNZD as well. Any positive changes to Australia’s economy will make the NZD increase in value. This would then make EURNZD drop in value. Similarly, if the Australian economy faces a decline, NZD would suffer as well which would make EURNZD increase in value.

The Gold Industry

New Zealand is one of the largest exporters of gold in the world. Any changes to the demand or price of gold would directly impact the value of NZD which would further impact EURNZD as well.

When gold is in high demand like during wedding seasons in Asia, New Zealand would be exporting more gold which would make their economy thrive. This would therefore make EURNZD drop in value. Similarly if gold is in low demand, New Zealand wouldn’t be exporting it as much and therefore their economy will suffer. This would make EURNZD increase in value.

The Dairy Industry

The EURNZD currency pair is greatly impacted by any changes to the dairy industry. This is because New Zealand is the largest exporter of whole milk powder around the world. Their economy is largely dependent on the demand for this product. If the demand for this product increases,

EURNZD would suffer a decrease in value. Similarly, if the demand for this product decreases, EURNZD will increase in value as New Zealand’s economy will face a decline. We can also look at this from a price point of view. An increase in price for these types of dairy products would decrease the value of EURNZD and a decrease in price would cause NZDUSD to increase in value.

Financial Institutions

Both the European Central Bank and the Reserve Bank of New Zealand are majorly responsible for any instability in the EURNZD marketplace. The ECB and RBNZ release monthly reports and statements regarding updates to any policy changes. These reports also display the economic and monetary forecasts for the upcoming short-term. Any positive results from the ECB will have a positive impact on the EURNZD currency pair. However, any positive results from the RBNZ will have an inverse impact on the EURNZD currency pair. The representatives of these individual banks also hold speeches frequently where they explain these results in more detail. These speeches are just, if not more, important in determining the direction of the EURNZD market. From ECB, Christine Lagarde who is the President of the institution is highly looked upon for her speeches. From RBNZ, Adrian Orr who is the Governor of the institution is highly looked upon for his speeches.

Most common questions asked by the forex traders about EURNZD :

Forex GDP, Babypips, Tradingview, Forexfactory.

EURNZD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

EURNZD has reached the bottom higher low zone of Uptrend

EURNZD Uptrend line Analysis EURNZD is moving in an Uptrend since from 2016 by forming higher highs and higher lows